INDEX

The oil market regained its upward price trend after OPEC+ announced an agreement to extend production cuts until December 2022, as decided at the closing of its 19th Ministerial Meeting on July 18th. The agreement includes monthly flexibilities of 400 thousand barrels per day starting in August and an upward adjustment of 1.632 million barrels per day (million barrels per day) in the production base starting in May 2022. The above satisfied all parties, including the United Arab Emirates, who had blocked the agreement at the last meeting on July 5th.

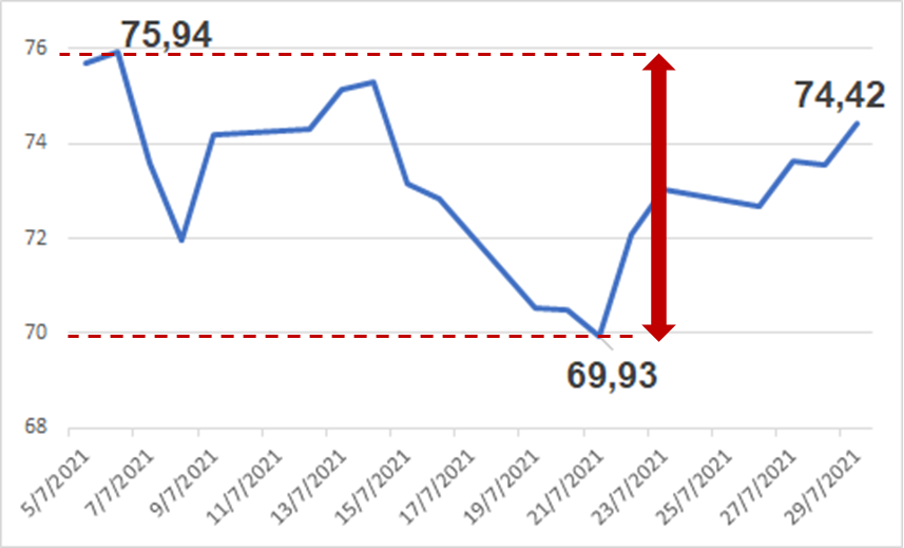

The lack of OPEC+ agreement immediately triggered a drop in oil price markers. Between July 5th and 16th, Brent fell from 77.16 to 73.59 dollars, while WTI fell from 76.25 to 71.81 dollars. A fall of 4.6% and 6.8%, respectively. On July 19th, the price of both markers fell below $70 a barrel for the first time since May 2021.

BRENT PRICE DECREASE

DUE TO THE EFFECT OF THE OPEC+ DISAGREEMENT

(5 – 29 July 2021)

WTI PRICE DECREASE

DUE TO THE EFFECT OF THE OPEP+ DISAGREEMENT

(5 – 29 July 2021)

After OPEC+ President, Saudi’s Energy Minister Prince Abdul Aziz bin Salman announced the agreement reached by OPEC+, the oil prices started to recover. As of July 30th, Brent quoted 76.33 dollars, while WTI was quoted at 73.96 dollars a barrel, up 11.24% and 11.34% compared to July 19th.

This price sensitivity to OPEC+ decisions is a clear indication that the market recognizes as fundamental the role played by the organization during the COVID-19 crisis in stabilizing the market and recovering prices.

As we pointed out in our OIL REPORT of July 18th, the market immediately perceived that the disagreement within OPEC+ could lead to another price war between producers, like the one that occurred in March 2020 and preceded the market’s collapse coinciding with the COVID-19 pandemic.

The OPEC+ agreement was accompanied by a review of the production base, which was the central demand of the UAE.

What is not yet clear is which country will have had to decrease its share of its OPEC production quota to meet the UAE’s demand for an increase. The redistribution of production quotas within OPEC has been a long-delayed discussion and a source of permanent tension among the countries, especially among the founding members, who share the organization’s total production, established since the quota system was set up in 1982.

OIL PRICE

On August 3rd, at the close of the European markets, the prices closed lower. While the International Exchange Futures (ICE) quoted Brent at 72.26 dollars a barrel, the New York Mercantile Exchange (NYMEX) closed with WTI at 70.24 dollars a barrel.

Both markers were affected since August 2nd by the fall of the PMI index in the U.S. and Chinese manufacturing industry, published by the Institute for Supply Management (ISM) and the National Bureau of Statistics of China. U.S. manufacturing contracted by 1.1% monthly in July, while China’s manufacturing contracted by 0.5 points.

Current Brent and WTI quotations represent an annual increase of 63.67% and 71.28%, respectively, and 20.82% and 28.43% to 2019 quotations. A clear indication of the oil market’s recovery, despite the permanent uncertainty regarding the performance of the international economy due to the COVID-19 pandemic.

But everything seems to indicate that, despite the different variants of COVID-19 that emerge and affect the world’s population, even those that have already been vaccinated – as has happened in the U.K., Europe and the USA – mass vaccinations will continue. The immunizations and the measures taken to allow a wider distribution among the world’s population will allow to overcome the global COVID-19 emergency and recover the economy, which, as we pointed out in the previous OIL REPORT, is expected to see a significant increase in oil demand by the end of this year.

OPEC Reference Basket (ORB).

The OPEC reference basket of crude oil (ORB) was quoted on August 2nd at US$73.89 per barrel, an increase of 1.5% concerning the quotation of July 16th, despite falling to US$69.93 on July 21st. Despite the price volatility during the first three weeks of July, the ORB quotation stood 73.41% above its quotation in November 2020, managing to maintain its upward trend, with values in June and July not seen since October 2018.

DECREASE OPEP REFERENCE BASKET (ORB) PRICE

DUE TO THE EFFECT OF THE OPEP+ DISAGREEMENT

(05 – 29 July 2021)

The OPEC basket reached an average quotation of $71.89 per barrel in June -the highest since October 2018-, presenting an increase between 7.1% and 8.9% in all its referential components, an average of 7.4% upward, influenced by the increase in the referential prices in official sales and crude oil differentials that make up the ORB, informed the organization in its Monthly Oil Market Report (MOMR) of July 15th.

OIL PRODUCTION

The OPEC+ agreement to extend the production cut policy until December 2022, instead of April 2022 -as initially planned-, indicates to the market the organization’s commitment to the surveillance of the stability of its fundamentals, to continue monitoring its behavior and to continue intervening in the market through its capacity to regulate oil supply.

It brings serenity to a market still traumatized by the 2020 collapse and by the uncertainties that still affect the performance of the world economy and, therefore, the oil demand.

The decision to make the current cutback more flexible to increase production by 400 thousand barrels per day per month, starting in August, will place 2 million additional barrels per day on the market at the end of the year, capable of satisfying the increase in demand, estimated this year at 5.95 million barrels per day. This will occur in the second half of the year, with greater emphasis on the last quarter, maintaining the supply-demand balance and avoiding price pressures that could affect the economy’s recovery.

At the same time, OPEC+ agreed that the production base to be applied as of May 2022 would be 43,732 million barrels per day, an increase of 1,632 million barrels per day to the production base taken as a reference for the April 2020 agreement, which did not include the production of Iran, Libya or Venezuela. Thus, there has been, in fact, a redistribution of production quotas, where Saudi Arabia and Russia will each go up to 11.5 million barrels per day (a rise of 500 thousand barrels per day). In comparison, the UAE managed to raise its own to 3.5 million barrels per day, increasing 332 thousand barrels per day with its current base.

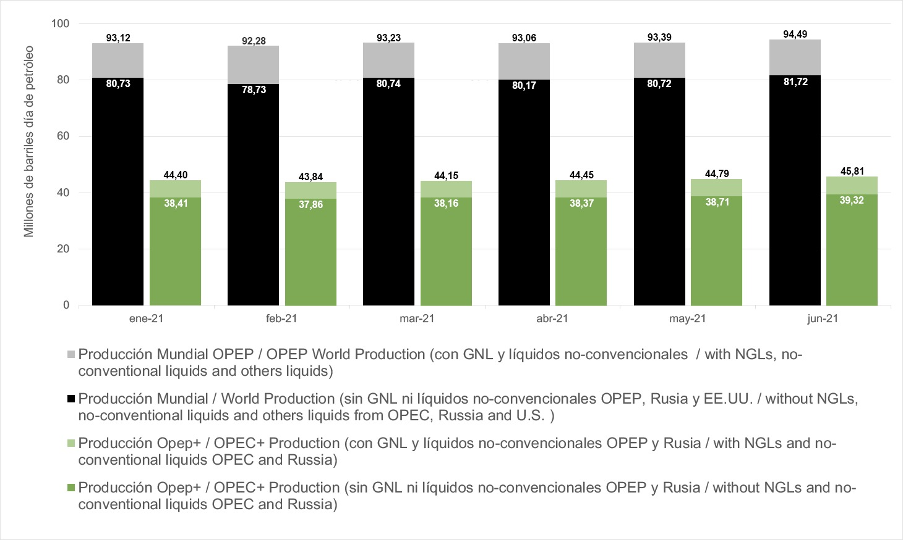

World oil production

Data from OPEC’s Market Monitoring Report (MOMR) for July 15th puts world oil, condensate, NGLs and unconventional liquids production at 94.49 million barrels per day for June.

WORLD PRODUCTION

(Crude oil, condensates, NGLs and non-conventional liquids)

(January – June 2021)

According to OPEC, EIA and Russian Ministry of Energy, when we put apart the volumes of condensates, NGLs and unconventional liquids in the U.S., Russia and OPEC, world oil production stands at 81.72 million barrels per day.

Currently, the world oil production is 81.72 million barrels per day, and OPEC+ accounts for 39.32 million barrels per day (48.11%), from which 26.034 million barrels per day (31.85%) corresponds to OPEC countries participating in the cuts, and 13.29 million barrels per day (16.26%) corresponds to Non-OPEC countries participating in OPEC+ agreements.

De la producción de la OPEP+, 26,034 million barrels per day, el 31,85% corresponden a la producción de los países OPEP que participan de los recortes, mientras que 13,29 million barrels per day, el 16,26% corresponde a los países No-Opep que participan de los acuerdos de la OPEP+.

Production cuts

In compliance with the agreements of the 15th OPEC+ Meeting, for June 2021, a relaxation of 350 thousand barrels per day (thousand barrels per day) of oil in the group’s cuts came into effect, placing the total cut at 6.2 million barrels per day; while for July the total cut remained at 5.759 million barrels per day, after a relaxation of 441 thousand barrels per day.

From August onwards, monthly flexibilities will be applied. In this way, monthly cuts will be 5.359 million barrels per day, in September 4.959 million barrels per day, in October 4.559 million barrels per day, in November 4.159 million barrels per day and in December 3.759 million barrels per day, closing the year with a decrease of 5.94 million barrels per day to the original cut of 9.7 million barrels per day, which began on May 1st, 2020.

At the same time, Saudi Arabia will continue with the progressive reduction of the additional and voluntary 1 million barrels per day cut it had implemented in its oil production between February and April 2021. The Saudi Kingdom recovered 350 thousand barrels per day (thousand barrels per day) of its production quota in June -which had an increase of 148 thousand barrels per day- due to the relaxation in its production cut, leaving its additional and voluntary cut at 400 thousand barrels per day. For July, Saudi Arabia will return 400 million barrels per day to its oil production, ending its additional voluntary cut.

Thus, OPEC+ oil supply for July will stand at 42.45 million barrels per day due to the relaxation of the cuts by the group and Saudi Arabia, while in August, it will be 42.85 million barrels per day.

Compliance

The OPEC+ production cut for June was 6.588 million barrels per day, which means compliance of 106.26% over the 6.2 million barrels per day agreement. If we add to this the voluntary cut by Saudi Arabia, then the total cut by the OPEC+ group of countries was 6.988 million barrels per day, bringing compliance to 112.7%.

The production cuts of the 10 OPEC countries (OPEC-10) (Angola, Saudi Arabia, Algeria, Congo, Gabon, Equatorial Guinea, United Arab Emirates, Iraq, Kuwait and Nigeria) reached 4,411 million barrels per day. This includes 400 thousand barrels per day of Saudi Arabia’s unilateral cut and the additional cut of 183 thousand barrels per day by Angola -to compensate for the overproduction presented by the African country in the second quarter of 2020- and 155 thousand barrels per day in Nigeria’s production. With this, compliance with the cut by OPEC-10 countries, without the additional and voluntary Saudi cut, was 110%.

On their side, Non-OPEC countries, signatories of the DoC, the production cut was 2,127 million barrels per day, with an overproduction of 73 thousand barrels per day by Russia, on the one hand, and an additional cut of 59 thousand barrels per day in its production by Malaysia, on the other, reaching compliance with the cut of 97.12%.

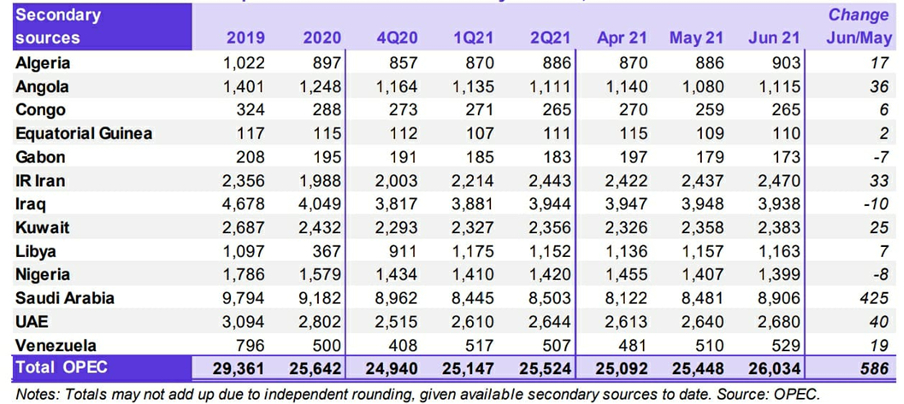

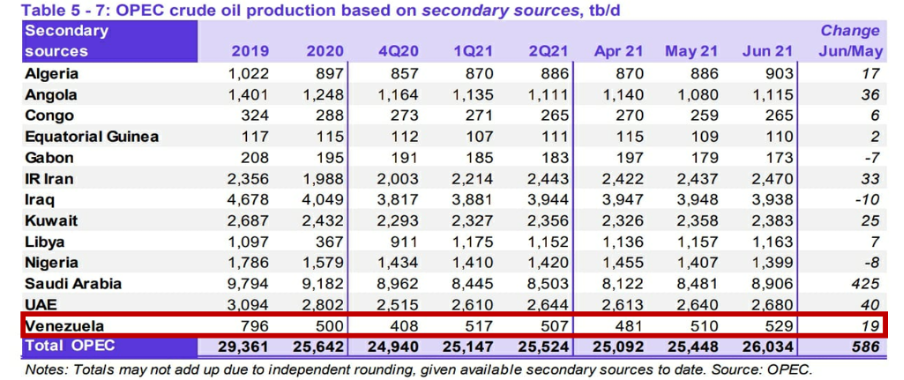

OPEC Production

According to OPEC’s July 15th MOMR data, OPEC member countries’ oil production as of June was 26,034 million barrels per day – its highest level in 14 months – an increase of 586 million barrels per day over May, as a result of both the 277 thousand barrels per day easing for the month, as well as 350 thousand barrels per day from Saudi Arabia’s easing of its voluntary cut of 1 million barrels per day.

OPEC PRODUCTION

(June 2021)

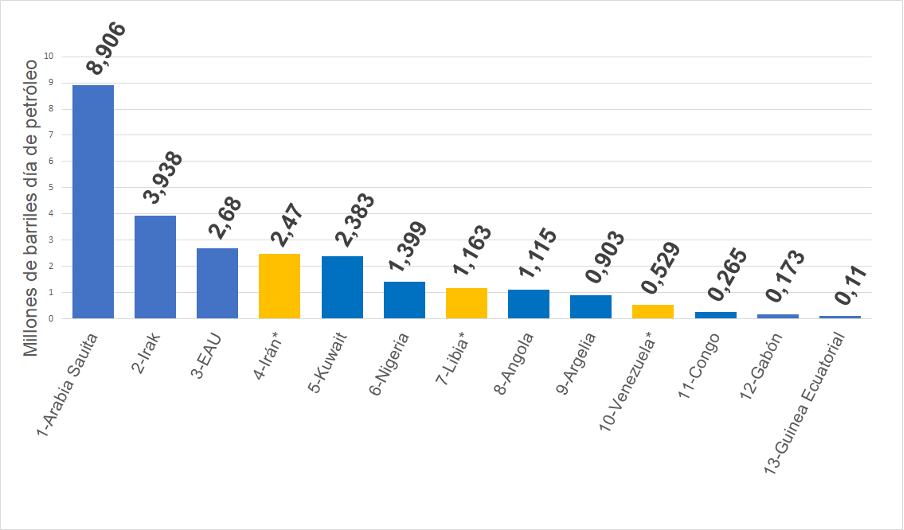

Saudi Arabia, together with the Persian Gulf countries (excluding Iran), United Arab Emirates, Kuwait and Iraq, added production of 17.9 million barrels per day -showing 475 thousand barrels per day more than in May-, corresponding mainly to Saudi production, which represents 68.78% of OPEC production, as well as 45.58% of OPEC+ and 21.96% of world oil production.

Nigeria and the rest of the African countries (excluding Libya), Angola, Algeria, Congo, Gabon and Equatorial Guinea, presented a production of 3.965 million barrels per day -showing 157 thousand barrels per day less than the previous month-, representing 15.23% of OPEC production, 10.09% of OPEC+ production and 4.86% of world production.

For their part, Iran, Libya and Venezuela, the three OPEC countries exempt from production cuts, presented a combined production of 4.162 million barrels per day, of which 2.47 million barrels per day (59.35%) corresponds to Iran, equivalent to 9.49% of OPEC production and 3.03% of world oil supply. Libya produced 1.163 million barrels per day (4.48% OPEC and 1.43% world) and Venezuela 529 thousand barrels of oil per day (2.03% OPEC and 0.65% world).

These results indicate that the organization made a redistribution of production quotas, with the increase of UAE based on the production quota of Venezuela. This country has not been able to reach the production quota corresponding to 11% of OPEC production and, which, in 2013, was equivalent to 3.1 million barrels of oil per day.

The collapse of Venezuelan production (2.5 million barrels per day between 2014-2021) has not been recovered. Unlike Iran and Libya -countries that have proven to be capable of recovering their production capacities in a short period – Venezuela has not been able to increase its production. Thus, the country is not in the best position to request respect for its 11% quota, as established since the system was implemented in the 1980s.

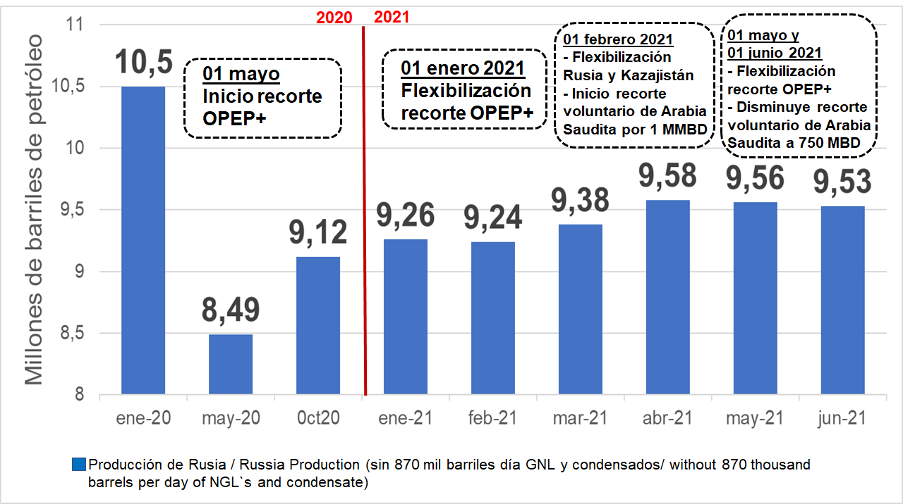

Russia

According to data published by the Ministry of Energy of the Russian Federation, the country’s oil production in June -without condensates and NGLs- stood at 9.53 million barrels per day, 30 thousand barrels per day less than in May, but still with an overproduction of 73 thousand barrels per day concerning its production quota in the OPEC+ cuts, which has been the constant since the third quarter of last year.

Russian oil production has increased by 1 million barrels per day, or 12.05%, from its production levels a year ago, thanks to OPEC+’s policy of easing cuts. However, it still sits 0.97 million barrels per day – 8.24% – below its record production levels of January 2020, pre-COVID-19.

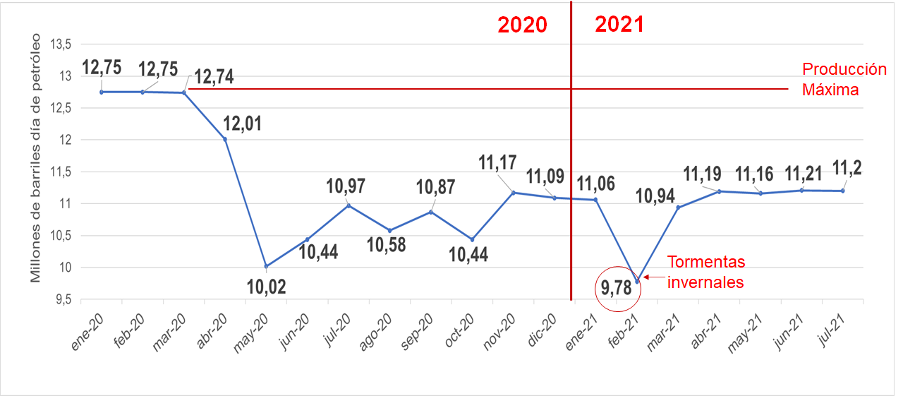

RUSSIA’S OIL PRODUCTION

-without LNG and condensates-

(May 2021)

Russia is moving forward to increase its production by developing oil reserves located in the Arctic. As we commented in our previous Newsletter, Russia’s strategic plan for geopolitical positioning in the region includes a new maritime transport corridor between Europe and Asia -the North Sea route-, an alternative to the Suez Canal.

Last July 22nd, the Business Standard newspaper reported that, according to Russian government sources, an investment of between 2 and 3 billion dollars by the E&P company ONGC Videsh Limited, a subsidiary of the Indian state oil company Oil and Natural Gas Corporation Limited, for the exploration and production of oil and gas in several fields offered by the Russian government, especially in the Arctic, in the Vostok project, with production estimates of 733 million barrels of oil per year (2 million barrels per day). ONGC Videsh owns 26% of Russia’s CSCJ Vankorneft, the license owner in the Vankor and North Vankor fields – Vostok project – both in northern Siberia, with estimated recoverable reserves, as of January 1st, 2019, of 3.1 billion barrels of oil.

United States

U.S. oil production has been stable since November 2020 -except for February 2021, affected by winter storms-, presenting a record of 11.21 million barrels per day in June, with a projection for July that does not vary the volume, as reported by the EIA in its July 7th Short-Term Energy Outlook (STEO).

U.S. OIL PRODUCTION.

-Excluding condensate, NGLs, and unconventional liquids.

(January 2020 – June 2021)

For the week of July 23rd, no significant variations have been registered in the 2021 volumes -except for those presented in February-, presenting a production of 11.4 million barrels per day, the highest of the year, according to the EIA’s weekly report of July 28th.

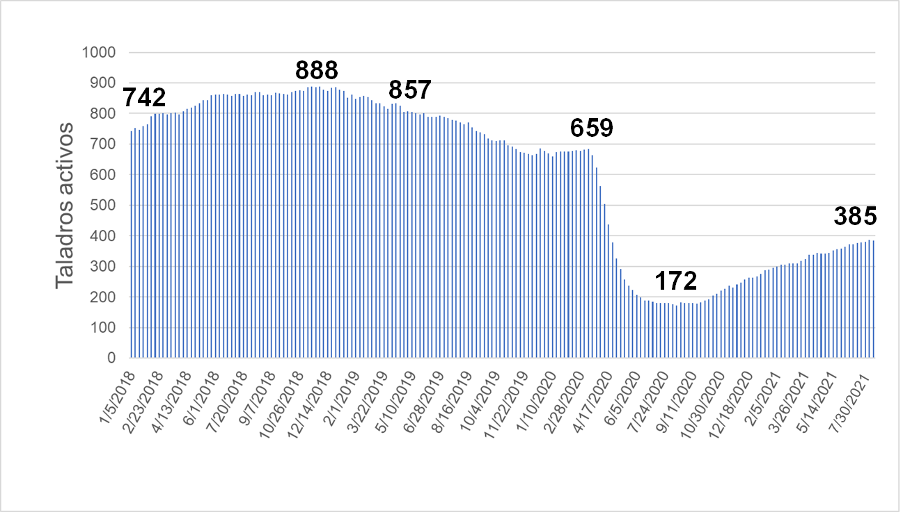

Drilling

The number of active drills registered in the U.S. as of July 30th was 385 -two less than on July 23rd-, which brought the activity record to 32 drills above the May 21st, 2021 figure and 204 more than a year ago, maintaining the rise it has been presenting since the fourth quarter of 2020, according to Baker Hughes, being the highest activity record since the OPEC+ production cut began, in May last year.

ACTIVE DRILLS IN THE US.

(January 2018 – July 30th, 2021)

Prospects for oil production in the U.S.

As commented above, the shale oil producers sector, unlike the large North American producers and transnational companies, needs permanent financial investment, supported by hedge funds and quick return financing, to sustain their operations and pay their financiers in a short time. This is the characteristic of independent and medium-sized shale oil producers.

For this reason, the estimates of U.S. energy authorities and industry analysts estimate that U.S. oil production in 2021 will remain around 11 million barrels per day, with a maximum of 11.4 million barrels per day for December. However, the EIA surprised with upward forecasts for 2022, estimating that as of September next year, U.S. production will, once again, be above the historic 12 million barrels per day barrier -something that only occurred between August 2019 and April 2020-, forecasting to close 2022 with a production of 12.3 million barrels per day.

The forecasts made by the statistics and information agency of the U.S. Department of Energy are striking, although the White House has launched its «Green New Deal» energy policy and is preparing legislative and fiscal packages to discourage the country’s hydrocarbon producers.

POLITICS

Iran-US: An agreement that awaits the installation of the new Iranian government

The government shift in the Islamic Republic of Iran, after the departure of a reformist president and the arrival of a conservative leader, will not change the result of the negotiations between the country and the U.S., within the framework of the Commission of the Joint Comprehensive Plan of Action (JCPOA) -the Iran nuclear agreement, approved and signed in July 2015 at the U.N. Security Council-, respecting and continuing the progress that has been achieved.

This was stated on July 18th, by the Iranian parliamentarian Abolfazl Amuei, member of the National Security and Foreign Policy Committee of the Mayles, amid a series of announcements within the current Iranian administration. Also, Iran’s Deputy Foreign Minister for Political Affairs and top Iranian representative in the rounds of negotiations in Vienna, Seyyed Abbas Araqchi, warned that «the talks in Vienna will have to wait for our new administration».

However, Amuei warned that the negotiations with the U.S. are «far from» Iranian expectations, becoming the first statement by either side to cast doubt on the agreement.

The White House, for its part, has not changed its intention to insist on the diplomatic route for Iran to return to the JCPOA nuclear agreement. The U.S. government sees the JCPOA as a way to «keep Iran’s nuclear program under control». Along these lines, the Department of State spokesman, Ned Price, declared on July 13th that, since the United States withdrew from the JCPOA, «none of the challenges we have with Iran, which are many, have improved». In this way, it is clear that the Biden administration intends to continue negotiations with Iran until reaching an agreement of «mutual return to compliance (with the JCPOA).»

Price’s statements were made, although the United States has not been in the JCPOA, and despite the pressure from conservative sectors, the Israel lobby and the Gulf monarchies pushing to break-off negotiations with Iran and to apply more sanctions. In this sense, the Biden administration is convinced that the JCPOA agreement «presents the best means to control Iran’s nuclear program in a verifiable and permanent manner».

«Green New Deal»

Although the energy policy of reducing fossil energy production in the U.S. -known as the «Green New Deal» – has become the policy of the new U.S. administration and its concrete response to the expressed commitment to Climate Change and the Paris Agreement, the EIA – the information agency of the Department of Energy (DOE) – estimates that oil production in the U.S. will have an unexpected increase of 200 thousand barrels per day by 2021 and 900 thousand barrels per day by 2022, which, at first glance, seems a contradiction within the government.

These EIA estimates call into question or contradict the results of the various initiatives taken by the Biden administration in developing its new energy policy. It would seem that we are in the presence of a confrontation between the powerful oil sector of the country and the White House, at a time when the legislation and the tax system on hydrocarbons could take an unprecedented turn in U.S. history, amid an intense confrontation between the government of Joe Biden and the Republicans in 13 states.

On April 11th, several news agencies reported that the Biden administration had prepared a legislative plan to limit drilling rights in the U.S. The plan will include significant changes – typical of an oil-producing country – such as increasing the royalty rates paid by companies to extract fossil fuels and revising financial bonds. In this way, the Government aims to guarantee that the taxpayers obtain a «fair return» from the hydrocarbons extracted from federal lands. It seems that the U.S. administration is in search of resources to sustain its various economic policies while discouraging hydrocarbon production activity in the country.

In an undercover investigation by Greenpeace, two investigators of the environmental organization managed to interview the senior director of governmental affairs of the U.S. oil company ExxonMobil, Keith McCoy. He assured that the transnational had «worked» to «weaken» essential aspects of the energy plan of U.S. President Joe Biden, meeting with influential Democratic congressmen to «narrow» Biden’s plan and «remove negative things», such as the payment of taxes.

On July 15th, Biden launched the largest anti-poverty program in U.S. history, where 39 million families earning less than 150,000 dollars a year and having children will receive credit assistance of 300 dollars a month for each child; a plan that, for the time being, will be maintained until December of this year. «We continue to build an economy that respects and recognizes the dignity of working-class families and middle-class families,» stated Joe Biden during the launch of the plan.

Biden has stated that the funds to sustain this program will come from the most powerful sectors of the American economy through reforms in its fiscal policy. «We can pay for it – the program – by getting the people at the top and the big corporations, more than 50 of those that didn’t pay taxes last year, to finally, simply, start paying their fair share,» the U.S. president explained.

The Secretary of the Department of the Interior, Deb Haaland, affirmed that she does not believe that there is a plan for a permanent ban on new licenses, assuring that «oil and gas production will continue in the future and we believe that is the reality of our economy and the world we live in». Energy corporations are among the 50 companies to which President Biden referred.

This whole situation develops after, July 15th, the Federal Judge of Louisiana, Terry Doughty, blocked at the request of the (Republican) Attorney General of Louisiana the suspension of the license for exploration and production of hydrocarbons in the Arctic National Wildlife Refuge of Alaska. The Biden administration had taken such action due to the moratorium on hydrocarbon activities signed last January 20th.

The above, under the argument that a new environmental review was needed in the refuge to determine the adequacy in granting the license conceded in 2017 under Trump’s administration. The refuge of nearly 20 million acres is home to significant wildlife, including polar bears, birds, reindeer and other species. Judge Dougthy’s action encompasses the suspension of licensing on all federal lands – which was signed by Biden on January 27th – ordering the continuation of delayed sale plans, such as Chevron Corporation’s sale in the waters of the Gulf of Mexico.

The Biden administration has not made any pronouncements but has acknowledged its dependence on fossil fuels. On the Republican side and the side of the corporations, they assure that Judge Doughty’s ruling covers the entire U.S. territory.

It remains to be seen whether the Biden administration will be able to overcome the influence of the country’s powerful oil sector and the energy transnationals to move forward with its «Green New Deal» energy policy and its tax reform -both emblematic aspects, flags of a broad Democratic sector that supported his candidacy- to finance its programs to combat poverty and maintain its commitment to the Paris Agreement.

ECONOMY

The recovery of the global economy during the first half of 2021 continues, albeit at an alternating pace. Except for China, the pandemic has continued to affect growth in emerging and developing economies. Nevertheless, the global economic growth forecast for 2021 ranges from 5.4% by the United Nations Department of Economic and Social Affairs (UN-DESA) to 6% as determined by the International Monetary Fund.

According to OPEC’s MOMR, part of the growth dynamic expected for the second half of this year is also expected to carry over to 2022, when a 4.1% growth is expected. The above, in an environment with less fiscal and monetary incentives, where growth rates will be slightly lower than the current ones.

Progress in controlling COVID-19 in developed economies (particularly the United States) and China has gradually recovered global economic growth. With the Americans and the Chinese already recording positive growth figures in the first quarter of 2021 (6.7% and 12.7%, respectively), the Eurozone and the United Kingdom’s economic revival have increased trade flows and productive activity.

As a result, world trade continues to grow due to the renewed dynamism of economic activity. According to the CPB World Trade Index, in April, world trade volumes rose by 25.3% year-on-year, following a 9.9% year-on-year increase in March.

However, the current difficulties related to the pandemic in several economies, even with high vaccination rates, the inflationary threats in the United States and Europe, and the rises in lending rates, have raised the alarm about a possible slowdown in the expected economic recovery, especially considering that sovereign debt in many countries has risen to such an extent that a rise in interest rates could cause fiscal tightening and constraints on the economy.

All of the above contributes to a possible slowdown in the economic recovery, especially considering that the sovereign debt of many countries has increased so that an increase in interest rates could cause fiscal restrictions and limitations to growth.

Some emerging economies have begun to benefit from increased demand for raw materials, as well as improved commodity prices.

The travel and tourism sector has also contributed to the rebound in economic activity in the Eurozone and some Asian economies, supported mainly by the rebound in China. In the United States, the significant rebound in travel and transportation led to an increase in demand for automobiles, light vehicles, trucks and related services, contributing to the demand and the increase in energy prices.

COVID-19

While trying to normalize its productive activity, with the leading economies undergoing massive inoculations and most developing countries without the necessary vaccines, the world faces an upsurge in the number of COVID-19 infections.

In particular, is people who, for various reasons, have not yet received both doses of vaccines against the coronavirus. Many of them are affected by the powerful «Delta» variant. The viral mutation became the most widespread and dangerous on the planet, given its aggressiveness in the organism.

The «Delta» variant is the most resistant to antibodies and has the highest transmission speed. Its rapid spread represents a threat to anyone who has not been vaccinated, including young people and children. In addition, its aggressive spread threatens to halt the progress achieved in the productive spheres in many places, including developed countries.

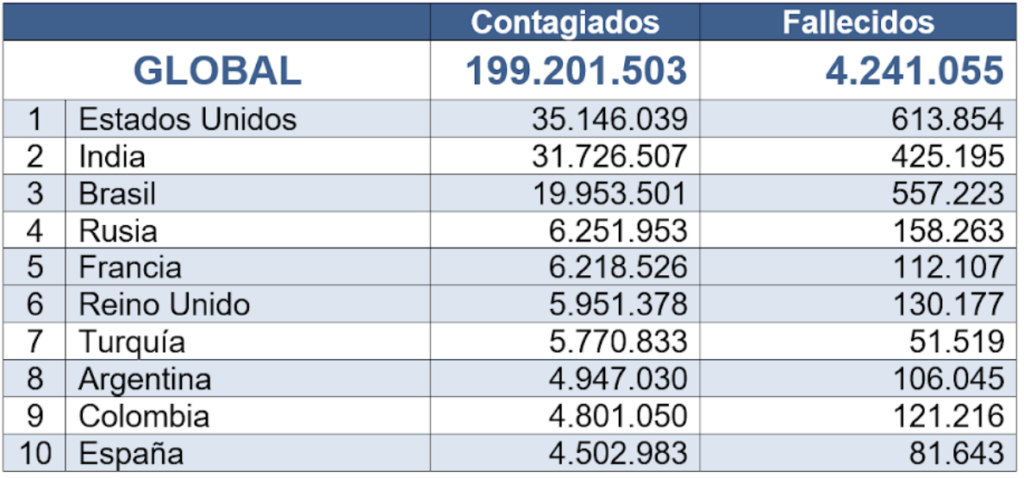

Worldwide infections and deaths

As of 03/08/2021, the number of people infected by COVID-19 worldwide is estimated at 200 million, while the total number of deaths is 4.2 million.

COUNTRIES MOST AFFECTED BY THE PANDEMIC

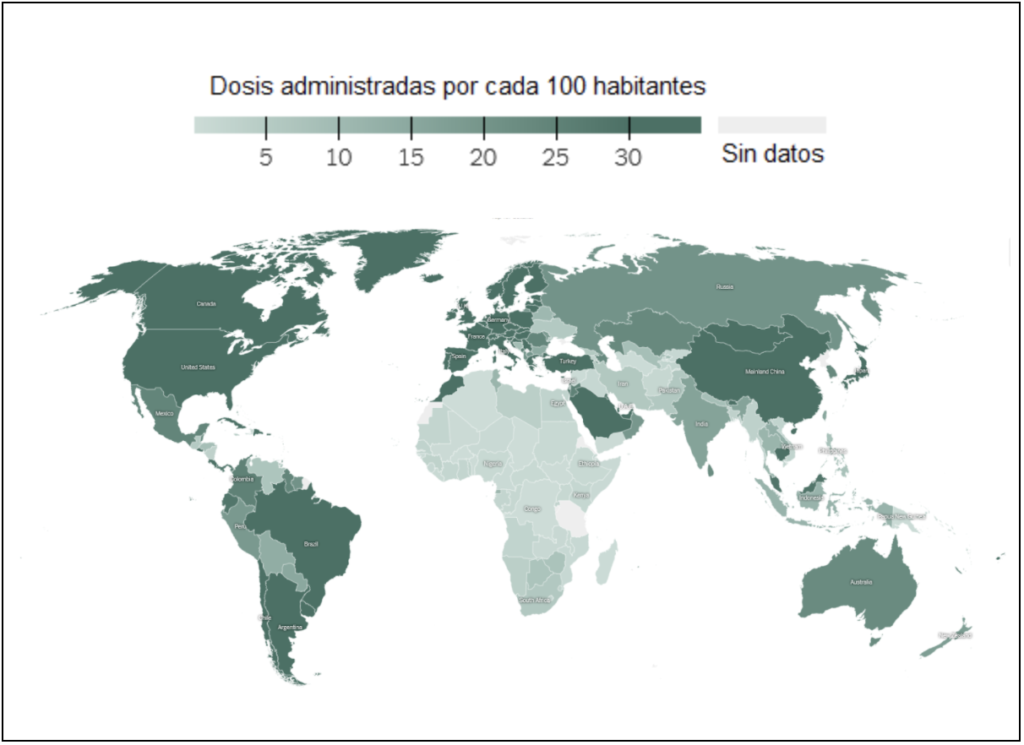

Global Vaccine Distribution

To date, more than 4.2 million doses have been administered worldwide, equivalent to 56 doses per 100 people, nearly double the previous month’s figures. The gap between vaccination programs between developed and developing countries remains, with many of the poorest countries still without even the first dose provided to their citizens.

The highest performing countries in terms of mass vaccinations are the United Arab Emirates, with 172 doses per 100 inhabitants (already administering second doses), followed by Malta (151/100) and Bahrain (142/100).

In the northern hemisphere, Canada leads (132/100), followed by the United Kingdom (128/100) and the United States (105/100), with the highest coverage among the large economies. Malta is the best performer within the European Union, followed by Belgium and Denmark (both 127/100). The Russian Federation still with a low rate of doses supplied (43/100).

In Latin America and the Caribbean, Uruguay leads (139/100), followed by Chile (135/100) and the Dominican Republic (94/100). Cuba (87/100) doubled its vaccination rate in one month, thanks to its vaccine, Abdala. The three most populous countries in the region, Argentina (72/100), Brazil (68/100) and Mexico (53/100), continue to vaccinate, although at a lower rate than required.

Venezuela is far behind the rest of the countries, with only 14 vaccinated per 100 inhabitants, where 10% of the population has received the vaccine, and only 4% have received the two doses required for immunization.

Africa continues to be the region with the fewest vaccinations, with Morocco (67/100), Tunisia and Equatorial Guinea (both 23/100) standing out, while the rest of the countries average less than 5 per 100 inhabitants.

In Asia, Mongolia leads (129/100), while China reached 121 doses per 100 inhabitants, followed by Turkey (89/100), Saudi Arabia (81/100) and Japan (71/100). India, lagging (35/100), continues to face a high number of infections and the effect of the Delta variant, identified initially on its territory.

OIL DEMAND

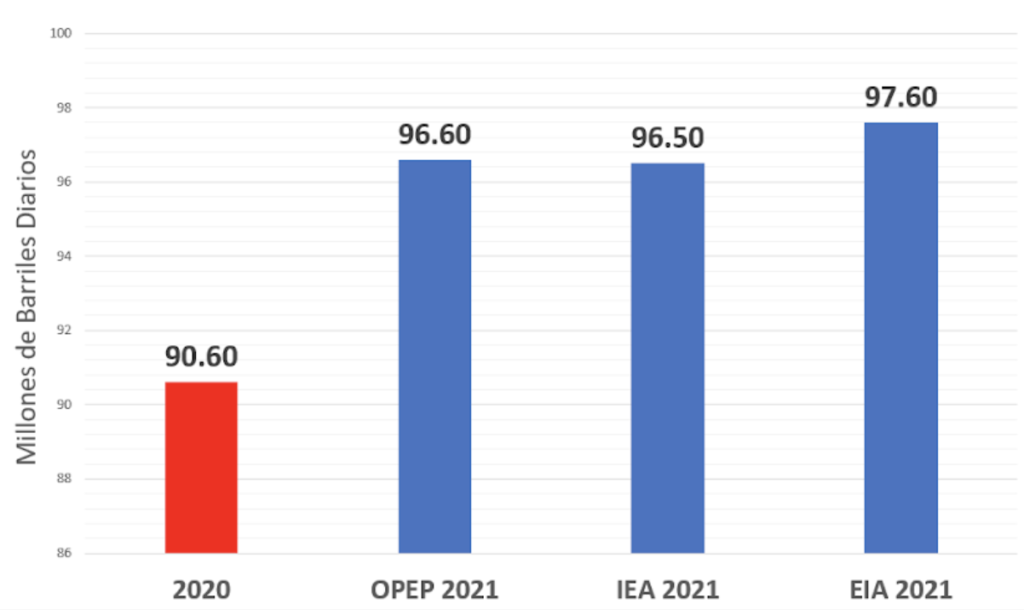

According to the June 2021 MOMR, global oil demand increase by 5.95 million barrels per day, unchanged from last month’s estimate.

As for total oil demand, OPEC project it at 96.6 million barrels per day, although the first quarter was revised downward due to lower-than-expected demand in major consuming industrialized countries. This was offset by better-than-expected data in the United States during the second quarter, likely to continue into the next quarter. The International Energy Agency (IEA) also maintained its forecast at 96.5 million barrels per day. In comparison, the U.S. Energy Information Administration (EIA) revised it down slightly (-0.1) from the previous month to 97.6 million barrels per day, respectively.

WORLD OIL DEMAND

(2020 – 2021)

All three agencies maintain their assumptions of higher oil demand for the second half of 2021, driven by higher production activity in OECD countries and China, and supported by the economic stimulus programs implemented and by higher mobility due to the summer vacation season, in a scenario of minimal travel restrictions.

For OECD countries, oil demand is forecast to increase by 2.7 million barrels per day to 44.7 million barrels per day by the end of the current year. Compared to 2019, the figure is almost 3 million barrels per day lower than pre-pandemic demand due to the limited recovery in transportation fuel consumption, particularly for aircraft. The United States is also expected to lead the recovery in demand in the American hemisphere, thanks to increased demand for gasoline and diesel, with light distillates also expected to contribute.

Outside of OECD countries, oil demand is forecast to increase by 3.3 million barrels per day to 51.9 million barrels per day by the end of 2021. This figure is almost 0.4 million barrels per day lower than total demand in 2019, even considering the eventual increase in demand in China and India and the steady rise in demand for industrial and transport fuel.

By 2022, a scenario is envisaged where global economic recovery and growth continue while COVID-19 is expected to have been contained. Thus, oil consumption is expected to be at levels comparable to pre-pandemic levels. Thus, OPEC forecasts world oil demand to increase by 3.3 million barrels per day on a year-on-year basis, while total world oil demand could reach and exceed 100 million barrels per day.

Of this 3.3 million barrels per day increase, 1.5 million barrels per day will come from OECD countries, even with the United States leading the increment. The remaining 1.8 million barrels per day will come from non-OECD countries, with China and India driving the increase, even exceeding pre-pandemic levels. Sustained recovery is expected to begin in other regions, such as Latin America, the Middle East and some Asian countries.

All forecasts for the second half of 2021 and 2022 remain subject to uncertainty related to COVID-19 (the current Delta variant, other variants that may appear, as well as possible complications related to mass vaccinations).

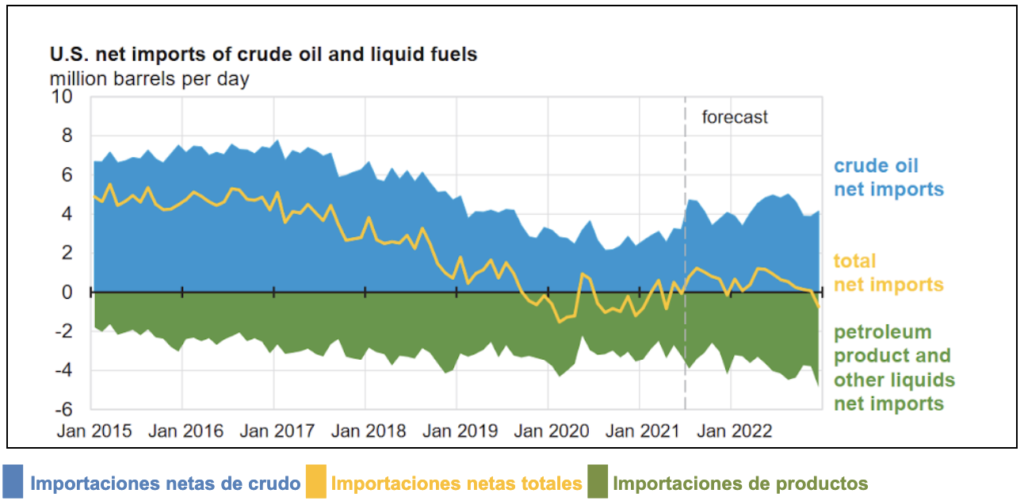

United States

According to OPEC, for April, U.S. monthly demand increased by approximately 4.8 MMDB y-o-y, reaching 19.85 million barrels per day and recovering from losses suffered during the 2020 downturn. However, this was 900 thousand barrels lower than April 2019.

The rebound is supported by higher gasoline (+2.9 million barrels per day) and jet fuel (0.6 million barrels per day) requirements. Both recovered after a drastic decline due to movement restrictions during the pandemic.

Diesel demand, meanwhile, increased by 0.5 million barrels per day in April 2021, levelling with April 2019 values. Preliminary data for May projects continued recovery in transportation fuels.

U.S. NET IMPORTS OF CRUDE OIL AND LIQUID FUELS

(million barrels per day, Projected March 2021- December 2022)

China

China’s General Administration of Customs reported that its economy maintains «steady growth and solid momentum»-showing a 27.1% annual rise in imports.

China’s oil demand in May increased by about 1.0 million barrels per day y-o-y compared to April’s 1.6 million increase. This, due to the magnitude of the same months’ decline in 2020, but 700 thousand barrels per day higher than May 2019.

The growing mobility in the Asian nation increased gasoline consumption (600 thousand barrels). Likewise, jet fuel demand registered a year-on-year increase of 0.3 million barrels per day due to increased flights, placing it on par with May 2019 levels. The petrochemical industry demanded more feedstock, particularly LPG (+0.4 million barrels per day y-o-y), used in propane dehydrogenation (PDH) plants, and increased cracking processes.

Oil demand is still expected to increase during the second half of the year, driven by the positive economic outlook and the return of mobility to pre-pandemic levels. The latter also implies higher vehicle sales and more miles driven, leading to higher gasoline consumption. Due to developments in industrial activity, petrochemicals, construction and agriculture, diesel and light distillates should also see significant increases.

By 2022, China’s oil demand is projected to exceed 2019, driven by sustained economic growth, albeit conditioned in part by fuel quality and emissions reduction programs, limiting the increase.

India

India’s oil demand declined by 30 thousand barrels per day y-o-y in May 2021 (down 800 thousand barrels per day compared to May 2019) after increasing by nearly 1.6 million barrels per day in April. The above, due to the increase in COVID-19 cases towards the end of April and during May, caused limitations in productive activity and the mobility of people.

In this context, the consumption of transportation fuels was affected, as well as for the diesel used for productive activities and goods transportation.

However, it is still expected that eventual relaxations in mobility, higher industrial production, and economic activity resumption will boost oil demand for the second part of 2021, provided that COVID-19 infections are controlled. Such an increase would comprise higher diesel consumption in the construction and agriculture sectors, an increase in transportation fuels, and middle distillates such as diesel.

According to OPEC, in terms of projections for 2022, India should increase by about 0.3 million barrels per day, surpassing pre-pandemic levels, supported by effective containment of the pandemic and sustained increase in Gross Domestic Product.

OIL STORAGE

One of the most evident signs of oil market stabilization is the draining of oil and oil product inventories. The trend continues to point to inventory drains in 2021, below the record levels reached in 2020 and below the average over the 2015-2019 period, higher than the increase in oil product storage over the same period.

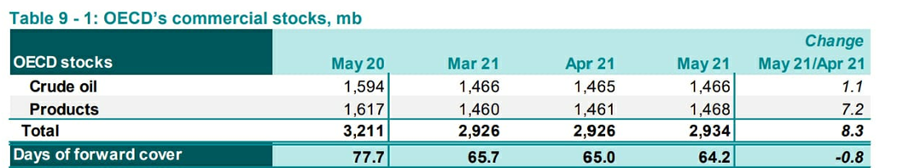

OECD countries

According to the MOMR, OECD countries’ commercial crude oil and product inventories adjusted their data, standing at 2.934 million barrels in May, 8.3 million barrels higher than in April and March, but falling by 277 million barrels from the same period in 2020 and 86.6 million barrels below the 5-year average. Days of inventory coverage was 64.2 days, down 0.8 days from April and 13.4 days, lower than in April 2020.

According to OPEC data, all OECD countries, except the U.S. – down 9.6 million barrels – showed an increase in crude inventories and product storage.

OPEC: CRUDE INVENTORIES IN OECD COUNTRIES

(April 2020 – April 2021)

Of the total OECD commercial inventories, 1,466 million barrels correspond to crude oil, presenting an increase of one million barrels in April of this year, placing 128 and 60.8 million barrels of oil below May 2020 and the average of the last five years, respectively.

Meanwhile, 1,468 million barrels of commercial inventories correspond to oil products, presenting an increase of 7 million barrels to April and 25.9 less than the average of the last five years, despite presenting a drop of 148.9 million for April 2020.

For its part, in EIA’s STEO of July 07th, they estimated in 2,88 million barrels the total inventories of crude oil and oil products in the OECD countries for May, foreseeing the existence of a monthly and annual decrease of 5 and 322 million barrels, respectively.

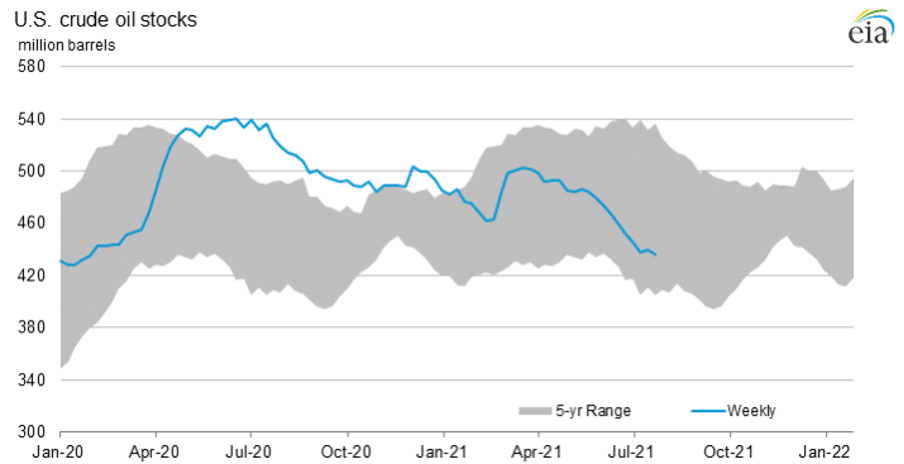

United States

Since June 04th, U.S. commercial crude oil inventories had a drain of 38.43 million barrels, to stand at 435.6 million barrels as of July 02nd, according to data from the EIA weekly report of July 28th, presenting an annual decrease of 90.37 million barrels of crude oil. So far in 2021, U.S. commercial inventories have fallen 49.86 million barrels, despite presenting an increase of 16 million barrels in storage between February 19th and April 19th, a product of the winter storm that affected oil operations in Texas and Louisiana.

In July 2021, commercial stocks were at 438.75 million barrels, draining less volume than the previous month, down 10.53 million barrels from June and 37.1 million barrels from January of this year, placing 29.6 million barrels below the 5-year average.

COMMERCIAL INVENTORIES OF U.S.CRUDE OIL

(January 2020 – July 28th, 2021)

The trend for U.S. crude oil inventories in 2021 is downward, adjusting the year-end projection to stand at 441.05 million barrels.

By July 23rd, cover days fell to 27.2 days, when the June average was 29.2 days. Between the end of February and March 19th, 2021, days of coverage were above 40 days, registering on March 12th the historical record of 41.8 days.

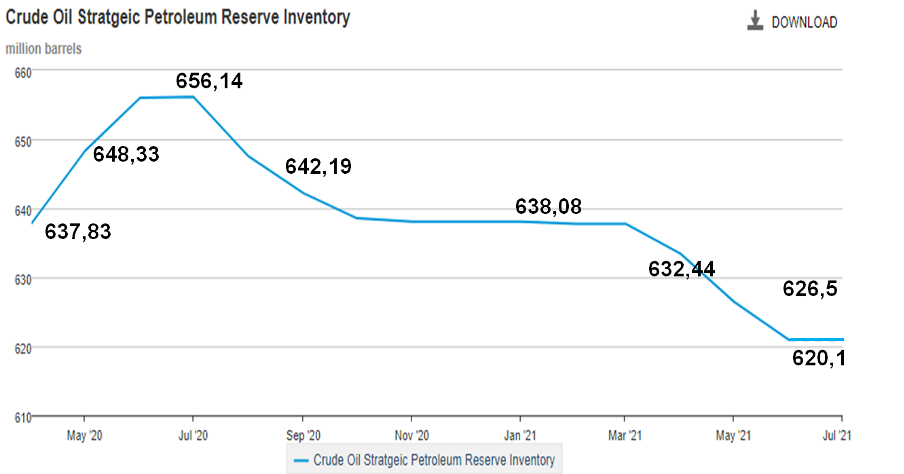

The strategic reserves are at 621.3 million barrels, without presenting modifications in their July levels. The last changes registered were on June 25th, when they drained 5.2 million barrels, presenting an annual drop of 34.8 million barrels over their highest level.

In April 2020, former U.S. President Donald Trump authorized the use of strategic reserves to store production excess to prevent the shutdown of their production, in the face of the collapse of the Cushing Oklahoma, which, since November 2020, has been draining inventories, falling to 35.443 million barrels, its lowest volume since November 2018.

STRATEGIC OIL RESERVES

U.S. STRATEGIC PETROLEUM RESERVES

(May 2020-July 2021)

Although the EIA estimates show no variation in strategic reserves for July and August, the year-end forecast is downward, forecasting 616.67 million barrels in 2021.

VENEZUELA

Oil production remains stagnant at 1930 levels.

According to data published in OPEC’s latest Market Monitoring Report (MOMR), issued on July 15th, oil production in Venezuela for June remains stagnant at 529 thousand barrels per day of oil, a drop of 2.484 million barrels per day, 82.39%, concerning the country’s average production of 3.015 million barrels per day as of 2013.

OIL PRODUCTION IN OPEC COUNTRIES

(June 2021)

The collapse of the country’s oil production, which occurred between 2014-2021, has set our productive capacities back to 1930, a setback of 90 years.

Since the government installed the ARA Commission in February 2020, oil production remains stagnant at these historical minimum levels of 500 thousand barrels per day, placing it 37.19% below the 2019 average.

The current level of oil production places Venezuela in tenth place in the ranking of OPEC oil producers, five places below the fifth place the country occupied within the organization in 2013 when the country’s average production for that year was 3 million barrels per day.

OPEC COUNTRIES PRODUCTION RANKING

(June 2021)

If Venezuela’s current production is transferred to 2013, with the countries that formed the organization at that time, the country would be in the last place in the organization’s ranking of producers. If it is not now, it is because of the presence in OPEC of small producers from Africa. The reality, no matter the attempts of the current Minister of Petroleum to make people believe that the country is today an influential player in OPEC, shows Venezuela without any ascendancy within the organization and in the international oil market.

The influential Venezuela in international oil policy, which the world approached, respected, listened to and consulted since the very foundation of the organization in 1960, no longer exists. Today, the government’s word on oil matters has no relevance in OPEC meetings or in any aspect of the international oil policy.

This political weakness of the country and the inability to comply with the production quotas corresponding to the country -11% of OPEC’s total production- has caused that, in the discussion opened by the United Arab Emirates, in its demand for a greater production quota, the organization has decided -de facto- to redistribute the country’s quota, to assign extra volumes to the UAE.

Despite the government’s failure to manage and direct the national oil industry, the ARA Commission has not shown any plan to remedy this debacle. The oil minister only promises to increase the country’s production to 1.5 million barrels per day by December this year, a promise that lacks technical-political foundations, like the previous ones made by the government.

The government set its hopes on private transnational capital, coming to participate in the oil production in terms that violate the legal framework and protected by the «secrecy» of the so-called «anti-blockade law». Basically, a process of auctioning PDVSA’s assets by using the reform of the Hydrocarbons Law prepared by the National Assembly.

However, the international oil companies do not respond to the government’s call and continue abandoning the country and its production assets, as happened recently with the French Total and the Norwegian Equinor, and previously with Rosneft (Russian Federation). In contrast, the rest of the international partners present in the country maintain zero activities, waiting for a change in the political situation.

Total Energies and Equinor out of Petrocedeño

On July 27th, the French oil company Total Energies and the Norwegian Equinor ASA (formerly Statoil) announced that they were withdrawing from the Petrocedeño joint venture. PDVSA had a 60% participation, thus abandoning their operations in the country.

In this way, the European oil companies abandon Petrocedeño, a Joint Venture formed in 2007 to develop the Junín 5 block of the Orinoco Oil Belt, after migrating the Oil Opening Agreements. The presence of oil companies as minority partners of PDVSA in the joint ventures was an objective of the Full Oil Sovereignty policy and the Organic Hydrocarbons Law, which recognized the contribution of private international partners under the Constitutional legal framework in force, for the development of the Orinoco Oil Belt.

In 2007, production in the Orinoco Oil Belt was 698 thousand barrels per day. After the nationalization and the creation of the Mixed Companies, the production of this oil region – home to the largest oil reserves in the world – reached 1,274 million barrels of oil per day in 2013, becoming the region with the highest growth and development prospects in the country.

The exit of the international oil companies, despite the government propaganda that pretends to turn it into a «success» and part of a nationalist policy, just evidences their failure in attracting the interest of international investors and partners, which are not willing to submit to the government’s improvisations and suffer the consequences of PDVSA’s operational collapse.

Gasoline queues continue

Even though the Minister of Petroleum, Tareck el Aissami, promised on June 21st, in an interview to the Bloomberg agency, that by the end of June, the fuel shortage in the country would cease, and that the «queues» of vehicles to get gasoline in the country would disappear. The reality, as we warned in our Bulletin of July 08th, is that the Minister lied. Both the shortage and the «queues» for fuel continue throughout the country.

Nothing of what the Minister assured was fulfilled. On the contrary, the situation continues to worsen. There is no fuel at all in the province, while in the capital, the queues are endless. This happens despite the fact that fuel distribution is in the hands of the military and that fuel is sold in dollars at international prices. Illegal fuel trafficking and a black market have been installed throughout the country, establishing quotas and prices for the sale of fuel at values far above the international market. Even in Caracas, it is possible to observe the sale of «pimpinas» – gasoline recipients, as was previously the case in the Colombian border cities.

The fundamental reason for this repeated failure of the government to supply the country’s domestic market and all its false promises lies in the fact that the country’s refinery circuit, which has an installed capacity of 1.2 million barrels per day, is paralyzed, today operating at less than 10% of its capacity, despite several failed attempts by the government to reactivate it.

As we have pointed out in previous Bulletins, in 2014, the country’s refining circuit managed to produce 1.1 million barrels per day of fuels, of which 694 thousand barrels per day for domestic consumption and 406 thousand barrels per day for export.

This absurd situation occurs in the country with the largest oil reserves on the planet, where PDVSA has always been able to supply the domestic fuel market -except for December 2002-March 2003 during the oil sabotage-. The government keeps in prison more than 120 workers and managers of the oil industry and has installed in the company a militarized regime of persecution and fear, while offering for sale, at auction prices, PDVSA’s assets -which in 2013 were valued at 231 billion dollars-, while its production infrastructure is dismantled to be sold -with the consent of the government- as scrap metal. This is the new business: selling the country for scrap.

BIBLIOGRAPHIC REFERENCES:

- [1] Comunicado de prensa, “19th OPEC and non-OPEC Ministerial Meeting concludes”, OPEP, 18 julio 2021.

- [2] Comunicado de prensa, “18th OPEC, non-OPEC Ministerial Meeting called off”, OPEP, 05 julio 2021.

- [3] Nota de prensa, “Manufacturing PMI® at 59.5%; July 2021 Manufacturing ISM® Report On Business®”, Cision PR Newswire, 02 agosto 2021.

- [4] Reporte, “Purchasing Managers Index for July 2021”, Oficina Nacional de Estadísticas de China, 02 agosto 2021.

- [5] Comunicado de Prensa, “OPEC daily basket price stood at $73.89 a barrel Monday, 2 August 2021”, OPEP, 03 agosto 2021.

- [6] Dr. Ayed S. Al-Qahtani, “Monthly Oil Market Report, 15 july 2021”, OPEP, 15 julio 2021.

- [7] Comunicado de prensa, “15th OPEC and non-OPEC Ministerial Meeting concludes”, OPEP, 01 junio 2021.

- [8] Publicación, “Declaration of Cooperation”, OPEP, 10 diciembre 2016.

- [9] Statistics”, Ministerio de Energía de Rusia, junio 2021.

- [10] Twesh Mishra, “India in talks with Russia for $2-3 bn investment in upstream oil assets”, Business Standard, 22 julio 2020.

- [11] “Short-Term Energy Outlook Data Browser”, Administración de Información Energética de EE.UU. (EIA), 07 julio 2021.

- [12] Weekly Supply Estimates”, Administración de Información Energética de EE.UU. (EIA), 28 julio 2021.

- [13] “North America Rig Count”, Baker Hughes, 30 julio 2021.

- [14] Joe Biden, “El Plan Biden Para Una Revolución De Energía Limpia Y Justicia Ambiental”, Joe Biden, octubre 2020.

- [15] Resolución 2231 (2015), Consejo de Seguridad de la ONU, 20 julio 2015.

- [16] Nota de prensa, “El próximo gobierno iraní no modificará sustancialmente el marco de las conversaciones nucleares”, Agencia de Noticias de Irán IRNA, 18 julio 2021.

- [17] Nota de prensa, “Las conversaciones de Viena deberán esperar a la nueva administración iraní”, Agencia de Noticias de Irán IRNA, 18 julio 2021.

- [18] Ned Price, “Department Press Briefing”, Departamento de Estado de EE.UU., 13 julio 2021.

- [19] “The Paris Agreement”, Convención para el Cambio Climático de la ONU, 2005.

- [20] Jennifer Dlouhy, “Biden continues his anti-U.S. oil and gas push while crude demand rises”, World Oil, 12 julio 2021.

- [21] Redacción, “La estrategia de ExxonMobil para debilitar la política climática de Biden”, Energía Hoy, 27 julio 2021.

- [22] Joe Biden, “Remarks by President Biden to Mark the Day That Tens of Millions of Families Will Get Their First Monthly Child Tax Credit Relief Payments Thanks to the American Rescue Plan”, The White House, 15 julio 2021.

- [23] Staff, “Biden lanza el mayor programa para combatir la pobreza en medio siglo”, Forbes, 15 julio 2021.

- [24] Executive Order 14008, Registro Federal de Archivos de EE.UU., 27 enero 2021.

- [25] Sala de Prensa, “Biden Promised To End New Drilling On Federal Land, But Approvals Are Up”, NPR, 13 julio 2021.

- [26] Sauel Chamberlain, “Federal judge blocks Biden moratorium on new oil, gas leases”, NY Post, 15 julio 2021.

- [27] Sala de Prensa, “Biden suspends oil-drilling leases in Alaska’s Arctic refuge”, NBC News, primero julio 2021.

- [28] “La situación económica mundial y las perspectivas a mitad de 2021”, Departamento de Asuntos Económicos y Sociales de la ONU, julio 2021.

- [29] “Informes de Perspectivas de la Economía Mundial”, Fondo Monetario Internacional, 27 julio 2021.

- [30] Reporte, “National Economy in the First Half Year Witnessed the Steady and Sound Growth Momentum Consolidated”, Oficina Nacional de Estadísticas de China, 15 julio 2021.

- [31] Weekly Stocks”, Administración de Información Energética de EE.UU. (EIA), 28 julio 2021.

- [32] Weekly Supply Estimates”, Administración de Información Energética de EE.UU. (EIA), 28 julio 2021.

- [33] Mayela Armas, “Maduro crea comisión para reestructurar petrolera venezolana PDVSA”, Reuters, 19 febrero 2020.

- [34] “Conozca el texto definitivo de la Ley Antibloqueo ya en vigencia”, Banca y Negocios, 15 octubre 2021.

- [35] “Ley Orgánica De Hidrocarburos”, Ministerio de Petróleo de Venezuela, 24 mayo 2006.

- [36] Fabiola Zerpa, “Total, Equinor Exit Venezuela Venture Amid Foreign Exodus”, Bloomberg Quint, 29 julio 2021.

- [37] Erick Shatzker, Alex Vásquez y Patricia Laya, “Venezuela Oil Czar Says Output to Skyrocket, Sanctions Be Damned”, Bloomberg, 21 junio 2021.

- [38] Nota de prensa, “Se registran largas filas de carros en las gasolineras de Venezuela para cargar combustible”, Semana, 23 julio 2021.

- [39] Nota de prensa, “Venezolanos sufren de largas filas para llenar tanques de gasolina en Caracas”, La Tercera, 26 julio 2021.