WAR IN UKRAINE

The Russian military intervention in Ukraine has generated a situation of unprecedented geopolitical tension in Europe that threatens not only world security, with the prospect of an escalation of the conflict that, with the participation of NATO, could lead to a nuclear war, as already warned by Russian Foreign Minister Sergey Lavrov[1], but also presents a powerful element of destabilization of the international oil and gas market as well as the world economy, which is barely recovering from the 2020-20collapse caused by the COVID-19 pandemic.

The Russian military ntervention[2] in Ukraine, far from being a blitzkrieg operation with precise objectives, has turned into a massive military operation with Russian infantry in Ukrainian territory, which is advancing slowly, particularly in the south-east of the country, suggesting a longer duration and complication of the hostilities. The declared objectives of the Russian operation, «demilitarization and denazification» of the neighboring country, seem to be still very abstract. However, what is clear is that Russia is ready to pay whatever the cost in order to prevent the extension of NATO and the stationing of offensive or nuclear weapons in Ukraine.

The Russian military intervention has been unanimously rejected by Europe, the US, the UK, Canada, and Japan, who have decided to impose massive economicsanctions[3][4][5][6][7] against the Russian Federation (none applicable to energy) and to supply arms[8][9] to Ukraine to deal with Russian forces.

Russia’s warlike actions and the heated rhetoric of all the actors directly and indirectly involved in the conflict, as well as the decisions of the EU, UK, USA, and Canada, have practically expelled Russia from the European economic-financial system and have put the continent in a scenario of escalating war with unforeseeable consequences. There is a widespread feeling of rejection of Russia and military tension in Europe. In this context, US President Joe Biden has made it clear from the beginning of the war, that the US «will not be involved«[10] in the Russian-Ukrainian conflict, ruling out a military intervention in Ukraine or an armed confrontation with Russia.

In response to the Russian military intervention, the United States, the United Kingdom, and the countries of the European Union imposed massive economic and financial sanctions against Russia, which have been extended to the confiscation of assets and reserves of banks and companies -including the Central Bank of Russia-, the blocking of trade and Russian air traffic in European, the US and Canadian airspace, as well as the removal of official Russian media from television and social networks in Europe and other countries of the world; the measures have even covered the artistic sector and sports, in a generalized atmosphere of military confrontation with Russia.

For its part, Turkey, a NATO member, announced its intention to prevent the passage of military vessels into the Black Sea, in the implementation of the Montreux Convention[11] and that it would not join the sanctions against Russia, so to keep a diplomatic channel open. On Saturday, March 5, it was announced that this Sunday, March 6, talks will take place between Turkish President Erdogan and President Vladimir Putin on the situation in Ukraine[12].

Germany’s unprecedented decision since World War II to «rearm», allocating €100 billion to its military sector[13], as well as the important shipment of advanced military weapons to Ukraine, seconded by the declarations of Switzerland and Sweden who broke with their historical conduct of neutrality during military conflicts -even during World War II and the Cold War-, and Finland’s and Sweden’s intention to join the NATO meetings -as a previous step to their incorporation- created an atmosphere of concern given the advance of militarist positions in Europe, and a potential military escalation.

Foreign Minister Lavrov’s statements turned out to be a point of attention regarding a consequence of such escalation when he affirmed, in an exclusive interview with the Russian Information Agency Novosti (RIA) on March 01, that if there were a third world war «it would involve nuclear weapons and would be destructive»[14]. These statements by Russia’s top foreign policy official followed the order given by President Putin on February 28 to place the country’s «nuclear defense» forces on high alert given the reaction and declarations of some NATO member countries.

But the timely statements by President Macron[15], in his message to the country on March 03, assuming a de facto leader position in Europe, were very precise and de-escalated the growing military tension by categorically clarifying that, despite his firm rejection of the Russian military intervention in Ukraine and imposing sanctions on Russia, «France is not at war with Russia«, in addition to announcing that his willingness to a phone conversation with President Putin of Russia and Zelenzky of Ukraine, to contribute to a diplomatic solution. These statements de-escalated the atmosphere of military tension.

While the military conflict is advancing and is expected to intensify, with a Russian offensive on the most important cities in the southeast of Ukraine, including the capital Kiev, both countries at war, Russia and Ukraine have been conducting direct negotiations in Belarus since March 02. The third round of talks will continue this Monday, March 07, after the meeting scheduled for the weekend was suspended, while the news[16] of today is that Denis Kireev, part of the Ukrainian negotiating delegation, was killed by the SBU (Ukrainian intelligence) in Kiev, accused of being a Russian spy. So far, the parties have agreed to establish a ceasefire in humanitarian corridors for the escape of civilians from the cities under Russian attack, an agreement that has not been effectively implemented.

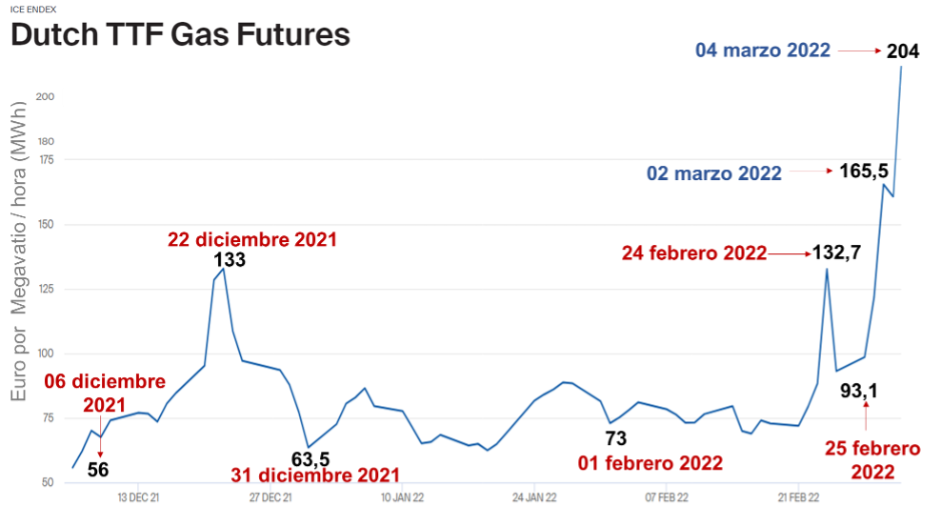

Before the war, gas in Europe had undergone extraordinary price increases, reflecting both the needs of post-Covid economic revival, as well as geopolitical tensions, due to the blockade of the Nord Stream 2 project. Since July last year, the price has risen from €24.75 per megawatt per hour (MWh) in June 2021, to €81.5 on January 31, 2022, an increase of 230%, with peaks of more than €160 in October and December last year.

However, since the Russian military intervention in Ukraine on February 24, the price of Dutch TTF Future Gas, the gas marker for Europe, has soared by between 80% and 130%, to stand at record prices of €204/MWh at the close of March 04. In other words, from June 2021 to March 04, the price of gas has risen by more than 700%.

The countries of the European Union have been careful that economic sanctions and restrictions on Russian banks do not affect gas sales and, at the same time, Russia has not suspended supplies to Europe, where the giant Gazprom continues to comply with gas supplies. There is no evidence that Russia is contemplating at the moment to suspend gas supplies to Europe, this is a strategic card. On March 01, Gazprom stated that supplies are within the contractually[17] agreed volumes.

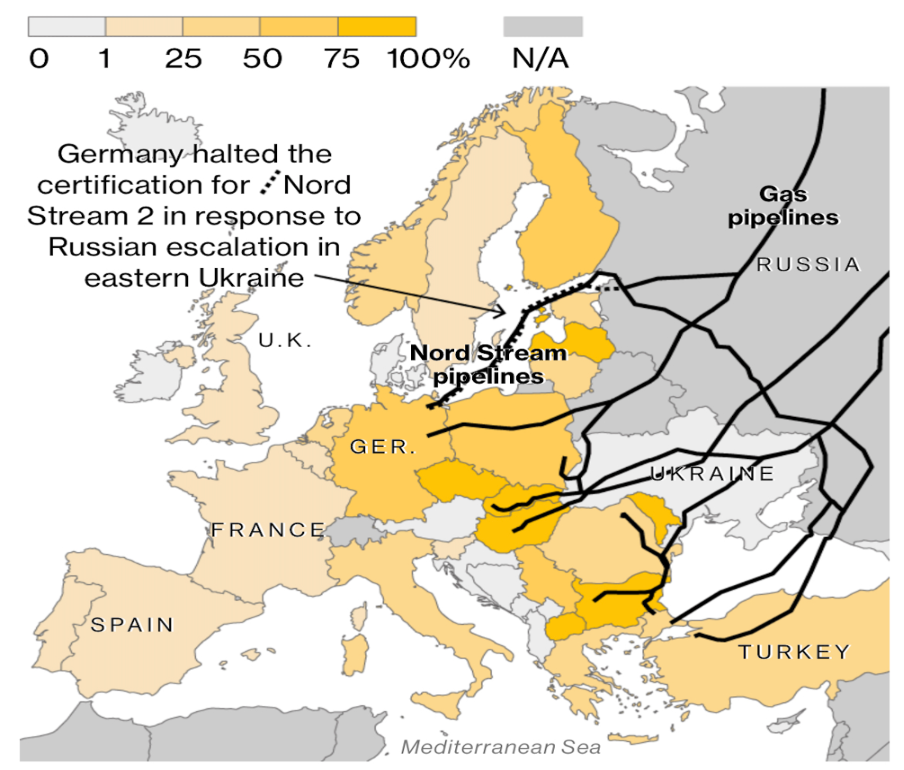

Nonetheless, on February 22, Germany decided to suspend[18] the Nord Stream 2 project, while the company responsible for the project -Nord Stream 2 AG, 50% owned by Gazprom, with participation from Shell, LMO, and German companies- filed for bankruptcy[19] on March 02.

On the other hand, the last OPEC+ ministerial meeting held on March 02[20], which lasted only 13 minutes, did not take any exceptional decisions given the geopolitical situation, nor was any mention of the conflict made. The conference decided to maintain unchanged its April 2020 supply adjustment agreement and that of July 2021 production adjustment mechanism, to increase, in April of this year, its oil production by 400 thousand barrels per day.

There was an expectation among large consumers, especially the United States, that the organization would place larger volumes of oil on the market, given the possibility that Russian production would be interrupted or reduced, or that it would make a statement to the contrary or take a retaliatory decision against the Russian Federation.

It is difficult for OPEC+, where Russia is a member and co-chairs the organization together with Saudi Arabia, to break their alliance, especially after the agreements and sacrifices made by the major producers to stabilize the market and recover the price, since the entry into force of the 9 million barrels per day oil cut in May 2020.

For its part, the US administration has been announcing successive releases of volumes of its strategicoil reserves[21][22], to which the International Energy Agency[23] has joined in an effort, so far unsuccessful, to halt the rise in oil prices.

The oil market is marked by a profound instability which, unlike what happened between 2020-2021 where its foundations were undermined by the COVID-19 pandemic, is closely and directly related to the war in Ukraine and the possible scenarios of its development.

The declarations made on March 3 by French President Emmanuel Macron, who made it clear that there would not be an armed confrontation between Russia and NATO, as well as by US President Joe Biden, who called for avoiding interference in the supply of Russian hydrocarbons, and by the German Minister of Economy and Energy, Robert Habeck, not to affect Russian oil and gas exports, reduced tensions on the market and caused the price of oil markers to fall, which throughout the day fluctuated up to maximum prices of $120 a barrel.

On March 04, Russian troops occupied the Zaporizhzhia nuclear power plant in Ukraine without incident, as declared by the IAEA[25]. As a result, there was a real fear in Europe that any of the four active nuclear power plants in Ukraine – with a total of 15 nuclear reactors – might be damaged by the military operations and that radioactive leaks might occur with catastrophic consequences for all countries. Nonetheless, Russian military forces, as they did with Chernobyl, have secured the facilities – all of which have Russian technology – and there has been no radioactive leakage.

Following this incident, Ukrainian President Zelensky accused Russia of «nuclear terrorism» and called for the imposition of a no-fly zone over Ukraine. However, the extraordinary meeting of the foreign ministers of NATO member countries on Friday, March 04, concluded with a categorical position against imposing a no-fly zone in Ukraine as requested by Zelensky or participating directly in the conflict or involving their troops in the conflict with Russia.

Such statements by NATO Secretary-General Jens Stoltenberg seem to confirm the scenario of the development of the war, with strong sanctions to collapse the Russian economy, but without suspension of Russian oil and gas supplies and an escalation to a direct military confrontation between Russia and NATO.

PRICES

OIL

The oil price has been strongly impacted by the instability resulting from the Russian military intervention in Ukraine. The geopolitical factor has imposed a «war premium» on the price of oil, which has caused it to vary in a band between $109 and $120 per barrel during the week’s trading day.

At the close of the markets on March 04, crude oil markers had an upward performance. Brent (ICE) and WTI (NYMEX) traded at $118.11 and $115.68 per barrel, respectively, an increase of 18% and 20% since the start of the war. These values represent an increase of more than $38 per barrel (47%) for both markers since January 04.

The rise in oil and fuel prices, far from responding to market fundamentals, will continue to be marked by the serious geopolitical situation involving Ukraine, Russia, and NATO. The market will be further destabilized depending on how the conflict evolves and the prospects of a military escalation with Russia. The premise of «not affecting» the oil market is far from realistic.

BRENT AND WTI QUOTATIONS

The $23 price increase since February 24 represents the «war premium» given the situation in Ukraine, and therefore cannot be attributed to market fundamentals. It is this reasoning that motivated OPEC+’s latest decision to keep its easing of cuts unchanged.

OPEC+ has argued that «the current fundamentals of the oil market and the consensus on its outlook, pointed to a well-balanced market, and the current volatility is not caused by changes in market fundamentals, but by current geopolitical developments«, so they did not take any decisions regarding production levels other than what was already foreseen in previous agreements.

In this last meeting, as in the group’s previous ministerial meetings on February 02[26] and January 04[27], the upward adjustment of 400 MBD in the group’s production quota for February, March, and April 2022 was ratified, amid demand that did not change its estimate for the first quarter of the year.

The oil market has been becoming stable since July 2021, as a result of the extraordinary OPEC+ production cuts, with demand recovering to 5.67 million barrels per day (MMBD) at year-end and inventories draining to the average levels of the last five years.

Even data published by the EIA in its February 08 monthly report[28] estimated OECD countries’ oil reserves stand at 2,676 million barrels in January 2022, the lowest level since the first half of 2014, while US commercial inventories, in the same month, fell to 1,178 MMBD, their lowest record since February 2015.

The price of oil in 2022 began a progressive recovery of its quotations, reaching over the threshold of $80 per barrel as of January 04. However, in this new situation of war between Russia and Ukraine and strong geopolitical tension, the price is above $100 a barrel, reaching quotations not seen since 2013 and with an upward trend.

In these circumstances, where geopolitical factors are having a definitive impact on the market, it is difficult to foresee how oil prices will behave. If sanctions against Russia cover the oil and gas sector or if the military situation escalates to a direct confrontation with NATO, not only would we be at the gates of a nuclear war, but the world’s second-largest oil producer would have difficulties in the short or medium-term to maintain its current production levels of 10 MMBD, which would mean a collapse in the world’s oil supply.

On the other hand, although European countries, the US and the UK, for the time being, avoid affecting or interrupting the supply of Russian oil or gas, market operators are not willing to assume risks that do not concern them, so they take their provisions to protect their economic interests in the event of a possible complication of the military scenario or a collapse of the Russian economy that would dramatically affect their oil and gas production or marketing capacity.

For the time being, Russia continues to export oil, although as a result of the sanctions and the rejection of Russian military action, the giant Rosneft has had to sell oil cargoes at heavily discounted prices.

Yesterday, March 04, it was known in open market operations, that Shell bought[29] a cargo of Ural crude at a 25% discount regarding Brent; it was also known that Rosneft is facing problems to sell[30] 83 million barrels of Ural crude in the market, at a discount, due to sanctions and political pressures, as well as to the problems they are having to secure crude transportation vessels. On the other hand, one of the major Russian oil companies, Lukoil, with an important presence in Europe, suffered a 99% drop in its share price, which will definitely affect its operational capabilities.

Despite this complex situation, the confrontational environment that exists and the isolation of Russia in the West and Europe, what is clear for the market is that there are neither sufficient strategic reserves nor additional oil production capacity in the US or Saudi Arabia to replace, in the short term, nor to do so in a sustained manner, the barrels of Russian oil in the market. A collapse in Russian oil production will surely destabilize the oil market, causing a price increase and a dramatic slowdown in the recovery of the world economy, which will suffer the devastating effect of the rise in oil and fuel prices.

The oil market and prices will continue to be marked by instability, fluctuating extraordinarily, in a way not seen since the economic crisis caused by the US real estate bubble in 2008, when the price reached $140 a barrel. But in this case, there is even greater uncertainty since its prices will vary according to the evolution of the military situation, geopolitical interests, and the uncertainty of the war and its terrible dynamics so that close monitoring of the situation is necessary in order to identify a definitive trend in the price.

GAS

The price of gas in Europe has increased by 131% since the beginning of hostilities between Russia and Ukraine, not only because Russia supplies more than 40% of the gas to Europe, but also because Ukraine is the transit country for half of the Russian pipelines to the continent.

The military conflict between Russia and Ukraine has put additional pressure on gas prices, which have been on the rise since June 2021, stemming from increased post-COVID demand and Russian pressure to gain approval for the Nord Stream 2 pipeline, whose certification was finally suspended by the German government.

On February 24, at the beginning of the military intervention initiated by Russia in Ukraine and the announcement of sanctions against the Eurasian country, the price of Dutch TTF Gas Futures, the benchmark for the value of gas in Europe, experienced a strong increase, exceeding €100 per Megawatt/hour (MWh) to reach €116.5 at the close of the day, after reaching €144 during the day, increasing by €55 in less than 24 hours.

However, the prospect of a suspension of Russian gas supplies or disruption to transportation systems as a result of the war in Ukraine has pushed gas prices in Europe extraordinarily.

At the close of Friday, March 04, gas quotations in Europe surpassed the €200 per MWh barrier, when on February 23, it was quoted at €88.3 per MWh, an increase of 130% since the beginning of the war and more than 700% since July 2021.

ALL-TIME HIGHS

OF GAS PRICES IN EUROPE

December 2021 – March 2022

Unlike oil supply, the possibility of diversifying gas supply sources to Europe has physical infrastructure constraints arising from the very nature of gas transportation and the immature, or underdeveloped, interchange infrastructure of this widely used hydrocarbon throughout Europe.

As a result, the rise in gas prices has a direct impact on the cost of electricity, heating, and industrial uses, with a high impact on inflation and production costs, especially in the winter season. Even before the beginning of the conflict, the cost of gas had already become an inflationary factor for European economies engaged in their post-cooling recovery with intensive use of fossil fuels, the only available energy.

There is no source of gas supply to Europe that can replace Russian gas in the short or medium term. Europe cannot forego Russian gas without suffering a collapse of its economy.

The European Union imported an average of more than 380 million cubic meters (mcm) of pipeline gas per day from Russia, or about 140 billion cubic meters (bcm) for the entire year. In addition, some 15 bcm was supplied in the form of liquefied natural gas (LNG). The total 155 bcm imported from Russia accounted for about 45% of the EU’s gas imports in 2021 and almost 40% of its total gas consumption.

INFRASTRUCTURE AND DEPENDENCE

OF RUSSIAN GAS SUPPLY IN EUROPE

2020

The quickest response to an eventual suspension of Russian gas supplies to Europe would be gas rationing in the region, as well as a switch to coal, or the increased use of liquid fuels to replace gas, especially in the electricity and industrial sector, as has already been decided by several European countries. This, in any case, will have a major impact on the European economy.

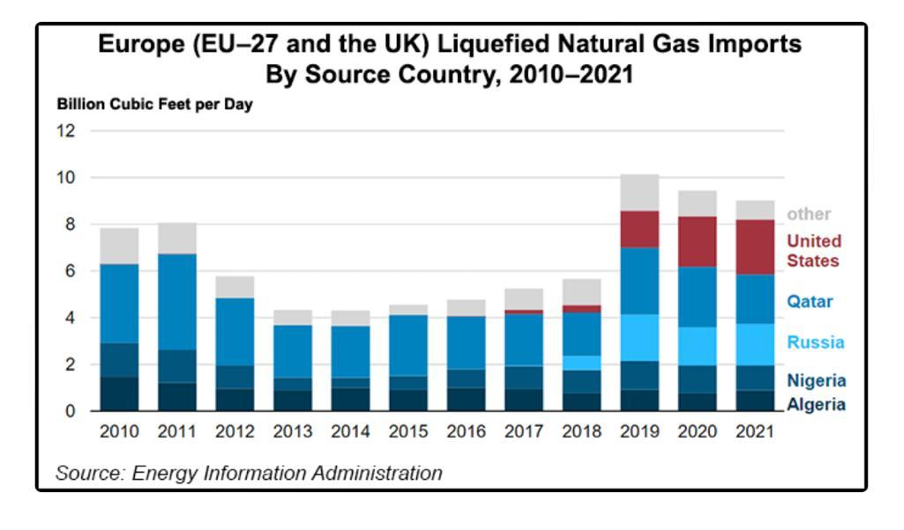

Liquefied Natural Gas imports are not a short-term option due to the lack of sufficient regasification terminals on the continent capable of receiving the necessary volumes to meet Europe’s energy needs.

In this segment, the US administration has been moving forward, gaining space in the European market, and has pressed the European Union for agreements to increase LNG supply from the US in the future.

The Energy Information Administration (EIA) shows that the US became the main supplier of LNG to the EU, covering more than 50% of the market so far in 2022. Earlier, in 2021, US imports had already become the main source of supply for European LNG demand, controlling 26% of the market, which puts it above Qatar (24%) and leaves Russia in third place, with 20% of imports, in a market that was largely dominated by Qatar until 2018 and of which the US was not part until 2017 (the year sanctions and blockade in Qatar began), and where Russian and US production became strong from 2019 onwards.

IMPORTED LNG

EUROPEAN UNION AND THE UNITED KINGDOM

(2010 – 2021)

Amid tensions and various meetings before the Russian military operation, on January 28, US President Joe Biden and European Union President Ursula von der Leyen signed an agreement to guarantee, from various sources around the world, a «continuous, sufficient and timely» supply of natural gas to Europe, in order to avoid a supply «crisis», including, according to the agreement, «those that could result from a new Russian invasion of Ukraine«[31]; an agreement that seeks to reduce dependence on Russian gas and the need to advance in the control of Eastern Europe, including Ukraine and Georgia. For this reason, the US President invited the Emir of Qatar, Tamim Bin Hamad Al-Thani, to a meeting[32] on January 31, informing him of his intention to designate Qatar as a non-permanent NATO ally.

However, Qatar’s energy minister and chairman of Qatar Petroleum, Saad al-Kaabi, said, in a video conference with European Union authorities that «the volume of gas needed by the EU cannot be replaced by anyone unilaterally, without disrupting supplies to other regions of the world,»[33] making it clear that Qatar cannot single-handedly take over the supply to Europe if gas shipments from Russia are cut off.

ECONOMY

After the devastating effects of the COVID-19 pandemic on the world economy, a direct military confrontation between Russia and Ukraine on the eastern flank of Europe has emerged, unexpectedly for all analysts.

The world economy, after the collapse of 2020 and a recovery of 5.9% in 2021, managed to position itself at the beginning of 2022 in frank recovery, where a global growth of 4.4% was estimated for the year.

The only uncertainties threatening its performance were the COVID-19 variants, particularly Omicron and the inflationary phenomenon, discontinuity in supply chains, and insufficient oil and gas supply to meet growing energy demand, especially from large industrialized economies.

The imminent risk of a war in Europe, involving the world’s second-largest oil producer and the world’s largest gas exporter, did not appear on the analysts’ horizon.

Inflation and energy

The large industrialized economies, «drivers» of the economy and world oil demand: the US, Europe, and Asia have been facing, since 2021 and 2022, at different levels, inflationary problems that put the recovery of their economies at risk. In some of them, as in the case of the US, the phenomenon of Stagflation is emerging, i.e. the stagnation of the economy, but with inflation.

In addition to the massive fiscal support and resources injected into the economy, especially in the US and Europe, and the disruptions in supply chains, a determining factor for inflation is the access and price of energy, especially oil and gas, which are intensely required by the large industrialized economies for their recovery and which have an immediate -direct- effect on consumers and the cost of goods and services.

The weight of energy costs in the inflationary matrix varies in each country, especially depending on its degree of energy independence or self-sufficiency, which even so, as in the case of the US, does not guarantee that energy is not a major factor in the inflationary phenomenon.

US annual inflation in 2021 was 7.5%, according to data released on February 12 by the US Bureau of Labor Statistics. The country’s annual energy inflation was 27%, and gasoline prices increased 40%[34].

The European Union, for February 2022, showed annual inflation of 5.9%, with a monthly increase of 0.8 points; whereas energy, with annual inflation of 31.7% and a monthly increase of 3.1 points, was the item that accounted for most of the inflationary rate, as reported by Eurostat on March[35] 02.

For its part, China, the largest Asian economy and the second-largest in the world, had in January of this year annual inflation of 0.9% in the Consumer Price Index (CPI). As for energy, it experienced a cumulative rise of 20% during 2021, according to recent data published by the National Bureau of Statistics of China[36].

The International Monetary Fund’s growth projections[37] for the world economy for January of this year, before the war, suffered a downward adjustment. US growth was adjusted to 4%, 1.2 points lower than forecast last October; for the Euro Zone, growth was projected at 3.9%, a reduction of 0.4 percentage points. The growth of the Chinese economy was projected at 4.8%, a reduction of 0.8 points with respect to its previous estimates.

A European war

In this scenario of a cautious recovery of the world economy, the war between Russia and Ukraine erupts unexpectedly for all analysts. A war whose humanitarian, political, economic, and military consequences are still difficult to estimate with certainty, with a still unclear outcome.

Beyond the economic and diplomatic logic, the logic of war has been imposed as a response to growing tensions between Russia and Ukraine which, although developing secretly, at some point emerged with all its violence, when Ukraine crossed what Russian President Vladimir Putin has defined as one of the «red lines«[38] of its national interests and military security.

The Russian military intervention in Ukraine has caused a severe setback to the recovery of the world economy and will have dramatic consequences for the European economy.

This war is no longer taking place in peripheral countries, nor far from Europe, but in the heart of Europe, at the eastern gate of the continent, in a territory that is not only the passage of most of the gas pipelines that transport gas from Russia to Europe but also constitutes the border, the disputed territory, between NATO and Russia.

On the other hand, Russia, the great power involved, not only has an unquestionable military weight, with a gigantic military and nuclear capacity but is also a relevant player in the development of the world economy, particularly in Europe.

Russia’s trade and financial exchange with Europe reached $280 billion, showing annual growth of 46% in 2021, according to data published by the Sputnik News agency. On the other hand, and perhaps the most important aspect in the economic situation, Russia is the second-largest oil producer in the world with current production of 10.04 MMBD and a capacity that can exceed 12 million barrels per day[39], besides being the first gas exporting country in the world, with a supply -only to Europe- of 380 million cubic meters of gas per day, equivalent to 140 trillion cubic meters (TCM) of gas per year.

The major industrialized economies of North America and Asia are watching the events from a distance, while China remains cautiously silent and the United States plays a leading role in the conflict; both major poles of economic and military hegemony in the world are keeping a prudent distance from the conflict.

From the very beginning of the conflict, US President Joe Biden made it clear that his country would not be directly involved in the conflict, as he stated on March 01: «Our forces are not engaged and will not come into conflict with Russian forces in Ukraine. They are not going to Europe to fight in Ukraine, but to defend our NATO allies«[40].

Sanctions

The response of the US, UK, and the EU to the Russian military intervention in Ukraine has been the imposition of massive sanctions on Russia, including severe economic and financial restrictions: freezing of assets, goods, and monetary reserves; sanctions and confiscations of Russian banks and companies; restrictions on trade, exchange of goods and services; ban on Russian flights over the airspace of more than 30 countries in Europe and North America; ban on exports, goods and services, and technologies; withdrawal of companies; blockade on social networks, internet, and Russian media; as well as participation in sporting and cultural events; individual sanctions and confiscations against Russian citizens, members of the government, including President Putin and Foreign Minister Lavrov, and the so-called «Russian oligarchs».

However, the sanctions explicitly exclude energy-related operations. The emphasis has been on blocking the financial system, access to or exchange of capital, blocking trade and supply of goods and services to deprive Russia of maneuvering possibilities to defend its economy, without directly affecting the oil and gas sector.

The United States, the European Union, and the United Kingdom have frozen assets and reserves of Russian banking, including the Central Bank, freezing more than $600 billion in foreign currency reserves abroad, leaving Russia with few tools to prevent a plunge in the ruble, which has fallen 30% against the dollar since Russia acceded to Ukraine, while inflation is estimated to be above 17%.

Sanctions against Russia have been imposed in a coordinated manner mainly by the US, the UK, and the EU since February 21, and have been successively joined by other countries such as Canada, Japan, and South Korea, among others.

In the US, the White House administration imposed sanctions on Russia as early as February 21, following the recognition of the republics of Donetsk and Lugansk, sanctions that have been escalating following Russia’s military intervention in Ukraine.

On February 22, President Joe Biden announced the first package of sanctions against Russia. In the second sanctions package on February 24, the energy sector was granted a license, exempting «any energy-related dealings» from the sanctions.

The US has sanctioned 12 Russian banks, among them the two largest: VTB Bank and Sberbank (the main bank in Russia and Eastern Europe), which represent more than 70% of Russian banks’ currency management, freezing their assets in US territory, and preventing them from accessing any currency other than the ruble.

The sanctions also include Russia’s largest state-owned companies, which, according to the US Treasury Department, hold assets in the United States of more than $1.4 trillion. Similarly, President Biden expects US sanctions against Russia to affect the trillions in Russian assets in the US financial system for doing business in and out of Russia; the US Treasury Department estimates that Russia moves $46 billion daily, $37 billion of which is in US currency.

The sanctions also cover the suspension of Russian financing, which affects Russia’s sovereign debt; restrictions of trade of high-tech products to the Russian market; and sanctions against Russian elites and their families, through the freezing of assets in the United States of individuals related to the government of President Vladimir Putin.

Days later, on February 24, President Biden informed that these measures would be joined by countries of the European Union and Japan. He also announced that he had communicated with the G-7 leaders who, he said, were «in total agreement» in limiting Russia’s capacity to do business in foreign currencies.

Last Wednesday, March 02, the United States announced new sanctions against «Russian oligarchs»[41], measures that will also affect their relatives.

For its part, the European Union, on February 23, agreed to a package of sanctions in response to the Russian Federation’s decision to recognize the non-government-controlled areas of Ukraine’s Donetsk and Lugansk provinces as independent entities and the subsequent decision to send Russian troops to those areas, including targeted sanctions against 351 members of the Russian State Duma and 27 other individuals; restrictions on economic relations with the non-government-controlled areas of Donetsk and Lugansk oblasts; and restrictions on Russia’s access to EU financial and capital markets and services.

However, following the Russian military intervention in Ukraine, the European Union held an extraordinary summit of Heads of State on February 24, where they agreed on the first package of sanctions against Russia related to different sectors such as financial, energy and transport, trade, supply of goods and services, technology, visa policy and additional sanctions against Russian nationals.

On February 25, the European Union adopted the second package of sanctions against Russia, imposing individual sanctions against Vladimir Putin, Sergey Lavrov, and members of the Russian State Duma, among others, as well as new economic sanctions.

On February 28, the EuropeanCommission[42] approved a support package worth €500 million to finance equipment and supplies to the Ukrainian Armed Forces, in addition to a third package of sanctions against Russia that includes a ban on the overflight of Russian aircraft from EU airspace; a ban on transactions with the Central Bank of Russia; a ban on access to the SWIFT system for seven Russian banks: Bank Otkritie, Novikombank, Promsvyazbank, Rossiya Bank, Sovcombank, Vnesheconombank (VEB) and VTB Bank; a ban on investing or participating in future projects co-financed by the Russian Direct Investment Fund or otherwise contributing to such projects; a ban on selling, supplying, transferring or exporting euro banknotes to Russia or any Russian natural or legal person or entity; the suspension of broadcasting in the EU of the public media Russia Today and Sputnik; in addition to further individual sanctions.

For his part, British Prime Minister Boris Johnson announced on February 22 the imposition of economic sanctions against five Russian banks and three individuals with «great wealth» in response to Russian President Vladimir Putin’s recognition of the independence of the Ukrainian regions of Donetsk and Lugansk. As part of these sanctions, he explained in a speech to the House of Commons, «any assets that these banks or individuals hold in the UK will be frozen«. Likewise, the affected individuals will not be allowed to enter the country until further notice.

The UK Government announced on February 28 a package of sanctions against Russia’s Central Bank in response to the invasion of Ukraine and has stressed that these are measures taken in coordination with the United States and the European Union (EU) to «prevent» the entity from «deploying foreign reserves in a way that undermines the impact of the sanctions» imposed so far on Moscow.

The United Kingdom announced the freezing of the assets of all Russian banks in its territory, including VTB Bank, the second-largest Russian bank. At the same time, the British Prime Minister, Boris Johnson, informed that they will prevent large Russian companies and institutions from accessing financing in the British capital markets. Additionally, he announced the blocking of any contribution to Russian technological development, promoting legislation to prevent the shipment of high technology products to the Russian market, as well as raw materials for the fossil energy extraction industry and hydrocarbon refining equipment.

Moreover, amid this confrontational atmosphere, NATO countries continue to mobilize troops, weapons, and combat equipment to member countries neighboring the conflict zone and the Russian border, while most EU countries, with particular emphasis on Germany, have agreed to send arms to Ukraine.

This scenario is taking place even though both Presidents Joe Biden and Emmanuel Macron have made it clear that their countries have no intention of going to war with Russia, while the NATO Secretary-General, upon his departure from the extraordinary meeting of the foreign ministers of the member countries, assured that the organization has no intention of getting directly involved in the war.

China and India

China, the world’s second-largest economy and the world’s largest oil importer (10.9 MMBD in December 2022), along with India, the world’s third-largest oil importer (5.14 MMBD in December 2022), have taken a cautious and distant position from the conflict.

China’s leadership is determined to preserve its economy and its growth targets, already affected by the global economic downturn and the lack of sufficient volumes of oil and gas, so it has had to resort massively to the use of coal since 2021.

The Chinese authorities estimated a 5.5% growth of the economy for 2022, contrasting with the 8.1% experienced last year.

China is, like Europe and the rest of the Asian economies, reliant upon energy imports. Therefore, it is not willing to risk Russia’s oil and gas supplies, nor its economic exchange with its neighboring country, for a military conflict in Europe for reasons of national interest, similar to those that China could wield in Taiwan or the China Sea.

China has said that it will not join the sanctions against Russia and becomes Russia’s potentially most important partner, not only to receive all the volumes of oil and gas that Europe, the UK, and the US reject but also to increase its economic, financial, commercial and technological exchanges with Russia, a country that could be forced to turn all its systems and exchanges towards the Asian giant. The Orwellian hypothesis of the «Euro-Asian» bloc with Russia and China as protagonists is clearly foreshadowed.

The same attitude -in smaller dimensions- has been assumed by India concerning the conflict. Being one of the fastest-growing economies in Asia and a net energy importer, it seems unwilling to join any blockade or actions that would prevent it from accessing Russian oil or gas volumes, especially when there is a net installed refining capacity of more than 700 MBD for heavy oil, with the characteristics of Russian Ural crude.

The purpose of the sanctions, their scope

The economic and financial sanctions imposed by the United States, the United Kingdom, the European Union, Canada, and Japan have been of great magnitude and could have devastating effects on Russia. They are aimed at «disconnecting» Russia from the European and Western financial system and economy, isolating it completely, breaking economic ties that have been built up since 1990, after the collapse of the Soviet Union.

The massive sanctions have a clear punitive orientation aimed at collapsing the Russian economy. As President Biden and EU officials have stated, «Russia will pay a high economic price for military intervention in Ukraine«, but this without affecting its ability to supply oil and gas to the market.

The US president said on March 01, during his first State of the Union address, that Vladimir Putin – whom he called the «dictator of Russia» – «may make gains on the battlefield, but he will pay a continuing high price in the long run,»[43] as the Treasury Department gave the green light to sanctioned Russian banking to operate energy trade transactions.

For the European Union, the aim of the sanctions, as Commission President Ursula von der Leyen said, is to «weaken Russia’s economic base» and damage «the Kremlin’s ability to pay for the war», which seems to be aimed at collapsing the Russian economy. However, in the EU sanctions, Russia’s oil and gas sector has also been exempted.

While some presidents, such as Emmanuel Macron, are more cautious and open to dialogue, others, such as German Chancellor Olaf Sholz, have been more aggressive in his discourse. On February 27, in his government statement during a special session of the German Parliament, Chancellor Sholz promised that «very soon» Russian leaders «will feel the high price they will have to pay for invading Ukraine.» [44]

For its part, despite all the sanctions, the Russian leadership maintains its position unchanged. On Saturday, March 05, following a press conference by Foreign Minister Lavrov, where Russia reaffirmed its goals of «denazification» and «demilitarization» of Ukraine, as well as doubting the negotiating intentions of Ukrainian President Zelensky, President Vladimir Putin, stated categorically that «whoever attempts to close the airspace (referring to Zelensky’s request to impose a no-fly zone) will be considered by us as participation in an armed conflict on the part of that country», in addition to describing the sanctions against his country «as war actions«[45].

Immediate effects of sanctions

At the close of the first week of the war and as the Russian army advances in the conquest of Ukrainian territory, the sanctions have begun to have effects both in Russia and in Europe itself, which is a logical consequence of integrated capitalist economies and globalization.

This conflict, unlike those that shook Europe for much of the twentieth century, is not ideologically motivated, nor are they opposing and isolated economic systems that confront each other. This makes an evident difference in the situation.

In Russia, the ruble has plummeted in the face of sanctions and restrictions that include the freezing of reserves and assets of the Russian Central Bank abroad. Although the government has taken defensive actions -surely planned before the conflict- such as the closure of the Moscow Stock Exchange (which as of February 28 had already fallen 35%) and the ban on foreign capital leaving the country, the impact on the population is direct, especially due to the effects of inflation and the fear of a widespread shortage of food, and goods and services, which, so far, has not occurred.

The population is trying to take its own precautions, turning to banks for cash, supplies, and protection, for what it expects to be hard times for the country, situations to which Russians have been exposed most cruelly in their history.

For its part, the country’s large military, energy, and manufacturing industrial conglomerate continues to operate to sustain the economy and the war effort. The oil and gas sector, despite announcements of the withdrawal of international partners such as BP, Equinor, and Shell, continue to operate at full capacity and the market has not reported any interruption of operations or supply of oil and gas to the market, which guarantees critical revenues for the country at this juncture.

The country’s financial sector is strongly affected by the freezing of assets and resources abroad, while large Russian companies are suffering the effects of the sanctions and the rejection of capital to war actions. Perhaps the most emblematic case has been the collapse of the shares of Lukoil, presided by Vaguit Alekperov, which has lost 99% of its value on the stock exchange, which led it to declare on March 03 its opposition[46] to the war in Ukraine.

Part of the strategy of sanctioning and confiscating assets of the so-called «Russian oligarchy» is to strike at President Putin’s political and economic support base, a strategy that, given the characteristics of power in Russia, could affect the objective of isolating him. This remains a big unknown.

Meanwhile, financial sectors and risk agencies are permanently monitoring Russian bills and debt, which were placed on Friday in the «junk» category by Fitch and Moody’s[47], which would indicate that Russia is on the verge of a «default».

On March 04, JP Morgan assessed that the Russian economy is on the way to collapse[48], estimating that the economy will have a 14% drop, similar to the one suffered in 1992. The study also estimated that the price of oil could reach $185 per barrel by the end of 2022.

Despite this situation, the Russian President and Foreign Minister Lavrov have declared that the Russian military offensive in Ukraine will be maintained until the goals defined as «demilitarization» and «denazification» of Ukraine are achieved, notwithstanding the progress of the talks between the two warring countries in Belarus, the third round of which is expected to take place this weekend. The Russian leadership appears to be willing to go to any lengths to achieve these goals.

In Europe, inflationary pressures on the economy have soared along with energy prices, both because of rising oil and gas prices and fears that there may be some disruption to vital energy supplies as a result of military operations.

At the same time, as Russia is a major producer and exporter of fertilizers, metals, grains, oil and, together with Ukraine, responsible for the supply of 30% of wheat to Europe, there are fears of a rise in the cost of food, goods and services, in addition to the impact of the rise in energy prices.

The IMF stated today, March 05, that the prolongation of the war will have devastating effects on the economy. «Sanctions on Russia will also have a substantial impact on the global economy and financial markets, with significant spillovers to other countries.»

At the end of the week, on Friday, March 04, after the Russian occupation of the Zaporizhzhia Nuclear Power Plant in Ukraine, panic spread due to the possibility of a nuclear accident and the European stock markets plummeted, losing €400 billion during the day.

Meanwhile, the Euro has continued to lose value against the dollar, trading at 1.092 dollars per Euro, the lowest value since May 2020.

The evolution of the war, the sanctions, and JP Morgan’s rating on Russian debt and securities, as well as the prospects of the collapse of the Russian economy, had a direct impact on the Stock Exchanges as well as on the value of the Euro. As mentioned at the beginning of this section, the war between Russia and Ukraine is a European War.

DEMAND

At present, it is impossible to know how world oil demand will behave, as it depends directly on the outlook for the world economy, which has been greatly affected by the Russia-Ukraine war and the sanctions against Russia.

However, when OPEC, agencies, and other specialized institutions make their forecasts of world oil demand, the objective is to determine whether this demand can be satisfied by the world oil supply and, consequently, the behavior of prices is estimated.

Although in a matter of days, specialized economic institutions should publish new demand projections, which will surely be affected by the negative outlook for the economy given the development of the war in Europe and its possible evolution scenarios, it is nevertheless important to review the estimates of world oil demand, before the war, made at the beginning of this year and the forecasts of the existence of sufficient oil supply to satisfy it.

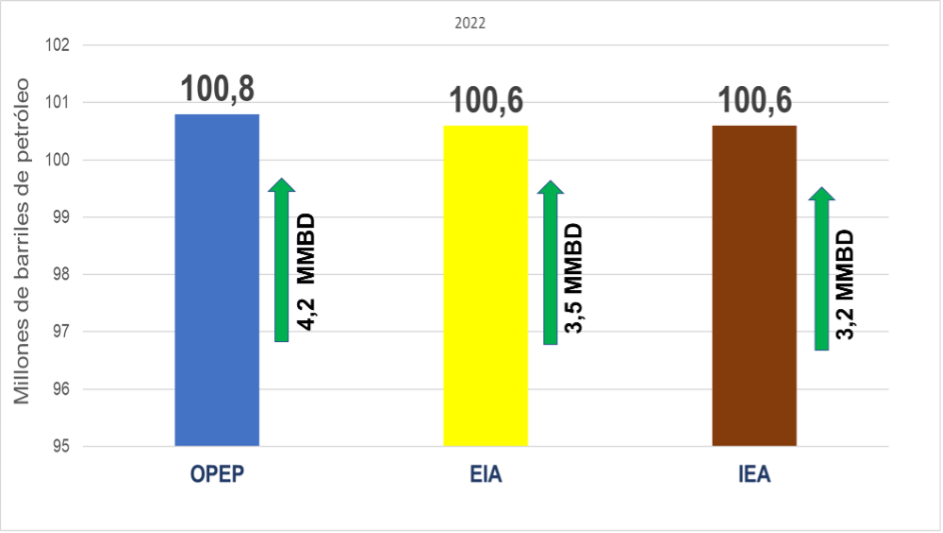

OPEC, in its monthly report published on February 10, projected oil demand for the first quarter of 2022 at 99.13 MMBD, unchanged with respect to the records reported in December of last year. Likewise, the forecast for 2022 remained unchanged at a historic 100.8 MMBD, with an estimated annual increase of 4.15 MMBD for the year.

On the other hand, the EIA, in its monthly report of February 08, adjusted upwards by 250 MBD the world oil demand for the first quarter of the year, regarding the data published on January 11, placing it at 99.7 MMBD.

In turn, the demand projection for 2022 places it at 100.6 MMBD, an annual increase of 3.5 MMBD. For its part, the IEA adjusted its demand estimate for 2022 upwards by 800 MBD, bringing it to the same level as the EIA (100.6 MMBD), with an annual growth of 3.2 MMBD.

INITIAL DEMAND ESTIMATES

(2022)

These projections indicate that, despite the uncertainties at the beginning of the year regarding the performance of the economy and its estimated growth of 4.4% for 2022, all analysts agree that world oil demand will recover this year to reach the level of 100 million barrels of oil per day, i.e. the levels of demand before the COVID-19 pandemic of March 2020.

What is important about this projection, which will surely – as we have said – change, is that we can assume that, in order to meet this eventual demand, the same levels of world oil supply as in April 2020 will be required, i.e. 99.8 MMBD.

Therefore, if there is no concern in the market – at least expressed in the reports we have reviewed – regarding the possibility of meeting this demand before the war between Russia and Ukraine, it means that the market assumes the existence of the same production capacities in the producing countries as existed in April 2020, the highest level of production prior to the COVID-19 pandemic.

We will focus below on the issue of oil production capacities, now in the face of the developing war between Russia and Ukraine, and the possibility of affecting Russia’s production capacities.

PRODUCTION

The Russian military intervention in Ukraine, the harsh sanctions imposed against Russia, as well as the possibility of an escalation in the conflict have generated great uncertainty for the oil supply worldwide, given the fact that Russia is the second-largest oil producer in the world, which is reflected in the increase in prices.

Although the sanctions imposed against Russia expressly exclude the oil and gas sector, it is foreseeable that the military situation or the economic and financial sanctions against Russia could reduce Russia’s current oil production capacity in the short or medium term.

The major industrialized economies, bent on their recovery from the devastating effects of the 2020-2021 COVID-19 pandemic, have required, since mid-2021, increased oil supply as demand has been restored to pre-pandemic levels, which has been reflected in recovery in demand by 5.67 MMBD during 2021.

Both OPEC and the agencies, IEA and EIA, estimated in January of this year, before the war, that world oil demand by 2022 would stand at 100.6 MMBD, the same levels as in 2019, before the pandemic.

But the energy needs and recovery goals of industrialized economies require more oil volumes at a lower price. For this reason, the US has repeatedly requested OPEC+ to make the organization’s production cut more flexible to have more volumes available in the market.

Given OPEC+’s refusal, at its last ministerial meeting on March 02, to increase production beyond the previously agreed 400 MBD, as it maintains that market stability and fundamentals have been recovering satisfactorily throughout 2021-2022, the US has coordinated with other major consumers to release barrels from their respective strategic reserves and has also done so unilaterally, which was expected to increase oil supply in the market and restore commercial inventory levels.

In November 2021, the US decided to release 50 million barrels of US[49] oil reserves to the market; in January of this year, the US Department of Energy authorized the release of another batch, for more than 13 million barrels[50], of its strategic oil reserves.

Immediately after the Russian military intervention in Ukraine, President Joe Biden announced the decision to release an additional[51] 30 million barrels of oil from strategic reserves, while the International Energy Agency requested its members to release another 30 million barrels of oil from their respective reserves[52].

However, these measures have had no impact on inventories, which have maintained their downward trend. US strategic petroleum reserves (SPR) have been drained since September 2021, without being able to stop the oil price increase. SPRs, have drained 42 million barrels in the last 6 months, dropping from 621 million to 580 million barrels, at an average of 2 million barrels per week; since Biden’s first announcement in November last year, reserves drained 16 million barrels of oil.

Despite this, US commercial oil inventories have fallen by 19 million barrels in the last six months, from 423.87 million barrels on September 03, 2021, to 413.42 million barrels last February 25.

EIA data estimates that commercial inventories of oil and petroleum products in the Organization for Economic Cooperation and Development – OECD countries (including the US), fell from 2,749 million barrels in September 2021 to 2,675 million in February 2022 (their lowest level since July 2014), showing a drain of 74 million barrels in that time frame.

The average volume of OECD commercial inventories in the last six months has been below 2.8 billion barrels, a 5-year low.

A stable price, at a reasonable level, increased demand, and draining of inventories indicate that the oil market was in equilibrium before the war.

Now with the new situation, all market fundamentals are affected: DEMAND – directly related to the economy -, SUPPLY – at risk due to the war and Russia’s production capacities – and INVENTORIES, which at this juncture are at minimum average levels.

These circumstances raise the question for market operators, which is the most uncertain aspect at the moment: Is there enough spare capacity to eventually replace the Russian oil supply and avoid a new collapse of the world economy?

Petroleum, liquids, and condensates (PLC)

World production of oil, condensates, LNG and unconventional oils (PCL) continues to increase gradually, mainly due to OPEC+’s policy of flexible cuts and the entry of volumes from the US and other producers, stimulated by the recovery in prices.

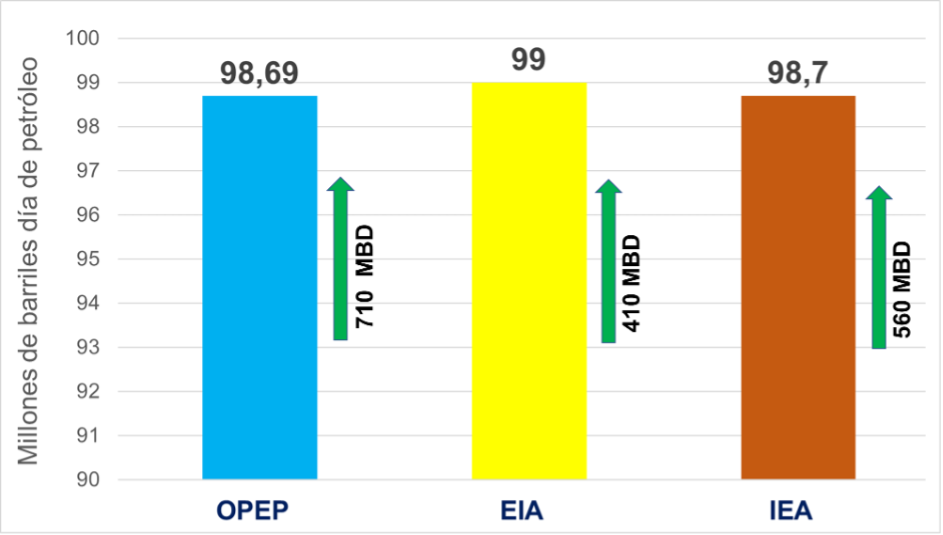

According to the latest OPEC Monthly Oil[53] Market Report on February 10, it indicates that in January 2022 world PCL production stood at 98.69 million barrels per day (MMBD), a monthly increase of 710 thousand barrels per day (MBD) over December 2021.

The Energy Information Administration (EIA) estimated world production at 98.59 MMBD in January (a monthly increase of 410 MBD), while the International Energy Agency (IEA) estimated it at 98.7 MMBD, with a monthly increase of 560 MBD.

WORLD PRODUCTION

of crude oil, condensates, LNG, and unconventionals

(January 2022)

World oil production

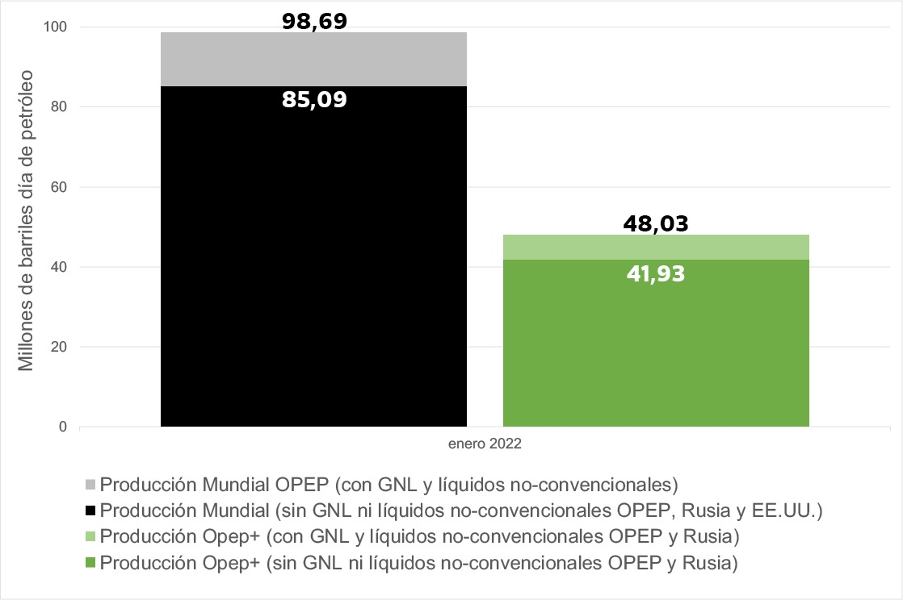

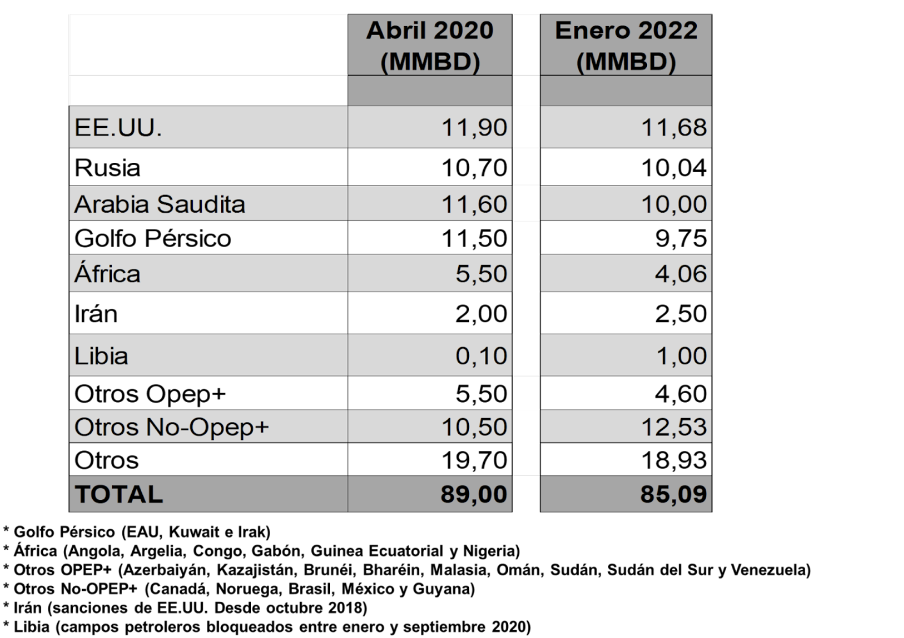

If we subtract condensate, LNG, and unconventional volumes from these volumes, world oil production in January 2022 stands at 85.09 MMBD, a moderate monthly increase of 200 MBD over December’s oil production. Production at the beginning of the year was affected by a 260 MBD drop in US production, offset by an increase in OPEC+, Canada, and China.

WORLD OIL PRODUCTION

(January 2022)

From August 2020 to January 2022, OPEC+ has increased its share of oil production by 6.34 MMBD, with an effective increase of 5.6 MMBD. Adding to the OPEC+ production increase is the production of 3.7 MMBD from other countries, primarily the US, Canada, and Norway.

OPEC+ production

By January 2022, OPEC+ production (including Iran, Libya, and Venezuela, exempt from the cut) stood at 41.93 MMBD, following a 400 MBD increase in its production quota for the month.

With the increase in the January 2022 production quota, plus the 5.959 MMBD increased between 2020-2021, the flexibility of the original 9.7 MMBD cut, initiated on May 01, 2020, reaches 66.6%, leaving only 3.341 MMBD to return to the March 2020 production level, which is expected to be added to the market, according to the latest OPEC+ agreement, gradually -maximum- until December 31, 2022.

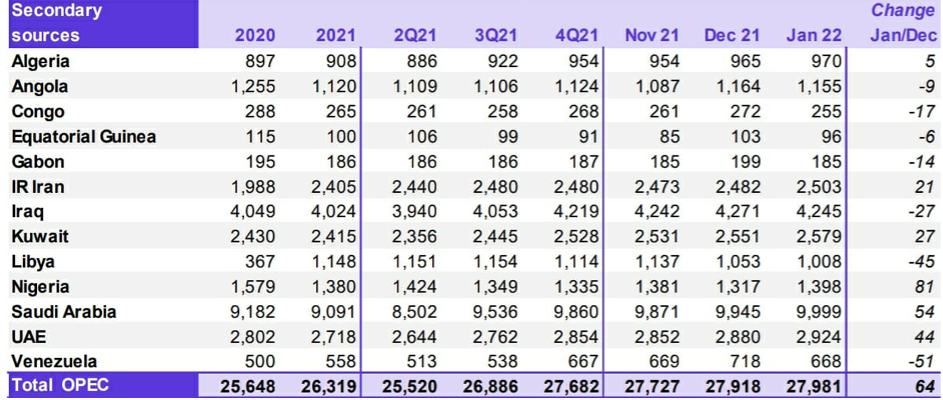

OPEC Production

According to MOMR data, oil production of the 13 member countries, as of January 2022, was at 27.98 MMBD, 60 MBD higher than December 2021.

OPEC COUNTRIES’ PRODUCTION

(January 2022)

Between 2020 and 2021, average OPEC production increased by 671 MBD, taking into account that the production cut agreed in May 2020 has been in effect during this period.

In January 2022, 70.6% of OPEC production (19.747 MMBD) is concentrated in the Persian Gulf countries (excluding Iran); while 14.5% (4.059 MMBD) is concentrated in African countries (excluding Libya); the three countries exempt from production cuts (Iran, Libya, and Venezuela) accounted for 14.9% (4.18 MMBD), of which 60% corresponds to Iran and 24.11% to Libya.

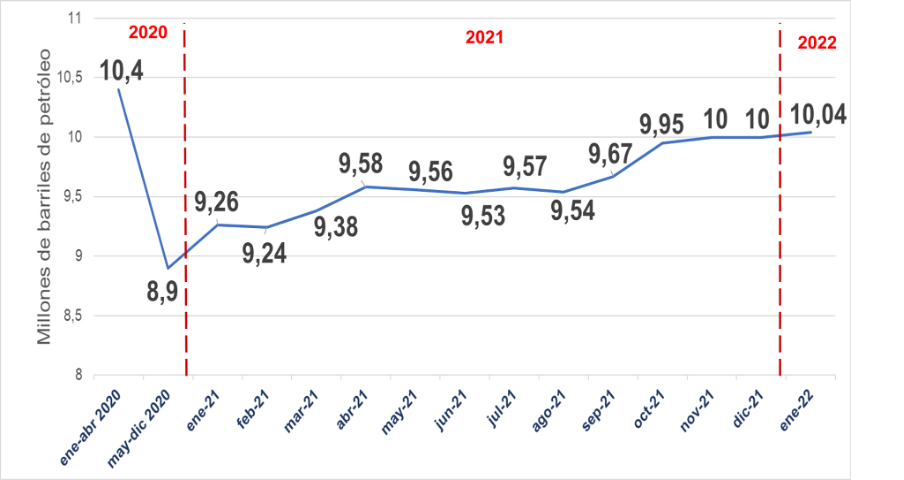

Russia

According to data published by the Ministry of Energy of the Russian Federation, the country’s oil production in January 2022 was at 10.04 MMBD, remaining at around 10 MMBD since November last year, representing 24% of OPEC+ production.

RUSSIAN OIL PRODUCTION (January 2020-January 2022)

Russia’s production will average 9.6 MMBD in 2021, an annual increase of 220 MBD, after recording an average of 10.4 MMBD during the first four months of 2020.

USA

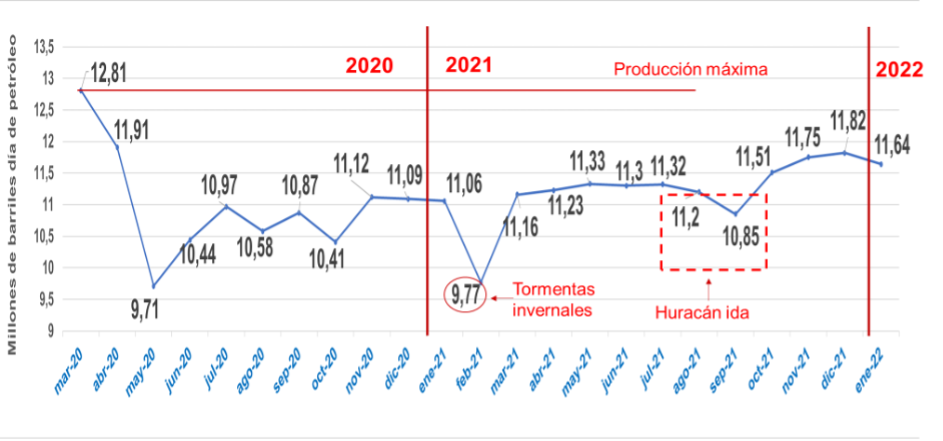

The latest weekly report from the EIA[54], places US production as of February 25, at 11.6 MMBD, a reduction of 200 MBD with respect to December 2021. Thus, the US remains the world’s largest oil producer.

In 2021, North American oil production, which has not been subject to any cutback agreement, has recovered 2.5 MMBD of production.

US OIL PRODUCTION *

(March 2020 – January 2022)

Source: Own elaboration with EIA STEO data from February 09, 2022.

Ranking of major producers

With the data on oil production before the pandemic, current production, and the projection at the end of the year, we can group the major producers as follows:

COUNTRIES WITH THE HIGHEST

OIL PRODUCTION

(2020-2022)

By April 2020, one month after the onset of the COVID-19 pandemic, world oil demand was estimated at 98.2 MMBD, which had the over-coverage of an effective supply of 99.93 MMBD, of which, when subtracting Condensates, NGLs, and unconventional (OPEC, Russia, and USA) volumes, 89 MMBD corresponded to oil production.

In January 2022, 22 months later, and even with the remaining OPEC+ production cut of 3.34 MMBD, production was at 98.7 MMBD, of which 85 MMBD corresponds to oil, with world demand estimated at 100 MMBD, which, at first glance, seems the indication of an oil market with a balanced supply-demand relationship, albeit with some pressure on supply and price.

UNCERTAINTIES ABOUT

OIL PRODUCTION

Since before the beginning of the war between Russia and Ukraine, there have been uncertainties regarding the behavior of oil production in some countries, especially in view of the economic crisis that has affected the world – including oil producers – as a consequence of the economic downturn between 2020-2021 caused by the pandemic and the lack of capital willing to invest in oil and gas production, particularly due to the campaign against fossil energies and the lobby of green energy producers – including nuclear energy – to attract investments from governments and large capital funds.

Although these aspects have brought forth issues for some producing countries, including the US, to sustain their production capacities, there were no major concerns in the oil market, because the possibility of an abrupt interruption of the world oil supply due to the collapse of any of the three major oil producers in the world the US, Russia and Saudi Arabia, was not foreseen or did not exist.

The production data in the chart above shows that by April 2020, the highest oil production in the world was reached, for instance, 89 MMBD, a volume that, added to the production of LNG and condensates from Russia, the USA, and OPEC, exceeded the demand at that time, creating an imbalance in the supply-demand relationship that, in addition to the declaration of the COVID-19 pandemic, caused the debacle of the economy and the oil market.

After 2020-2021, the years of the economic collapse, we have world oil production data as of January 2022, with a volume of 85 MMBD of oil, still subject to OPEC+ production cuts.

Until January 2022, the market was in balance and there was no evidence of major problems for producers to meet the oil demand estimated for 2022 at an average of 100 MMBD. With the Russia-Ukraine war and massive sanctions on Russia, the world’s second-largest oil producer, this situation has changed dramatically.

Consequently, the unknown at this point is whether the producing countries maintain the same production capacities as in April 2020, or whether they have decreased due to the factors mentioned before. It is essential to estimate what the oil production capacity is and when additional barrels would enter the market in the scenario of interruption of Russian oil production or supply.

Now, all the world’s centers of strategic thinking and analysis are assessing possible scenarios of crude oil supply and an inventory of all available sources and oil production capacities that could replace – at least partially – Russia’s production.

Since before Russia’s military intervention in Ukraine, leaders of EU countries, as well as the US, have insisted – for politically motivated reasons – on the need not to depend on Russian oil and gas, claiming that these can be replaced by other suppliers, such as North African countries, the US or the Persian Gulf monarchies, led by Saudi Arabia.

After the outbreak of the war, the same sectors and countries that have been talking about not depending on energy exports from Russia have acted so that the supply of Russian oil and gas to the market, in particular to the European Union, is not interrupted. There are powerful reasons for this.

According to Eurostat, the body in charge of statistics in the European Union, in 2020, 97% of the oil consumed in the EU was imported[55]. A similar situation occurs with gas, where 83.6% also comes from imports. The countries of the European Union are highly dependent on oil and gas imports.

Again according to the same source, during the first quarter of 2021, Russia supplied 69.8% of EU oil imports, while covering 46.8% of gas imports. There is a close energy dependence of the EU on Russia.

Russian oil production, which has been averaging 10 MMBD for the last three months and exports 6 MMBD of oil, of which 2.5 MMBD to the EU and 1.7 MMBD to other European countries, corresponds mostly to Ural crude. At the same time, Russia exports 2.7 MMBD in oil products (naphtha, diesel, and fuel oil), of which 1.2 MMBD are for the EU market.

In turn, 380 million m3/day (184 billion m3/year) of gas produced in Russia reaches Europe through pipelines, while 20% of European LNG imports are Russian.

Problems in OPEC

OPEC production capacity has declined since 2014, mainly due to the problems faced by African producers (Nigeria, Angola, Algeria, and Libya); Iran due to US sanctions [56]since 2018; and the collapse of the oil industry in Venezuela since 2014.

This production decline is masked by the massive production cut in effect since May 2020. Until we have OPEC at maximum production requirements, i.e. without production cuts, we will not be able to determine its true capacities.

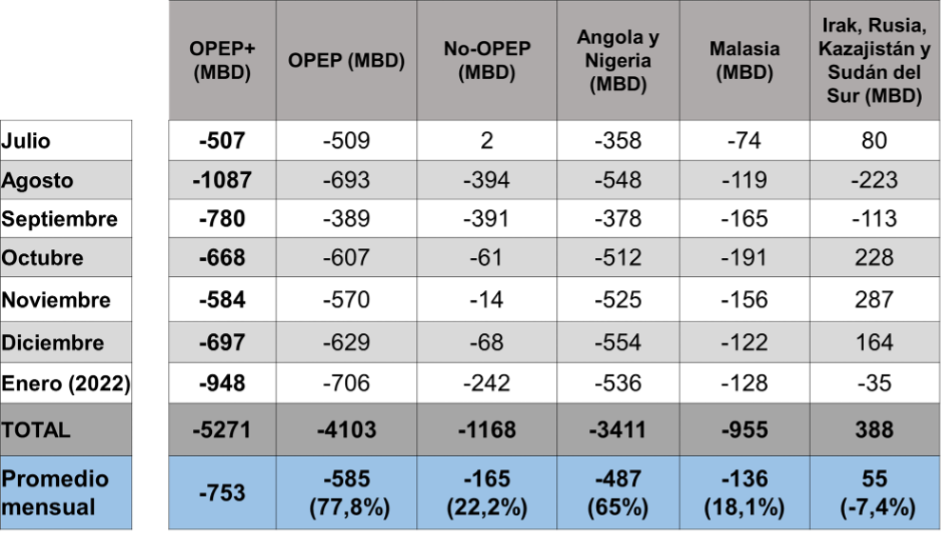

However, the level of non-compliance observed in OPEC+ supply reflects that there are problems among some member states (OPEC and Non-OPEC participating in the cuts) to meet their production quota, despite the significant cut in their crude oil supply levels.

OPEC+ below its allocated quota

Each report presented by OPEC+ on the group’s production agreements, where the mechanisms of flexibility and increase in supply have been ratified, until the total cuts of May 2020 are eliminated, has been accompanied by evidence that the group’s actual production, especially since July 2021, has not been able to meet the quota for each month. The group even reports Mexico’s production as part of its supply, even though the Aztec country does not participate in the cuts, only in the group’s meetings.

Between July 2021 -the month in which Saudi Arabia ended its additional voluntary cut of 1 MMBD- and January 2022, OPEC+ was unable to meet its allocated production quota, ceasing to produce an average of 750 MBD per month, of which 585 MBD are from OPEC-10 and 165 MBD from the 9 Non-OPEC countries participating in the agreements.

OIL VOLUME

BELOW THE OPEP+ AGREED QUOTA

(July 2021 – January 2022)

Had OPEC+ fulfilled 100% of its allocated production quota, it would have added more than 750 MBD per month to world oil production, impacting its value, curbing the rise in energy and fuel prices, and affecting inflation in industrialized economies.

77.8% (585 MBD) of the problem is concentrated in OPEC countries, of which 83.2% (487 MBD) are in African countries (Angola and Nigeria).

Oil production in Africa

Disinvestment in the oil industry in the two top producers on the African Atlantic coast (Angola and Nigeria), has led both countries’ production to fall more than 500 MBD below their OPEC+ allocated quota during 2021 and January 2022.

According to OPEC data, the proven crude oil reserves of the seven African member countries of the Organization (including Libya) amount to 109.6 billion barrels, while gas reserves reach 445 TCF.

With a production base of 6.9 MMBD of oil within OPEC, during 2021, the region had an average production of 5.1 MMBD, a drop of 1.8 MMBD. The countries located on the Atlantic coast (Angola, Gabon, Equatorial Guinea, and Nigeria) control 43% of the reserves, had a combined production of 2.9 MMBD, while the countries in the north of the continent (Algeria and Libya) that concentrate 55% of the reserves, had a combined production of 2 MMBD in 2021.

The fundamental factor for this drop in African oil production capacity lies mainly in the absence of investment in the sector, especially in the countries of the Atlantic coast. As stated by the African Energy[57] Chamber, the global reduction in capital expenditure for investment in fossil fuels and the difficulty in developing other energy sources have caused oil production to underperform in a continent where 600 million people have no access to energy and live without electricity.

In North Africa, major oil and gas producers Algeria and Libya have been impacted by political destabilization and foreign intervention, and war in Libya. Both countries have seen their oil production decline. In the case of Algeria, it had fallen from 1 MBD to 850 MMBD between April and December 2020, to recover to 0.97 MBD in 2022. In the case of Libya, its production increased sharply after the end of the blockade of ports and oil fields, as a result of the ceasefire agreement signed at the UN in October 2020, which allowed its production to rise extraordinarily from 100 MBD to 1 MMBD in January 2022; however, these levels are 600 MBD below the production levels of January 2011, before the war.

Both countries are gas suppliers to Europe through the TransMed (Algeria-Italy), Medgaz (Algeria-Spain), and Green Stream (Libya-Italy) pipelines. Algeria satisfies 11.4% of the gas demand needs through these systems, while Libya’s supply has remained at minimum levels and with little reliability since the 2011 war.

Venezuela

The oil production situation in Venezuela continues to be characterized by the collapse of its oil industry, as a result of internal political persecution, the militarization of the sector, and the massive diversion of resources from the sector to sustain its operations.

Between 2014-2022, oil production in the country, which has certified reserves of 316 billion barrels of oil, has fallen by 2.34 MMBD, 77.8% from its 2013 production level of 3.015 MMBD.

As of January 2022, Venezuelan production stands at 668 MBD, with an average production of 558 MBD in 2021 and 500 MBD in 2020. In other words, production remains stagnant at close to 500 MBD during its third year.

Besides all the political problems and the mismanagement of the sector, the US sanctions, since January 2019, and the exit of major international partners, including the Russian giant Rosneft, amid a chaotic political and social situation, can be added to the mix, with an accumulated drop in GDP of 75%, which has plunged the country into the worst crisis in its history.

From the very beginning of Russia’s military intervention in Ukraine, Venezuelan President Nicolás Maduro expressed his full support to the Russian military action, remaining a lone voice in the world, only accompanied by very few countries. No oil-producing country made such statements, nor did the major Latin American countries or China.

However, after the massive sanctions imposed by the US, the UK, and the European Union on Russia, the government’s discourse has lowered its tone and -although maintaining the rhetorical support for Russian military action- has invited the US to consider the country as a source of oil[59] to replace Russian oil shipments to the US. However, US President Joe Biden signed last March 03, the extension[60] of the executive order that sustains the sanctions against Venezuela in force since 2015.

Venezuela, with the collapse of the oil industry and the loss of more than 2.4 million barrels of oil production, not only fell from fourth place (2008) to tenth (2022) in the ranking of oil-producing and exporting countries within OPEC but also lost any strategic importance for the United States and the Western Hemisphere, at least from the oil point of view, even more so when the US is now the world’s leading oil producer and exporter of oil and gas.

The real problem now facing the Venezuelan government, in addition to those derived from the management of the collapsed oil sector in a global situation where it cannot take advantage of prices, lies in the fact that the massive sanctions imposed on Russia directly affect Venezuela.

The flow of payments and resources made to Venezuela for the scarce oil exports it makes -and which are free of the payments to the debts with China- passes through the Russian banking and financial system. On the other hand, the country’s exports are in the hands of Russian or Russian-registered «traders» and operating companies. Additionally, the payments made by the government to private parties involved in oil operations, and to whom PDVSA’s activities and assets have been transferred within the framework of the secret «Anti-Blockade Law», receive their payments or make their transactions through the Russian financial system, today subject to strong sanctions.

Where the greatest capabilities lie.

USA

Undoubtedly, the world’s largest oil producer is in first place. In November 2019, North American oil production reached 12.97 MMBD, its historical maximum production, maintaining its level above 12.8 MMBD during the first three months of 2020. Between April 2020 and all of 2021, it lost 1.6 MMBD capacity, to currently stand, in January, at a production of 11.7 MMBD.

What is remarkable is that contrary to US Department of Energy estimates that predicted in November 2021 maximum recovery of 500 MMBD by 2021 after the 2020 collapse, US production recovered by 700 MMBD, mainly due to shale oil production and fracking in the Permian Basin.

For February 2022, the EIA, the U.S. Department of Energy’s agency, adjusted upward its oil production forecast by 400 MBD to 12 MMBD.

The tremendous economic and industrial capacity of the sector became evident when, after a series of mergers and acquisitions, producers, especially of shale oil, were able to pay off billion-dollar debts to Hedge funds and even pay billions of dollars in dividends to shareholders in 2021, recovering their production potential to pre-pandemic levels.

For their part, the major US oil companies, Exxon Mobil, Chevron and Conoco, among others, have resisted the onslaught and decisions of the White House within the framework of the «Green Deal» energy policy announced by President Biden at the beginning of his term, repealing executive decisions and authorizations granted to the oil sector by the previous administration.

The US administration has evidently postponed its environmental discourse and its «Green Deal» policy in favor of economic interests and its strategic imperatives in international politics.

Despite this, the maximum additional production that can be expected, at best in the US, is an additional 1 MMBD, i.e., its maximum production level in the first quarter of 2020.

Saudi Arabia and the Persian Gulf countries

The Saudi Kingdom, the world’s third-largest oil producer with a January production of 9.9 MMBD, reached its highest production level in April 2020, when it was in the middle of the price war with Russia, placing its production at 11.6 MMBD. That is 1.7 MMBD above its current levels.

On the other hand, the rest of the Persian Gulf countries -without Iran-, i.e. UAE, Kuwait, and Iraq, with a combined production of 9.72 MMBD by January 2022, reached their highest production level -also engaged in the price war with Russia- in April 2020, when they produced a combined 11.5 MBD, i.e. 1.8 MMBD above current levels.

As a whole, the Persian Gulf countries (Saudi Arabia, UAE, Kuwait, and Iraq), embarked on a process of privatization and attracting foreign investment for the sector, have a combined production of 19.72 MMBD and could add 2 MMBD in the short-medium term.

Iran and the nuclear agreement

Iran, with a current production of 2.5 MMBD, has been affected since October 2018 by the US sanctions reimposed by Donald Trump’s administration, despite which it has been increasing its production gradually since February 2021. There is a precedent that, when sanctions were lifted in January 2016 -thanks to the Iranian nuclear agreement reached with the US and the P5+1 countries in June 2015- oil production was able to increase by only 800 MBD over 12 months.

In the event that the talks in Vienna between Iran and the US, which resumed on February 08 and are in the «final stage» – according to the parties – can culminate in an agreement in the short term that will lead to the lifting of economic sanctions on Iran and its oil sector, production will gradually increase to the indicated levels.

An agreement with Iran and the lifting of sanctions is strategic for the US and Europe at this time, not only because of the Persian country’s oil capacity, but also because of the immense gas reserves it shares with Qatar in the South Pars-North Dome field, which could reach Europe in the medium term, via gas pipelines, interconnecting with the Medgaz pipeline, or LNG cargoes. In any case, these are costly developments that take time to materialize.

However, on March 05, at a press conference held by Russian Foreign Minister Sergei Lavrov, when asked about the nuclear agreement with Iran, to which Russia is a party, Lavrov indicated that they would not accept that the agreement contemplates any kind of sanction on relations between Russia and Iran, which places a difficult element to be resolved at this time in the ongoing negotiations.

Russia

The Russian Federation, with a January production of 10.04 MMBD, is solidly positioned on the international oil scene as the second-largest oil producer in the world. Also, with a production of 515 BCM of gas, it is the largest exporter of gas to Europe, both via pipelines -most of which cross the territory of Ukraine- or LNG.

In April 2020, during the price war with Saudi Arabia and the Persian Gulf Monarchies, Russian production stood at 10.7 MMBD, its highest output on record, although in those eventful days, Russian Deputy Prime Minister and Energy Minister Alexander Novak stated that the country had a production capacity that could reach up to 12 million barrels per day.

It is clear that there is no source of gas supply to replace Russian gas in Europe. Any interruption of supply would cause tremendous damage if not the collapse of the European economy in the short term, practically a war economy, so European countries have been very clear that the massive sanctions imposed on Russia will not directly affect gas supplies from Russia.

This demand has always been on the table in discussions between Europe and the US on sanctions against Russia because, unlike the EU’s Western allies, the US and Canada (self-sufficient in energy production), Russian gas supplies are a matter of survival for these countries.

But in the oil sector, some sectors and countries have led people to believe that the situation is less serious. They are wrong.

From the available data, some of which we have discussed before, there is no possibility of substituting Russian oil volumes in the market, neither in the short nor in the medium term.

A collapse of Russian oil production, even more so with the current minimal inventory levels and the growing needs and problems of the industrialized countries, will drag with it the entire world economy, which will enter another period of shock, as happened between 2020-2021 due to the COVID-19 pandemic.

EPILOGUE

It is possible to make estimates and scenarios of the evolution of the situation in the oil, economic, and even political spheres, but at this time the situation does not respond to the fundamentals of the oil market, the economy, or even international politics, but rather to a dynamic of confrontation and violence, with many opposing interests, which could trigger or escalate to extreme situations.

At this time, a diplomatic and political solution to the war between Russia and Ukraine is needed, to prevent it from worsening, to reach real agreements between the parties that can be sustainable over time, to restore the principles of coexistence and respect between nations.

We may be in the presence of events that will radically change our prospects for the future. Definitely, the geopolitical scenario has already been disrupted, especially in Europe, now we must put an end to the war, without more victims, and seek a solution, a balance between the interests and rights of all peoples. Let peace prevail!

Bibliographic References

- [1] Redacción, “Russia’s Lavrov: A third world war would be nuclear, destructive, Al-Jazeera, 02 de marzo 2022.

- [2] Redacción, “Putin declares beginning of military operation in Ukraine, TASS, 24 de febrero 2022.

- [3] Comunicado de Prensa, Opening remarks by President von der Leyen at the joint press conference with President Michel and President Macron following the Special meeting of the European Council of 24 February 2022, Comisión Europea, 25 de febrero 2022.