INDEX

OIL PRICE

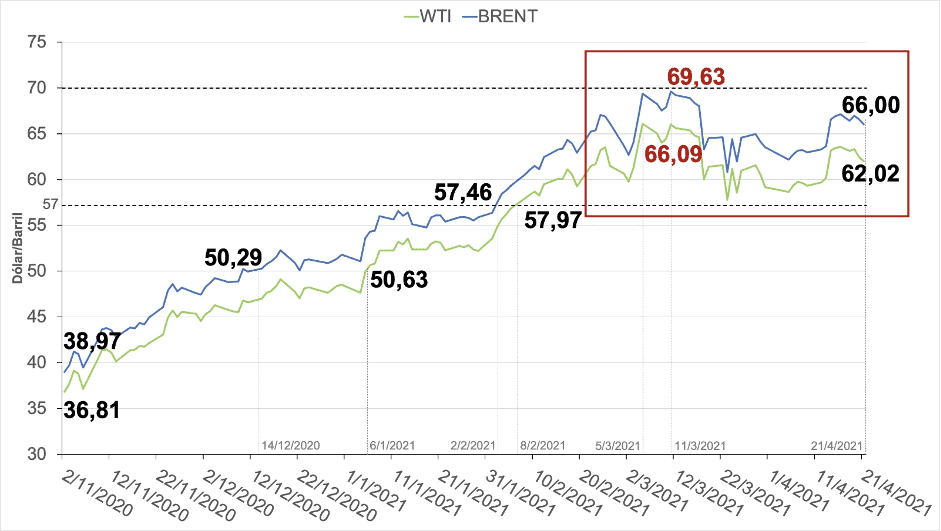

Oil prices continue the upward trend initiated in November, where markers have experienced five months of recovery in their quotations, reflecting the sustained stabilization of the market after the massive OPEC+ production cuts, the draining of inventories, and the gradual recovery of world oil demand.

A year after the oil price collapse, when WTI was trading at negative values of -35 dollars a barrel, an unprecedented phenomenon in the history of the oil market, both Brent and WTI markers have recovered, respectively, 241% and 520% of their value.

Despite the sustained increase in prices observed since November 2020, in February and April 2021, prices fluctuated between US$57 and US$70. The uncertain recovery of the world economy and the restrictions for travel and mobility amid the main factors. Also, the new waves of the COVID-19 are still strongly affecting Europe, India, and Brazil. Some additional factors such as the weather events in the USA that interrupted the refining activity and the fluctuations in the value of the U.S. dollar have affected crude oil prices in the period.

As of April 21st, Brent and WTI closed the day down, trading at 66 and 62.02 dollars per barrel, respectively. However, they showed a recovery of 6.2% and 5.7%, respectively, with their quotations as of April 5th, 2021, and 69.4% and 68.5% with their quotations at the beginning of November 2020.

BRENT / WTI PRICES

(November 2020 – closing April 21st, 2021)

According to OPEC’s Monthly Oil Market Report (MOMR), for April 2021, the Organization expects world oil demand to recover by 6 million barrels per day to reach an average of 96.5 million barrels per day, as a result of a rebound in the world economy, especially from the 3rd and 4th quarters of the year, due both to the massive economic aid packages and fiscal stimuli and to the acceleration of the vaccination process in industrialized countries.

Based on these expectations and the drop in commercial inventories observed since the beginning of the year 2021, the OPEC+ countries, at their 15th Meeting of Ministers on April 1st, decided to continue with the policy of «flexibilization» of production cuts, increasing their oil supply by 1.3 million barrels per day in 3 stages, between May and July.

Within the framework of the same meeting, the Saudi Arabian Minister of Energy informed that his country would also increase its oil supply from May to July, putting an end to its additional cut of 1 million barrels per day, which came into effect in February.

OPEC Basket

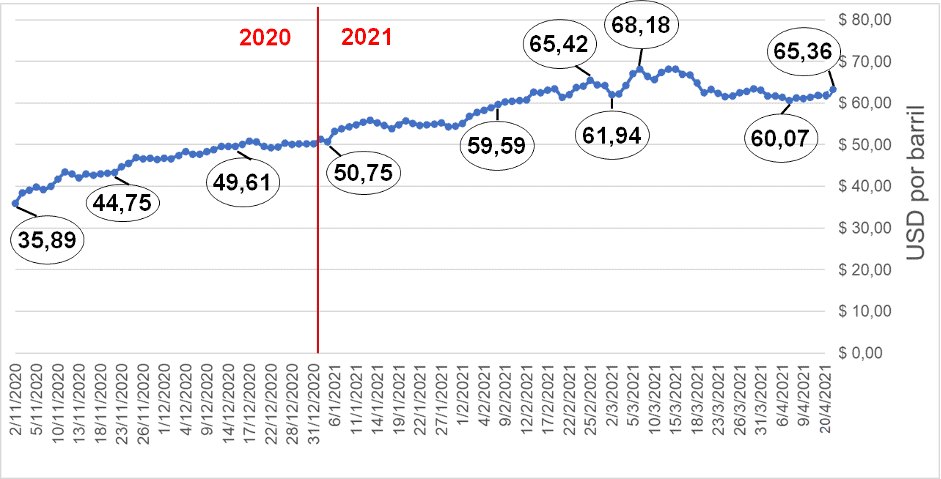

The OPEC reference crude oil basket (ORB) has also maintained its upward trend since November 2020, trading on April 20th at $65.36 per barrel, 53.4% higher than its November 2020 price.

OPEC crudes increased in a range of 10.6% to 12.2%, between January and February, mainly North African crude references, while the March average presented a monthly increase of 5.75%, maintaining the upward trend. However, after the OPEC+ and Saudi Arabia announcements on April 1st, the basket fell by 2.1%, to settle to 61.77 dollars per barrel.

OPEP BASKET PRICES

(November 2, 2020 – April 16, 2021)

Murban Crude

On March 29th, the state-owned Abu Dhabi National Oil Company (ADNOC) announced the commercial release of Murban crude, ADNOC’s flagship crude oil grade, and the launch of the Abu Dhabi Murban Crude Oil Future with futures contracts on the new ICE Future Abu Dhabi (IFAD), the representation of global exchange operator and listing services provider Intercontinental Exchange (ICE) in Abu Dhabi, the first derivatives exchange in the capital of the United Arab Emirates (UAE), an initiative led by ADNOC’s Minister of Industry and Advanced Technology and CEO, Sultan al-Jaber.

In doing so, the UAE is placing a new type of crude oil and a new benchmark for oil prices on the global oil market.

«Today, with our outstanding partners, we are bringing a new benchmark to life,» said ICE President and CEO Jeffrey Sprecher at the launch of Murban and IFAD.

Murban is a light crude with current production of 2 MMBD, low production cost, and a portfolio of 60 customers in 30 markets.

During the launch, the Emirati state company commented that, apart from ADNOC and ICE, nine other companies were incorporated as founding partners of IFAD: the British oil company British Petroleum (B.P.), the Korean refiner G.S. Caltex, the Japanese E&P INPEX, the Japanese oil company ENEOS, the Chinese state company PetroChina, the Thai state oil company PTT, the Dutch transnational Royal Dutch Shell, the French oil company Total and the Dutch energy trader Vitol.

ADNOC reported that the current market for Murban is in the Arabian Gulf and the Asia-Pacific region, with future contracts physically delivered from the UAE state-owned emirate’s terminal in Fujairah, expected to become a benchmark for 32% of global oil production.

Murban’s first quotation for IFAD futures contracts was on March 29th, opening the market at $63.9 per barrel and closing at $63.03. To date, its highest price was on April 1st, when it closed at US$63.9 per barrel. After the OPEC+ and Saudi Arabia announcements, prices fell by 3.7%, to close at 61.54 dollars at the end of April 9th.

OIL PRODUCTION

On April 1st, the 15th OPEC+ Ministers’ Meeting was held where it was decided to continue with the policy of relaxing the production cuts initiated in August 2020, increasing oil supply by 1,291 million barrels per day (MMBD), progressively, between May, June, and July. For May 1st, the group’s production will be increased by 500 thousand barrels per day (MBD), in June an additional 350 MBD, and in July, an additional 441 MBD, until completing the agreed amount.

It was decided that starting next May, Russia and Kazakhstan will not receive the benefits to apply for additional flexibilities in their production cut quotas -as they had been doing since February-, since the group’s production increment will be distributed among the 19 countries participating in the previous production cut.

Thus, the OPEC+ cut will stand at 5.76 MMBD for July, a decrease of 1.44 MMBD for January, and 3.90 MMBD for the original cut of 9.7 MMBD, initiated on May 1st, 2020.

Accompanying these OPEC+ decisions, Saudi Arabia announced that it would end its unilateral and additional 1 MMBD oil cut that was in effect between February and April. The Saudi Kingdom will increase its production by 250 MBD in May, 350 MBD in June, and 400 MBD in July.

Both decisions will increase the world’s oil supply by 1.291 MMBD for July, placing it around 81.3 MMBD of oil, 5 MMBD more than July 2020, but 5.5 MMBD less than 2019, the highest oil production year on record.

These numbers invite us to estimate that the scenario expected by OPEC+ and the rest of the oil-producing countries is to return to the 2019 global supply.

The International Energy Agency (EIA) projects global production of 83.2 MMBD for 2021, which represents an increase of 2.26 MMBD over 2020 production, although 4.2 MMBD is less than that recorded in 2019.

These oil production increases and projections are in line with OPEC and other agencies’ estimates regarding an increase in global oil demand starting in the second half of 2021 and stabilizing the oil market, which will allow the incremental oil production to be absorbed.

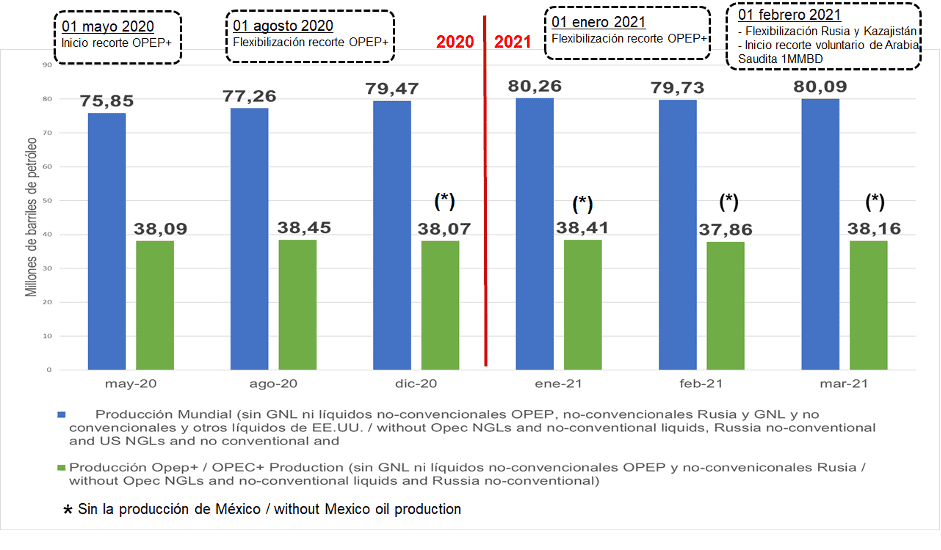

World Production

According to the MOMR, world oil production in March was 80.09 MMBD, 360 thousand barrels per day more than in February, due to the increase in production by Iran, Russia, and the U.S. was offset by the unilateral production cut of 1 million barrels per day of oil by Saudi Arabia.

Of the total world oil production, 47.65%, 38.16 million barrels per day, corresponds to the production of OPEC+ countries.

WORLD OIL PRODUCTION

(May 2020 – March 2021)

The Energy Information Agency (EIA), in its «Shor-Term Energy Outlook» (STEO) of April 6th, records a world production of 80.37 million barrels per day, 240 thousand barrels per day more than the OPEC data.

OPEC+ production

The signatory countries of the Declaration of Cooperation (DoC), grouped in OPEC+, produced 38.16 MMBD in March 2021, a monthly increase of 300 thousand barrels per day.

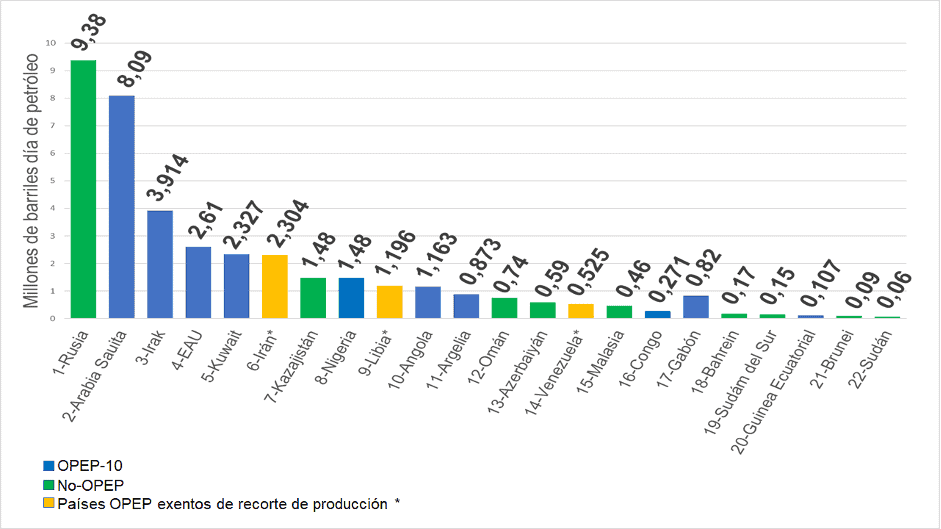

The 13 OPEC countries presented an output of 25.04 MMBD, representing 65.62% of OPEC+ supply and 31.27% of world production.

OPEP+ COUNTRIES PRODUCTION

(March 2021)

On the other hand, the 9 Non-OPEC countries that signed the DOC reached 13.12 MMBD, equivalent to 34.38% of OPEC+ production and 16.38% of world production.

OPEC+ production cuts

In March 2021, the OPEC+ production cut was 7.962 MMBD, including 1.029 MMBD of the additional cut by Saudi Arabia, which allowed the group’s cut to be 912 thousand barrels per day above the agreed quota, a compliance of 112.94%.

The 10 OPEC countries participating in the production cuts (Angola, Saudi Arabia, Algeria, Congo, Gabon, Equatorial Guinea, Equatorial Guinea, United Arab Emirates, Iraq, Kuwait, and Nigeria) reduced 5,665 MMBD, meeting their commitment by 124.12%.

Of this group, Iraq once again showed overproduction, this time of 57 thousand barrels of oil per day. Meanwhile, the commitment of Angola – whose minister, Dr. Diamantino Pedro Azevedo, chairs the OPEC Conference – to the compensation agreements for last year’s overproduction stands out. While its production rose 40 MBD in March, Angola’s production cut was 104 MMBD above its allocated quota, which has been happening since September 2020, responding beyond its production cut commitment and the compensation for overproduction it made in May and June 2020.

On the part of the nine Non-OPEC countries, signatories of the DoC, the production cut in March was 2,297 MMBD, with an overproduction of 189 thousand barrels of oil per day, reaching a compliance with the cut of 92.4%.

Once again, Russia presented an overproduction of over 100 thousand barrels of oil per day. In comparison, Kazakhstan did so by 43 thousand barrels per day, although the two countries were the only ones to receive the benefit of making an additional relaxation to their production cut quota in March, 65 thousand barrels per day Russia and 10 thousand Kazakhstan.

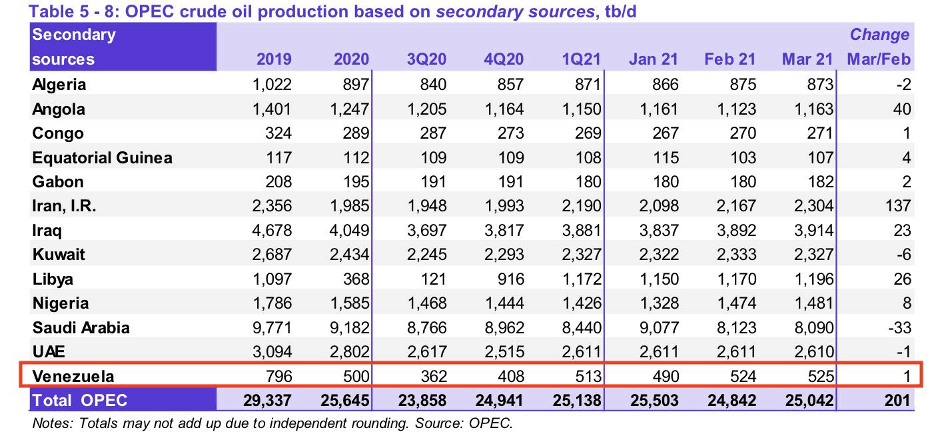

OPEC production

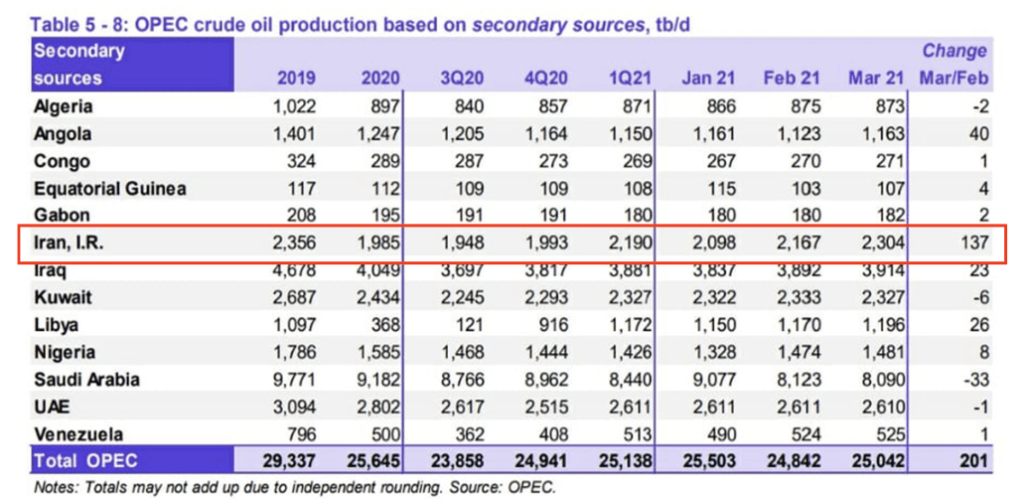

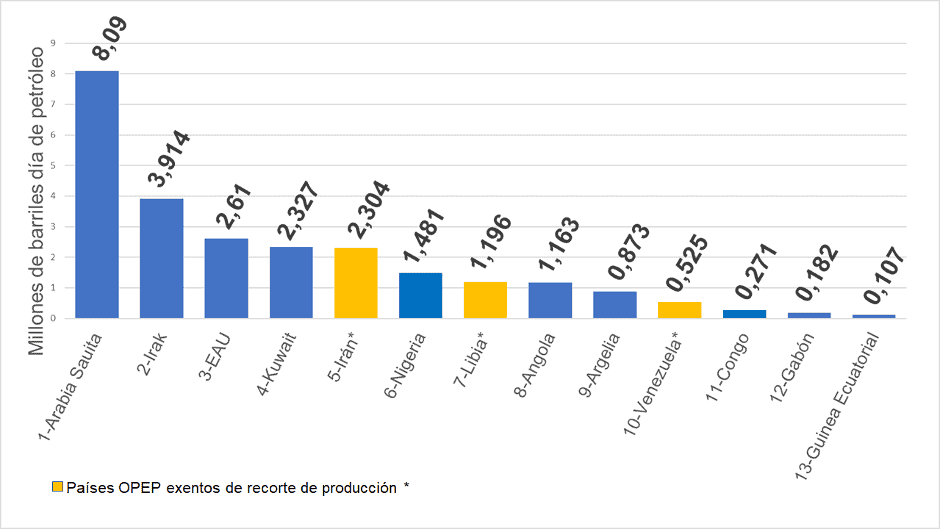

OPEC recorded production of 25,042 MMBD in March, according to April 13th MOMR data. Production increased 201 thousand barrels per day due to a new monthly increase in Iran’s production, this time by 137 thousand barrels per day of oil, reaching its average production level of 2019.

OPEC COUNTRIES PRODUCTION

(March 2021)

The production of the Gulf monarchies (Saudi Arabia, UAE, and Kuwait) added to that of Iraq was 16.941 MMBD, equivalent to 67.65% of the group’s production, 44.39% OPEC+ and 21.15% of the world’s crude oil supply.

The African countries excluding Libya: Angola, Algeria, Congo, Gabon, Equatorial Guinea, and Nigeria produced 4,077 MMBD in March, representing 16.28% of OPEC, 10.68% of OPEC+ and 5% of world oil production.

Iran, Libya, and Venezuela, the three countries exempt from quota cuts, presented a joint production of 4,025 MMBD in March 2021, of which 2,304 MMBD (57.24%) corresponds to Iran, equivalent to 9.2% of OPEC production and 2.88% of world oil supply. Libya produced 1,196 MMBD (29.71% OPEC and 1.5% worldwide) and Venezuela 525 thousand barrels of oil per day (2.1% OPEC and 0.65% worldwide).

OPEC COUNTRIES’ PRODUCTION RANKING

(March 2021)

U.S. – Iran: The difficult road to dialogue

One of the biggest challenges for Joe Biden’s administration will be to resume dialogue with Iran to restart the 2015 Joint Comprehensive Plan of Action (JCPOA) nuclear agreement, endorsed by the U.N. Security Council, which the Trump administration disregarded, and imposing substantial sanctions on the Persian nation since September 2018.

Since the beginning of his term, President Joe Biden has indicated his willingness to resume dialogue with Iran leading to a return to the 2015 agreement. At the head of this challenging task is Anthony Blinken, veteran diplomat, now Secretary of State.

This process is expected to be complex because of the damage to the credibility of the U.S. commitment due to the previous disregard of the agreements, the sanctions, and retaliations imposed on Iran by the Trump administration, as well as the powerful lobby of Israel and the Gulf monarchies in Washington, and the pressure of the most conservative sectors on the Iranian president, Hassan Rohani. Parties have declared their intention to seek an understanding, and for this purpose, a first «indirect» meeting between the parties was held.

On April 2nd, Robert Malley, the official envoy appointed by the U.S. to deal with Iranian affairs, stated in an interview to the Public Broadcasting Network (PBS) that if Iran is prepared to return to compliance with the agreement during President Biden’s administration, «we will have to look at the sanctions» and «see what we need to do so that Iran enjoys the benefits that it was supposed to enjoy under the agreement. In that case, we would have to remove the sanctions that are incompatible.»

On the same date, Iran’s Deputy Foreign Minister, Seyyed Abbas, warned that his country would meet only with the JCPOA Commission to examine the U.S.’s return to the agreement and that there will be no direct dialogue, at any level, between the Iranian and U.S. delegations.

Between April 6th and 9th, the first round of the 18th JCPOA Meeting was held in Vienna, where a crucial step was taken for Iran to return to the JCPOA agreements.

During the meeting, it was agreed to form two expert groups, one with the JCPOA and Iran, where Iran’s nuclear commitment will be addressed; the second, consisting of the JCPOA and the U.S., will focus on lifting U.S. sanctions on Iran.

At the JCPOA meeting in Vienna, Robert Malley reiterated his position of April 2nd, which contemplates considering the lifting of sanctions if Iran returns to the commitments of the 2015 Agreement. This position was ratified by the spokesman, Ned Price, on April 6th.

The U.S. envoy reported that the meeting with Iran was indirect through the representatives of the European Union and the JCPOA countries. He made it clear that the U.S. participation and its contribution of ideas at the Vienna meeting were taken very seriously by all the countries present. Although he says he did not observe a «reciprocal» willingness on the part of Iran to return to its JCPOA commitments, he claims that Iran took the issue seriously and very formally from what was conveyed at the meeting.

For his part, Iranian President Hassan Rohani celebrated that «in recent days, we have witnessed a new chapter in the revitalization of the JCPOA,» where all the actors at the meeting, including the U.S., «have come to the conclusion that there is no better solution than the JCPOA and that there is no other way than the full implementation of the JCPOA.» Rohani stated that Iran’s commitment to the JCPOA is a «new chapter in the revitalization of the JCPOA.» Rohani stated that Iran’s voluntary implementation of the Additional Protocol to the agreement and the implementation of centrifuges is «provisional,» which is essential information on the road ahead.

However, progress towards an understanding between Iran and the U.S. suffered a setback on April 11th, when the Shahid Ahmadi Roshan nuclear facility for uranium enrichment, located in Natanz, was the victim of a «cyber-attack,» according to Ali Akbar Salehi, Director of the Atomic Energy Organization of Iran (AEOI), describing the event as «nuclear terrorism» and pointing to Israel as the perpetrator. Then, on April 14th, Iranian President Hassan Rohani stated that «in response to the enemy,» his country will enrich uranium to 60%. «They want to empty our hands in the face of negotiations,» warned the Iranian leader.

The cyber-attack on the Iranian nuclear facility and the response of the Iranian government, as well as the visit of the U.S. Secretary of Defense Lloyd Austin to Israel on April 11th, are elements that show the difficulties and the powerful regional interests that the parties will have to overcome to reach a nuclear agreement under the terms agreed in 2015, an agreement that must be accompanied by the lifting of U.S. sanctions against Iran.

This prospect, as we mentioned in our Oil Report of January 20th, 2021, opens not only the possibilities of Iranian oil production being restored to 3.8 MMBD, as it happened in 2016, after the lifting of U.S. sanctions in 2015, but also the restoration of Iranian oil supply to China, its primary buyer, embroiled in a commercial and geopolitical dispute with the U.S.

Despite the stumbles and tensions, the parties held, under the same format of indirect contacts, a new round of negotiations in Vienna since April 17th, which maintains the pulse of the negotiations and shows the willingness of the parties to reach a solution, having reached an understanding to start working on a joint draft, as Seyed Abas Araqchi, the foremost Iranian representative in the negotiations, said last April 18th.

Amid this scenario, Iran’s production saw an increase of 137 thousand barrels per day in March, to stand at 2.3 MMBD, a level it last recorded in May 2019. Since last January, Iran’s oil production has risen by 210 thousand barrels per day, despite U.S. sanctions, which is a sign of the Persian country’s productive and industrial capabilities.

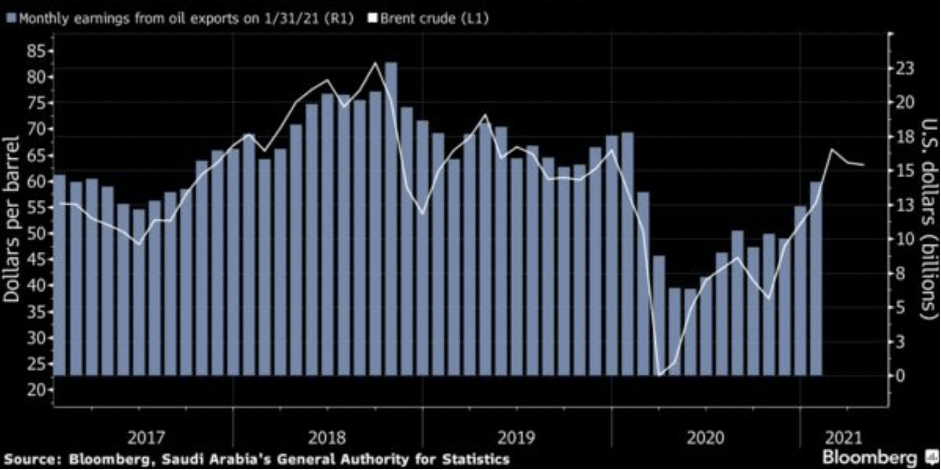

Saudi Aramco leases assets

On April 9th, Saudi Aramco completed the leasing of the country’s oil transportation assets and announced the creation of the mixed capital subsidiary Aramco Oil Pipelines Company (AOPC). The company will be 51% owned by Saudi Aramco and 49% by EIG Global Energy Partners, a U.S. institutional capital investment firm that makes direct transactions backed by assets such as oil reserves, pipelines, processing facilities, among others.

Aramco will lease AOPC, its network of more than 90 crude oil pipelines, for 25 years. In exchange, the US-based EIG will advance it, through AOPC, a payment of US$12.4 billion.

This operation is part of the opening of the Kingdom’s oil sector to international private capital, as promoted by Crown Prince Mohammed bin Salman, under his Saudi Vision 2030 and which began in 2019 with the sale of 1.5% of Saudi Aramco’s shares, for a value of US$26 billion.

However, this process started just before the oil market collapse in 2020 in the wake of the COVID-19 pandemic. The above caused the Kingdom to take on debt to meet its dividend commitments to private investors and not hinder its ambitious plan to open up the country. At the same time, oil prices and Aramco’s revenues recover.

CHANGES IN SAUDI ARAMCO’S REVENUE (2017-2021)

The net profit of the Saudi state-owned Saudi Aramco, in 2020, was $49 billion. It managed to pay dividends to its shareholders to the value of $75 billion, according to the Annual Report of the oil company, of which around $73 billion are dividends for the State, which, as we commented in the previous Newsletter, had to face a public debt of $227 billion in 2020, which will rise to $250 billion in 2021. To show profits and pay dividends, Aramco had to borrow $96.13 billion in 2020.

Aramco’s needs to meet its commitments with international investors and maintain its attractiveness for opening up the oil sector are conditioning the Kingdom’s oil policy and its positions within OPEC and OPEC+. Such positions variated from the price and market war of March 2020 to unilateral cuts to sustain the price per barrel, despite the position of its Gulf allies to increase the flexibility of the cuts to meet their own economic needs.

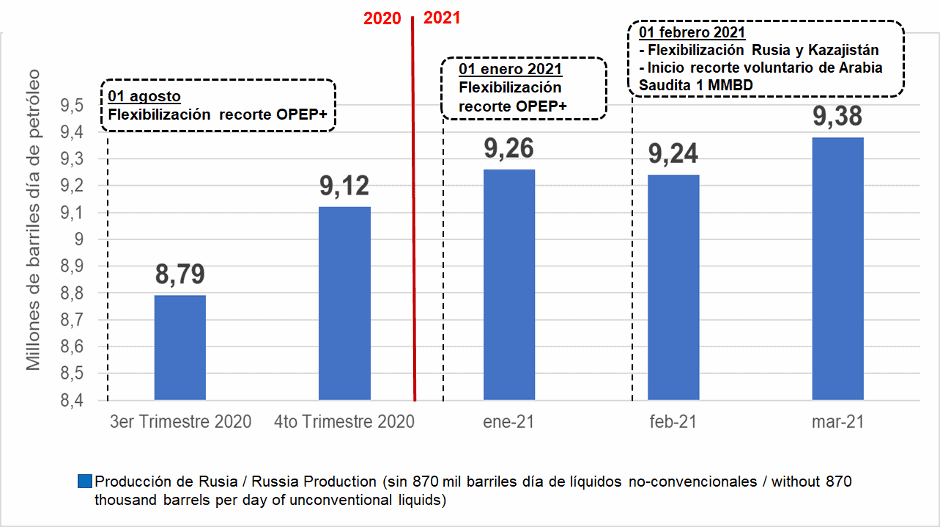

Russia

By March 2021, Russia’s oil production was 9.38 MMBD, according to Russian Energy Ministry data, 140 MBD higher than the previous month, which includes the easing of its 65 MBD production quota authorized for March.

Russia’s production will not return to the record levels of 2019 after the Russian Energy Ministry informed in a strategy document to which the Russian business daily Kommersant had access, as reported by The Moscow Times last April 12th. The document refers to the current situation of the Russian oil industry as «critical» while forecasting the highest peak for 2029, with a crude oil production of 10.23 MMBD and 8.5 MMBD for 2035, estimating that condensate production will be the same as in 2021 (0.87 MMBD).

Russia’s crude oil production in 2019 was 10.5 MMBD. As of May 2020, Russian oil production has been regulated in compliance with OPEC+ cut agreements, averaging for the year with 9.4 MMBD of oil.

RUSSIAN OIL PRODUCTION

(2020 – March 2021)

U.S.

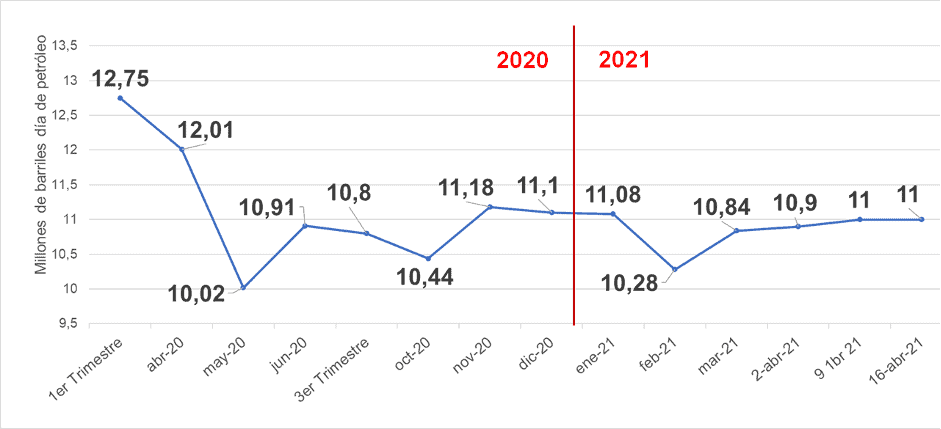

According to the EIA weekly report, published on April 21st, by the week ending April 16th, U.S. oil production was 11 MMBD, showing an increase of 720 MBD over February. At the time, oil production in the U.S. was 10.28 MMBD, severely affected by the snowstorms and freezing temperatures that impacted the State of Texas, causing the suspension of electricity supply and the stoppage of oil production and refining in the region. U.S. production in April has remained at 11 MMBD.

U.S. OIL PRODUCTION.

(November 2020 – April 2021)

Oil production by March 2021 reached 10.84 MMBD, 560 MBD higher than in February, recovering oil operations in Texas after being affected by the February winter storm. Aggregate onshore oil production in the U.S. registered an increase of 470 MBD in the same period, while in the Gulf of Mexico, it increased by 90 MBD.

All analysts agree, including former U.S. Secretary of Energy Dan Brouillette, that oil production will remain stable throughout 2021 at around 11 MMBD. A slight increase in 2022, as we have pointed out in our previous Reports, due to the dependence of shale oil producers on financing and the intensity of capital flows they require for their operations.

Scott Sheffield, the CEO of Pioneer Natural Resources Company, one of the main shale oil producers in the country, considered during the annual meeting of the energy researcher BloombergNEF that there is not much evidence of a significant boost in shale production. According to him, producers lived the experience of an oil market with low prices for shale oil operations, deciding not to generate capital expenditures and to follow a more conservative strategy regarding the capital investment that allows them to obtain higher profitability from their assets and returns to shareholders.

For Sheffield, the situation experienced in the first half of last year with oil prices is the result of the «frustration» of Saudi Arabia and Russia in the face of the growth of U.S. production, generating a price war that forced U.S. oil producers to make divestment decisions and mergers that caused the loss of 2 MMBD. Sheffield says that, concerning U.S. shale basins and fields, only the Permian basin will increase production, while the others will decline. «If we grow too much again, there will be another price war,» said the CEO of Pioneer Natural Resources.

The U.S. government seems to have no interest in seeing local oil production increase while promoting «green energy.» The Department of the Interior convened a public forum on March 25th as part of the U.S. government’s comprehensive review of the oil and gas program, as mandated by Executive Order 14,008. Secretary of Interior, Dan Halland, acknowledging the contribution of hydrocarbons to the U.S. economy, said that «fossil fuels will continue to play an important role in the U.S. for years to come, but that the administration of the last four years rushed to meet a false urgency of political timetables by offering vast swaths of federal waters and lands for oil and gas development over and above all other land and water uses.»This is an issue of environmental preservation and the economic sustainability of Joe Biden’s administration.

Within the framework of its «Clean Energy Revolution» policy, the Biden administration made important decisions, such as denying Chevron Corporation’s an oil exploration and exploitation license in the Gulf of Mexico. Later, Executive Order 14.008, signed last January 27th, suspended the leasing of federal waters and lands to oil and gas E&P. Finally, the Public Environmental Protection Executive Order that reversed the permit for the construction of the Keystone Pipeline, which would bring Canadian heavy crude oil into the Gulf of Mexico.

At the same time, it opens space for «clean energies,» such as the «Vineyard Wind I LLC» project being carried out by the Bureau of Ocean Energy Management (BOEM), announcing last March 29th, the identification of 800,000 acres as areas for wind energy off the coast of New York, within the framework of the advances for the development of the largest commercial wind project in the USA.

These decisions are beginning to generate open reactions from oil-producing companies against the Biden administration. Last March 24, 13 states in the country (including Texas, Louisiana, Alabama, and Alaska) filed a lawsuit before a federal court in Louisiana against President Joe Biden, requesting that the aforementioned Executive Order 14,008 be challenged.

In this environment and the face of a political-economic situation not favorable to oil producers -especially shale oil- in the U.S., it is estimated that U.S. oil production will remain around 11 MMBD in 2021; projections show a slight increase in 2022, but below 11.4 MMBD.

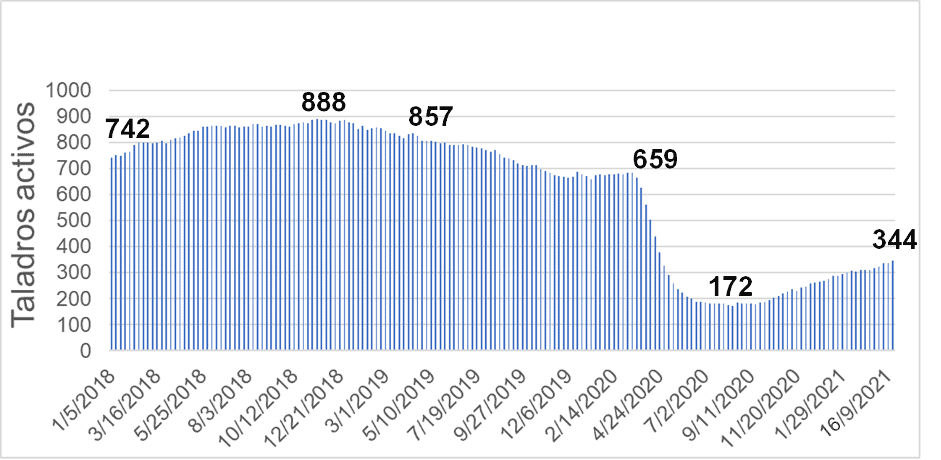

Drilling

Last April 16th, Baker Houghes’ weekly report recorded activity on 344 drills, seven more than the previous week and 27 above the March 12th, 2021 figure. This is the highest amount of activity in the last 12 months, but still far from the 624 recorded at the pandemic’s start on March 27th last year.

According to the same report, the Permian basin in Delaware recorded 226 drills on April 14th. 23 more than on March 12th and 81 above the activity record on October 30th, 2020. In Texas, the Eagle Ford basin had 32 active drills as of April 14th, holding steady from March 19th and doubling activity from October 23rd, 2020.

ACTIVE DRILLS IN THE US

(January 2018 – April 16th, 2018)

Information from MOMR and Rystad Energy indicate that shale companies have focused their investments on incomplete operating wells. Producers are looking for lower costs, estimated to be 4 billion dollars more than what was used in 2020, in a moment when shale oil producers in the U.S. need a barrel around $52. Although the WTI price has been above that level since the beginning of 2021 and above $60 since mid-March, companies prefer to pay off debts and pay dividends.

The EIA reported, in its April 12th Weekly Drilling Report, that 641 shale wells were completed in March 2021 (151 more than the previous month), with 177 of them being wells that were drilled but uncompleted, while 464 drilling activities were recorded (68 more than in February). In March 2020, at the onset of the pandemic, 1,091 shale wells were drilled, and 1,015 were completed.

Since 2014, monthly U.S. Shale Oil activity shows that there has been more drilling recorded in shale wells than the number of wells completed, which generated more than 4 thousand shale wells drilled remaining uncompleted between January 2014 and July 2020. Starting in August 2020, and the number of shale wells started to decline for the first time, with more wells being completed than drilling activity. There are currently 6,912 shale wells drilled but not completed in the U.S.

Other Non-OPEC countries

Azerbaijan, Canada, Kazakhstan, Mexico, and Norway reported an estimated joint production of 10 MMBD in March 2021, taking into account data from Mexico and Norway for February of this year. Except for Canada, with an output of 5.68 MMBD, the rest of the countries, producing less than 1.8 MMBD each, forecast stable figures for 2021.

The EIA predicts a 600 MBD drop in Canada’s production in April, at 5.04 MMBD between April and May, to recover the previous level in June, a situation that usually occurs every year with the North American country’s production.

On April 14th, the Mexican Congress approved the reform of the Hydrocarbons Law, modified in 2013 during the administration of former President Peña Nieto, which privatized oil activity, opening up for the entry of foreign private capital and handing over a good part of the fuel market, expecting a foreign investment that never arrived. However, the reform presented by President Manuel López Obrador did not meet the expectations and promises of reversing the opening and recovering the control and ownership of the oil sector in the country, but only modified issues related to sanctions for the handling, illegal sale, and smuggling of fuel.

In February, Mexico’s crude oil production was 1.67 MMBD, remaining in the range of 1.7 MM in its production since December 2019, a drop of 850 MBD from the 2.52 MMBD levels in its 2013 oil production and 1.58 MMBD from the 3.25 MMBD production recorded in 2006.

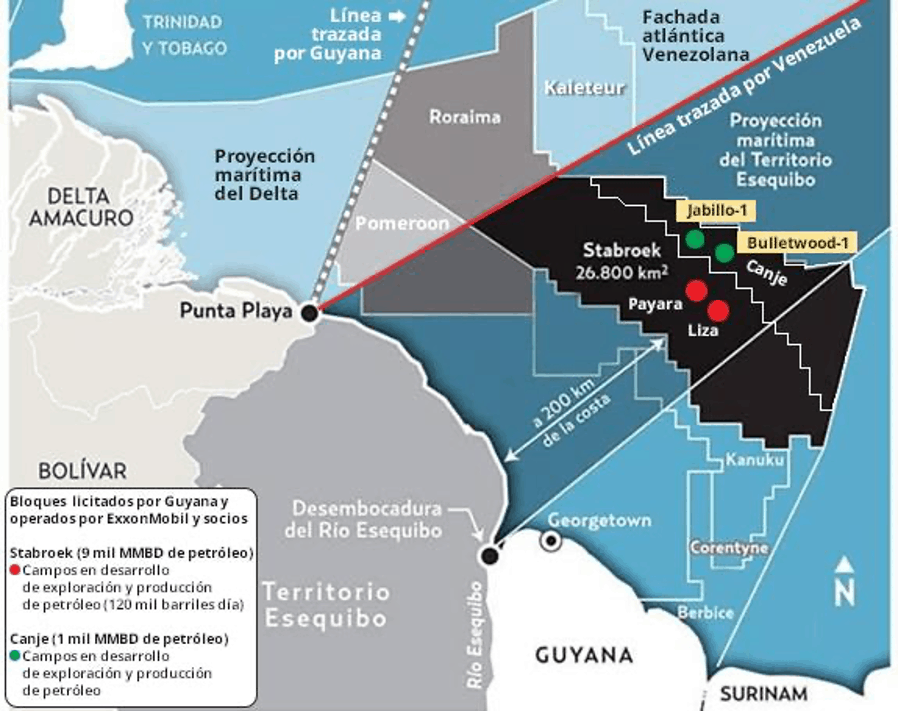

Guyana expands its oil operations

The transnationals operating in Guyana continue to advance in the exploration, production, and export of crude oil, operating in territorial waters of the Essequibo in dispute with Venezuela, in the Stabroek, Canje, Kaieteur, Demerara, and Orinduik blocks. Likewise, Guyana offered offshore licenses to operate in Venezuelan waters off its Atlantic coast, in the Roraima and Pomeroon blocks, and the western half of the Stabroek block, and most of the Kaieteur block.

The reserves found in Stabroek, until 2020, are estimated at 9 billion barrels of oil. Since the middle of last year, the block is producing 120 MMBD and has exported 6 MMBD, while development is progressing in the rest of the Stabroek fields and the other blocks.

Last March 24th, the U.S. operator Hess Corporation, which has a 30% participation in the Stabroek block and ExxonMobil and China’s CNOOC, sent India the fifth shipment of Guyanese crude, with 997,420 thousand barrels of crude, becoming the first export of Guyanese crude in 2021.

At the beginning of April, the sixth crude oil cargo was shipped – the second in 2021 – with a volume of close to 1 MMBD, according to Guyana’s Minister of Natural Resources, Vickram Bharrat.

On the other hand, on March 30th, American investor Westmount Energy, which in December 2020 became a shareholder of the Canadian JHI Associates, presented provisional data for the second half of 2020, where they confirm the existence of hydrocarbon reserves in the Canje block, operated by ExxonMobil with a 35% participation, and having as partners Total (35%), JHI Associates (17.5%) and the Guyanese Mid-Atlantic Oil & Gas, Inc. (12,5%).

OIL PRODUCTION BLOCKS IN THE ESSEQUIBO’S WATERS AND VENEZUELA’S ATLANTIC COAST.

The drilling of the second well in the Canje block began last March 14th in the Jabillo-1 field, making a stop in April for maintenance activities, estimating to restart operations next May 31st. The estimated drilling in Guyana for 2021 may reach 16, according to the planning of the oil operators of the blocks, according to the Norwegian researcher Rystad Energy.

Westmount Energy’s estimated oil reserves in the Jabillo-1 field alone are 1 billion barrels. Simultaneously, the oil reserves estimated by ExxonMobil in the Stabroek block are 9 billion barrels.

ECONOMY

During the first quarter of 2021, the world economy continues its recovery, significantly supported by the massive monetary and fiscal stimuli underway in the largest developed economies, which, although fundamental in the short term, bring with them the risk of inflation in the medium term, especially in the U.S. and Europe.

For the second half of the year, a recovery in the global economy and higher oil demand is expected, led by the U.S. and China, but with more lag in Europe and the developing countries.

The above is based on the expectation that mass vaccinations progress successfully in industrialized economies to contain the pandemic. However, to date, the impact of the pandemic continues, with Europe, Latin America (particularly Brazil), and India showing a worrying increase in infections. This upturn would harm the recovery of oil demand for the current year.

Another factor affecting the performance and recovery of all economies, particularly developing countries, is related to the growing sovereign debt, with the additional risk of increasing interest rates that could create more fiscal complications.

Even under these premises, international organizations such as the World Bank, the International Monetary Fund, and OPEC expect world economic growth in 2021 to be around 6 percent.

The virus is spreading more aggressively than expected in Europe, India, and Latin America, including its new strains. The increase of tension against Russia and Iran, the situation in the China Sea, and the trade dispute between the U.S. and China are elements of uncertainty that also threaten the normalization of global economic activity.

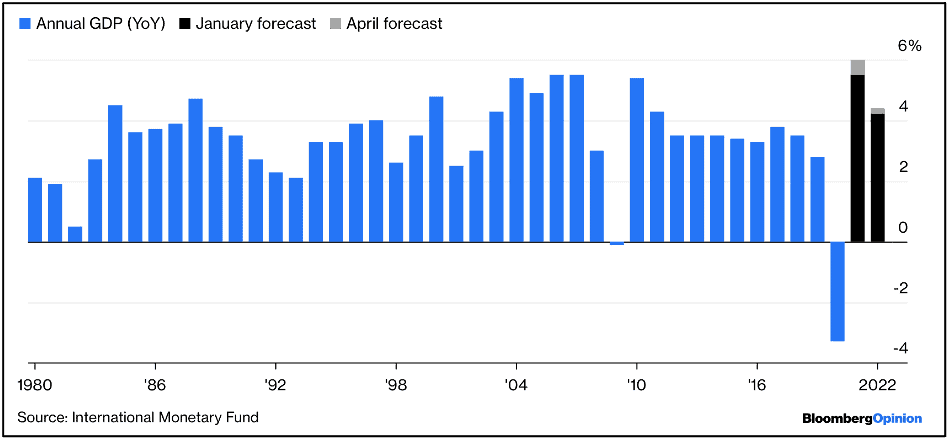

IMF Outlook

After an estimated contraction of 3.3% in 2020, as explained by the International Monetary Fund (IMF) in this month’s World Economic Outlook, the global economy is expected to grow in 2021 by 6%, moderating towards 4.4% in 2022.

ANNUAL CHANGE IN WORLD GDP (1980-2022)

For industrialized and emerging economies, projections for 2021 and 2022 improved after the results of additional fiscal supports began to show, combined with the recovery driven by mass vaccinations in the second half of 2020 and the first quarter of the current year.

Global growth is expected to moderate to 3.3% over the medium term (post-2022), reflecting expected damage to supply potential and pre-pandemic forces, including slower aging-related labor force growth in advanced and some emerging market economies. Besides, the IMF estimates the pandemic-generated recession of lesser impact than that caused by the 2008 global financial crisis.

On the other hand, emerging economies and the rest of the developing countries have been more affected and are expected to suffer more significant losses in the medium term due to the lack of financial resources for relief plans such as those implemented in the European Union, the United Kingdom or the United States, in addition to limitations in access to doses of COVID-19 vaccines.

The economic impact has been significant for countries dependent on tourism and commodity exports. Many of these countries entered the crisis in a precarious fiscal situation, with high debt levels and limited payment capacity.

Except for China, India, and the most dynamic Asian economies, the recovery of this group of countries will depend on the evolution of the pandemic, particularly in cases such as Brazil, where new strains of the COVID-19 virus have been found. This could prolong the impact of the pandemic if the vaccines available for the new variants identified are not effective.

Latin America and Africa

According to the IMF’s April 2021 World Economic Outlook, after a sharp downturn in 2020, only a mild recovery and at different speeds is expected in Latin America and the Caribbean by 2021. There has been a recovery in manufacturing in the second half of 2020, exceeding expectations in some large exporting countries in the region such as Argentina, Brazil, and Peru, raising the forecast for 2021 to 4.6 percent (a one percentage point revision) from last October.

In the long term, the outlook will depend on the behavior of the pandemic and the countries’ capacity to respond to it.

Except for countries such as Chile, Costa Rica, and Mexico, most countries in the sub-region have not had access to the vaccine doses necessary to proceed with mass inoculations of their citizens. Forecasts for the tourism-dependent economies of the Caribbean for 2021 were revised downwards from the previous percentage of 3.9 percent to 2.4 percent.

In the African continent, with 4.3 million reported infections and 115,000 deaths, most of these in sub-Saharan Africa, the most significant contraction in the region’s history was recorded in 2020 (-1.9 percent). By 2021, growth is expected to rebound to 3.4%. As in Latin America and the Caribbean, tourism-dependent economies are likely to be the most affected.

ASIA: China-Iran Strategic and Economic Partnership Agreement

On March 27th, after almost half a decade of negotiations between Beijing and Tehran, Chinese Foreign Minister Wang Yi and his Iranian counterpart, Mohammad Javad Zarif, signed the agreement on the strategic and economic partnership between the two nations.

This framework will be valid for twenty-five years and establishes trade and investment agreements for an amount of 400 billion dollars.

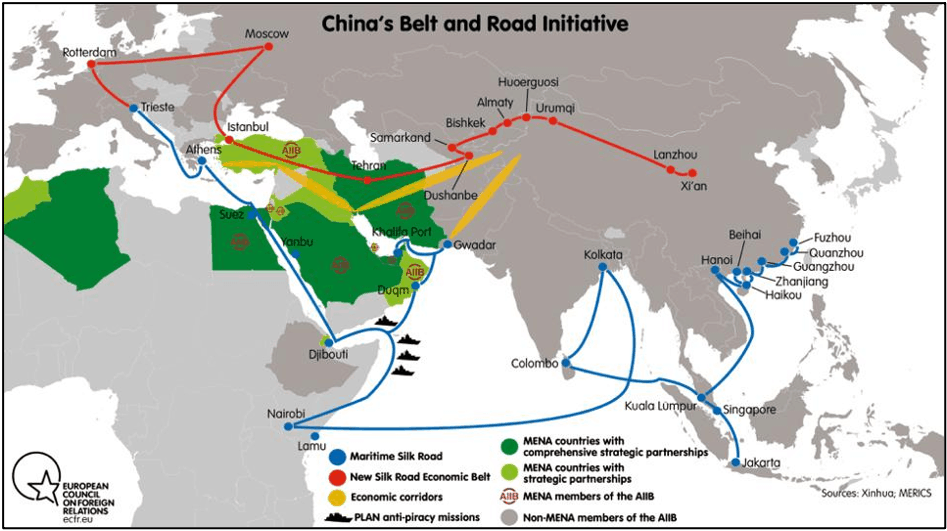

The agreement’s details are aligned with China’s New Silk Road strategy, which involves significant investments in industry and infrastructure in the Eurasian region, intending to expand its economic and political hegemony in the long term.

The main sectors of the agreement are oil, gas, petrochemicals, renewable energy, nuclear power, and energy infrastructure, military and high-tech cooperation, and the construction of ports to facilitate Iran’s integration into the New Silk Road trade routes.

CHINA’S NEW SILK ROAD INITIATIVE

Such a strategic partnership between the two nations has geopolitical implications for U.S. oil strategy, the trade war with China, and Western sanctions on Iran.

China’s willingness to negotiate with nations sanctioned by the West is based on the race to supply itself with the natural resources that its companies require, particularly oil and gas. Hence the importance of hydrocarbons in the recently signed partnership. China’s purchases of Iranian oil and gas will help the former have a greater financial flow, necessary to alleviate its economy, deeply affected by the sanctions.

Additionally, future Chinese exports and imports could be simplified by the resurrection of the 926-kilometer railway line (New Silk Road on the map), which crosses most of Central Asia and can expand further into Turkey.

However, China has a risk of disrupting its relations with other Middle Eastern countries, as currently, it is Saudi Arabia’s largest trading partner and Israel’s second-largest. In addition to cooperating on security issues, both countries consider Iran to be their main geopolitical threat.

UNITED STATES: federal spending is expanded

A new proposal to be added to the $1.9 trillion stimulus package and a recently submitted plan to spend $2.3 trillion on the country’s infrastructure was presented on April 9th by the Director of the Office of Management and Budget of the U.S. President, Shalanda Young, and outlined by U.S. President Joe Biden. It proposes the expansion of federal spending for 1.52 trillion dollars. This aims to improve areas such as education, health research, and the fight against climate change. In this way, the Biden administration continues with the expansion of fiscal spending as an incentive of the post-COVID-19 economy, establishing a break with the policies of his predecessor, Donald Trump, whose budget proposals prioritized military spending and border security while cutting spending in areas such as environmental protection.

The infrastructure plan mentioned above, presented last April 7th by the Biden administration, includes, among other aspects, investments in roads and bridges, drinking water, broadband expansion, and electrical infrastructure to create 19 million additional jobs. The Plan has been favorably received by the international financial sector and the different agencies, which estimate the recovery of the U.S. economy of around 6% by 2021.

The $2 trillion that Biden will ask Congress to approve for his American Jobs Plan will be spent over eight years and paid for with tax increases over 15 years, including raising the corporate rate from 21% to 28% and increasing the overall minimum tax. Biden also wants to encourage domestic manufacturing by making it more expensive for U.S. companies to produce goods and services overseas.

In total, the proposal calls for an increase of $118 billion (an additional 16%) for government discretionary spending in F.Y. 2022, compared to this year’s base spending appropriations. Whether that increase will translate into more significant federal deficits in their following budget proposal remains to be established.

Democratic leaders in Congress hailed the plan on Friday and suggested it be incorporated into government spending bills for fiscal 2022. Republicans, meanwhile, criticized the proposal as lacking in detail and called it an excessive expansion of the federal government. They also claimed that the administration was not spending enough on defense to counter potential military initiatives by China.

The proposal also seeks to integrate climate programs into agencies such as the Agriculture and Labor departments on the environment. That money would be in addition to renewable energy spending in infrastructure legislation also proposed by Biden, which would earmark about $500 billion for programs such as increasing production of electric vehicles and building climate-resilient roads and bridges.

Department of Energy funding would increase by $4.3 billion, up 10.2% from last year. This includes $1.7 billion for technologic research and development of nuclear power plants or hydrogen fuels and $1.9 billion for a new clean energy initiative to help build energy-efficient houses and accelerate permitting for transmission lines that can carry wind and solar power across the country.

Finally, the Environmental Protection Agency, whose funding and staffing the Trump administration sought to cut, would receive a $2 billion increase under Biden’s plan.

CHINA: recovery continues with record growth

According to China’s National Bureau of Statistics, gross domestic product (GDP) grew during the first quarter of 2021, at a record level of 18.3%, compared to the same period last year. Meanwhile, the PMI Industrial Activity Index increased to 54.3% for March.

As contemplated in the 14th Five-Year Plan for the years 2021-2025, the Chinese government aims to change the country’s economic growth model, so far focused on exports, to one of dual circulation (more imports) and domestic consumption. Similarly, the Chinese government set a growth target of over 6% for 2021, based on an increase in industrial activity and trade.

Unlike the United States and European Union countries, China has not distributed massive stimulus packages to its citizens to boost domestic consumption. Analysts believe that China’s first quarter provides a strong indication that it will grow beyond its target, with estimates such as those from Oxford Economics putting this at 8.9%.

Household consumption is also expected to remain a key driver of growth from the second half of 2021 onwards, as consumer confidence and employment conditions improve despite delays in the production and logistics of the vaccination process. As of March 31st, according to National Health Commission officials, 120 million doses of vaccines had been administered. However, thanks to the measures taken by the authorities, the country has few cases of infections and zero deaths from Covid-19.

European Union

According to the President of the European Central Bank (ECB), Christine Lagarde, in an interview for CNBC last April 9th: «the European Union (E.U.) will overcome the obstacles created by COVID-19 and will reach its economic rhythm by the end of this year».

Amid severe spikes in coronavirus cases across the E.U., leading to another round of closures just as other developed economies look to accelerate, the European representative claims that the E.U.’s economic situation will improve during the second half of 2021.

According to the latest IMF projections, E.U. growth will be 4.4 percent in 2021, about the same pace as the average for advanced economies, but well below the 6.4 percent estimate given to the United States.

Both the ECB and the U.S. Federal Reserve have provided strong monetary support to their citizens and businesses. However, the U.S. nation has been very effective with its massive vaccinations, and fiscal support programs passed since March last year to date, with other stimulus packages under discussion.

Regarding the region’s lag behind the mass vaccinations carried out in the United States and the United Kingdom, Lagarde said she expects the proportion of the population that received at least one dose to reach 70 percent by the summer. To date, only 14 percent of those living in the 27 E.U. countries have been vaccinated, compared to 33.5 percent in the United States.

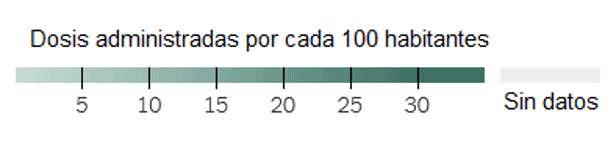

COVID-19

The asymmetry in access and global distribution of vaccines is maintained. The United States and the United Kingdom have monopolized lots of vaccines, well above the total of their populations, applying to date, respectively 63 and 64 doses per 100 inhabitants. Similarly, countries such as Chile (70 per 100), the Emirates (100 out of 100), and Israel (116/100, i.e., second doses) have managed to obtain a larger proportion of vaccines than the world average.

In contrast, the European Union reaches an average of 25 doses per 100 inhabitants, with severe limits in its vaccine inventories, following defaults in deliveries by Pfizer and AstraZeneca and delays in its bureaucracy. Latin America and the Caribbean only 9 out of 100, and Africa, the region is lagging the furthest behind, minus 1 out of 100, with countries not having started mass vaccinations.

China, the manufacturer of several vaccines against the coronavirus, has acknowledged that its vaccines have been less effective than those of other laboratories. At the same time, China continues to progressively inoculate its population (14 doses per 100 inhabitants) and exporting the vaccine to third countries.

The Russian Federation, also a vaccine producer, still has a low level of vaccination (11/100). Although they tried to increase Sputnik’s exports and started negotiations with the World Health Organization to include it in the COVAX mechanism, Russia continues to face political obstacles, even with the vaccine’s proven effectiveness and the non-existence of side effects such as those presented by others.

Mass vaccination at a lower rate than expected has consequences in human lives and an economic recovery that will take longer to arrive. The COVAX mechanism, endorsed by the WHO, aims to supply vaccines to middle- and low-income countries that request them. Although 98 million vaccines have been committed through this mechanism, it is still far from enough to protect 70% of the population in these countries.

Thus, by the middle of the year, we could be in a scenario where most of the United States and the United Kingdom population will be vaccinated. By the end of the year, presumably those of the European Union and a large part of Asia. However, for Latin America and Africa, and the rest of the developing countries, the prospects for vaccination still look remote and will probably extend until the end of 2022.

Worldwide infections and deaths

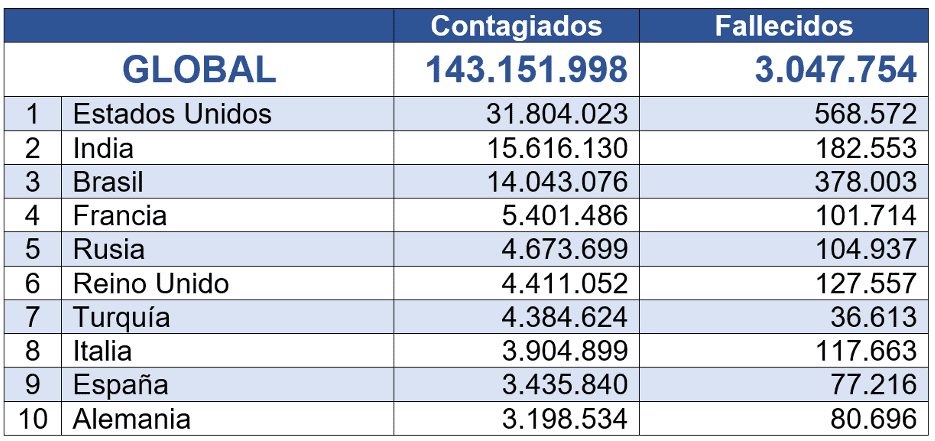

As of 21/04/2021, the number of people infected by the coronavirus worldwide has reached 143 million. The total number of deaths has passed the 3 million mark, with 82 million people has recovered from the virus.

TOP 10 COUNTRIES AFFECTED BY THE PANDEMIC

Global Vaccine Distribution

More than 828 million doses have been administered worldwide, equivalent to 12 doses per 100 people. However, there is still a large gap between vaccination programs between developed and developing countries, with many of the latter still failing to report vaccination figures.

There is a significant gap between continents. Africa has the lowest vaccination rate (1 in 100 people), with many countries yet to initiate mass vaccination. It is followed by Oceania (2.9), Asia (7.9), Latin America (12), Europe (21), and North America (36).

Blood clot cases in AstraZeneca’s application

At the beginning of April, the European Medicines Agency (EMA) reported having received 169 reports of blood clots in the blood vessels of the brain and 53 cases of splanchnic vein thrombosis or coagulation in the veins of the abdomen. This figure corresponds to 34 million doses of AstraZeneca vaccines administered in Great Britain and the European Union in the past three months. Of the cases reviewed, 18 were fatal and occurred within two weeks of receiving the first dose.

Because of the above, Britain’s Medicines and Healthcare products Regulatory Agency recommended against the use of AstraZeneca in people under 30 years of age, after reviewing 79 cases of rare clotting linked to low platelets, with 19 fatalities. Eleven of the deaths were in people under 50 years of age, and three were under 30 years of age.

For its part, the EMA stated that unusual blood clots are very rare side effects, and countries should decide how to proceed, as they may vary from country to country. The Agency has assured that the benefits of using AstraZeneca’s vaccine continue to outweigh the associated risks.

AstraZeneca is currently the most widely used vaccine in the world (118 countries), followed by Pfizer-BioNTech (85), Moderna (36), Sinopharm (29), Gamaleya (24), Sinovac (19), and Janssen (2).

Problems with Janssen

U.S. federal health agencies on Tuesday called for an immediate pause in the use of Janssen, Johnson & Johnson’s single-dose coronavirus vaccine after six people developed blood clots within two weeks of vaccination. All six recipients were women between the ages of 18 and 48 years. One woman died, and a second woman in Nebraska has been hospitalized in critical condition. According to data from the Centers for Disease Control and Prevention, nearly seven million people in the United States have received Johnson & Johnson shots so far, and approximately nine million more doses have been shipped to the states.

Meanwhile, on April 19th, the European Medicines Agency (EMA) recommended the Janssen vaccine for licensure in European Union countries for use in people over 18.

Record infections in India

In India, which is currently facing the world’s largest coronavirus outbreak, emergency authorizations will be granted for foreign-made vaccines that have been approved for use by regulatory agencies in the United States, the European Union, the United Kingdom or Japan, or by the World Health Organization, eliminating the requirement for local clinical trials. This was prompted by the spike in infections, which on Monday 12nd recorded a record 161,736 new coronavirus infections in 24 hours, the seventh consecutive day in which India surpassed 100,000 cases.

With more than 14 million confirmed cases, the second-highest number of cases after the United States, and the fourth-highest number of deaths (more than 174,000), India has administered some 105 million doses of domestically produced vaccines to date for a population of 1.3 billion people. Still, it is widely believed that the country needs to rapidly increase inoculations because other measures have failed to control the virus.

India’s outbreak has implications for the entire world, as its pharmaceutical industry was supposed to manufacture and export hundreds of millions of doses of AstraZeneca’s vaccine. Now, it is forced to keep most supplies in the country.

Infections and mortality out of control in Brazil

In Brazil, the spread of COVID-19 has intensified, causing the health system’s collapse, with its staff exhausted and unable to care for all the people in need. With the increase in coronavirus infections, the Latin American country is the most devastated by the virus in the entire region regarding the number of deaths and total population.

Brazil, with 214 million inhabitants and 14 million infected, has more than 365,000 deaths. Compared to India, the second country most affected by the pandemic after the United States, there are more than twice as many deaths as the Asians, who have a population of 1.4 billion. During the first week of April, a record peak of 4,000 deaths was reported in one day. It is also noteworthy that most of those infected are people under 40 years, which contrasts with other countries, where the pandemic affects more older adults.

The increase in infection and death rates occurs while the pace of vaccine inoculations has accelerated in the last month, after an initially slow start. Nearly 33 million Brazilians have been vaccinated to date.

Multiple waves have hit Brazil and at the same time have identified variants of the virus that have proved more lethal, along with variants seen in South Africa and the United Kingdom.

The main responsible for this crisis is the Brazilian president, Jair Bolsonaro, who was initially a pandemic denier, opposing closures and other pandemic mitigation measures, going so far as to ridicule the use of masks and calling COVID-19 «just some flu.»

DEMAND

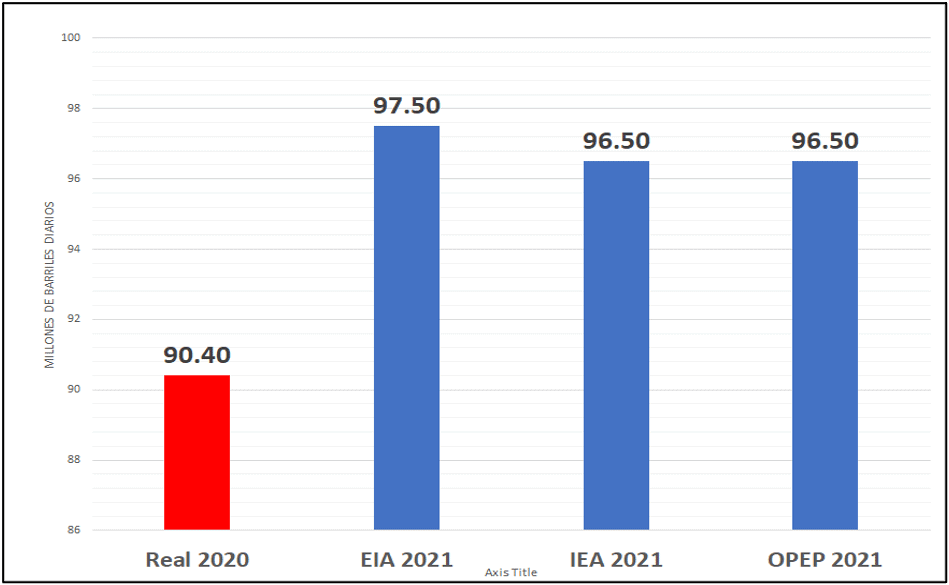

According to the MOMR, OPEC estimates world oil demand growth this year to increase by about 6.0 MMBD year-on-year, to stand at 96.5 MMBD.

The largest increase in oil demand is expected during the second half of the year, based on the premise that the vaccination process in industrialized economies and a gradual easing of measures against COVID-19 will advance rapidly during the first half of the year and that developing countries will not be extraordinarily affected by the pandemic.

For the second half of 2021, OPEC expects oil demand to be stimulated by a more robust economic rebound than forecast last month, supported by stimulus programs underway in the major economies and by an eventual easing of pandemic-related mobility restrictions amid an acceleration in the rollout of vaccination. The estimate for the 2021 close is for global oil demand to reach 96.5 MMBD.

Meanwhile, the International Energy Agency (IEA) and the Energy Information Administration (EIA) agree with OPEC in estimating an increase in demand for 2021, with demand picking up during the second half of the year.

WORLD OIL DEMAND

(2020 – 2021)

IEA estimates an increase in demand by 5.5 MMBD with respect to 2020, to close 2021 at 96.5 MMBD of oil, estimating an increase in the second half of the year, also based on the premise of a massive vaccination process in the large industrialized economies and relaxation of mobility restrictions between countries. Meanwhile, the EIA estimates a year-on-year increase in demand of 5.5 MMBD, to an average consumption of 97.7 MMBD by 2021.

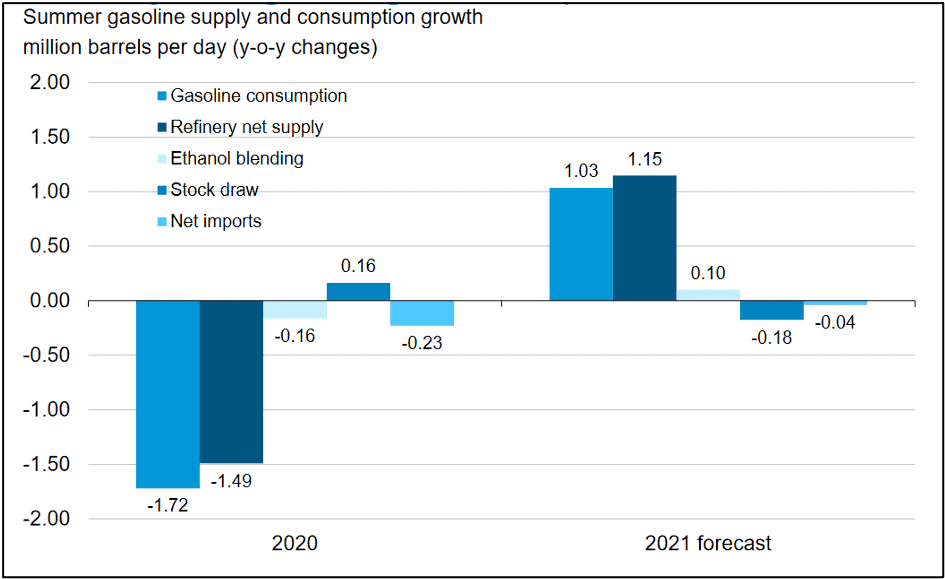

The rapid and massive Covid-19 vaccination process in the U.S. and U.K. and the economic recovery in Asia, led by China, has boosted the consumption of products, especially gasoline.

The behavior of the North American market boosts gasoline consumption due to the proximity of the summer season and the lifting of land transit restrictions in the country.

PROJECTED GASOLINE SUPPLY, CONSUMPTION, AND INVENTORIES IN THE US.

(Summer 2021 vs. 2020 in millions of barrels)

For diesel, a year-on-year improvement is also expected. Consumption of light distillates will be supported mainly by a solid petrochemical demand in countries such as China, the United States, and India, but still below pre-pandemic levels.

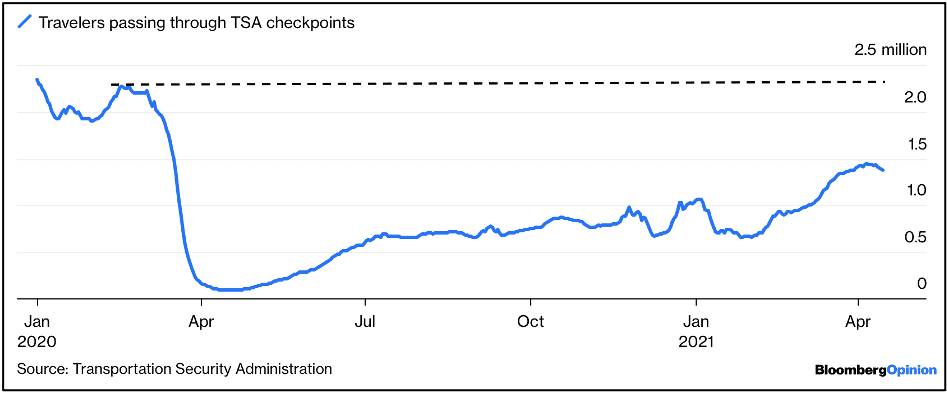

However, the still limited international air traffic will continue to condition growth in jet fuel demand, accounting for 8% of global fuel consumption (10% in OECD countries).

NUMBER OF PASSENGERS IN AIR TRAFFIC

TSA (2020-2021)

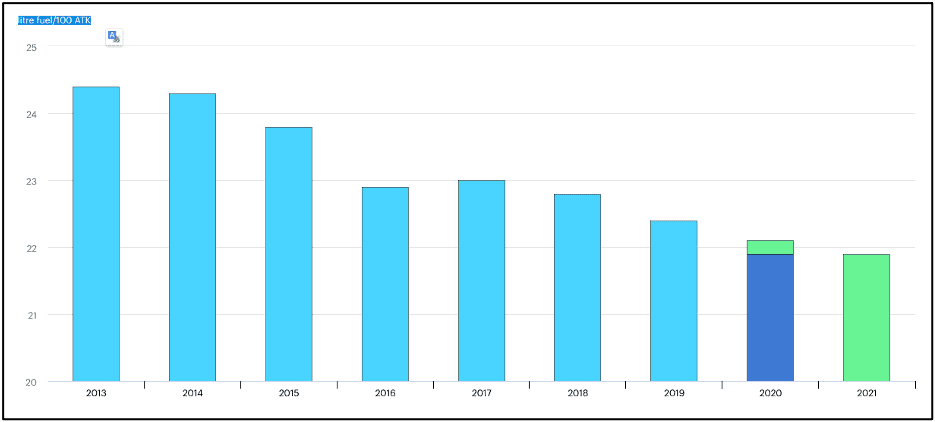

In 2020, aviation fuel consumption was 22.1 liters of fuel/tonne-available kilometers (ATK). By 2021, demand is estimated to reach similar levels to 21.9 liters fuel/ATK, considering that as long as there are no substantive improvements regarding the pandemic, international flights will not increase to levels higher than last year.

GLOBAL AVIATION FUEL CONSUMPTION 2013-2021

(Liters of fuel/ATK)

UNITED STATES

According to OPEC’s April MOMR, U.S. oil demand fell 1.3 MMBD last January to stand at 20.2 MMBD of oil. This drop, partly offset by higher light distillate requirements for the petrochemical sector, was due to reduced demand for transportation fuels due to the high number of infections caused by COVID-19 before starting the vaccination process last December.

Shutdowns and restriction measures in most states during January 2021 affected economic developments, mobility, and, consequently, oil demand.

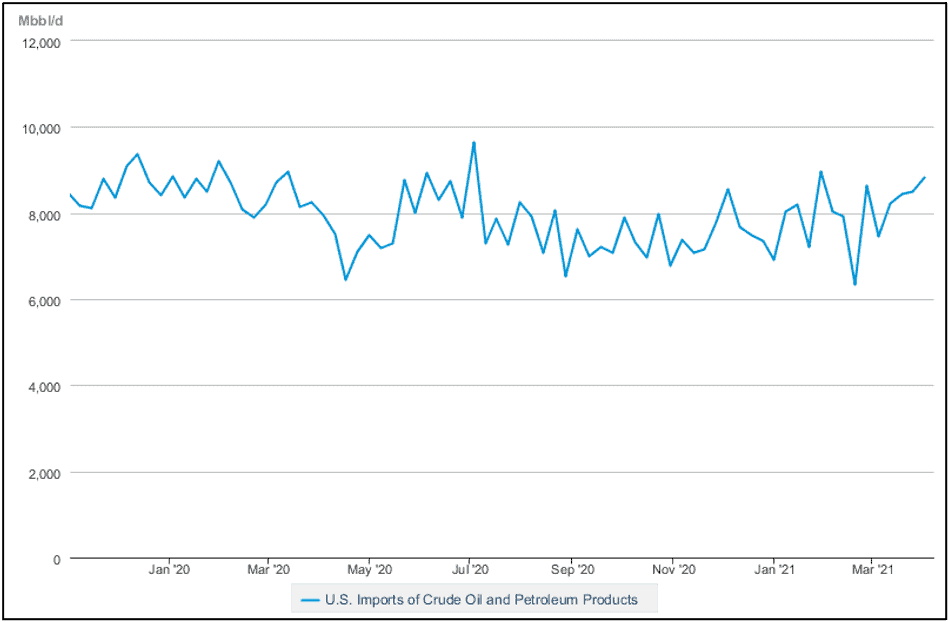

Regarding its crude oil and product imports, this reached 8.5 MMBD, representing a 9.8 percent increase from 7.7 MMBD on March 05th.

U.S. CRUDE OIL AND PRODUCT IMPORTS

(2020-2021)

CHINA

China’s oil demand has rebounded since April 2020, posting a February 2021 increase of more than 2.5 MMBD on a year-over-year basis, after rising about 0.5 MMBD over 2020 in January. The February increases are mainly related to the recovery of the country’s main economic sectors, which has been reflected in the 18% increase in GDP in the first quarter of the year.

Growth in the petrochemical sector is expected to continue to support demand. For LPG and naphtha, both added more than 0.5 MMBD y-o-y increase in February, after increasing by about 0.4 MMBD y-o-y in January.

Transportation fuel also rose sharply in February, despite some travel restrictions during the Lunar New Year vacation.

Gasoline and jet fuel demand returned to growth after posting declines in January. The MOMR indicates an increase of about 1.0 MMBD y-o-y in gasoline and jet fuel demand for February. Fewer constraints on transportation due to the COVID-19 pandemic during February 2020 supported this growth. Diesel fuel, meanwhile, increased solidly by 0.8 MMBD y-o-y in February, after posting growth of about 0.2 MMBD y-o-y in January. The increases reflect expanding manufacturing and industrial activity in the country.

China’s oil demand is expected to increase in 2021, given the economic recovery of international trading partners, particularly the United States, export-supported economic momentum, and China’s strict policies in controlling domestic COVID-19 cases while also maintaining GDP growth projections.

While demand for petrochemicals and ground transportation fuel is expected to continue to grow, demand for aviation fuel will remain below pre-pandemic levels, given the current constraints on international air traffic.

According to the EIA, China’s crude oil imports in March increased by 21% over last year, reaching 11.74 MMBD, but considering that during the same period in 2020. The country was facing the worst moment during the pandemic, and oil demand was lower, given the mobility restrictions to contain the coronavirus, with its effects on economic activity.

INDIA

From the world’s third-largest importer, oil demand continued to decline in February by more than 0.2 MMDB y-o-y, to stand at 4.82 MMDB, from 5.03 MMDB in 2020, representing a 4.1% drop. Demand was down mainly for diesel (7.5%), gasoline (3.0%), and jet/kerosene (28.5%), while light distillates were up year-on-year (8.4%). Jet fuel consumption was negatively affected by the reduction in international flights. On the other hand, LPG demand increased year-on-year due to higher demand for cooking fuel, while naphtha demand increased in February due to better petrochemical margins.

Although the country is currently suffering from an excessive amount of COVID-19 infections, with more than 200,000 per day during the last week, making it the country with the highest number of daily cases in the world. However, India’s economy is expected to grow by 9.8% this year, and oil demand is expected to increase by 13.48% to 4.99 MMBD.

STORAGE

One of the most evident signs of stabilizing oil market fundamentals is the draining of oil and product inventories that peaked well above their average and days of coverage. The oversupply of the oil market during the first half of 2020 was due to the collapse of the world economy as a consequence of the Covid-19 pandemic.

The draining of inventories and the recovery of oil prices confirm the need to regulate the oil market. Thus, OPEC+, after overcoming the disagreements and the price war of the first quarter of last year that led to the historic agreement in April 2020, implemented the production cuts of 9.7 MMBD that came into effect on May 1st. After successive relaxations, the cut now stands at 6.975 MMBD. By July, it will be 5.795 MMBD, excluding the additional voluntary cut by Saudi Arabia between February and June 2021.

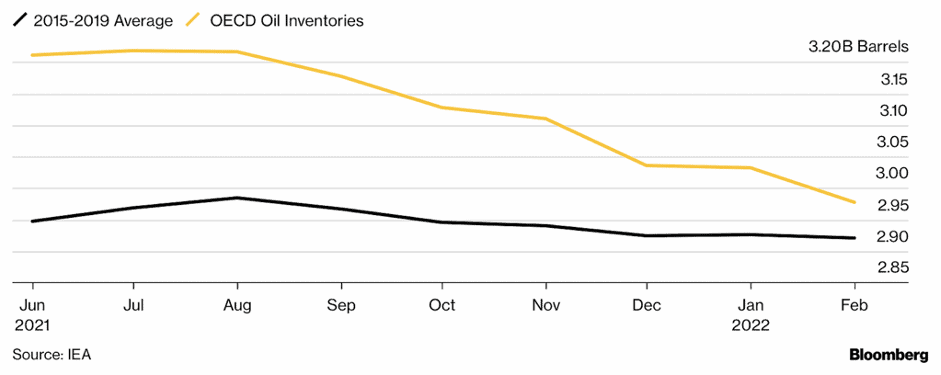

OECD Countries

In its MOMR for April, OPEC indicated that the commercial inventories of the OECD countries, as of February 2021, stand at 1,498 million barrels, a drop of 6.7 MMDB to the values of a year ago. Days of inventory coverage was 68 days, down 6.7 days from February.

OECD COUNTRIES’ CRUDE OIL INVENTORIES

U.S.

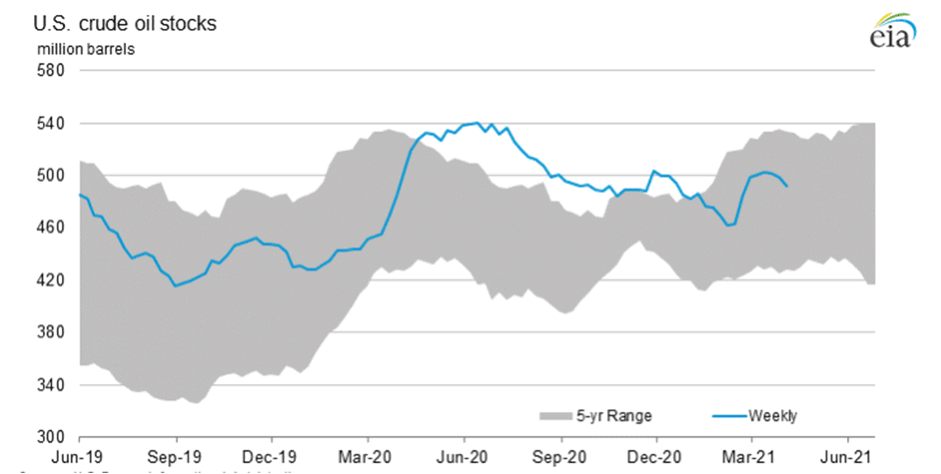

Meanwhile, according to the EIA’s weekly report of April 21st, 2021, U.S. commercial crude oil stocks fell by 8.8 million barrels in the last three weeks, to stand at the close of the week of April 16th at 493.02 million barrels, dropping 7.7 million barrels of oil from 2020.

U.S. CRUDE OIL STORAGE.

(June 2019 – April 2021)

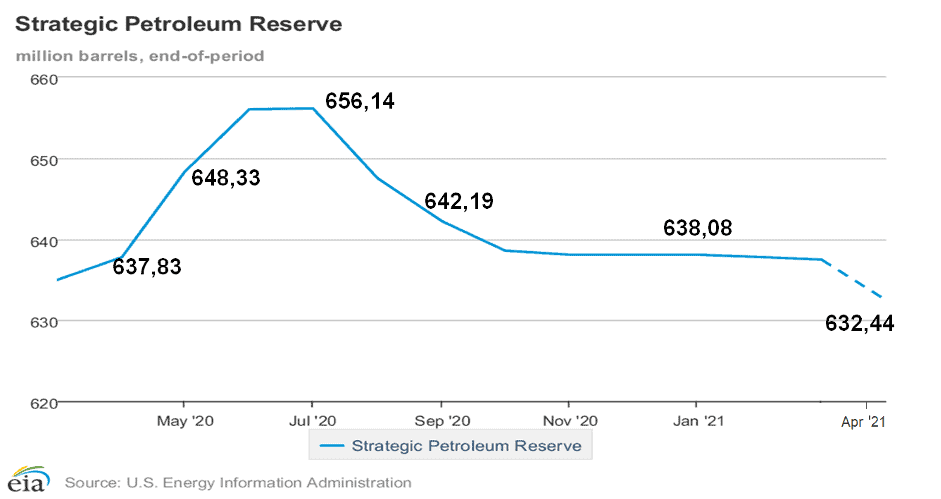

The strategic reserves fell to 1.85 million barrels in the same period. A decrease of 20.2 million barrels compared to July 2020, after the Trump Administration, in April of the same year, authorized their use to store the excess production of U.S. operators to prevent the shutdown of their production in the face of the collapse of the Cushing Oklahoma. The EIA’s estimates mark a downward trend this year, forecasting that strategic reserves will stand at 632.44 million barrels at the end of April, and at the end of 2021, they will stand at 615.61 million barrels.

U.S. STRATEGIC PETROLEUM RESERVES.

(April 2020 – April 2021)

In March, with a record of 502.7 million barrels, commercial reserves increased by 17.2 million barrels compared to the previous month and 19.2 million barrels compared to the average of the last five years.

The trend of crude oil inventories in the U.S. in 2021 is downward, as has been the case since November 2020. However, they recorded an increase between January and February due to winter storms that affected refining activity in Texas. For January 2021, commercial inventories averaged 475.8 million barrels, registering an increase of 26.9 million barrels in March.

Although the EIA estimates another slight increase of 1 million barrels in commercial crude oil inventories for April, the trend in 2021 marks downward, forecasting that it will close the year with 459 million barrels.

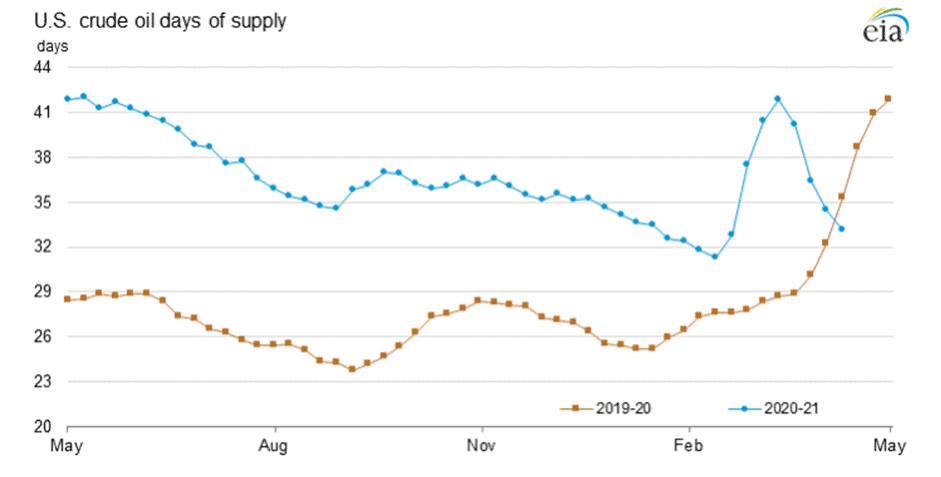

By April 16th, according to the EIA’s latest weekly report, the days of coverage dropped to 33 days, when as of March 12th, it was 41.8 days, while a year ago, it was 35.3 days.

U.S. CRUDE OIL DAYS OF SUPPLY

(May 2019 – April 2021)

CHINA

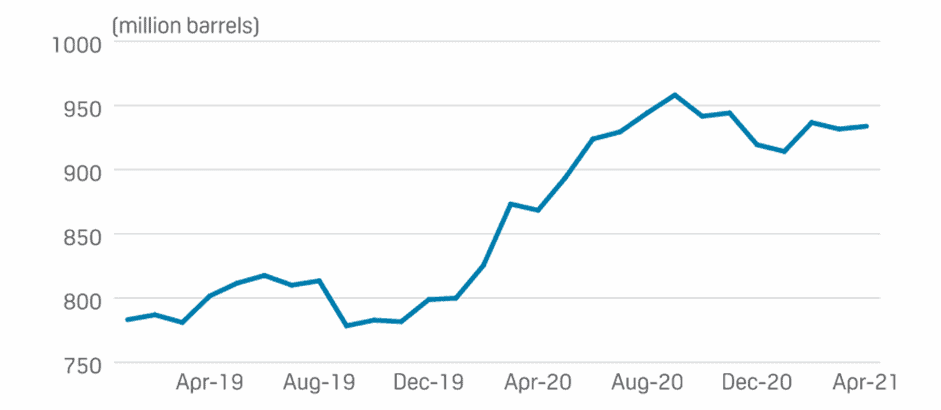

According to the Global Platts agency, taking data from the analyst Kpler, China’s oil inventories in April stood at 933.82 million barrels of oil, with an estimated storage capacity of 1.394 billion barrels indicating the use of 67% of its storage capacity.

China has a policy of permanently increasing its crude oil imports to raise inventories, taking advantage of the low prices registered since the beginning of the market collapse, sustaining its economic growth, and strengthening its strategic reserves. The oil imports caused the collapse of the crude oil handling infrastructure in July 2020, which forced it to slow down the level of imports as of August 2020, remaining stable at levels close to 11 MMBD.

CRUDE OIL STORAGE IN CHINA

(April 2019 – April 2021)

VENEZUELA

According to secondary sources reflected in OPEC’s MOMR, oil production in Venezuela is 525 thousand barrels of oil per day.

Despite the government’s repeated promises to recover oil production, at least up to 1.5 million barrels per day (50% of 2013 production) for this year, the reality is that Venezuela’s oil production is stagnant after its 100 years of oil history.

OIL PRODUCTION OF OPEC COUNTRIES

(March 2021)

The country’s oil production averages 513 MBD in the first quarter of the year, maintaining the same levels of 2020, but presenting a drop of 283 MBD to the production of 796 MBD in 2019 and of 2.490 million barrels per day, to its production of 3.015 million barrels per day of oil in 2013.

As of 2014, oil production in Venezuela has experienced an unprecedented collapse worldwide, losing 82.6% of its oil production in 7 years, falling back to the country’s production levels of 90 years ago, in the early ’30s.

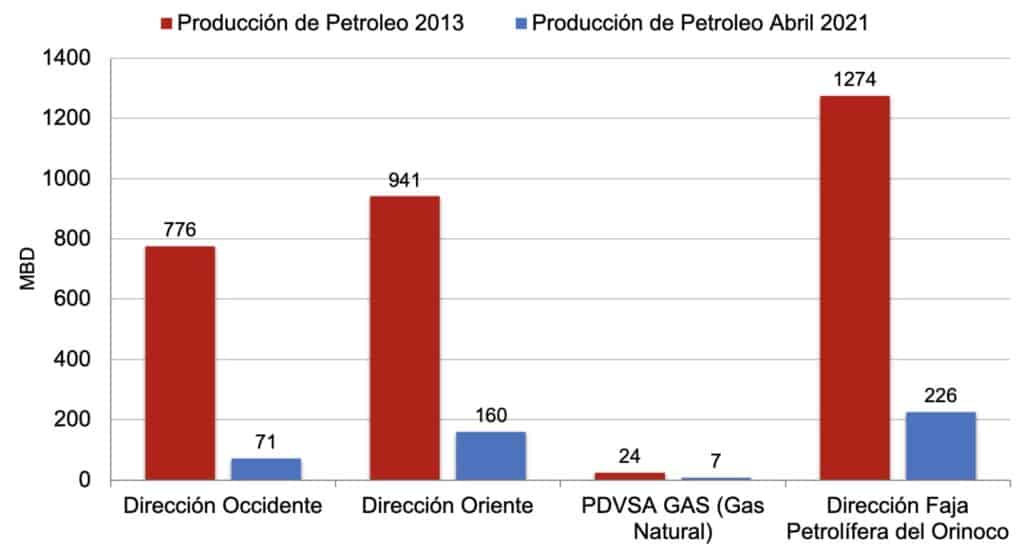

Production in the operating areas of the country

The oil activity in the country is concentrated in 5 large operating areas with different degrees of age, complexity, and characteristics of their deposits and particular operations, namely: West, East, Oil Belt, PDVSA Gas, and Offshore.

The collapse of PDVSA’s oil activity has occurred in all its operational areas, both in oil production and in the upgraders, refineries, and cryogenic complexes. The above indicates that, beyond any operational complexity or the specific situation of a particular area or business, it is not a technical problem but a political problem.

The collapse of PDVSA is general and covers the functioning of the entire industry. After successive interventions of the government who responded to political and group interests, it began the persecution and imprisonment of its directors, managers, and workers. Later, by appointing 7 Directors with no knowledge of the operations and management of the industry to control and intervene directly in the budget and disbursements of the company, directly diverting operational, maintenance, and investment resources to other government priorities, which resulted in an interruption of the procurement and operational contracting processes, with the consequent progressive collapse of operations to their minimum levels.

The militarization of PDVSA, as of 2017, opened the doors to a process of privatization and surrender of oil operations, through Decree 3,368, with the subscription of the illegal «Oil Services Contracts,» where PDVSA’s operational control was reversed. The best oil areas of the country were handed over to private operators, as well as the control and participation of PDVSA was ceded to transnational companies in the most prolific and essential areas of the Orinoco Oil Belt.

On the other hand, internally, a policy of dismantling the company’s capacities was initiated, allowing them to be lost or handed over to private operators and companies, as has been the case of the fleet of ships, boats, drills, oil services activities, among others, as well as the sale and commercialization of crude oil.

The industry’s militarization and the Memorandum 2792, signed by the Minister of Labor -which ignores the labor conquests and demands of the workers-, brought with it the deployment of an anti-worker policy and permanent persecution, which caused the departure of more than 30 thousand engineers, technicians, and specialized workers, as well as the loss of essential conquests and benefits, medical insurance, savings fund and benefits of the oil workers, both active and retired, who work in precarious conditions and have suffered a deep process of generalized impoverishment.

The collapse of the company and its productive capacities is clearly reflected in the operational results of the different oil-producing areas of the country.

OIL PRODUCTION BY OPERATING AREA

2013 vs. April 2021

In Occidente, the most complex and oldest area of the country, oil production stood at 776 MBD in 2013, while as of April 2021, only 70 MBD are produced, a drop of 106 MBD of oil, a loss of 86.3% of the area’s oil production. In this area, the most prolific fields are operated by the private companies, to which the production and export operations were handed over.

In Oriente, oil and NGLs production stood at 941 MBD in 2013, while in April 2021, it stands at 160 MBD, a drop of 781 MBD of oil, a loss of 82.9% of the area’s oil production. In this area, in 2018, the best fields and deposits were handed over to private parties through the figure of oil «Service Contracts» without them having had the performance expected by the government.

The traditional areas, both east and West, have been exposed to permanent failures, spills, and accidents that impact the environment and affect their operational performance, reducing their reliability.

At the end of March, there was an explosion of a gas pipeline that supplies gas to the Pigap II reinjection plant, located in the community of El Tejero, in the State of Monagas, causing the suspension of activities in the wells associated with such facility, an accident that was attributed by the government authorities to another «terrorist attack,» without providing further explanations or evidence, in what has become the usual argument of the authorities in the face of recurring accidents and operational events that affect PDVSA and its facilities.

Orinoco Oil Belt, the area where more than 217 billion barrels of proven crude oil reserves are concentrated -certified by the Canadian company Ryder Scott- where the new developments and the expansion of the country’s oil activity are located, oil production stood at 1,274 million barrels per day of oil in 2013, while in April 2021 it stands at only 226 MBD, a loss of 82.2% of the area’s oil production.

In this great oil province, nationalized by the government of President Chavez in February 2007, oil production under the operational control of PDVSA, both in the areas of its own efforts and in the joint ventures, kept growing steadily from 698 MBD in 2007 to 1,274 million barrels per day in 2013, an increase of 576 MBD in the 6 year period, an increase of 82.5%. A region full of oil resources that constitutes the expansion of our oil production towards the future and the material and economic basis for the development of the great Orinoco project, as conceived in the Plan of the Homeland 2013-2019.

BIBLIOGRAPHIC REFERENCES:

- [1] Dr. Ayed S. Al-Qhatani, OPEC Monthly Oil Market Report, OPEP, 13 abril 2021.

- [2] Nota de Prensa, 15th OPEC and non-OPEC Ministerial Meeting concludes, OPEP, primero abril 2021.

- [3] Noticias, OPEC daily basket price stood at $65.21 a barrel Friday, 16 April 2021, OPEP, 19 abril 2021.

- [4] Comunicado de Prensa, Historic moment for ADNOC as world’s first Murban Futures Contracts commence trading, ADNOC, 29 marzo 2021.

- [5] Alex Lawler, Rania Gamal, Ahmad Gaddar y Vladimir Soldatkin, OPEC+ to ease oil curbs from May after U.S. calls Saudi, Reuters, primero abril 2021.

- [6] Short-term Energy Outlook Data Browser, Administración de Información Energética de EE.UU (EIA), 06 abril 2021.

- [7] Short-Term Energy Outlook, Administración de Información Energética de EE.UU (EIA), 06 abril 2021.

- [8] Resolución 2231 (2015), Consejo de Seguridad de la ONU, 20 julio 2015.

- [9] Executive Order 13846, Reimposing Certain Sanctions With Respect to Iran, Federal Register, Home of Teasure, 07 agosto 2018.

- [10] Judy Goodruff, U.S. and Iran agree to talks on returning to the 2015 nuclear deal, 02 abril 2021.

- [11] Redacción, La delegación iraní no mantendrá ningún contacto con la de EEUU, Agencia de Noticias de la República Islámica de Irán IRNA, 02 abril 2021.

- [12] Redacción, Concluye en Viena la primera ronda de la Comisión Conjunta del JCPOA, Agencia de Noticias de la República Islámica de Irán IRNA, 06 abril 2021.

- [13] Joseph Haboush, US warns Iran against ‘maximalist demands’ after start of nuclear talks in Vienna, Alarabiya, 06 abril 2021.

- [14] Departamento de Prensa, Department Press Briefing – April 6, 2021, U.S. Department of State, 06 bril 2021.

- [15] Oficina del Vocero, Briefing With Senior State Department Official On Recent U.S. Engagement in Vienna Regarding the JCPOA, U.S. Department of State, 09 abril 2021.

- [16] Redacción, Rohani: Los países miembros del acuerdo nuclear han reconocido que ese tratado es la mejor solución, Agencia de Noticias de la República Islámica de Irán IRNA, 07 abril 2021.

- [17] Redacción, El desesperado atentado contra Natanz evidencia el fracaso de los oponentes a los avances industriales y políticos de Irán, Agencia de Noticias de la República Islámica de Irán IRNA, 11 abril 2021.

- [18] Redacción, Rohani afirma que el enriquecimiento de uranio al 60% es una respuesta a las maldades de los enemigos, Agencia de Noticias de la República Islámica de Irán IRNA, 14 abril 2021.

- [19] Comunicado de Prensa, Secretary Austin Travels to Israel, Germany, NATO HQ and United Kingdom, Departamento de Defensa de EE.UU., 08 abril 2019.

- [20] Comunicado de Prensa, Joint Comprehensive Plan of Action: Joint Commission resumes today, 17 April, Servicio de Acción Exterior de la Unión Europea, 17 abril 2021.

- [21] Katy Dartford, Iran cautiously optimistic about progress of nuclear deal talks in Vienna, 18 abril 2021.

- [22] Departamento de Comunicaciones, Aramco signs $12.4 billion infrastructure investment deal with EIG-led consortium, 09 abril 2021.

- [23] Reino de Arabia Saudita, “Saudi Vision 2030”, en Vision 2030, 2017.

- [24] Saudi Aramco Annual Report 2020, Saudi Aramco, 23 marzo 2021.

- [25] Álvaro Escalonilla, Saudi Aramco pondrá más acciones a la venta en los próximos años, Atalayar, 29 enero 2021.

- [26] Statistic, Ministerio de Energía de la Federación Rusa, primero abril 2021.

- [27] Redacción, Russia May Have Passed Peak Oil Output – Government, The Moscow Times, 12 abril 2021.

- [28] Weekly Supply Estimates, Administración de Información Energética de EE.UU (EIA), 14 abril 2021.

- [29] Timothy Gardner, U.S. oil production will not return soon to pre-pandemic levels, energy secretary says, Reuters, 28 octubre 2020.

- [30] Kevin Crowly, Shale CEO Warns of OPEC+ Price War if U.S. Oil Production Surges, Financial Post, 14 abril 2021.

- [31] Prensa Interior, Share Secretary Haaland Delivers Remarks at Interior’s Public Forum on the Federal Oil and Gas Program, U.S. Department of Interior, 25 marzo 2012.

- [32] Joe Biden, Tackling the Climate Crisis at Home and Abroad, Federal Register, primero de febrero 2021.

- [33] Joe Biden, Executive Order on Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis, White House, 20 enero 2021.

- [34] Stephen Boutwell, BOEM Advances Offshore Wind in Major U.S. East Coast Energy Market, BOEM, 29 marzo 2021.

- [35] Equipo de Reuters, Fourteen U.S. states sue Biden administration over oil and gas leasing pause, 24 marzo 2021.

- [36] Redacción, Drilling activity is set for two consecutive years of growth but will lag pre-pandemic levels, Rystad Energy, 23 marzo 2021.

- [37] Rings Count, Baker Houghes, 16 abril 2021.

- [38] Drilling Productivity Report, Administración de Información Energética de EE.UU (EIA), 12 abril 2021.

- [39] La Cámara de Diputados aprobó, en lo general y en lo particular, reformas a la Ley de Hidrocarburos, Cámara de Diputados de México, 14 abril 2021.

- [40] Redacción, Guyana’s 5th oil cargo was sold to Hess, no decision yet on exports to India, Oil Now, 24 marzo 2021.

- [41] Redacción, Guyana lifts its 6th million-barrel oil cargo, next shipment could be affected by drop in production, Oil Now, 14 abril 2021.

- [42] London Stock Echange, Interim Results, Westmount Energy, 30 marzo 2021.

- [43] Redacción, Exploration activity in Guyana to speed up, with record number of wells set for 2021, Rystad Energy, 12 marzo 2021.

- [44] World Economic Outlook Reports april 2021, Fondo Monetario Internacional FMI, 06 abril 2021.

- [45] Ariel Cohen, China-Iran $400 Billion Accord: A Power Shift Threatens Western Energy, Forbes, 5 abril 2021.

- [46] Sarah Hansen, Here’s What’s In Biden’s $2 Trillion Infrastructure Plan, Forbes, 31 marzo 2021.

- [47] Directora Shalanda Young, FY 2022 Discretionary Request, Oficina de Gestión y Presupuesto de la Presidencia de EE.UU., 09 abril 2021.

- [48] Grady McGregor, Behind China’s eye-popping 18.3% Q1 GDP growth, parts of its recovery are losing steam, Fortune, 16 abril 2021.

- [49] Jeff Cox, Lagarde sees strong rebound for EU economy in second half, expects U.S. to meet inflation goal son, CNBC, 09 abril 2021.

- [50] Ludwin Burger, How worried should we be about blood clots linked to AstraZeneca and J&J vaccines?, Times Live, 13 abril 2021.

- [51] Michael Erman, U.S. calls for pause to J&J COVID-19 vaccine over rare blood clots, Reuters, 13 abril 2021.

- [52] Chris Kay, The pandemic is deadlier in Brazil than in India and no one knows why, The Economics Time, 16 abril 2021.

- [53] Kelly McLaughlin, Most COVID-19 ICU patients in Brazil are now under 40 years old. Experts think the spread of a variant is to blame, 16 abril 2021.

- [54] Oil Market Report – April 2021, Agencia Internacional de Energía, 13 abril 2021.

- [55] Analysis and forecast to 2026, Agencia Internacional de Energía, 13 abril 2021.

- [56] The 10th (Extraordinary) OPEC and non-OPEC Ministerial Meeting concludes, OPEP, 12 abril 2020.

- [57] Weekly Stocks, Administración de Información Energética de EE.UU (EIA), 14 abril 2021.

- [58] Oceana Zhu, Expanding storage, energy security push to keep China’s crude inventories high, S&P Global Platts, 7 abril 2021.

- [59] Nicolás Maduro,Decreto 3.668, Finanzas Digital, 12 abril 2018.

- [60] Redacción Venezuela, ¿Qué es el Memorando 2792 y por qué los trabajadores deben exigir su anulación?, La Izquierda Diario, 06 junio 2019.