INDEX

PRICE

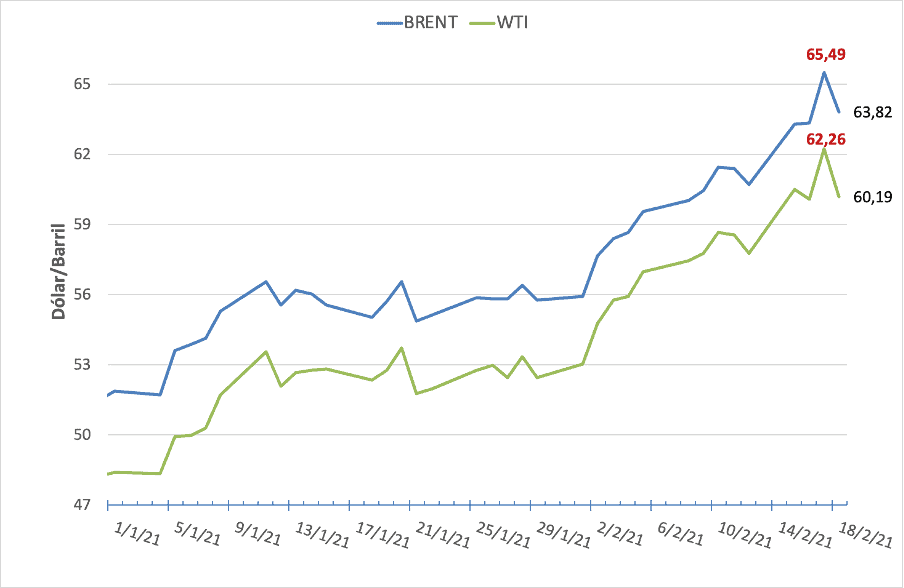

Oil prices maintain their upward trend started in January, with Brent and WTI markers above the threshold of 60 dollars a barrel for more than seven consecutive weeks.

The entry into force, on February 1st, of the OPEC+ cuts and the additional cut of one million barrels per day by Saudi Arabia, the expectations of an economic recovery derived from the start of massive vaccinations against COVID-19 in the industrialized economies and the announcement of new economic aid packages in the US and Europe, have contributed to the rise in prices. Brent and WTI markers have been quoted at maximum values since the oil market crisis began almost a year ago.

The cold wave that hit the US also sustained the rise of the markers due to the low temperatures in Texas, the oil heart of the country. This situation has forced to stop the production of more than one million barrels of oil per day -especially Shale-Oil-, and the operations of oil pipelines to declare the force majeure. The storm has also caused the shutdown of large refineries, which has affected refining capacity by around 3 million, and the suspension of services and operations due to the interruption of electric service affecting more than 5 million Americans in the region. A new high was recorded on Thursday, February 18th, when Brent and WTI markers rose to $65.49 and $62.26 per barrel, respectively, a 3% rebound from the previous day’s prices.

Geopolitical factors played a role in this price rally, following announcements of attacks on Saudi Arabia by Yemen’s «Hutií» militias, who announced via al-Masirah television on Monday cross-border drone attacks on Saudi airports, which were intercepted before the attack.

As of February 19th, Brent and WTI markers traded at 63.82 and 60.19 dollars per barrel, respectively, despite a drop of 1.67 and 2.06 dollars per barrel, respectively, from their previous day’s quotations. The week’s closing values were the highest quotations of the last 13 months, with a recovery of 23% and 25% concerning the closing prices of 2020.

OIL PRICE PERFORMANCE

BRENT AND WTI

(December 2020 – February 19th, 2021)

As highlighted by OPEC in its Monthly Oil Market Report (MOMR), published on February 11th, the main factor for oil price recovery observed since the beginning of the year is the entry into force of the new OPEC+ cuts. The above means a more restricted easing than the agreed in the initial agreements and the additional cut by Saudi Arabia in February and March.

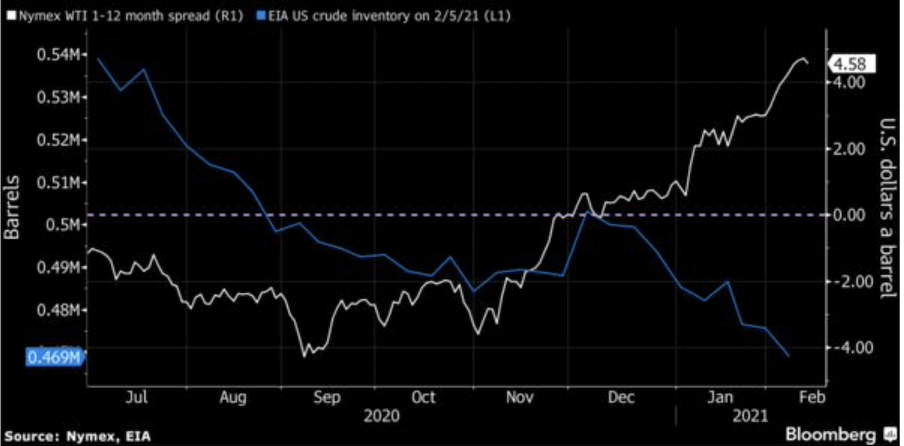

On the other hand, the draining of commercial inventories in OECD countries, especially in the US, has given an essential signal for the stabilization of oil market fundamentals, as stated this Sunday, February 14th, by Russian Vice-Premier Alexander Novak: «We have seen low volatility in the last few months. This means that the market is balanced and the prices we see today are in line with the market situation».

According to OPEC’s latest MOMR on February 11th, OECD countries’ commercial inventories have shown a reduction of 39.3 million barrels in December 2020, a drop of 1.29% from their November 2020 levels. According to preliminary data, in January, inventories are expected to fall further. In the US, the crude oil inventory drain has been more pronounced, with a drawdown of 6.7 million barrels of oil, according to the Energy Information Administration (EIA) in its February 12th report.

The inventory drain results from OPEC+’s policy of cuts, which since April 12th, 2020, have taken more than 2.202 million barrels of oil out of the market. A policy which, despite the internal pressures of its members, it seems that it will not change for its next meeting on March 04th, as expressed by the Iraqi Oil Minister, Ihsam Abdul Jabbar, last February 10th, when he stated that «in March the agreement (of OPEC+) will be that production will remain at the same level.»

As a result of the OPEC+ policy of production cuts and the prospects of recovery of the economy and oil demand towards the second quarter of the year, due to the massive vaccination campaigns against COVID-19, the price structure currently observed in the oil market is one of «backwardation,» which discourages the storage and construction of inventories, a fundamental element to achieve market balance.

THE CURRENT MARKET PRICE STRUCTURE -BACKWARDATION- FAVORS THE DRAINING OF INVENTORIES

OPEC Basket

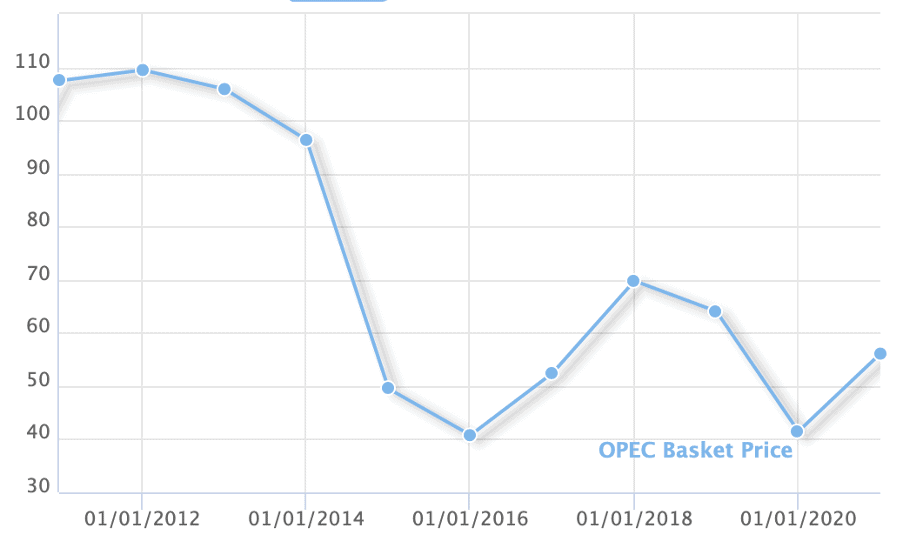

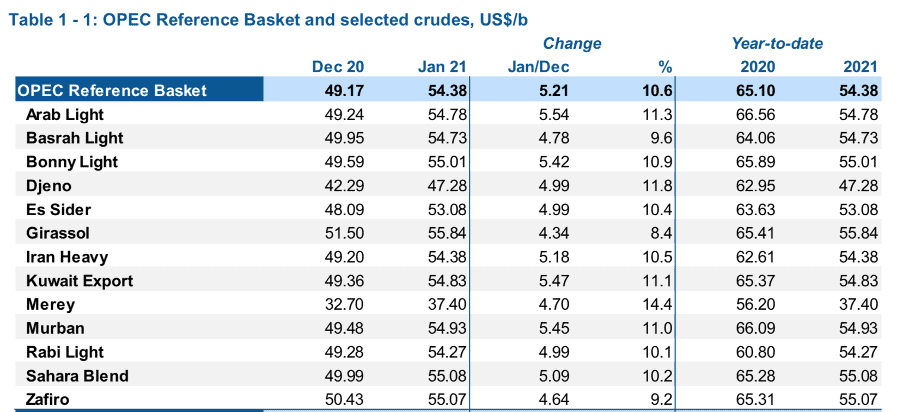

The OPEC Basket has increased $5 per barrel in January, for an average of $54.21 per barrel, according to data from February’s MOMR. For 2021, OPEC estimates a more stable market with an annual average price of $54.38 barrel. Although this represents a 31% recovery from the 2020 average price, it is still 16% below the 2019 average price of $64.04 per barrel.

OPEP BASKET PRICE

(actual 2012 – projection 2021)

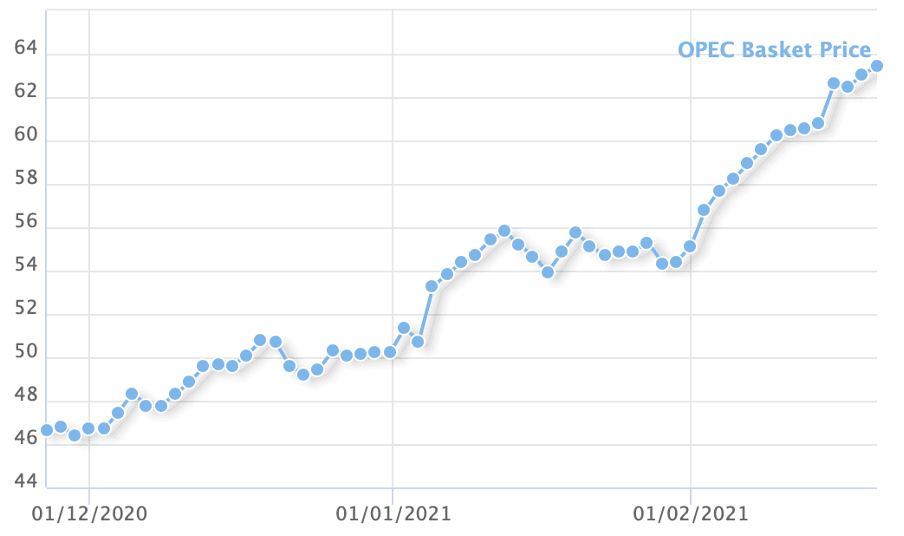

According to the latest OPEC Basket, as of Friday, February 20th, the average price was US$61.30 per barrel, after reaching US$63.43 per barrel the previous day, reaching levels similar to those of January 2020.

OPEP BASKET PRICE

(January 2020 – February 2021)

All the crude segregations that make up the OPEC Basket marked their highest quotations in the last ten months. The light crudes Bonny Light, Sunflower, Sahara Blend, and Sapphire, traded above 55 dollars a barrel, a monthly increase of 10%, because of the expected increases in gasoline and LPG consumption related to the winter season in North America and Europe.

OPEP BASKET CRUDE OIL BENCHMARKS

(December 2020 – January 2021)

Medium and heavy crudes also showed an upward trend with a higher monthly increase of 11%, favored by the increase in demand in Asia, as OPEC reported in its monthly MOMR report.

Futures

According to the EIA report, «Short-Term Energy Outlook,» published on February 9th, the average price of Brent crude oil increased 5 points in January concerning the previous month, reaching US$55 per barrel. The report estimates that by the first quarter of 2021, the average price of Brent could reach 56 dollars per barrel and then fall back to 52 dollars per barrel during the rest of the year, only if a greater relaxation of the OPEC+ cuts is decided during the year.

Prices present a «backwardation» structure, as expectations regarding the recovery of demand and the draining of inventories in the United States and Asia increase the gap concerning spot crude oil sales.

The spot prices are 4 points higher than futures contracts, according to data from the International Energy Agency (IEA), favored by the prospects of a reduction in supply. In turn, the expected demand boost as of the second quarter of 2021, considering that the positive effects of the vaccination campaigns and the expected reactivation of the leading economies worldwide will be seen, in addition to a contained supply resulting from the OPEC+ agreements, as well as more significant reductions in inventories.

Futures contracts are at the highest levels since April 2020, although the current oil value is encouraging present-time sales and driving inventory drawdowns. Meanwhile, buyers are renewing contract dates because it is more profitable.

OIL PRODUCTION

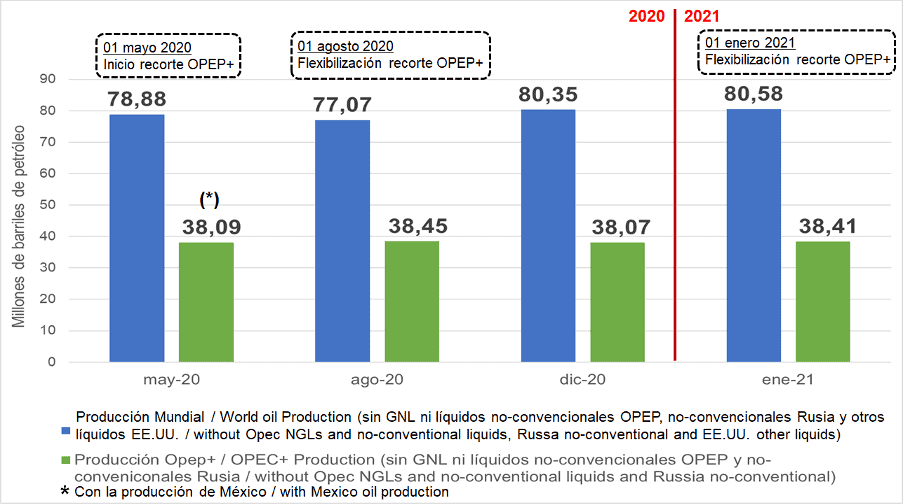

World Oil Production

According to the latest MOMR of February 11th, in January 2021, world oil production stood at 80.58 million barrels per day (MMBD) of oil – the highest registered since the 87.7 MMBD level in April 2020, which means a 0.27% month-on-month increase. This results from the production cuts by the OPEC+ countries and Saudi Arabia in particular to achieve a balance of the fundamentals of the oil market. A fundamental factor for world oil production to January only shows an increase of 230 thousand barrels compared to December, despite the easing of the cuts in January and the increase in production that Libya and Canada have been experiencing, and the stabilization of production in the US.

From the total world oil production, 38.41 million barrels per day corresponds to the production of OPEC+ countries, which represents 47.67% of global production.

WORLD OIL PRODUCTION

(May 2020 – January 2021)

Although OPEC+ relaxed its production cut quota by 500 thousand barrels per day as of January 1st, 2020, the net month-on-month increase in its production was 347 thousand barrels per day, as a result of the additional cut of 267 thousand barrels per day by Angola and Nigeria to their production quota -complying above their compensation commitment assumed in July last year-, and the production cut by Saudi Arabia, which was 3.5% above its agreed quota.

On the other hand, with a production of 9.26 MMBD in January, Russia presented an overproduction of 141 thousand barrels of oil per day, while US production fell month-on-month by 100 thousand barrels of oil per day. This reflects the volume recorded – 230 thousand barrels per day – in the increase in world production in January.

In its STEO published last February 9th, the EIA records in January 2021 a projected world production of 80.68 MMBD, an increase of 118 thousand barrels per day to those recorded in December 2020. Meanwhile, the IEA’s record for world production in January was 80.74 MMBD[13].

The three sources -OPEC, IEA, and EIA-, presented similar data regarding world production during the first month.

OPEC+ cuts

In January 2021, the OPEC+ production cut was 7.427 MMBD, 227 thousand barrels of oil per day above the agreed quota of 7.2 MMBD, with compliance of 103.2% of the cut.

The OPEC countries participating in the agreements (OPEC-10) made a cut of 4.923 MMBD -359 thousand barrels per day above their quota of 4.564 MMBD-, complying with 107.9% of what was agreed. In comparison, the 9 Non-OPEC countries participating in the agreements made a cut of 2.504 MMBD -132 thousand barrels per day below their quota of 2.636 MMBD-, complying with 95% of what was agreed.

For February, the OPEC+ production cut quota will be 7,125 MMBD due to the flexibilization of 65 thousand and 10 thousand barrels of oil per day that will benefit Russia and Kazakhstan, respectively, which was agreed on January 5th at the 13th Meeting of OPEC and Non-OPEC Ministers.

In addition to the agreed production cut quota, there will be a voluntary cut of 1 MMBD by Saudi Arabia, announced on January 5th by the Saudi energy minister, Abdulaziz bin Salman, which will be effective from February of this year.

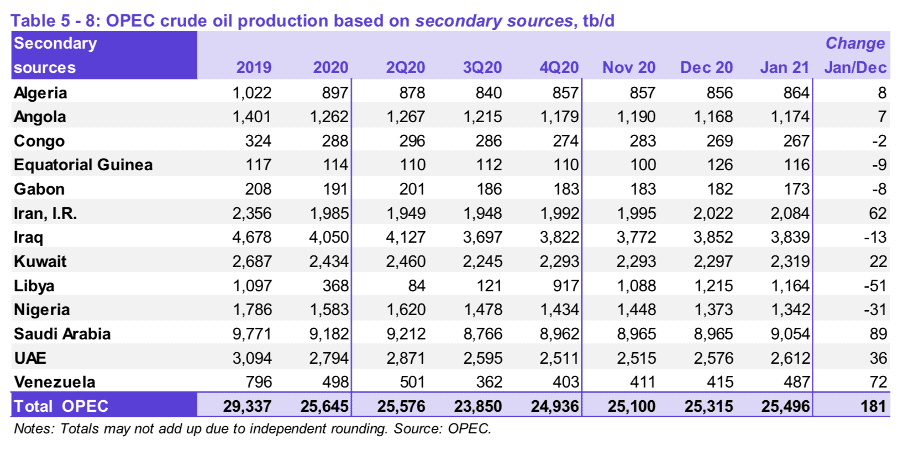

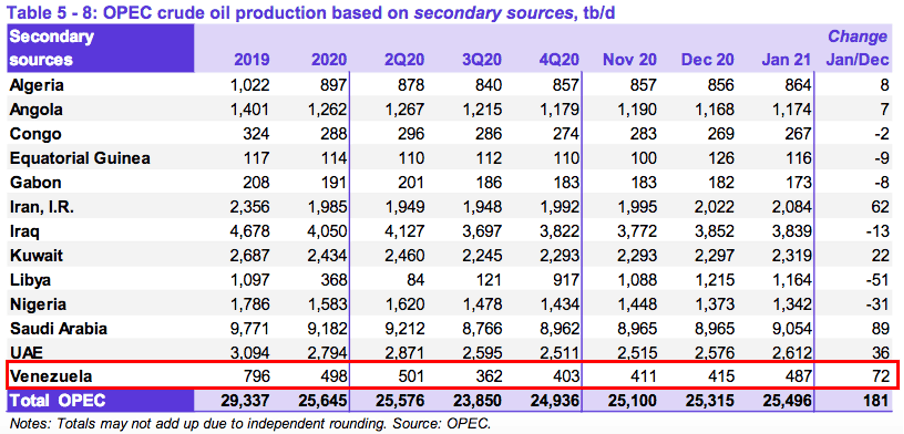

OPEC Production

According to OPEC, in data published in the MOMR of February 11th, member countries’ production, according to secondary sources, was 25,496 MMBD of oil as of January. These numbers do not yet reflect the relaxation of production cuts or the new quotas that came into effect on February 1st and Saudi Arabia’s voluntary production cut effective for February and March.

PRODUCTION OF OPEC COUNTRIES ACCORDING TO SECONDARY SOURCES

(2019 – January 2021)

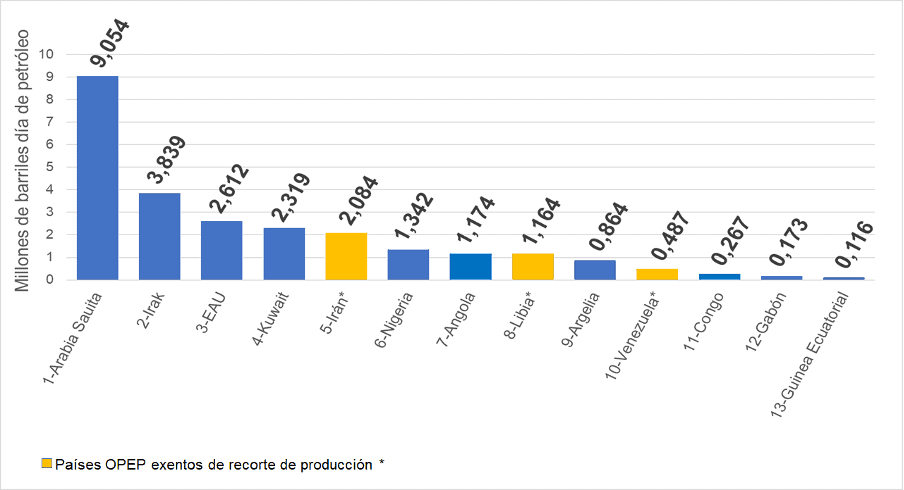

Although OPEC production rose by 181 thousand barrels of oil per day, the easing of 304 thousand barrels per day[14] in the group’s production – by January 2021 – allowed the Gulf monarchies (Saudi Arabia, UAE, and Kuwait) to increase their production by 147 thousand barrels per day.

The production of Saudi Arabia, UAE, Kuwait, and Iraq, was 17.824 MMBD, 69.9% of OPEC production, where Saudi Arabia leads with a 9.054 MMBD output, corresponding to 35.5% OPEC’s production, 23.57% of OPEC+ and 11.24% of world production.

African countries (excluding Libyan production), led by Nigeria, Angola, and Algeria, produced 3,936 MMBD, 15.44% of the OPEC’s production. Nigeria and Angola produced 2,516 MMBD, reflecting the additional 267 thousand barrels per day cut to their quota under their production compensation commitments.

On the other hand, the three countries out of the production cuts -Iran, Libya, and Venezuela- recorded 3,735 MMBD, 14.64% of OPEC total production, with 2,084 MMBD (55.8%) that corresponds to Iran, 1,164 MMBD, 31.2%, corresponds to Libya, and 0.487 MMBD, 13%, corresponds to Venezuela.

OPEP COUNTRIES PRODUCTION RANKING

(January 2021)

Saudi Arabia: Saudi Aramco privatization moves forward

Saudi Aramco, the Kingdom of Saudi Arabia’s state-owned oil company, will launch new public share sales operations in the coming years, as announced on January 28th by Crown Prince Mohammed bin Salman, at the 4th Forum for Future Investment Initiative. The announcement is part of the Kingdom’s privatization bid to attract $600 billion in private investment over the next ten years, as previously announced by the Crown Prince himself on January 13th, 2020, during the World Economic Forum. Of this investment, 15%, $90 billion, will be financed by international private capital, while $300 billion corresponds to privatizations already underway in companies and projects.

This new offer, according to the Crown Prince, aims to finance the Public Investment Fund, as the Kingdom needs to cover the fiscal deficit, which, according to KPMG’s budget report, exceeded US$79 billion in 2020, and by 2021, it is estimated to be US$37.6 billion. The above is the primary motivation for equity offerings in companies, projects, and state bonds, seeking financing and liquidity. In the case of Aramco, the debt with the private sector, according to the same KPMG report, was 228 billion dollars in 2020, and the Saudi government itself estimates it will rise to 250 billion in 2021.

Bin Salmán assured that the privatization process will continue in Aramco, the world’s largest company, whose capital exceeds 200 billion dollars. He has not yet informed how many shares will be put up for sale, the amount of the offer, or whether the minimum dividend payment to shareholders will increase. But he did make it clear that the reforms initiated in 2016, where 5% of the shares were placed for sale and selling 1.5% of the shares, will be duplicated, so it is conceivable that the next public sale placement will be for 10% of its shares.

The Crown Prince affirms that with the investment plan -based on its assets and profits-, the Kingdom seeks to carry out «the fourth industrial revolution» and turn Saudi Arabia into «a leading renewable energy country,» strengthening its role in «environmental protection.»

Libya

The closure of the Waha Oil Company pipeline – as announced by the National Oil and Gas Corporation of Libya (NOC) last January 17th-, caused Libya’s production to drop by 50 thousand barrels per day, which registered a production of 1.164 MMBD of oil for January, 4.2% less compared to the close of 2020.

As mentioned in our Newsletter of December 08th, 2020, Libya’s oil production – dramatically affected after the 2011 military intervention, the civil war, and the instability that has plagued the North African country since then -, despite having experienced a dizzying recovery of 1,357%, after the agreements to lift the blockade of the oil fields and the ceasefire, on September 18th and October 23rd, will have to solve the severe problems of deterioration of infrastructure and services to recover its operational reliability and sustain its current production levels.

The new power groups in Libya, supported by the different international actors with interests in the country, held on February 05th in Geneva, the meeting of the Libyan Political Forum, led by the UN Support Mission in Libya, which culminated in the election of the Libyan Presidential Council, which will lead the country until the presidential elections on December 24th.

International actors with a presence in Libya have agreed with the different factions and rival groups. They look for a political agreement that returns some governance to the country and allows them to manage the production of the largest oil reserves in Africa (48.363 billion barrels of oil).

In the framework of this political agreement, the state oil company, NOC, destroyed as a result of the war, seems that it will no longer be an operator and will become only an administrator of contracts with the oil transnationals, as is happening in Venezuela, losing the sovereign management of its oil.

On January 06th, NOC approved that the US Department of Energy design the country’s oil production development plan and carry out a corporate restructuring, with the aim of «aligning it with the best international corporate practices» and achieving more significant capital investment international private.

In the same direction, on January 26th, NOC transferred to the French company TOTAL the development of operations, the maintenance of the facilities, and the wells of the North Gialo and NC-98 fields, which have a production capacity of 180 thousand barrels of oil per day.

Iran

On February 07th, US President Joe Biden, in an interview with CBS News, affirmed that he would not lift sanctions «until Iran stops enriching uranium.» The Persian country is allowed to do so up to 3.67%, according to the Joint Comprehensive Plan of Action (JCPOA), agreed and signed at the UN Security Council. But since January 01st, 2021, under a Law approved by the Iranian Islamic Consultative Assembly last December, they do so at 20%.

Previously, on January 27th, the US Secretary of State, Anthony Blinken, opened the door to move towards lifting sanctions on Iran, but only «if Iran returns to compliance with its obligations» under the JCPOA. According to the new Secretary of State, Biden’s position is, once the JCPOA is taken up by both sides, «to build a longer and stronger agreement» where «other issues» in Iran’s relationship can be addressed. The above was rejected by the Iranian Foreign Minister, Jarav Zafir, who stated that the agreement was reached «after arduous negotiations and does not require any reorganization.»

From the Iranian side, the two most representative voices of the country responded.

First, it was the Supreme Leader of the Revolution, Ayatollah Khamenei, who, on February 07th, stated that Iran would resume the JCPOA commitments only if the US «lifts all the embargoes effectively and after we can verify it and see if it has been done correctly or not.»

Then, on February 12th, Iranian President Hassan Rohani made it clear that it is the US who «must take the first step» for Iran to resume the JCPOA agreements since it was the US who «failed to fulfill its obligations three years ago,» as well as «its commitments stipulated in Resolution 2231 of the JCPOA». Iran considers that they have not abandoned the agreement but have «reduced» some of their commitments, following the US exit from the agreement and imposing sanctions.

As the statements of the leaders of both countries indicate, there is still a long way to go before there is any possibility of lifting the sanctions on Iran’s economy and, therefore, on the Iranian oil industry, although the rapprochement that is taking place with the visit of the Director-General of the International Atomic Energy Agency (IAEA) Rafael Grossi to Tehran[33], which began on February 21st, is a positive step, as he met with the Atomic Energy Organization of Iran and agreed on three points for the IAEA to continue with its monitoring and verification activities: first, that Iran continue to apply -without limitations- the «Comprehensive Safeguards Agreement» with the IAEA; second, the agreement of a temporary, legal bilateral understanding that allows the IAEA to follow up and verify for up to 3 months; and, lastly, to periodically review the technical understanding between the parties, with which they hope to have a level of cooperation and exchange of information that is fundamental to support future negotiations.

In this context, Iran raised its production in January 2021 by 62 thousand oil barrels per day, registering 2,084 MMBD, its highest level since January 2020.

Should the US and Iran return to the JCPOA agreement, the Persian country – with proven reserves of 208.6 billion barrels of oil and 895.5 trillion cubic feet of gas – could increase its production and bring it to 2.6 MMBD in 6 months and 3.8 MMBD in 12 months, as it already did in 2016, after the Obama administration lifted sanctions against Iran.

The recovery of Iran’s full oil production capacities after an eventual lifting of sanctions would be a positive step for the international oil market, as it would allow a strengthening of OPEC and the Persian nation to recover its leadership within the Organization, balancing the power exercised de facto by the Gulf monarchies, as well as regularizing and giving reliability to oil supplies to the European and Asian markets, traditional destinations of Iranian production.

An eventual diplomatic rapprochement and resumption of negotiations between the US and Iran looks like one of the most significant international policy challenges for the new Biden administration due to its geopolitical implications in the complicated situation of the Middle East and the political-military commitments of the US with its allies in the Persian Gulf monarchies and Israel.

Non-OPEC production

Russia

According to Russian Ministry of Energy data, Russia’s oil production in January 2021 was 9.26 MMBD, presenting an overproduction of 141 thousand barrels per day of oil concerning its 1.881 MMBD OPEC+ production quota.

Russia, one of the OPEC+ leaders, met 92.5% of its cut quota, failing, for the seventh consecutive month, to comply with its agreed production quota. During the last OPEC+ meeting on January 5th, it was agreed that both Russia and Kazakhstan would increase their production quota by 65 MBD and 10 MBD, respectively.

Canada

Canada reached its production maximums in December 2020, when it registered 5.9 MMBD, a recovery of 20.4% compared to August last year, when it reached 4.9 MMBD according to EIA’s STEO data updated on February 9th [35]. This sustained recovery of 1 MMBD of Canadian oil results from the WTI price recovery since June, reaching over 40 dollars a barrel, the cost threshold for Canadian production.

This indicates that the price recovery allows the reactivation of production in the most expensive oil areas, as is the case of Canadian oil sands and extra-heavy crudes and US shale oil.

However, the expansion of Canadian crude oil production remains constrained by transportation infrastructure problems to bring it at a reasonable cost to the Gulf of Mexico refining complex on the US East Coast.

On January 20th, 2021, President Joe Biden, in fulfillment of one of his election pledges and with the commitment to clean energy development, signed an executive order to revoke the permit granted to TC Energy Corporation by the Trump administration for the construction of the «Keystone XL,» Phase IV of the «Keystone» pipeline system that would connect Canada to the US.

The «Keystone» is a pipeline system extending from the Western Canadian Sedimentary Basin in Alberta to refineries in Illinois and Texas to oil storage tank farms and distribution centers in Cushing, Oklahoma.

The «Keystone XL» is the fourth phase of the system mentioned above, whose objective is to connect the terminals of Hardisty, Alberta (Canada), and Steele City, Nebraska (United States), by a shorter route and through a higher capacity pipeline. In this way, it would take light crudes from Baker, Montana, to blend with heavy crude production from Canada’s oil sands.

But the «Keystone XL» has been the subject of environmental controversies for which, in 2015, President Barack Obama suspended the project by not granting his permission for the construction of the project. In January 2017, Donald Trump took measures to complete the pipeline and bring Canadian crude oil to the Gulf of Mexico refining complex.

The «Keystone XL» is considered by Canadian producers, crucial to ensure that their heavy crude production reaches the North American refining system in the Gulf of Mexico designed to process heavy and medium crudes from Mexico and Venezuela. The above would give viability to new investments to increase the production of high-cost heavy crudes from the oil sands of Athabasca (Alberta).

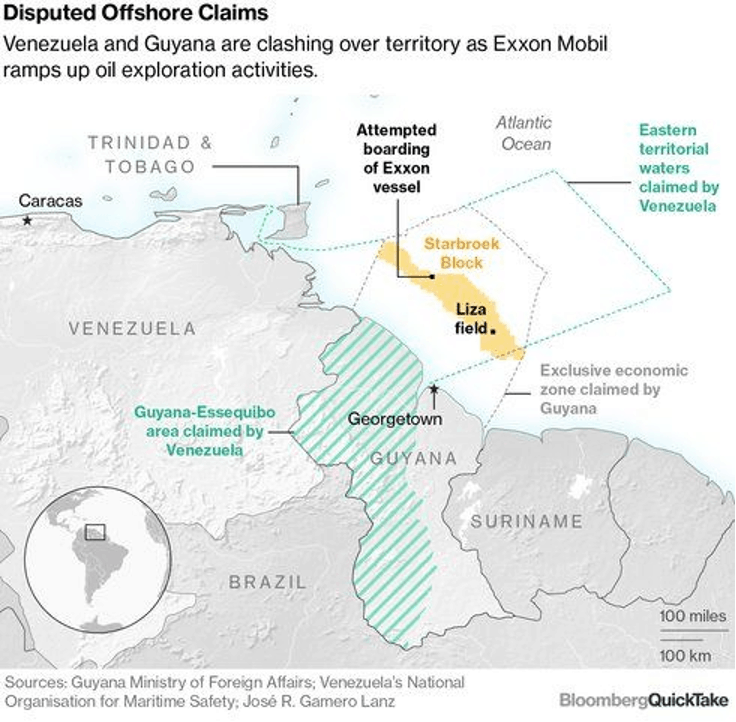

Guyana

Oil production in Guyana reached 130 thousand barrels per day in January 2021, as reported by ExxonMobil Guyana Alistair Routledge, a subsidiary of the US transnational. They also reported problems with a gas compressor in the offshore platform Liza Destiny, which will cause production in February to drop to 120 thousand barrels of oil per day.

The second FPSO (Floating Production, Storage, and Offloading) will operate in the Liza field, Phase 2, called Liza Unity, with a production capacity of 220 thousand barrels of oil per day. Currently, under construction in Singapore, it is expected to be delivered by the end of this year to start operations in January 2022. Therefore, Guyana’s production in 2021 will maintain January levels.

GUYANA’S OIL PRODUCTION

STARBROEK BLOCK

Likewise, ExxonMobil’s partner in the Stabroek Block, the US oil company Hess Corporation, announced that 80% of the 1.9 billion dollars of its budget for 2021 – 1.5 billion dollars – is earmarked for the development of its projects in Guyana.

Last February 10th, Guyana made its first export of 2021, the fifth since they started producing in the Stabroek block, a cargo shipped by Hess – of which the volume of the cargo and the destination were not informed -, which had a value of US$ 21.22 million.

With the five exported cargoes (February 2020, May 2020, August 2020, December 2020, and February 2021), Guyana has received $206.6 million, of which $185.4 million in profit and $21.2 million royalties going into a fund, said Guyana’s vice president, Bharrat Jagdeo.

The Stabroek Block, operated by subsidiaries of the US ExxonMobil, Hess Corporation, and the Chinese China National Offshore Oil Corporation, in the waters of the Essequibo Sea -a territory in international litigation-, has more than 8 billion barrels of oil reserves, according to its operators, with the potential to produce 750,000 barrels of oil per day by 2025. It is expected to increase its production by 220 thousand barrels per day in 2022 and 2024.

Guyana’s oil production in the Essequibo territory’s waters continues to advance and expand, although these waters are in dispute with Venezuela. The Guyanese authorities and oil transnationals have taken advantage of the Venezuelan government’s inability and weakness to pay attention to these violations of the Geneva agreement signed by both countries in 1966[42] and to claim more vigorously their sovereignty over the waters of the territorial sea of the Essequibo.

Guyana’s government filed a request before the International Court of Justice in 2018 to settle the dispute, despite Venezuela’s non-acceptance of the ICJ’s action in this case.

In this way, the interest of the oil transnationals operating in the area has created a situation that poses a conflict between countries that will surely intensify and escalate once Venezuela resolves its internal political problems.

United States

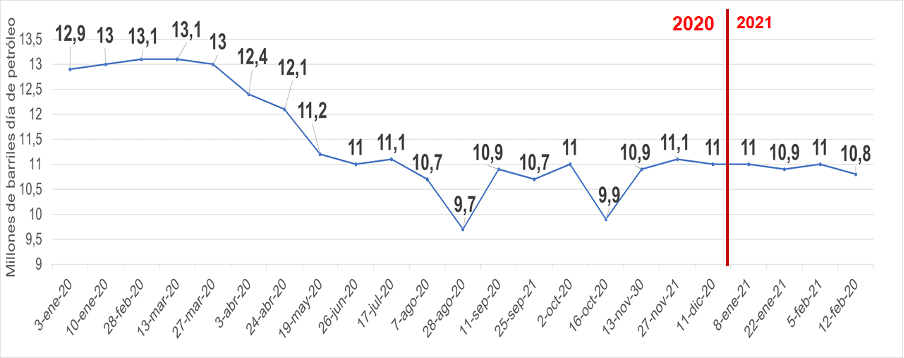

US oil production, as of February 5th, was 11 MMBD, maintaining the same level since November 13th, 2020, to then present a brief decrease on February 12th to 10.8 MMBD, according to data from the Energy Information Administration (EIA) published on February 18th.

In its STEO of February 9th, the EIA estimates that US production will remain at 11 MMBD throughout 2021.

US OIL PRODUCTION.

(January 2020 – February 2021)

These estimates of stagnation in oil production in the US, in which several analysts -including OPEC in its MOMR- agree, are due to several factors.

On the one hand, the independent producers of North American shale oil, in a scenario marked by uncertainty regarding economic recovery, are using the extraordinary income obtained from the increase in prices from the second half of 2020 to pay off substantial debts and distribute dividends, after a year of accumulating losses. On the other hand, the US oil sector has reacted with caution and a particular hostility to the new US administration’s announcements and decisions on environmental matters, restricting and reviewing the facilities and incentives for the oil sector within the framework of its announced «Clean Energy Revolution.»

An example of this is the statements made on January 29th by the president and CEO of Chevron Corporation, Michael Wirth, who stated, during the presentation of the company’s financial results for the 4th quarter of 2020, that, given the new policies adopted by the government of Joe Biden, the company has options outside the US territory, affirming that «if the conditions in the United States become so onerous that they discourage investment, we have other places where we can take those dollars,» in explicit reference to Executive Order 14.008, signed by President Biden, last January 27th, which -in its Section 208- establishes the suspension of new oil and natural gas licenses in public lands and offshore waters, until the Secretary of the Interior can review, together with the rest of the National Climate Task Force, the Federal practices for the granting of those permits.

These new US administration decisions seem to slow down the plans of some of the big oil companies, such as Chevron.

In the meeting mentioned above, Wirth announced that Chevron’s investment plans in Permian and the Gulf of Mexico in 2021 were on different tracks: in Permian, they are going for investment in private lands; in the case of the Gulf of Mexico, they were targeting fiscal lands that were offered in November 2020 and were to be awarded in March of this year, Lease Sale 257[48], which covers an area of 78 million acres and more than 14,500 blocks, located in the Outer Continental Shelf of the Gulf of Mexico (160 million acres), which is estimated to have a reserve of 48 billion barrels of undiscovered and technically recoverable oil.

At the same meeting, Chevron’s CEO made it clear that what is being sought with the Gulf of Mexico and Permian is to increase the company’s capital to cover debts and dividends and meet obligations with the hedge funds.

However, on February 15th, the Bureau of Ocean Energy Management (BOEM) announced that, under Executive Order 14.008, the decision to tender Lease Sale 257 is rescinded.

Likewise, Section 209 of the same Order, Biden removes from the Fiscal Year 2022 budget proposal, direct federal funding subsidies to fossil fuels.

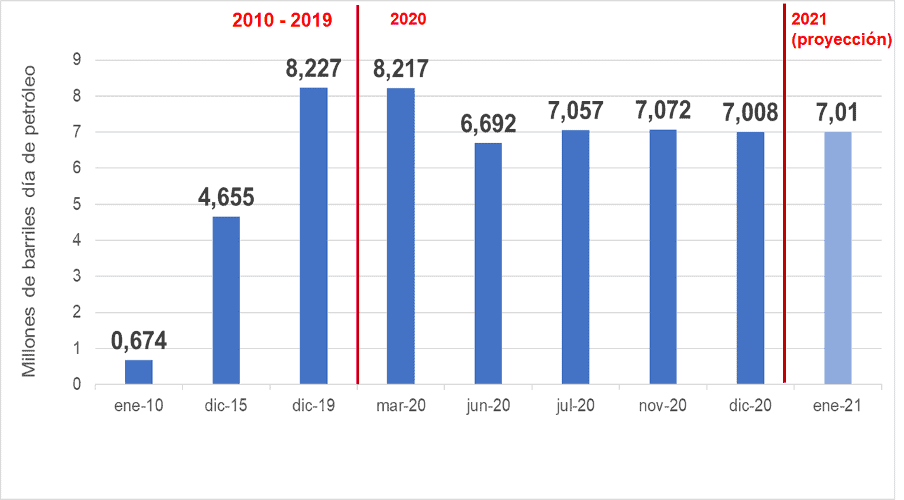

Shale Oil

Norwegian energy researcher Rystad Energy estimates that in January 2021, the number of shale wells with fracking activities was 822, the highest number since the 1,057 wells registered in March 2020[50], reflecting the increased liquidity in the cash flow of producing companies, as a consequence of the recovery of the oil price above $40 as of July 2020.

According to Rystad Energy itself, the number of wells to which they started drilling and were not completed decreased by 700 in December 2020, registering 5,700 wells in those conditions, the lowest value since the pandemic began in March 2020.

The shale oil industry is in a position to sustain well completion operations with cash flow generated by prices between $40-45 a barrel, both to pay debts and pay dividends, but without initiating new drilling campaigns.

Shale oil production, a business sustained on hedge funds, has been severely impacted this year 2020 by the collapse of prices, which has caused medium and independent companies to accumulate large losses and debts. This has forced them to sell, leading to a phenomenon of mergers and concentration in the sector that will reduce participation to no more than ten operators – as pointed out by the Financial Times – with an increasingly more significant presence of large US oil companies such as ConocoPhillips, Chevron, and Exxon Mobil.

The shale oil sector, which in the past decade had an investment of 400 billion dollars, has had an extraordinary growth that took shale oil production from 0.674 MMBD in January 2010 to 4.655 MMBD in December 2015 and to 8.227 MMBD in December 2019, a level it maintained until March 2020, when the pandemic is declared in the world, to then fall to 6.692 MMBD in June last year.

US SHALE OIL PRODUCTION

(2010-2021)

With the increase in oil prices observed as of July 2020, shale producers have opted to pay debts and dividends instead of making new investments and drilling, which has kept production at 7 MMBD, which is likely to be maintained in 2021.

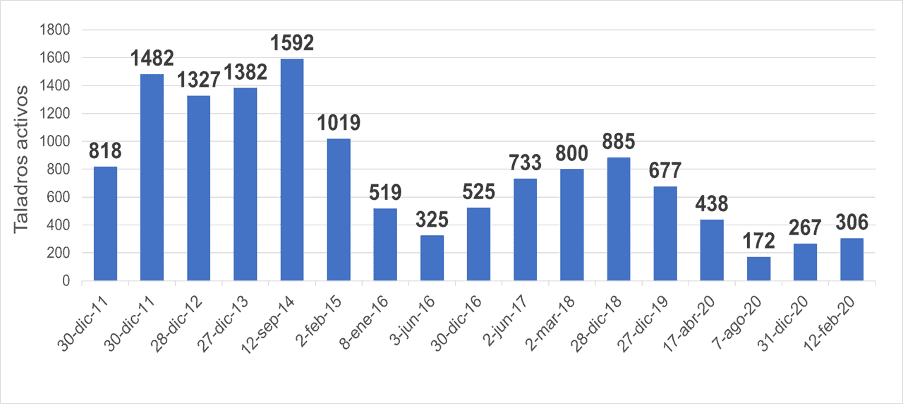

Drilling activity

For the week of February 19th, 305 operating rigs were registered in the US, as reported by Baker Hughes last February 19th, maintaining the level from the previous week -the highest since the 325 recorded on May 1st, 2020- and presenting activity in 6 more than during the week of February 2nd. A slow but continuous growth since November 11th last year. However, this operating rigs level shows an annual drop of 55% when there were 678 active rigs on February 14th, 2020.

DRILLING ACTIVITY IN THE USA

(2011-2021)

Cold wave in Texas

The freezing temperatures that have been recorded since February 11th in Texas have caused interruptions in the North American oil industry. On February 15, 8 refineries in the Gulf of Mexico (Motiva Enterprises, Valero Energy and Total, in Porth Arthur; Citgo, in Corpus Christi; Lyndon Basell, in Houston; Marathon, in Galveston Bay; ExxonMobil, in Beaumont and Baytown) had to stop operations, which amount to 3.15 MMBD of oil[54].

Likewise, a source from Rystad Energy informed Bloomberg that it received reports from several operators in the Permian Basin, warning about the interruption in the electric energy service in the area, which is estimated to affect between 1.5 and 1.7 MMBD of oil production.

They warn that if the weather in the region does not change, it is likely that the oil sector’s situation will continue until the end of the week. With this, US production may fall below 9.5 MMBD in February, in a month where world oil production will have a voluntary cut of 1 MMBD by Saudi Arabia.

ECONOMY

According to several international economic institutions, 2021 will be a year of positive growth and recovery of the world economy after the 4.3% drop experienced during the year just ended due to the pandemic. The World Bank expects the economy to expand 4% in 2021, similar to OPEC’s forecast (4.4%), while the IMF projects up to 5.5% for the same period. All of the above assumes that vaccinations are executed on a massive scale, covering all geographic areas, thus controlling COVID-19’s advance.

New virus variants and the considerable increase in infections, particularly in Western economies, with vaccination programs at a slower rate than expected, are the variables that add uncertainty to the favorable forecasts. Although they will slow down the recovery, these drawbacks are expected to be temporary, considering that the distribution of vaccines will improve and, together with other related measures, will contribute to improving economic and social dynamics.

Thus, the recovery could begin around mid-2021, thanks to implementing monetary and fiscal stimuli in the leading Western economies, particularly in the European Union and the United States, which will impact household and business consumption.

In the global context, China will be the country with the highest expected growth rate for 2021, with 7% [56] leading the Asian region, followed by India with a growth forecast of 6.7%.

A greater dynamism of emerging economies and developed countries, which according to the Organization for Economic Cooperation and Development (OECD), will average 3.5%, will drive greater demand for hydrocarbons, which according to OPEC, will increase by 5 million barrels per day during 2021.

G-7 finance ministers meeting

The finance ministers of the Group of Seven (G-7) emphasized, on February 12th, in a virtual meeting, the importance of supporting the economies affected by the pandemic towards recovery.

The teleconference between the G-7 finance ministers and central bank governors was the first since the arrival of Joe Biden as US president. The meeting was decided to be held last month to overcome the unilateralist policies of Donald Trump, his predecessor. The United States took over the rotating presidency in 2020, but Trump called the G-7 «obsolete,» expressed his desire to bring Russia on board, and postponed the annual meeting until after the presidential election. In the end, that summit did not take place.

This teleconference was the first ministerial meeting of the G-7 grouping the United Kingdom, Canada, France, Germany, Italy, Japan, and the United States, plus the European Union, under the British presidency in 2021, led by the UK Chancellor of the Exchequer, Rishi Sunak.

The attendees exchanged views on how best to proceed through the global recovery phases from the pandemic caused by COVID-19.

US Treasury Secretary Janet Yellen emphasized the Biden administration’s commitment to multilateralism in solving global problems.

Japanese Finance Minister Taro Aso called for «policy responses» to put economies on a path to recovery and actions to accelerate vaccine distribution to benefit developing countries. British Minister Sunak supported this point.

Support for low-income nations was also discussed during the virtual meeting. The group of 20 (G-20), which includes major industrialized economies and emerging countries, is currently leading a debt relief program for the most impoverished nations that have been affected by the pandemic.

As for priorities for 2021, Sunak cited support for global economic recovery and progress toward new international tax rules for digital giants after multilateral negotiations stalled amid US concerns about their potential impacts on US companies.

Sunak also called on his international counterparts to make climate and natural considerations central to all economic and financial decisions this year and pressed for concrete action by the G-7 to achieve a carbon-free society.

It also urged working to reach a lasting multilateral solution on the tax issue before mid-2021, the date scheduled for a G-7 summit to be held June 11-13 in Cornwall, England.

US-China: first rapprochement

President Joe Biden and his Chinese counterpart, Xi Jinping, had their first exchange in a telephone call on Thursday, February 10th.

According to both countries’ news agencies, during the call, the Asian leader reportedly expressed the need for China and the United States to reestablish bilateral dialogue mechanisms. They also state that Biden and Xi seemed to have adopted a conciliatory tone.

The state-run Xinhua news agency adopted an optimistic tone about the conversation, noting that Xi acknowledged the differences between them and that these differences should be managed.

The Xinhua said Xi rejected Biden’s concerns about Taiwan, Hong Kong, and Xinjiang and clarified that those issues concern China’s internal affairs, so they concern Chinese sovereignty. He also warned that «the United States should respect China’s fundamental interests and act with caution.»[59] He also warned that «the United States should respect China’s fundamental interests and act with caution.»

Despite US officials signaling that Washington will keep in place the technology export restrictions and tariffs imposed by the previous administration of Donald Trump, global stock indexes mostly rose after the call became known.

Investors and businesses in the region hope that a more balanced approach to relations between the world’s two largest economies by the Biden administration can help minimize future trade and investment impacts.

Optimistic forecasts for the US economy

According to the latest survey of economists by Bloomberg, expectations for U.S. Gross Domestic Product growth increased for the first quarter of 2021 and each subsequent quarter through mid-2022. According to it, expected economic growth for 2021 will be around 6% and will be the strongest since 1984.

US businesses are reopening, and millions of Americans are now vaccinated. An increase in economic activity during 2021 is highly probable, after its 3.5% drop in 2020.

On the other hand, Democrats in Congress are preparing to inject $1.9 trillion as a stimulus for the economy. Since the pandemic’s start, this would be the third aid package, continuing the policy established during Donald Trump’s administration in the White House.

Biden’s proposal includes direct payments of $1,400 for most Americans and an unemployment benefit of $400 per week to be paid through September, $20 billion to support the vaccination program, and $350 billion to support state and local governments, among others, such as raising the minimum wage to $15 an hour.

In the June 2020 aid package approved by former President Trump, up to $1,200 per person plus $500 for children under 17 was provided. In the package approved late last December, payments of $600 were sent to individuals and an additional $600 per child.

According to data from the Department of Health’s Centers for Disease Control and Prevention (CDC), as of Tuesday 16, about 39.7 million people (12% of the population) had received at least one dose of the Covid-19 vaccine. In contrast, about 15 million (4.5%) had been fully vaccinated.

According to consumer price index data released by the Federal Bureau of Labor Statistics (BLS)[62] on Wednesday, January 10th, inflation remained moderate during January (0.3%), revealing that the economy can absorb more stimulus without overheating.

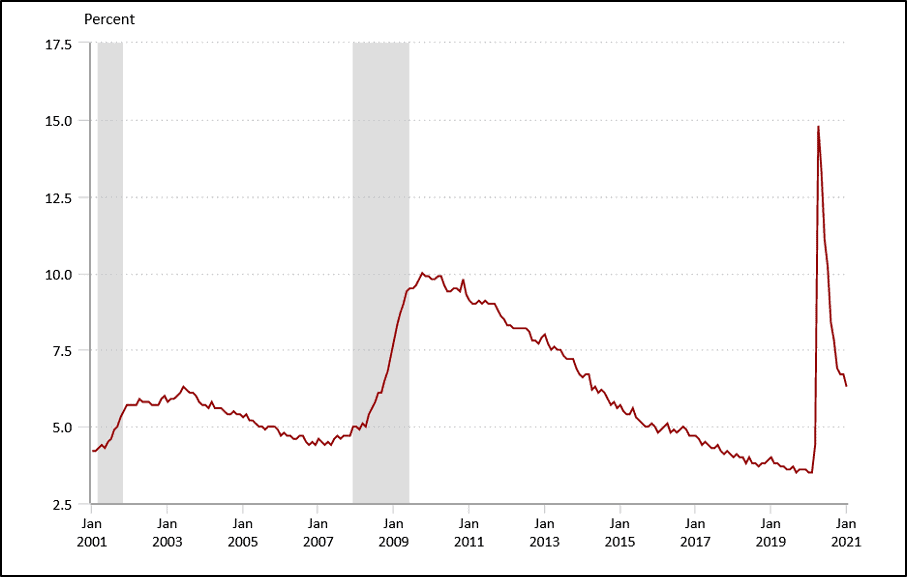

Revising the latest BLS unemployment report, between December 2020 and January 2021, the unemployment rate went from 6.7% to 6.3%, forecasting that the unemployment rate will continue to fall this year to around 5.5%.

UNEMPLOYMENT RATE IN THE UNITED STATES

(2001-2021)

EU: Economic projections for 2021

According to the European Commission’s 2021 winter economic forecast, the euro area economy will grow by an average of 3.7% in 2021 and 3.9% in 2022, according to the latest European Union (EU) forecast published by the European Commission.

The EU economies would reach their pre-crisis output levels earlier than the autumn 2020 economic forecasts predicted. In large part, the report states that in both the second half of 2021 and 2022, growth will gain more significant momentum than expected as the vaccination process progresses and containment measures are phased out.

The increase in the number of COVID-19 cases, coupled with the emergence of new and more contagious strains of the virus observed in the last quarter of 2020, forced the Member States to reintroduce or intensify containment measures. However, according to Eurostat, economic growth is expected to resume next spring, with more momentum in the summer as more people within the EU are vaccinated.

The euro area’s inflation is forecast to rise from 0.3% in 2020 to 1.4% in 2021, falling slightly to 1.3% in 2022. While remaining generally subdued in both the eurozone and the EU, inflation forecasts are slightly worse than in the autumn. The delay in the economic recovery results in prices remaining unchanged, given the current low impact of the aggregate demand on prices.

The Commission considered the risk that, in the short term, the pandemic could be more persistent than expected or that there could be new delays in the vaccination programs, such as those already presented after the non-compliance with the distribution schedules of the major laboratories. This scenario could delay the lifting of containment measures, which, in turn, would affect recovery times.

Besides, the Commission considers that the crisis could cause structural damage to the economic and social fabric of the EU, including the bankruptcy of companies and job losses, damaging the financial sector, increasing unemployment – currently at 7.5%, equivalent to 14.3 million workers – and worsening the living conditions of the population.

The European Commission’s next economic forecasts will be in the spring, in May 2021.

Italy: Mario Draghi, new Prime Minister

On Friday, February 12th, Mario Draghi, former president of the European Central Bank, after a meeting with the Italian Republic President, Sergio Mattarella, prepares to accept his request to form a new government formally.

After presenting a government of national consensus and having the support of most of the major political parties, Draghi was sworn in at noon on Saturday 13 and will be tasked with organizing the recovery from the crisis caused by Covid-19, following Mattarella’s call after the previous coalition collapsed amid the latest pandemic wave.

After the meeting, Draghi announced his ministers’ list, including several technocrats in central roles, although it is mainly composed of figures from the country’s largest political parties.

Daniele Franco, CEO of the Bank of Italy, will become the new Minister of the Economy. Vittorio Colao, the former CEO of Vodafone, will be appointed Minister of Innovation and Technology.

There will be continuity with some ministers from the outgoing government of Giuseppe Conte, with Luigi Di Maio of the Five Star Movement remaining as Foreign Minister and the independent Luciana Lamorgese, as Minister of the Interior. Roberto Speranza, the current Minister of Health, will also remain in office.

Italy has been hit by the health and economic crisis resulting from the pandemic, with more than 92,000 deaths and the most profound economic contraction since World War II, with its GDP falling by around 9%.

Unlike the previous technocratic government led by former European Commissioner Mario Monti, who was tasked with setting up an austerity government, Draghi will be in charge of drawing up plans to distribute more than 200 billion euros from the European Union’s recovery package.

Last Monday, February 15th, the Bank of Italy announced that by 2020, the country’s public debt stood at €2,569.3 billion, increasing by €159.4 billion more than in 2019, representing 134.7 percent concerning its Gross Domestic Product.

Draghi’s impact has been positive, as he has lowered the risk perception of Italy, the third-largest economy in the European bloc, bringing interest rates for sovereign indebtedness to their lowest level in more than five years. His profile as a technical and former high-level EU official, his well-known pro-European stance, and the strength of the coalition with which he comes to the office, are positively received by economic agents, who have high expectations for Italy’s recovery in the medium term.

China overtakes the United States as the EU’s main trading partner

On Monday, January 22nd, it became known, as stated by the European statistics agency Eurostat, that China overtook the United States for the first time as the European Union’s (EU) leading trading partner in 2020.

The trade volume between the EU and China reached 586 billion euros in 2020, surpassing the 555 billion euros of trade between the EU and the United States. Similarly, EU exports to China increased by 2.2% to €202.5 billion, while imports from the Asian country to the bloc grew by 5.6% to total €383.5 billion[66].

EU exports to the United States fell by 8.2% in the same period, while imports fell by 13.2% compared to the previous year.

The United Kingdom, which is no longer part of the EU, now ranks as its third most important trading partner.

After overcoming the pandemic’s initial impact, China recovered during the last quarter of 2020, being the only world economy with a positive GDP variation, growing by 2%. Thus, China’s exports to Europe benefited from strong demand for medical and electronic equipment, while the EU increased its exports of automobiles and luxury goods.

The EU and China seek to ratify an investment agreement, which has been under negotiation for several years and would give greater market access to companies on both sides.

These strategies could be framed as part of the so-called «Belt and Road» initiative[67], better known as the «Silk Road,» the Chinese government’s massive infrastructure project, which stretches from East Asia to Europe.

This initiative was adopted in 2013 to invest an estimated $8 trillion in almost 70 countries, making it the most important foreign policy project of the current president, Xi Jinping. It has raised US fears due to the access and expansion that this initiative would give to Chinese goods and services through South Asia, Europe, the Middle East, and Africa, increasing its economic presence and geopolitical influence.

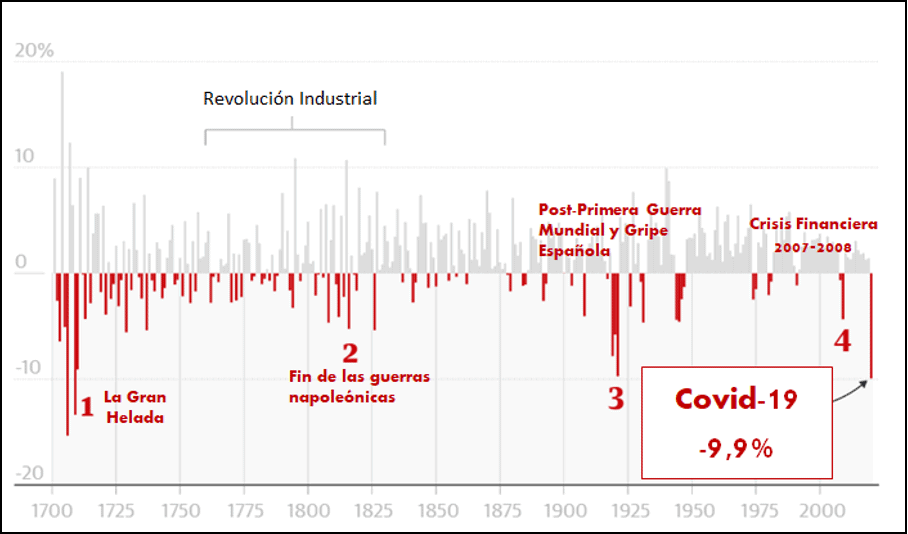

United Kingdom: the worst economic downturn in three centuries

The British economy suffered its worst downturn in 300 years during 2020 due to the pandemic caused by COVID-19. According to the Office for National Statistics (ONS), gross domestic product (GDP) fell by 9.9%[68], affecting all sectors and being the largest recorded since the «Great Freeze» of 1709, when the economy contracted by 13%.

MAJOR FALLS IN THE BRITISH ECONOMY

BETWEEN 1700 and 2020

However, the latest figures from the aforementioned statistical body showed that the economy avoided a double-dip recession (a fall in GDP after a six-month decline followed by a brief period of stabilization or recovery). This was achieved after achieving 1% growth in the last quarter of the year, beating expectations in early autumn of a further fall in GDP as the pandemic worsened. Easing in the run-up to Christmas allowed the economy to grow at a monthly rate of 1.2% in December, following a 2.3% decline in November during the second English quarantine.

This decline is larger than that caused by the 2008 financial crisis (-5%), and that suffered in 1921 when the UK was recovering from World War I and the «Spanish flu» pandemic (-9.7%).

The UK’s annual economic decline was the worst among G7 members, after GDP fell by 3.5% in the United States, 5% in Germany and Canada, 5.6% in Japan, 8.3% in France, and 8.9% in Italy.

Last January, the IMF lowered forecasts for the UK recovery in 2021, with 4.5% for this year (1.4 percentage points lower than the 5.9% growth forecast made last October). According to Gita Gopinath, IMF chief economist, Brexit would shrink the UK economy by about 1% during the first quarter of 2021.

Post-Brexit economy

This weekend the UK-Singapore Free Trade Agreement[70] (UKSFTA) comes into force, which translates into bilateral trade in the order of £17 billion ($24 billion). This would be the British’s first significant agreement after their recent exit from the European Union.

The new agreement includes the elimination of tariffs on Singaporean goods (such as food products, petrochemicals, electronics, and more) entering the UK, greater access to each country’s respective services and government procurement markets, as well as the reduction of non-tariff barriers in specific sectors. The UKSFTA will also remove technical barriers to trade (labeling, packaging, design) for both Singapore and UK exporters.

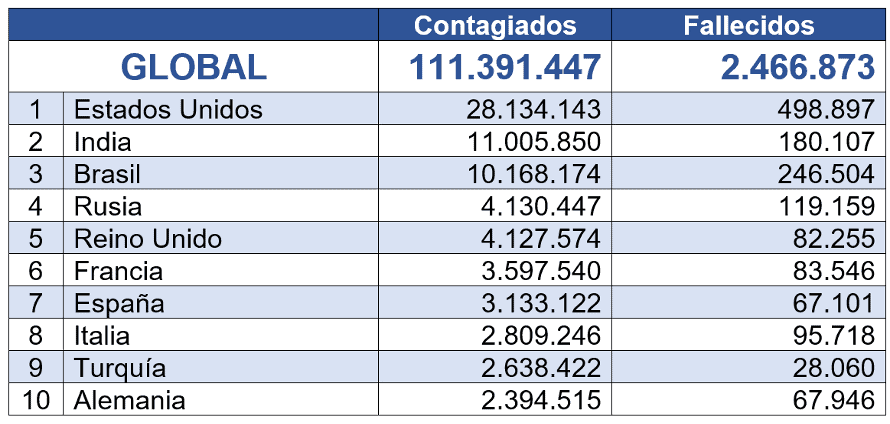

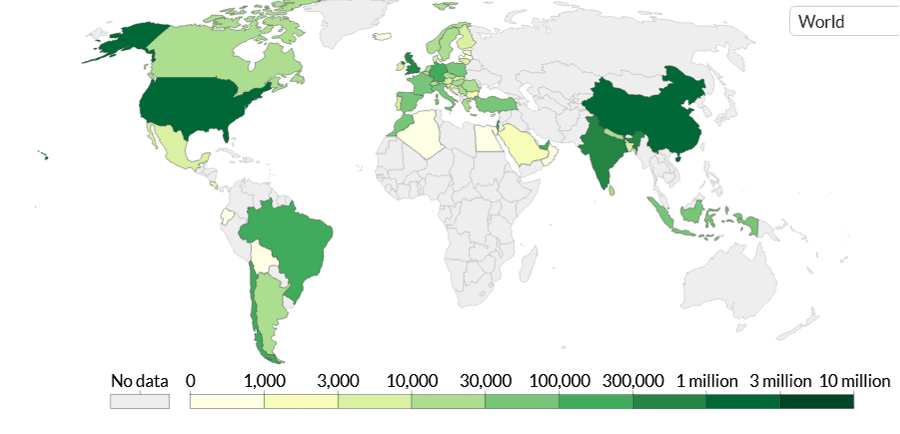

COVID-19

As of February 22nd, 2021, the number of people infected with coronavirus worldwide exceeded 111 million people, while the total number of deaths has reached 2.46 million, while 62.85 million people have recovered from the virus, according to data compiled by Johns Hopkins University[71]:

TOP-10 MOST AFFECTED COUNTRIES BY COVID-19

Since their emergence for mass use at the end of last year, the vaccines developed against COVID-19 allow us to expect the end of the pandemic and better economic prospects for 2021.

However, the vaccination process has presented several problems that have slowed it down. The first of these has been the production that does not meet the urgent needs of the countries, as in the case with Pfizer and AstraZeneca, who have failed to meet their agreed supply schedules to the European Union.

The second problem has been the asymmetry in the allocation of vaccine quantity quotas. While in the USA, the United Kingdom, China, and Russia, governments have demanded that vaccines produced in their countries should be destined primarily for their inhabitants. The rest of the countries do not receive sufficient quantities of vaccines. Hence there is a marked difference in the number of vaccinated people.

To date, 56 million people have been vaccinated in the USA, 16 million in the UK, and 40 million in China. At the same time, in the 27 EU countries, the numbers are much lower (23 million in total), as well as in Latin America, the rest of Asia, and Africa. No vaccines are available for these countries.

ASYMMETRY AND INEQUALITY IN THE ADMINISTRATION OF COVID-19 VACCINES WORLDWIDE

09/02/2021

The graph above shows that, in developed countries, vaccinated people can already be counted in the tens of millions. At the same time, in most of the developing world, vaccinations have not even begun.

The countries or regions that are home to the laboratories that produce the vaccines are at the forefront of the number of doses administered. At the same time, Africa, part of Asia, Latin America, and the Caribbean are the most affected regions.

The third major problem is the limitation for the poorest countries to acquire vaccines and the lack of adequate infrastructure for their storage and distribution. Apart from the ethical problem of inequality in the current world order, it will undoubtedly cause the pandemic to extend beyond the current year in the poorest countries.

This fact was recently denounced by the Director-General of the World Health Organization himself, Tedros Adhanom Ghebreyesus. On Tuesday, January 18th, during a meeting of the Executive Board of the Organization, he criticized the fact that industrialized countries are taking advantage of the rest of the world to procure vaccines against COVID-19. In this way, they would be hoarding the available doses and, in the future, in the opposite direction to the COVAX initiative, the multilateral mechanism that seeks to accelerate the development, production, and equitable access to tests, treatments, and vaccines against COVID-19.

DEMAND

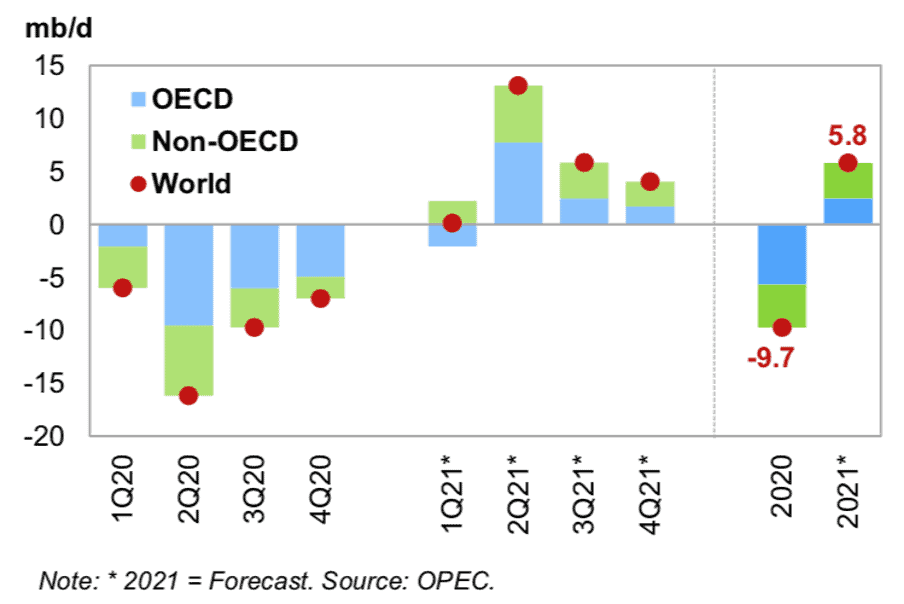

According to the OPEC monthly report, the February 11th MOMR, the contraction in world oil demand in 2020, was 9.7 MMBD, a 9.72% drop from 2019.

For 2021, OPEC estimates an average demand of 96.1 MMBD, an increase of 5.8 MMBD to 2020. However, it made a downward adjustment of 100 MBD, to its estimate of last January, because of the containment measures activated at the beginning of the year in the OECD countries.

OPEC considers that the expected increase in demand will occur from the second quarter of the year due to the positive effects on the economy of the massive financial aid packages in developed countries and the progress of the mass vaccination process, and the reduction of COVID-19 cases. The above will bring the lifting of mobility restrictions between countries and increase fuel consumption for air and land transport.

CHANGE IN WORLD OIL DEMAND

OIL DEMAND

(2020-2021)

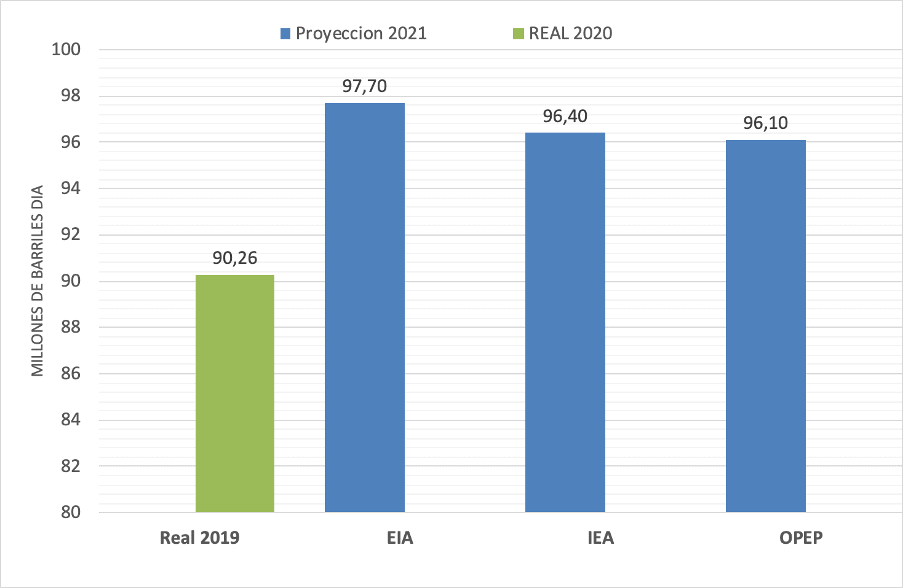

Meanwhile, the Energy Information Administration (EIA) and the International Energy Agency (IEA) adjusted their projections for 2021 by 200 thousand barrels per day, by 97.7 and 96.4 MMBD.

The IEA highlights that the recovery in demand was affected by new COVID-19 strains, which generated new containment measures.

WORLD OIL DEMAND PROJECTIONS

(2020-2021)

ASIA

According to OPEC projections, of the increase in demand by 5.8 million barrels by 2021, 37% would correspond to Asian demand with 2.15 million barrels per day. However, China and India are the countries that will continue to drive oil consumption in the region during 2021.

According to Refinitiv Oil Research’s preliminary data, Chinese crude oil imports increased in January to 12 MMBD[73], a 32% rebound from December 2020 imports, mainly due to increased quotas allocated to independent refiners known as «Teapots.»

According to OPEC’s MOMR, India’s crude oil imports increased in Q3 and Q4 by 12% and 35%, respectively, along with China’s main drivers of demand in 2020.

According to OPEC data, other countries in Asia showed a drop in demand during the last quarter of 2020 due to the spike in Covid-19 contagions. OPEC estimates that this situation will reverse in 2021, as the most extensive year-on-year recovery in demand is projected to be in Malaysia, Indonesia, Singapore, Thailand, and the Philippines.

US

US crude oil imports fell for the fourth consecutive week, according to data published by the EIA in its «This Week in Petroleum» report on February 18th, these registered 5.831 MMB, which represents a weekly reduction of 1% and 12% to February 2020.

US CRUDE OIL IMPORTS

(2016 – 2022)

The EIA, published on February 17th the «EIA forecasts the United States will return to being a net petroleum importer in 2021 and 2022», where they estimate that the US will once again become a net importer of crude oil, as its domestic production has decreased by 5% to 11 million barrels per day since the peak recorded in February 2020, not enough to supply the demand of its refineries.

US production fell 5% during 2020 with no significant impact on imports, as it was offset by an 8% drop in consumption from 2019 due to the health crisis.

The EIA forecasts an increase in US crude oil demand of 17% and 15% for 2021 and 2022, respectively, which will increase oil imports into the US in the face of stagnant US production expected in 2021.

STORAGE

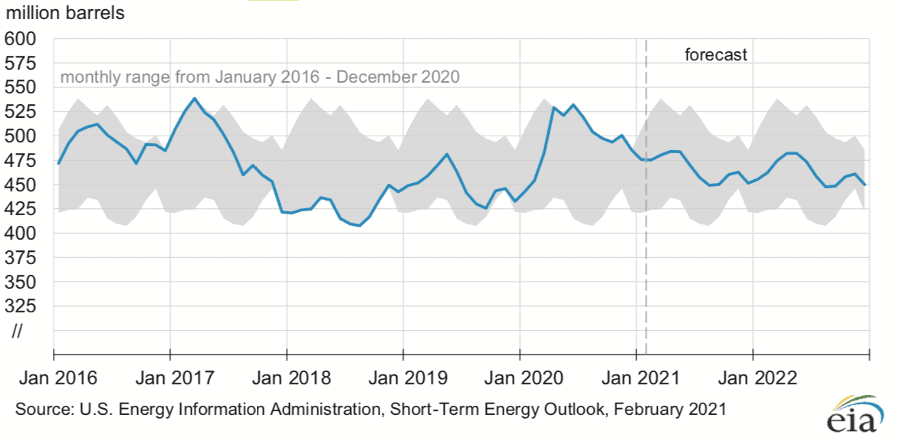

Crude oil storage continues to decline in January 2021 due to strict compliance with OPEC+ production cuts since May 2020, which has allowed for the draining of crude oil inventories.

Of note is the month-on-month drop of 23 MMBD in total US commercial oil inventory stocks, falling from the 1.347 billion barrels recorded in December 2020 to 1.324 MMBD in January 2021, but up 2% from January 2020 and 2.7% relative to the 5-year average (2106-2020), according to the STEO report released on February 9th by the EIA.

These data coincide with those published by OPEC on February 11th, where oil inventories in the US for January 2021 are placed at 1,324 billion barrels, with a month-on-month drop of 18.4 MMBD, 2% annual growth, and 2,7% to the 5-year average.

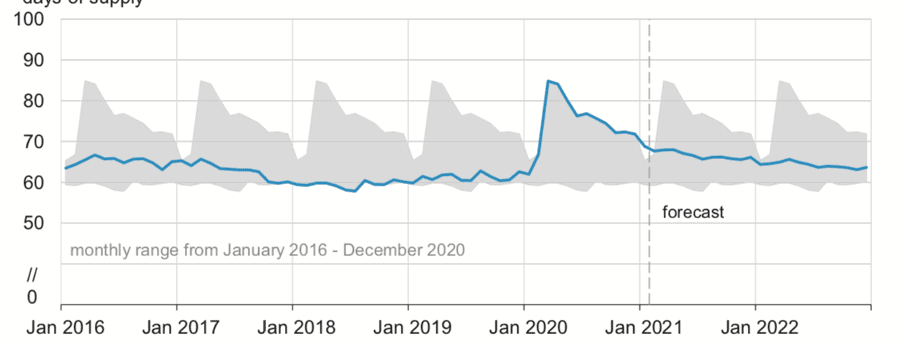

According to OPEC’s MOMR of last February 11th, the inventories of OECD countries presented a level of 3.068 billion barrels of oil in December 2020, registering a month-on-month fall of 39 million barrels and 142 million barrels since August 2020. Still, they remain 183 million barrels above the 5-year average.

The EIA monthly report forecasts that OECD country inventories will stand at 2.959 MMB by 2021 and 2.935 MMB by 2022, down 3% and 4% respectively from 2020 levels.

CRUDE OIL STORAGE OECD COUNTRIES

(2016 – 2022)

USA

US commercial crude oil storage has fallen for nine consecutive weeks, according to the EIA report as of February 18th, reaching 461 million barrels, in a clear sign of the trend of draining inventories and balancing market fundamentals. However, inventories remain 6% above levels recorded on the same date last year.

Days of cover also continue to decline, with 31.3 days of cover recorded for the week of February 1st. Average storage for 2021, according to EIA forecasts, will be 1,275 MMB, a downward adjustment from January estimates, down 5% from record levels in 2020, though still above the five-year average.

US CRUDE OIL STORAGE

(2016 – 2022)

VENEZUELA

On February 18th, the action of the Presidential Commission «Alí Rodríguez Araque» (ARA Commission) was extended for 12 months until February 2022. It was created by a presidential decree in February 2020, within the framework of the privatization of the oil sector carried out by the national government.

In its first year, the ARA Commission has no accomplishment to show for it. On the contrary, oil production continues to decline, the national refining system remains paralyzed and the country suffers an acute shortage of fuels in the domestic market, which is why the government continues to import them from Iran.

Concerning this ARA Commission’s performance, we made a detailed analysis based on verifiable data published on www.rafaelramirez.net.

Faced with the inability of its own management teams at PDVSA and as a fundamental part of its new policy, the government insists on handing over oil operations and the commercialization of crude oil to the international private sector, using the much-questioned «Anti-Blockage Law.» It is an instrument of doubtful legality, approved without national discussion, and does not offer any transparent legal or Constitutional framework for private participation.

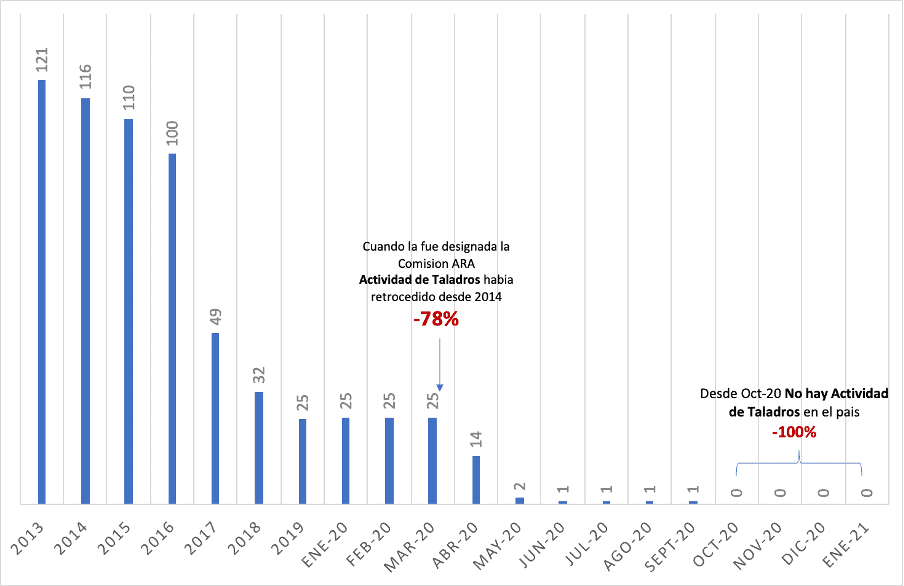

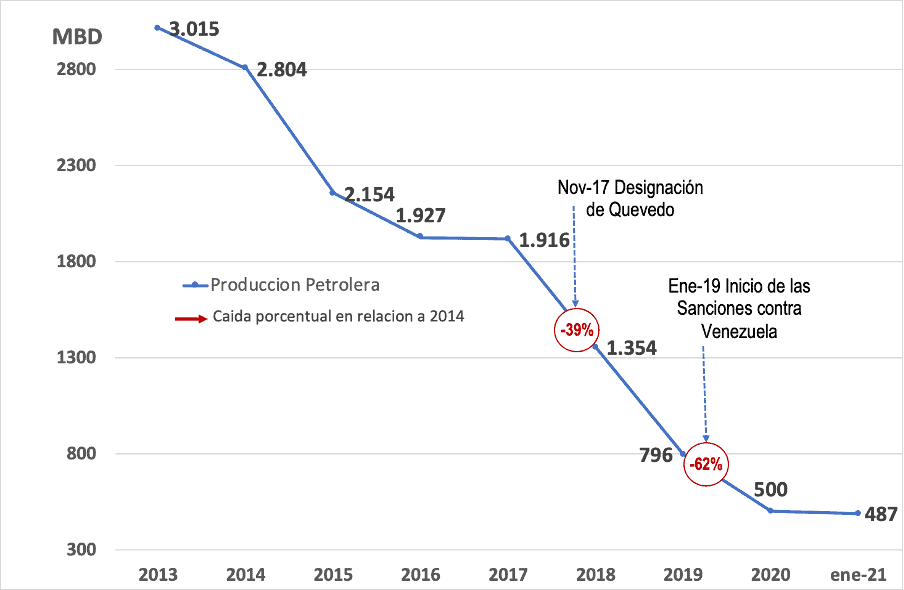

Oil Production

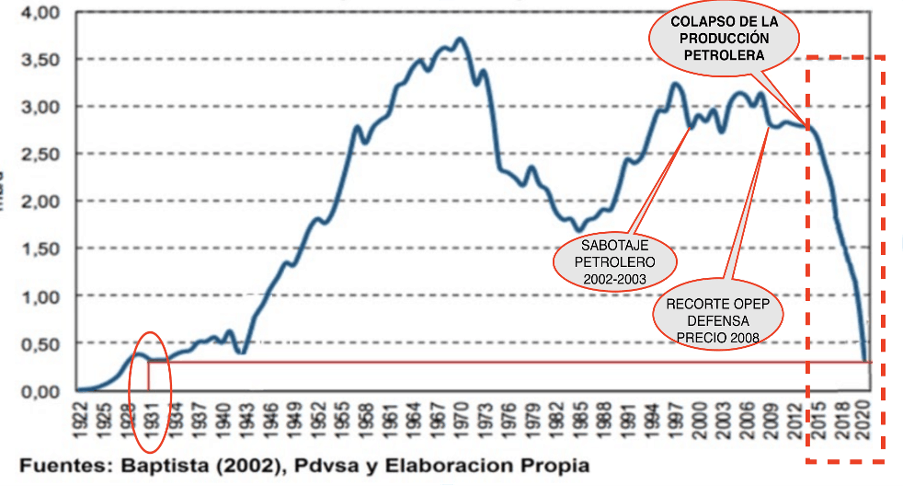

The drop in oil production continues to plummet since 2014. According to OPEC, Venezuela’s production as of January stands at 487 thousand barrels per day of oil, a drop of 83% concerning the production levels of 3,015 million barrels per day of oil in 2013 and of 33% to the beginning of activities of the ARA Commission, when it stood at 783 thousand barrels per day of oil.

PRODUCTION OPEP COUNTRIES

(2018-December 2020)

Beyond the government’s rhetoric with multiple presidential announcements promising production recovery, the oil industry will not recover while it is subjected to a militarized management, with a strong disinvestment due to the diversion of resources and the loss of technical personnel and manager trained to manage PDVSA.

The collapse of oil production in the country is unprecedented worldwide. It is not substantially due to external factors, but is due to the violent political attacks against the company and its workers. The company’s militarization, the diversion of resources, and poor management are accompanied by a dysfunctional government, incapable of guaranteeing the country’s governability. This situation does not escape the oil industry. The current levels of oil production are the same levels from the 1930s to the beginning of the country’s oil industry.

HISTORICAL EVOLUTION OF OIL PRODUCTION IN VENEZUELA

(1920-2021)

The oil industry is still paralyzed. There is currently no drilling activity in the country, although, in 2014, PDVSA had 384 active drills, of which 268 belong to its subsidiary PDVSA Servicios Petroleros, and 116 corresponded to private companies, as reflected by OPEC in its data.

As of February 2020, there are no active drilling rigs in the country, which places the production increase as a merely rhetorical proposal. The above is a clear indicator that the situation of collapse will not change in the short or medium-term since there is no subsurface work, no drilling, or well repairs.

DRILLING ACTIVITY IN VENEZUELA

(2013 – January 2021)

US sanctions: the government’s excuse

On multiple occasions, the Venezuelan government has tried to hide behind the United States’ sanctions regarding the loss of the operational capacities of PDVSA and the deterioration of the entire infrastructure of the oil industry.

Although the sanctions are illegal, limit access to technology and services, and limit commercialization capacities, we must say that they are not the cause of the collapse of oil production in the country, nor the lack of fuel for the population.

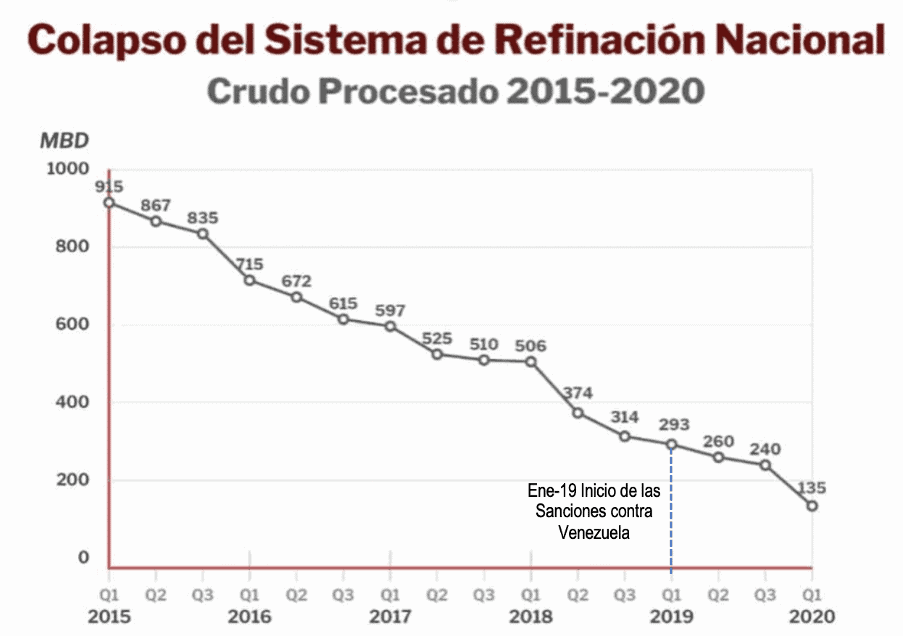

The US sanctions against PDVSA were imposed in January 2019, but by that date, oil production had already fallen by 62% in 2013, to 1,150 million barrels per day.

Although these sanctions were only in the financial area, the company had already been militarized, and internal political persecution had been unleashed, which led to the imprisonment of more than 100 directors, managers, and workers, causing an exodus of more than 30 thousand skilled workers, engineers, and supervisors from the company and the country.

On the other hand, after intervening PDVSA as of 2014, the government controlled PDVSA’s finances and budgets, using the resources destined for the operating and investment budget to comply with other government priorities. Between 2015-2019, according to statements made by the president, the government paid more than 70 billion dollars for debts with the financial sector, leaving PDVSA without resources to sustain its operations.

VENEZUELA’S OIL PRODUCTION

(2014 – December 2020)

The collapse of the refining circuit

The pronounced deterioration of the national refining circuit is undeniable. It is reflected in the severe fuel shortage -including gasoline, diesel, and domestic gas-, whose production has not been possible to reestablish despite multiple failed attempts to restore normal operations due to a sustained process of decrease in its capacities as a consequence of disinvestment by the company, which affects the execution of scheduled and corrective maintenance that guarantees the operational continuity of the facilities mentioned above.

The installed refining capacity in the country in 2014, according to PDVSA’s Management Report[81], was 1.3 million barrels per day with the Paraguaná Refining Complex (Amuay-Cardón refineries) El Palito refinery, Puerto la Cruz refinery, and Bajo Grande refinery. Currently, only the Cardón Refinery is active, but its intermittent operation is insufficient to meet domestic market requirements.

The consumption of the domestic market in 2014 was 663 thousand barrels per day, supplied by the refining equipment installed and in operation. Exports of over 400 thousand barrels per day were also carried out, which generated a significant income.

As we have denounced on multiple occasions, the destruction of the country’s refining system is seen with the militarization of PDVSA, the persecution of its workers, and the diversion of resources, reasons that led to a collapse of 85% in the amount of crude oil processed in the country’s facilities.

During the last year, the ARA Commission has tried unsuccessfully to reactivate the Venezuelan refining complex without success. The refining system operates at barely 10% of its capacity, and the country continues to suffer an acute shortage of fuels and gas for domestic consumption.

However, in their attempts and lack of technical capabilities, the national refineries’ interventions have caused operational accidents and oil spills that have affected the environment.

Last October 28th, an attempt to reactivate the Amuay refinery of the Paraguaná Refinery Complex, there was an overpressure in the vacuum distillation tower (VGO) which caused an explosion and critical damages to the facility. The government, in an implausible manner, attributed to a «terrorist attack with missiles,» something denied by the refinery workers themselves.

In August 2020, in an attempt to reactivate the El Palito refinery, occasioned an oil spill that affected the Morrocoy National Park, an important ecological reserve of the country. Approximately 25 thousand barrels of crude oil were spilled, according to data obtained through satellite images.

Subsequently, in September of the same year, the state of Falcón again suffered a spill due to a crude oil leak from a submarine polyduct of the Paraguaná Refinery Complex, which extended for more than 13 kilometers in the town of Río Seco, affecting more than 200 fishermen by limiting their fishing possibilities in the area.

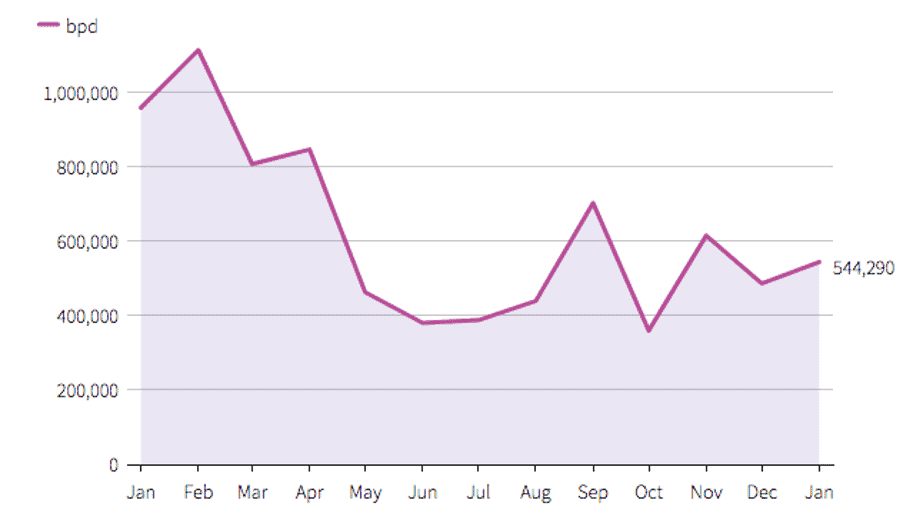

New clients boosted exports in January

OPEC’s February 11th report, secondary sources report an increase of 72 MBD in Venezuela’s production, which reflects the crude exports due to the draining of inventories that have been made through new «partners,» mostly Russian and Turkish companies, which have taken over PDVSA’s trading operations and have transported 76% of the oil, based on an aggressive discount policy that reaches between 40-50% of the value of Venezuelan Merey crude.

As we have pointed out in previous reports, in Venezuela, there is no authority to control the sale of oil or to verify the sales prices after the government intervened and closed the control office of the Ministry of Oil located in Vienna – after filing false charges against it – eliminating oil sales using price formulas.

Today it is not known to whom it is sold, nor how much, nor at what price, so there is an absolute opacity to the crude oil commercialization processes that give space to these massive discounts of the oil sales price to the detriment of the country’s revenues.

Refinitiv Eikon’s records published by Reuters estimate that in January, crude oil exports reached 544 thousand barrels[86], which represents an increase of 31% concerning the 415 thousand barrels of December.

NEW CUSTOMERS HELP VENEZUELA INCREASE JANUARY EXPORTS (January 2020 – January 2021)

The commercialization of hydrocarbons in Venezuela by way of exports in 2013[87], with direct management by PDVSA, was 2,051 thousand barrels per day, of which 1,596 thousand barrels per day were of crude oil, 433 thousand barrels per day of products, and 22 thousand barrels per day of Liquefied Natural Gas. Regarding exports of joint ventures of the Orinoco Oil Belt, a volume of 374 thousand barrels per day was added for that year, for 2,425 thousand barrels per day of exports of the industry in 2013.

Unfortunately, there are currently no official reports on the Venezuelan oil industry’s operations and, considering the data reported by Refinitv Eikon, it would correspond to a 78% drop in exports.

On the other hand, according to data tracked by Refinitv Eikon, there is a possibility that this volume exported by PDVSA in January corresponds to the volumes stored in the floating facilities of the Corocoro project, stored in the vessel Nabarima.

This vessel, abandoned off the Gulf of Paria’s coast, presented a risk of collapse and possible spill. For that reason, transfer operations were carried out to the vessel Icaro, which delivered this cargo to Caroní, anchored in the Bay of Amuay, while it was being marketed.

BIBLIOGRAPHIC REFERENCES:

- [1] Comunicado de Prensa, “13th OPEC and non-OPEC Ministerial Meeting concludes”, en OPEP, 05 enero 2021.

- [2] Javier Blass, Grant Smith y Salma El Wardani, “Saudis Take Charge of Oil Market With Surprise Output Cut”, en Bloomberg, 05 de enero 2020.

- [3] Joe Biden, “Remarks by President Biden on the State of the Economy and the Need for the American Rescue Plan”, en White House, 05 de febrero 2021.

- [4] COM(2021), “Communication from the Commission to the European Parliament, the Council, the European Central Bank, the European Economic and Social Committee and the Committee of the Regions”, en Comisión Europea, 19 de enero 2021.

- [5] Doyle Rice y Elinor Aspergen, “At least 4 dead, 150M people under winter advisories as ‘unprecedented’ storm stretches across 25 states; 4.3M without power in Texas”, en USA today, 15 de febrero 2021.

- [6] Yacine Sariahmed, “Monthly Oil Market Report february” 2021, en OPEP, 11 de febrero 2021.

- [7] Vladimir Soldatkin, “Russia’s Novak says oil market on recovery path – news agencies”, en Reuters, 14 febrero 2021.

- [8] Ahmed Rasheed, “Iraq says OPEC+ cuts unchanged in March, but easing after”, en Reuters, 10 febrero 2021.

- [9] Secretaria, “OPEC daily basket price stood at $61.30 a barrel Friday, 19 February 2021”, OPEP, 22 febrero 2021.

- [10] “Short-Term Energy Outlook”, en U.S. Energy Information Administration, 09 febrero 2021.

- [11] Mohammad Ali Danesh, “Monthly Oil Market Report february” 2021, en OPEP, 11 de febrero 2021.

- [12] “Statistics”, en Ministerio de Energía de la Federación Rusa, primero febrero 2021.

- [13] “Oil Market Report – February 2021”, en Agencia Internacional de Energía, 12 febrero 2021.

- [14] Anexo a Comunicado de Prensa, “Voluntary Production Levels”, en OPEP, 05 de enero 2021.

- [15] Álvaro Escalonilla, “Saudi Aramco pondrá más acciones a la venta en los próximos años”, Atalayar, 29 de enero 2021.

- [16] Comunicado de Prensa, “HRH Crown Prince Participates in Strategic Dialogue Session of World Economic Forum”, Saudi Press Agency SPA, 13 enero 2021.

- [17] Dr. Abdullah Al Fozan, “Saudi Arabia Budget Report 2021”, KPMG en Arabia Saudita, diciembre 2020.

- [18] “Waha Oil Company’s production reduced by 200,000 BBLPD due to necessary repairs on the 32-inch Pipeline – connecting (Samah – Dahra) Fields – to Esseder Oil Terminal”, en cuenta Facebook de la Corporación Nacional de Petróleo de Libia NOC, 17 de enero 2021.

- [19] Rosa Muñoz Lima, “Francia encabeza intervención aérea en Libia”, en Deutsche Welle, 19 de marzo 2011.

- [20] Agencias de Noticias, “Haftar announces conditional lifting of Libya oil blockade”, en Al Jazeera, 18 de septiembre 2020.

- [21] Noticias ONU, “Libia: La ONU aplaude el acuerdo de alto el fuego y llama a alcanzar una solución política para un futuro de paz y seguridad”, en Organización de las Naciones Unidas ONU, 23 octubre 2020.

- [22] Noticias ONU, “»Momento histórico» para Libia con la selección de un nuevo liderazgo interino”, en Organización de las Naciones Unidas, 05 febrero 2021.

- [23] Hossein Hassani, “Libya facts and figures”, en OPEP, 2020.

- [24] Comunicado de Prensa, “The NOC is launching a project to study and improve the Strategic Plan of the National Oil Corporation and support the corporate governance in the oil sector in collaboration with the US Department of Energy”, en Corporación Nacional de Petróleo de Libia NOC, 06 enero 2021.

- [25] Comunicado de Prensa, “Development of the new fields … The use of renewable energies in the Libyan oil sector … Lack of budgets and its impact on continuity of current production and new field development … The main topics in the meeting of the NOC with Total”, en Corporación Nacional de Petróleo de Libia NOC, 29 de enero 2021.

- [26] Cassidy McDonald, “Biden says U.S. won’t lift sanctions until Iran halts uranium enrichment”, en CBS News, 07 de febrero de 2021.

- [27] Consejo de Seguridad de la ONU, “Resolución 2231 (2015) Aprobada por el Consejo de Seguridad en su 7488a sesión”, en Documentos de la Organización de las Naciones Unidas ONU, 20 julio 2020.

- [28] Redacción BBC, “Crisis nuclear de Irán: la controversial nueva ley de Teherán para restringir los controles a su programa nuclear”, en BBC Mundo, 03 de diciembre 2020.

- [29] Rueda de Prensa, “Secretary Antony J. Blinken at a Press Availability”, U.S. Department of State, 27 de enero 2021.

- [30] Noticias, “Zarif descarta que vayan a producirse nuevas conversaciones sobre el acuerdo nuclear”, Agencia de Noticias de la República Islámica de Irán IRNA, 07 de febrero 2021.

- [31] Noticias, “Ayatolá Jamenei: Irán retomará los compromisos del acuerdo nuclear, si EEUU levanta todas las sanciones de manera efectiva”, Agencia de Noticias de la República Islámica de Irán IRNA, 07 de febrero 2021.

- [32] Noticias, “Rohani: Nadie debería esperar que Irán dé el primer paso con respecto al acuerdo nuclear”, Agencia de Noticias de la República Islámica de Irán IRNA, 09 de febrero 2021.

- [33] Nota de Prensa, “Joint statement by the Vice-President of the Islamic Republic of Iran and Head of the AEOI and the Director General of the IAEA”, Organización Internacional de Energía Atómica OIEA, 21 de febrero 2021.

- [34] Hossein Hassani, “Iran facts and figures”, en OPEP, 2020.

- [35] “Short-Term Energy Outlook Data Browser: Canada Petroleum Production”, en U.S. Energy Information Administration, 09 febrero 2021.

- [36] Presidente Joe Biden, “Executive Order on Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis”, en The White House, 20 de enero de 2021.

- [37] Conferencia de Prensa, “Statement by the President on the Keystone XL Pipeline”, en Obama White House, 06 noviembre 2015.

- [38] Jeff Mason y Ethan Lou, “Trump greenlights Keystone XL pipeline, but obstacles loom”, en Reuters, 24 de marzo 2017.

- [39] Laurel Sutherland, “Exxon denies link between higher output and compressor malfunction”, en Stabroek News, 09 de febrero de 2021.

- [40] Redacción, “Construction of second FPSO on Schedule”, Stabroek News, 16 de enero 2021

- [41] Redacción, “Guyana exported its first oil cargo for 2021 last week: over US$206M now in account”, en Oil News, 10 de febrero de 2021.

- [42] Tratados de Naciones Unidas, “Acuerdo para resolver la controversia entre Venezuela y el Reino Unido de Gran Bretaña e Irlanda Del Norte sobre la frontera entre Venezuela y Guayana Británica”, en Consulado Venezolano en Vigo.

- [43] Comunicado de Prensa, “Guyana files an application against Venezuela”, en Corte Internacional de Justicia, 04 de abril 2018.

- [44] “Weekly Supply Estimates”, U.S. Energy Information Administration, 10 febrero febrero 2021.

- [45] Presidente Joe Biden, “El plan Biden para una Revolución de Energía Limpia y Justicia Ambiental”, en la página web deJoe Biden , noviembre 2020.

- [46] Departamento de Inversiones y Asuntos Externos, “4Q20 Earnings Conference Call Edited Transcript”, en Chevron Corporation, 29 de enero de 2021.

- [47] Presidente Joe Biden, “Executive Order on Tackling the Climate Crisis at Home and Abroad”, en The White House, 27 de enero 2021.

- [48] Beverly Winston, “BOEM Proposes First Gulf Oil and Gas Lease Sale for 2021”, en Bureau of Ocean Energy Managment BOEM, 17 de noviembre 2020.

- [49] “BOEM Rescinds Record of Decision for Gulf of Mexico Lease Sale”, en Bureau of Ocean Energy Managment BOEM, 12 de febrero de 2021.

- [50] Artem Amabrov y Lefteris Karagiannopoulos, “Shale revival: US drilled but uncompleted wells already at pre-Covid-19 levels and await fracking”, en Rystad Energy, 25 de enero 2021.

- [51] Derek Brower y Myles McComirck, “US shale oil: can a leaner industry ever lure back investors?”, en The Financial Times, primero de febrero 2021.

- [52] “Petroleum & Other Liquids: Tight oil production estimates by play”, en U.S. Energy Information Administration, 10 febrero febrero 2021.

- [53] “North America Rig Count”, en Backer Hugues”, 12 de febrero 2021.

- [54] Arpan Varghese, “U.S. oil wells, refineries shut as winter storm hits energy sector”, 15 de febrero 2021.

- [55] “Global Economic Prospects:Global growth scenarios”, en Banco Mundial, 24 enero 2021.

- [56] Alexis See Tho, “China’s GDP growth beat estimates. What does it mean for 2021?”, en Financial Managment, 26 enero 2021.

- [57] Equipo de Reuters, “G7 finance ministers discuss COVID recovery plans, climate”, en Reuters, 12 d febrero 2021.