INDEX

THE COMEBACK OF OPEC+

After the deadlock due to the United Arab Emirates (UAE) position during the last ministerial meeting (reason for which we delayed the issuance of June’s OIL REPORT), on July 18th, the President of OPEC+, Prince Abdulaziz bin Salman and Minister of Energy of Saudi Arabia announced that the group finally reached an agreement. The achieved deal is consistent with the 2016 Declaration of Cooperation (DoC) and the decision reached at the April 12th, 2020 Meeting, closing the 19th OPEC+ Ministers’ Meeting.

OPEC+ approved the Saudi and Russian proposal to extend the production cut until December 2022, with monthly flexibilities of 400 thousand barrels per day starting in August, as well as an upward adjustment of 1.632 million barrels per day in the production base starting in May 2022, which left all parties satisfied. These resolutions, according to the OPEC+ president, are taken after observing the «continued strengthening» of market fundamentals, due to the «clear signs of improvement» shown by oil demand, the fall in oil reserves in OECD countries and the «continuation» of the economic recovery in most countries.

The last time the ministers of the OPEC and non-OPEC countries that signed the DoC met, the 18th OPEC+ Ministers’ Meeting (July 05th) was cancelled[1], a decision taken by the presidency (Saudi Arabia) and co-presidency (Russia) of the group, after having been postponed twice. The meeting was initially scheduled for July 1st. It couldn’t reach an agreement after the UAE refused to support the extension of the agreement beyond April 2022, maintaining the current production base, a proposal presented by the Arab and Russian delegations.

Cancelling the meeting was an initial response by the Saudi minister (OPEC+ president) to the UAE minister of energy and industries, Suhail Mohamed Al Mazrouei, in the face of the latter’s attempts to take advantage of the market’s expectation and the need for consensus within the organization to press for a higher oil production quota as a condition for continuing to support the agreements.

In an unusual stance, both countries – close political allies in the Persian Gulf – publicly exposed their differences, indicating the level of disagreement between strategic partners. Russia and the rest of the countries stayed out of the dispute. It was an issue between the two Gulf monarchies.

UAE is pressuring both OPEC and OPEC+, as they did in December 2020 -when they hinted at their intention to leave OPEC- to give course to the volumetric policy that has been imposed in the country. The above was the logical consequence of the privatization of the oil sector advanced by the government, aiming to take the country’s production from 3 to 4 million barrels per day in 2020 and 5 million barrels per day in 2030.

However, a UAE delegate informed Reuters on July 13th that the UAE and Saudi Arabia reached a draft agreement that would unlock the OPEC+ agreement, where the UAE would support the proposed increase in production from Saudi Arabia and, in turn, the Saudis would approve a UAE production base at 3.65 million barrels per day, starting April 2022. They are still in talks.

A similar situation happened in Venezuela in the 90s, when the privatization process of the industry -known as the «Oil Opening»- was started. In this regard, the privatization of the Abu Dhabi National Oil Corporation (ADNOC) and the inclusion of the interests of private actors promotes a volumetric policy to recover its investments, to the detriment of the price stability policy, which involves managing oil production and supply within the OPEC and OPEC+ agreements.

The UAE, in addition to seeking higher production to attract the interests of private players involved in the privatization process, also seeks to redefine OPEC’s production before Iran reaches a nuclear deal with the U.S. and sanctions against the Persian nation’s oil sector are lifted. This could bring Iranian production to 3 million barrels by the end of this year.

There was some expectation from the market and an almost unanimous consensus within OPEC+ to increase oil production by 2 million barrels per day between August and December, at a monthly 400 thousand barrels per day. The aforementioned, foreseeing that the demand increment, estimated for this year at 5.95 million barrels per day, will take place from the second half of the year and extending the production cut agreements from April 2022 -as initially planned- until December 2022.

On their side, the most important producers of the group, Russia and Saudi Arabia, are not willing to continue losing market quotes to U.S. producers. So, they favor increasing production as of August to maintain the price at levels that will prevent the increase in U.S. «Shale Oil» production and Canadian unconventional crude oil.

After the initial nervousness, market operators have reacted cautiously, trying to evaluate scenarios in the face of a demand that, despite the COVID-19 problems, continues to recover and a price that continues to climb ever closer to the threshold of 80 dollars a barrel. For that reason, large consumers such as the U.S., through the White House, have expressed their concern that OPEC+ will not reach an agreement to increase its oil supply and maintain a price at levels that will contribute to the recovery of the world economy.

For the oil-producing countries, the worst scenario is that the disagreement between the Gulf monarchies may lead to retaliations and disregard the production quota agreements to avoid losing markets. All of the above in the face of an increase in U.S. shale production that may cover the oil supply left by OPEC+, stimulated by the higher prices, which may generate another «price war» -as happened in March 2020- that may cause, once again, the destabilization of the market and the fall of oil prices.

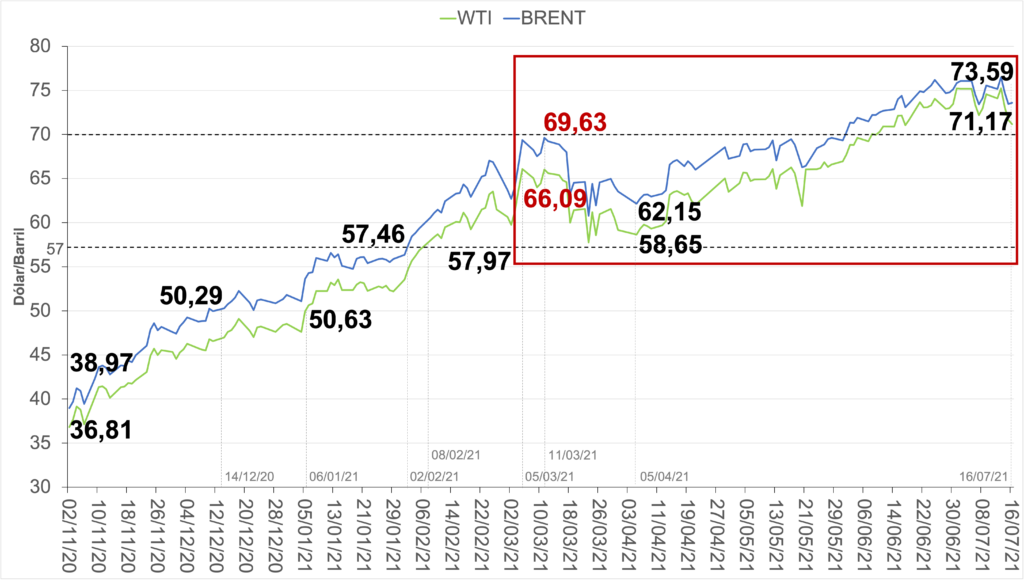

OIL PRICE

At the close of July 15th, the Intercontinental Exchange (ICE) quoted Brent at 73.59 dollars per barrel, while the New York Mercantile Exchange (NYMEX) quoted WTI at 71.17 dollars per barrel. A fall of 4.1% and 6.7%, respectively, to the quotations of July 05th, when Brent and WTI reached 76.73 and 76.25 dollars a barrel, the highest values since October 2018, as a market reaction to the lack of agreement within OPEC+.

On Sunday July 18th, following the agreement of the OPEC+ countries to increase production for the rest of 2021, Brent is trading at $ 71.15, while WTI reached $ 69.22.

PRICE CHART

(November 02nd 2020 – July 16th 2021)

The oil price has maintained its trend since November 2020 due to the production cut policy initiated by OPEC+ as of May 2020. In this way, market stabilization was reached after the «price war» of March 2020, coinciding with the collapse of the world economy and the reduction in oil demand due to the COVID-19 pandemic.

Oil price markers have recovered more than 50% of their value during this year 2021, to stand above the threshold of $70 a barrel since June 01st, very close now to $80 a barrel, values not recorded since October 2018.

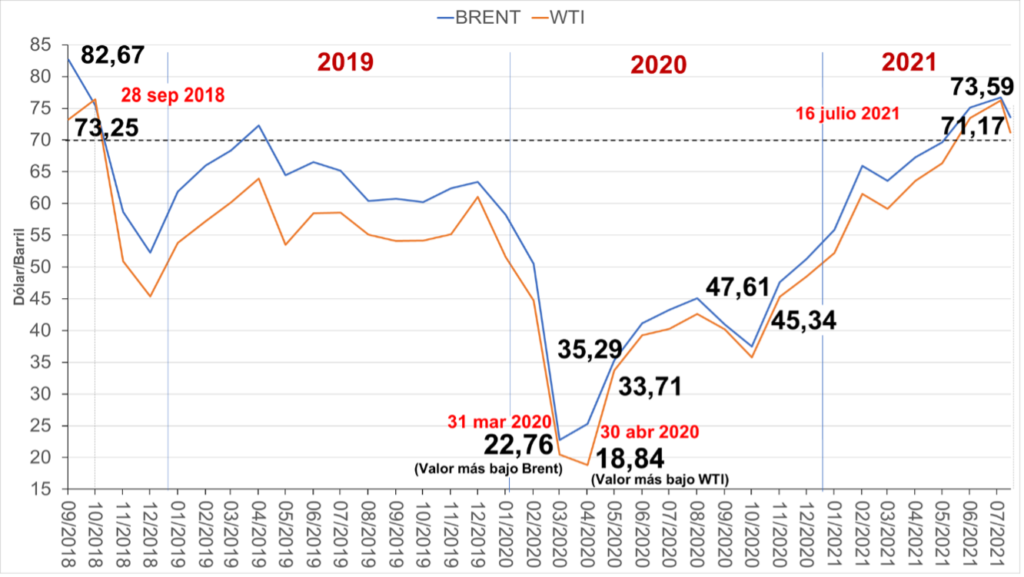

PRICES PERFORMANCE

(September 2018 – July 16th 2021)

The fundamental factor in price recovery has been OPEC+’s massive production cuts -which allowed to reduce the oil supply that flooded the market during the first half of 2020-draining inventories that reached historic levels. At the same time, the world economy is recovering since the beginning of this year, led by China and the Asian economies, as well as the U.S., U.K. and the Euro Zone, who have sustained their recovery based on massive contributions of money and fiscal support.

The optimism in oil market recovery comes with the increase of the vaccinations this year, especially in the U.S., U.K., Europe and China. This has allowed the easing of the restriction measures and the reactivation of production, trade and tourism. So it is estimated that global oil demand will increase to reach an average of 96.58 million barrels per day by 2021, achieving an annual increase in global oil demand of 5.95 million barrels per day.

However, specialized agencies and organizations agree that the full recovery of oil demand will occur during the second half of this year, due to the complexity of the vaccination process of the world’s population, even in industrialized countries, as well as the asymmetry in the access to vaccines by poor and developing countries.

The appearance of virus variants or mutations, which have once again hit countries that had already vaccinated a significant percentage of their population and had relaxed their movement restrictions, is a new factor of concern for the economy’s recovery.

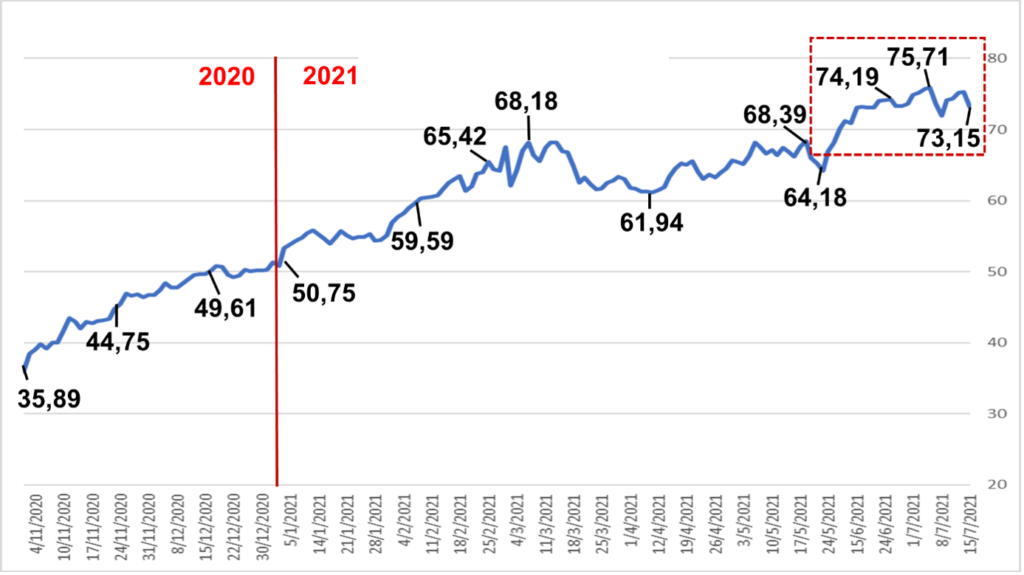

OPEC Reference Basket (ORB)

The OPEC Reference Basket of Crude Oil (ORB) was quoted last July 15th at $73.15 per barrel, a drop of 3.7% to the quotations of July 05th -due to the cancellation of the 18th OPEC+ Meeting-, but placing 71.7% above its quotation in November 2020, maintaining its upward trend, with values in June and July that had not been seen since October 2018.

OPEP REFERENCE BASKET PRICES

(November 2020 – July 15th 2021)

The crudes that compose the OPEC basket varied the monthly value of their quotations in 5.8% average upward, during May 2020, reaching a quotation of 66.91 dollars a barrel -the highest since May 2019-. This was influenced by the increase in the referential prices in official sales and crude oil differentials that make up the ORB, rising in all its referential components between 5.5% and 6.4%, as reported by the organization in its Monthly Oil Market Report (MOMR) on June 10th.

PRODUCTION

As we mentioned before, the cancellation of the 18th OPEC+ Ministerial Meeting introduced some uncertainty to the market just after it has reached some balance in its fundamentals that has allowed sustaining the price recovery to current levels, increasingly closer to the threshold of 80 dollars a barrel.

The failure, due to the lack of agreement with UAE, prevents the entry into force of a new phase of easing of the cuts that were aimed at increasing oil supply by 2 million barrels per day, with a monthly increase of 400 thousand barrels per day, which would satisfy the increase in demand of 5.95 million barrels per day that is forecasted for this year and expected to take place from the second half of the year onwards.

All OPEC+ countries, without exception, have agreed to greater flexibilities in production cuts to alleviate their economic situation and maintain oil prices at a level that will prevent the entry of additional volumes of North American crude, with higher production costs.

While Russia has expressed its difficulties in maintaining the current levels of production cuts, both because of pressure from private operators and the technical difficulties of managing production in its mature heavy crude oil fields, the UAE, Saudi Arabia’s strategic partner, has blocked any new agreement until the baseline production against which the current production cut quotas are agreed is discussed.

UAE’s position to push for an increase in its production had its first public episode during the 12th OPEC+ Ministerial Meeting last December 04th, when the emirates informed that they would invest 122 billion dollars to increase their production capacity. A couple of weeks before, they threatened to leave the organization. However, in the end, an agreement was reached, while Saudi Arabia made an additional cut of one million barrels per day between February and March as «a gift» to the producing countries.

However, the United States maintained its position of increasing production by further relaxing cuts and revising the production levels used as a basis for establishing the current quota of cuts. What is clear is that the UAE is willing to seek a more significant market, even at the cost of fracturing OPEC unity.

So, what levels of cuts are in place?

Due to the lack of agreement during OPEC+ Ministerial, the cuts and the production levels of the signatory countries of the DoC agreement remain what was established at the previous meeting, held last June 1st, when the production cuts relaxation, approved during the last April ministerial meeting, was ratified.

In compliance with these agreements, for May 2021, the OPEC+ countries applied a relaxation of 350 thousand barrels per day (thousand barrels per day), placing the production cut for that month at 6.55 million barrels per day, while for June and July, it remained at 6.20 million barrels per day and 5.76 million barrels per day, respectively, which would represent a decrease of 3.905 million barrels per day to the original cut of 9.7 million barrels per day initiated on May 01st, 2020.

At the same time, Saudi Arabia began phasing out the additional, voluntary 1 million barrels per day cut it had implemented in its oil production between February and April 2021. In May, the Saudis recovered 250 thousand barrels per day (thousand barrels per day) of its production quota, which had an increase of 113 thousand barrels per day due to the relaxation in its production cut, leaving its additional and voluntary cut at 750 thousand barrels per day. For June, Saudi Arabia will increase its oil production by 350 million barrels per day and 400 million barrels per day in July, ending its additional and voluntary cut.

Thus, OPEC+ oil supply for July will stand at 42.45 million barrels per day due to the relaxation of the cuts by the group and Saudi Arabia, an increase of 4.3 million barrels per day to the first quarter of the year. These levels will remain in place for OPEC+ countries until a new meeting of ministers or an announcement is made to overcome the impasse with the UAE.

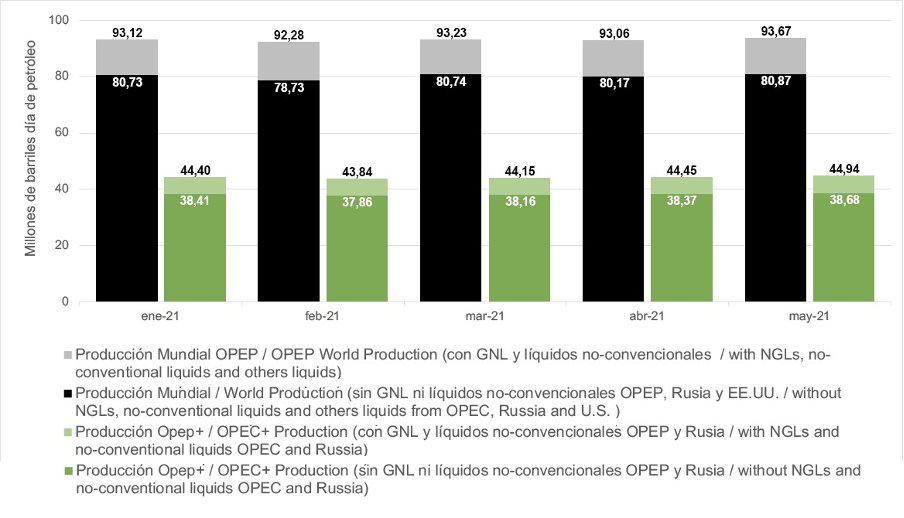

World oil production

OPEC’s MOMR data for June 10th place world oil, condensate, NGLs and unconventional liquids production at 93.67 million barrels per day for May, while the Energy Information Administration (EIA) puts it at 94.7 million barrels per day, a difference of 1.1 million barrels per day.

WORLD PRODUCTION

(Crude oil, condensates, NGLs and unconventional liquids)

(January – May 2021)

However, if we separate the volumes of condensates, NGLs and unconventional liquids in the U.S., Russia and OPEC, world oil production stands at 80.87 million barrels per day, according to both OPEC data published in the MOMR as mentioned earlier, as well as information from the EIA on July 07th and data from the Russian Ministry of Energy. Of this production, 38.73 million barrels per day correspond to OPEC+ supply, 47.9% of world production.

OPEC+ production cuts

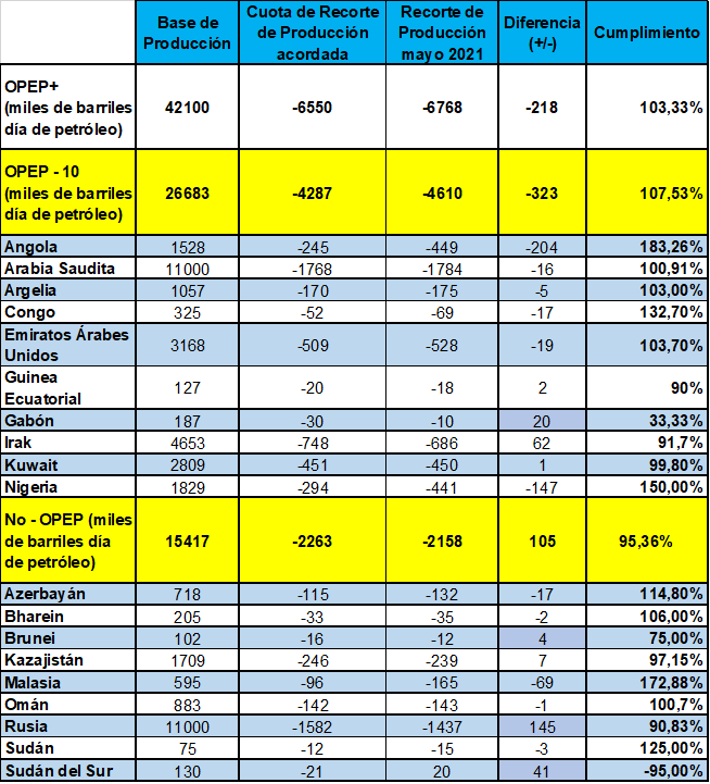

The OPEC+ production cut for May was 6.768 million barrels per day, with compliance of 103.33% over the agreement of 6.55 million barrels per day. If we add to this the voluntary cut by Saudi Arabia, then the total cut by the OPEC+ group of countries was 7.518 million barrels per day, bringing compliance to 114.78%.

OPEP+ PRODUCTION CUT

(Without the additional cut by Saudi Arabia)

(May 2021)

The 10 OPEC countries participating in the production cuts (Angola, Saudi Arabia, Algeria, Congo, Gabon, Equatorial Guinea, United Arab Emirates, Iraq, Kuwait and Nigeria), reduced by 5.36 million barrels per day, including 750 thousand barrels per day of Saudi Arabia’s unilateral cut and the additional cut of 204 thousand barrels per day by Angola -to compensate for the overproduction presented by the African country in the second quarter of 2020- and 147 thousand barrels per day in Nigeria’s production. On the other hand, Iraq presented, once again, an overproduction of 62 thousand barrels per day. With this, compliance with the cut by OPEC-10 countries (signatories of the DoC agreements) was 107.5%.

Regarding the nine Non-OPEC countries, signatories of the DoC, the production cut was 2.158 million barrels per day, with an overproduction of 145 thousand barrels per day by Russia, on the one hand, and an additional cut of 69 thousand barrels per day in its production by Malaysia, on the other, reaching compliance with the cut of 95.36%.

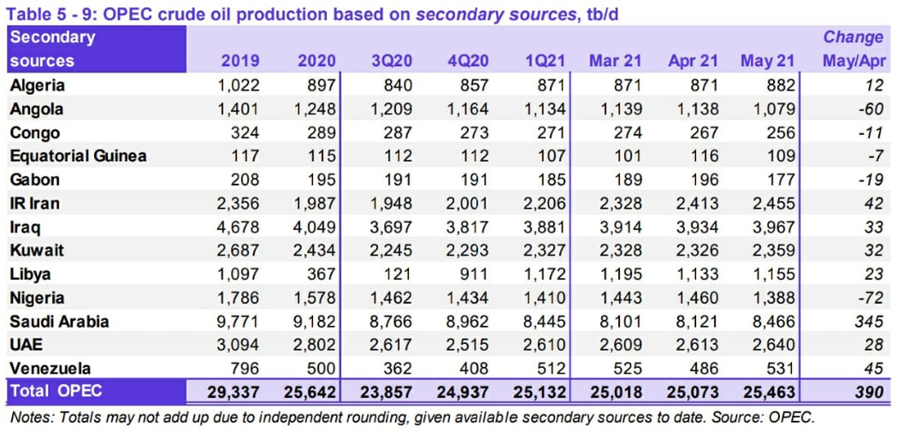

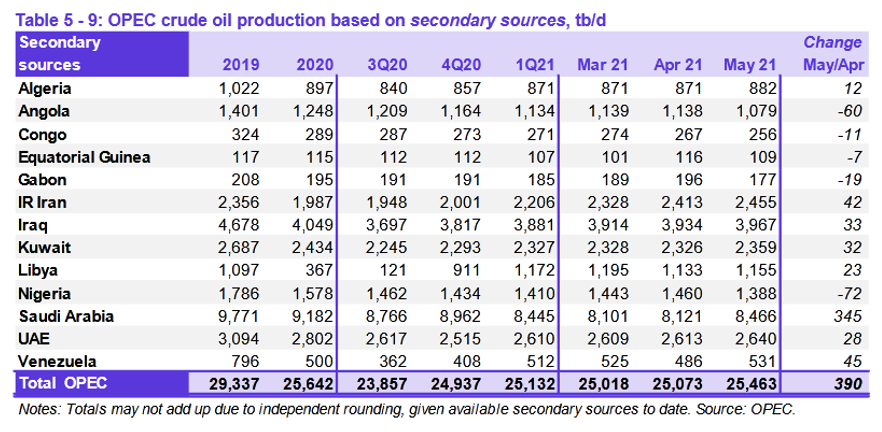

OPEC Production

OPEC oil production in May was 25.463 million barrels per day, according to MOMR data on June 10th, showing the same production level recorded in January of this year and surpassing the rest of the levels presented since the last quarter of 2020.

Although an additional 300 thousand barrels per day of flexibility in OPEC’s production cut came into effect in January of this year, its effects were offset mainly by Saudi Arabia’s additional cut of 1 million barrels per day that came into effect between February and April. Following the new agreement to relax the 277 thousand barrels per day production cut for May, Saudi Arabia’s voluntary cut also began to be relaxed by 250 thousand barrels per day.

While it is true that OPEC eased its production cut by 527 thousand barrels per day in May, this was offset by the monthly difference in the additional cuts made by Angola and Nigeria.

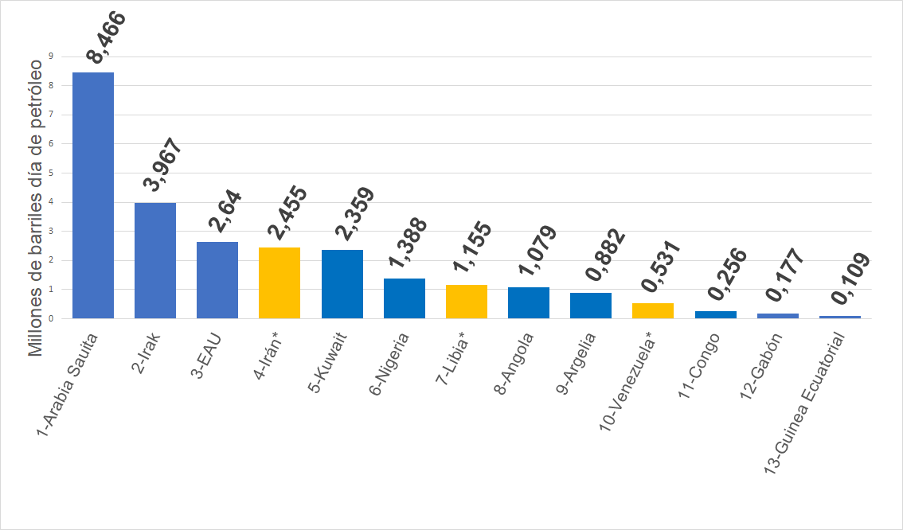

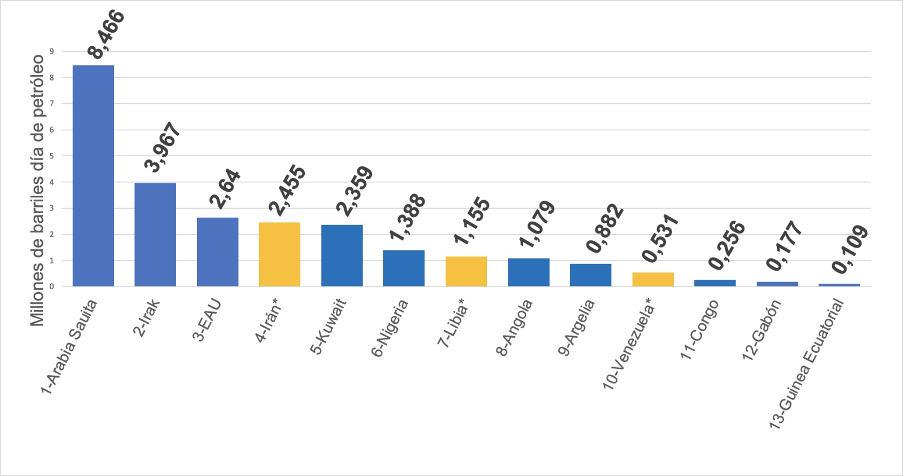

PRODUCTION OF OPEC COUNTRIES

(May 2021)

Saudi Arabia, together with the United Arab Emirates, Kuwait and Iraq, totalized a production of 17.43 million barrels per day. This represented 68.46% of OPEC production, as well as 45.07% of OPEC+ and 21.55% of world oil production (excluding LNG, condensates and other non-conventional liquids OPEC, Russia and the U.S.).

Nigeria and the rest of the African countries (excluding Libya), Angola, Algeria, Congo, Gabon and Equatorial Guinea presented a production of 4.122 million barrels per day, representing 16.46% of OPEC total, 10.74% of OPEC+ production and 5.14% of world production.

PRODUCTION RANKING OF OPEC COUNTRIES

(May 2021)

Iran, Libya and Venezuela, the three OPEC countries exempt from production cuts, presented a joint production of 4,141 million barrels per day, of which 2,455 million barrels per day (59.29%) corresponds to Iran, equivalent to 9.64% of OPEC production and 3.04% of world oil supply. Libya produced 1,155 million barrels per day (4.54% OPEC and 1.43% world) and Venezuela 531 thousand barrels of oil per day (2.08% OPEC and 0.65% world).

The laggards

Only Libya and Iran seem to increase and stabilize their production from the OPEC countries exempted from production cuts, which will probably open the internal discussion on production quotas and cuts that correspond to each country.

Libya’s oil production has risen to over one million barrels, following the signing of peace agreements last October that allowed the lifting of the blockade of oil production areas by the forces of the Libyan National Army of the Eastern Parliament (Tobruk). Since then, Libyan oil production rose from 150 thousand barrels per day in September 2020 to 1.2 million barrels per day in December of the same year, which has kept fluctuating.

Iran’s oil production, for its part, has increased by 430 thousand barrels per day since the beginning of this year, reflecting a 23.6% recovery in its production compared to the 2020 average. Should a nuclear agreement be reached between the U.S. and Iran, which would allow for the lifting of nuclear arms embargoes, the U.S. and Iran could reach an agreement.

With a nuclear agreement reached between the U.S. and Iran, allowing the lifting of sanctions on the Persian oil sector, production could increase by 500 thousand barrels per day by the end of the year, bringing Iranian production to 3 million barrels per day. In this regard, Iran would once again make the country a major player in the international oil market, possibly opening fissures within OPEC, when the Persian Gulf monarchies demand that Iran returns to the production cut agreements, with a redistribution of production quotas among member countries.

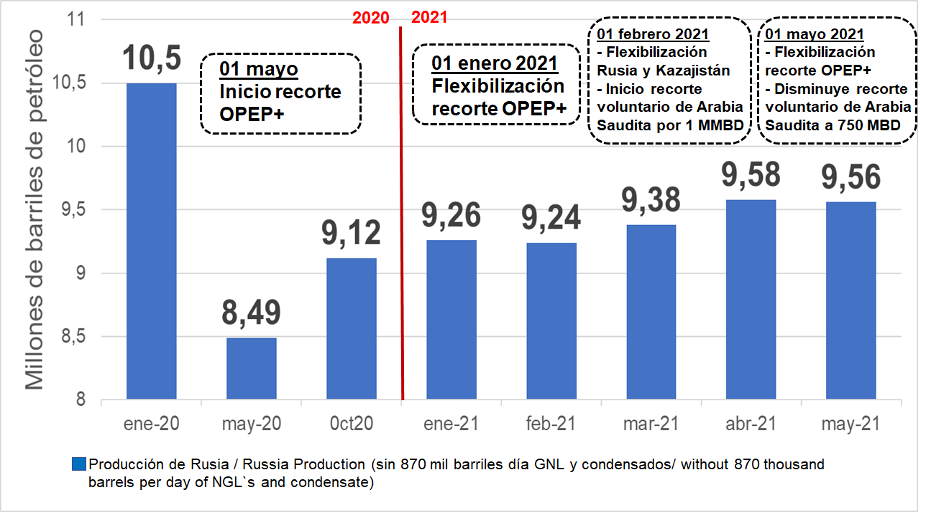

Russia

According to the Russian Ministry of Energy, the country’s oil production in May -without condensates nor NGLs- stood at 9.56 million barrels per day. This means 20 thousand barrels per day less than in April, but still with an overproduction of 145 thousand barrels per day to its quota in OPEC+ cuts, which has been constant since August last year.

Russian oil production has increased by 1.07 million barrels per day, 12.6% over its year-ago production levels, thanks to OPEC+’s easing cuts policy; however, it still sits 0.94 million barrels per day, 9% below its record production levels of January 2020, pre-COVID-19.

RUSSIAN OIL PRODUCTION

-without LNG and condensates-

(May 2021)

The Russian Federation, aware of its status as an oil-producing country, continues to move forward with its plans to increase its production. However, its expansion is based on the development of oil reserves located in the Arctic, a stance that goes against the policies of Europe and the U.S. of preserving and protecting the environment in the Arctic, but which is part of a strategic plan for Russia’s geopolitical positioning in the region, that includes a new maritime transport corridor between Europe and Asia.

On June 07th, the Russian oil company Rosneft announced that it held a travelling exhibition, with suppliers and contractors, of the Vostok oil project. This project, located in the Russian Arctic, started in 2019 and has 15 oil fields and reserves of 45.5 billion barrels of oil. It is estimated, by 2024, a production of between 1 and 2 million barrels per day of oil will be marketed through the North Sea to the Asian market, opening an alternative route to the Suez Canal, with a fleet of 50 oil tankers of different classes.

On June 10th, Rosneft announced that they agreed on the general terms for selling a 5% stake in the Vostok project to a consortium of energy traders Vitol S.A. (Netherlands) and Mercantile & Maritime Energy (Singapore), for an undisclosed amount. The Russian oil company justifies that «the lack of investment in the oil industry, as well as the growth of the world population and its prosperity, drive the demand for energy resources, which is why more and more new types of projects are being sought». The production cost at Vostok will be 75% below the costs of other large projects from different companies worldwide. Already in 2020, Rosneft sold 10% of the Vostok project to Singaporean-Swiss energy trader Trafigura Group, with which it began the development of the project’s fields.

United States

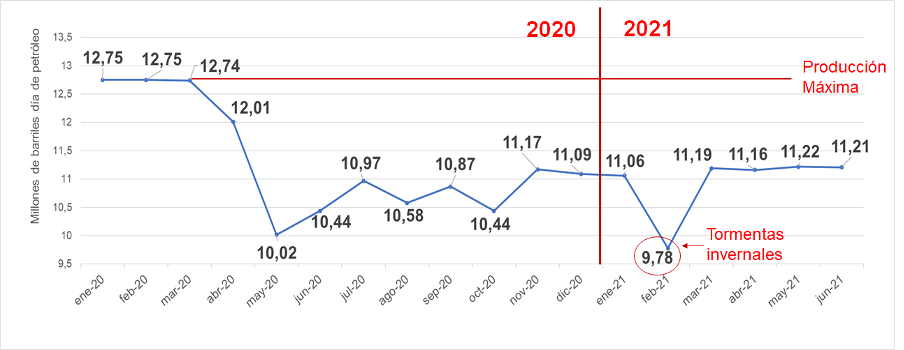

The U.S. oil production has been stable since November 2020 -except in February 2021, when affected by winter storms-, presenting a record of 11.22 million barrels per day in May and 11.21 million barrels per day in June, as reported by the EIA in its July 07th Short-Term Energy Outlook (STEO), with a forecast of 11.2 million barrels per day for July.

US OIL PRODUCTION.

-Excluding condensate, NGLs, and unconventional liquids-

(January 2020 – June 2021)

For July 02nd, no significant variations have been registered in the volumes of 2021 -except for those presented in February-, presenting a production of 11.3 million barrels per day, the highest of the year, according to the EIA’s weekly report of July 08th.

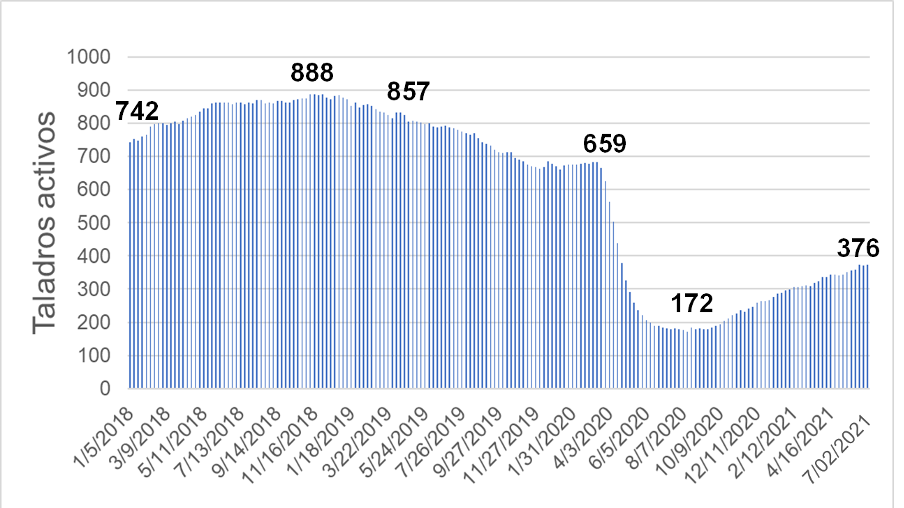

Drills

The number of active drills registered in the U.S. as of July 02nd was 376, which brought the activity record to 23 drillers above the May 21st, 2021 figure and 188 more than a year ago. According to data published by Baker Hughes, the increase registered since the fourth quarter of 2020 is sustained, being the highest activity record since the OPEC+ production cut began in May last year.

But, in turn, drilling activity is at December 2016 levels (excluding data during the pandemic), when shale production was at 5.2 million barrels per day, in full growth mode, leading it to exceed 7.8 million barrels per day in 2019.

In the Permian Basin in Delaware, 63% of the activity registered, with 237 operating drills, 96 more than October 2020 and 236 less than in July 2018. This was the last month before the pandemic declaration, in which U.S. oil production recorded 11 million barrels per day and previous to its production climb that took it past 12.7 million barrels per day between November 2019 and March 2020.

Haynesville, between Louisiana and Texas, is the second basin with the second-highest drilling activity as of July 02nd, recording 49 operations, keeping activity above 40 since November 2020.

ACTIVE DRILLS IN THE US.

(January 2018 – July 02nd, 2021)

DUC

A common practice among shale oil producers in the U.S. is to drill shale wells and leave them uncompleted by abandoning activities and moving rigs to drill other wells, depending on the market price, to optimize the use of contracted drills. This is only possible given the characteristics of shale oil sands that, to start production, need to be «fractured» with water at high pressures.

These drilled but abandoned wells are called DUC (Drilled but uncompleted wells). Under this production process, the number of new wells drilled will exceed the number of wells completed monthly if the market price is not competitive enough. In this way, the DUCs become «a reserve» of the operators to be used, completing the well and fracking when market conditions improve, or cash flow is required. The amount of DUCs estimates how quickly, and at what cost, shale production can be restored in the U.S.

In the EIA Drilling Report of June 14th, it can be seen that in May, a total of 408 drills were operational for a production of 7.8 million barrels per day in shale wells. The number of completed wells was 779, 14 more than in April, while new drilling was recorded in 532 wells, 21 more than the previous month. Meanwhile, 6,521 wells were recorded drilled but uncompleted, decreasing 247 DUC in the month and 2,301 in a year.

Between January 2014 and March 2020, the monthly operating drilling log had dropped from 1,391 to 702 units, while the number of new drillings went from 1,645 per month to 1,009, with shale oil production rising from 4.5 million barrels per day to 9.2 million barrels per day, while DUCs increased from 4,502 to 8,557.

During the same period, the number of wells drilled but not completed increased monthly, without exception, until reaching a peak of 8,868 DUC in June 2020, three months after COVID-19 was declared a pandemic. Since then, the opposite has happened. The number of wells completed monthly by the oil operators has been higher than the number of new wells drilled. This is due to the control of expenses and investments that the operators are carrying out, taking advantage of the recovery of oil prices to recapitalize themselves and cover their debts.

Prospects for oil production in the U.S.

The Department of Energy and several analysts estimate that oil production in the U.S. will remain at around 11 million barrels per day for the rest of 2021. One of the fundamental reasons for this stagnation of domestic production is the characteristic of independent and medium-sized Shale Oil producers, whose activity is based on hedge funds and quick return financing.

As we have previously commented, the shale oil producers sector, unlike the large North American producers and transnational companies, need permanent financial investment to sustain their operations and pay their financiers in a short period.

Therefore, when the oil market collapse occurred in the second quarter of 2020, and North American production fell due to low prices, small and medium-sized shale oil producers entered a process of debt accumulation, bankruptcies, and acquisitions that changed the composition of the sector. Acquisitions and mergers were reported throughout 2020, such as those of Chevron Corporation and Noble Energy. Also, ConocoPhillips and Concho Resources, Pioneer Natural Resources and Parsley Energy, to name a few. In the meantime, the oil sector’s debt – counting only the 46 companies that filed for bankruptcy last year – reached levels of over $53 billion in 2020 and an accumulated sector debt of over $176 billion since 2015 (262 companies in bankruptcy), according to the «Monthly Monitoring of Oil and Gas Companies in Bankruptcy» by the American firm Hynes & Boone.

The situation described is because once the price of WTI surpassed the threshold of $40 per barrel as of mid-2020, Shale Oil producers, whose production is equivalent to 71% of U.S. production, have made use of their «reserves» of DUC wells to have cash flow, paying debts and dividends. In this way, no new investments are taking place until their financial situation is balanced.

This situation of stagnation of North American production is estimated to occur only until the end of this year, enough time for the financial recovery of the shale producers. In its forecasts for 2022, the EIA estimates that U.S. production will increase to 11.8 million barrels per day.

However, the lack of agreement within OPEC+, with the cancellation of the 18th Ministers’ Meeting, opens an unexpected possibility for Shale Oil producers. If the price increases due to unsatisfied market demand, Shale Oil operators may opt to increase their production and take unanticipated profits for this year while still meeting their debt and dividend payment commitments to shareholders.

Shale oil operators’ decision to increase production may pay off in the short term, given the current amount of DCU’s that could be completed quickly, increasing North American production.

POLICY

Lack of consensus at the 18th OPEC+ Ministers’ Meeting

Before announcing the 18th OPEC+ ministerial’s cancellation, the meeting had been postponed twice due to the «confrontation» between Saudi Arabia and UAE about extending the production cut agreement with the group’s current production base. According to different news agencies, it was reported that the OPEC+ countries abandoned the meeting due to the «standoff» between the Saudi and UAE representatives.

The day before, Minister bin Salman referred to the UAE’s stance against the proposed extension of the production cut agreement and the production base, leaving his opinion on the responsibilities of not reaching an agreement. «It is the whole group against one country, which saddens me, but this is the reality,» the Saudi minister said. For his part, UAE energy minister Suhail Mohamed Al-Mazrouei showed his resolve not to accept a proposal that does not include his request to have April 2020 production recognized as a base. «It is unreasonable to accept more injustice and sacrifices; we have been patient,» the Emirati minister claimed.

Even the U.S. took part in the disagreement. In a press conference on July 06th, White House spokeswoman Jen Psaki commented that Joe Biden’s administration is «closely monitoring» the development of the meeting and its «impact» on the global economic recovery in the face of the pandemic. Psaki assured that they were in «high-level conversations with Saudi Arabia and the UAE», as they understand that an agreement in OPEC+ that promotes access to energy (a production increase) will impact U.S. prices. Psaki herself mentioned, on July 2nd, the interest for there to be «sufficient oil production capacity available worldwide» to cover «the restart of the world economy and the resumption of normal consumer activity».

Initially, on July 01st, Saudi Arabia and Russia presented their proposal to increase the group’s production quota by 2 million barrels per day by December 2021 (400 thousand barrels per day per month between August and December) and to extend the agreement beyond April 2022, which was rejected by the UAE – as explained above, with the support of Kazakhstan, re-editing -in a way, but under different circumstances- the pressure exerted by Venezuela within the Organization during a process of privatization of the oil industry in the 90’s to impose a volumetric policy against a price-stability strategy.

The UAE, through the privatization of its national oil company – where the equity managers control 20% of the state-owned ADNOC and 100% of its pipelines – has received billionaire investments that allowed it to increase its production capacity for 2020 (4 million barrels per day) and 2030 (5 million barrels per day). Therefore, they demand that the production base to be applied to it has to be as of April 2021, where they reached a record level of 3.84 million barrels per day (they had only surpassed 3.2 million barrels per day on five occasions, with a maximum of 3.5 million barrels per day in March 2021), being 700 thousand barrels per day higher than their current production base (3.168 million barrels per day) and 800 thousand barrels per day above 2019, the year of its highest average.

OPEC has already experienced this situation, which took oil prices below $10 per barrel in the 1990s. Only the will to recover what was stated in OPEC’s statutes and defend the price of oil -which was embodied in the II Summit of Heads of State of the organization in 2000 in Caracas – made it possible to exercise a policy of defending the price of oil, reaffirming the «inalienable» and «permanent» sovereign right of oil-producing countries over their natural resource for the benefit of their peoples, which was ratified at the III Summit of Heads of State in Riyadh, Saudi Arabia, in 2007.

Iran-US: A step closer to reaching an agreement before August

On June 20th, in Vienna, Austria concluded the sixth round of meetings of the Joint Commission of the Joint Comprehensive Plan of Action (JCPOA) -the Iran nuclear deal approved and signed in July 2015 at the U.N. Security Council-. According to the top Iranian representative at the meetings and Iran’s Deputy Foreign Minister for Political Affairs, Abbas Araqchi, progress was made on the draft texts of the negotiations and only «the remaining important issues of the JCPOA» remain, which «require serious decisions in capitals.» Araqchi himself stated that the JCPOA is a «significant agreement» that «requires serious decisions in capitals».

Araqchi himself stated that they hope that in the next round of meetings, the seventh, a conclusion will be reached for an agreement between the parties to reactivate the JCPOA and the U.S. economic sanctions against Iran will be lifted. «Now it is closer than ever to an agreement,» the Iranian official said as he left the meeting.

Rouhani’s government acknowledges the reconciliation of differences between them and the U.S. during the negotiation process, where «the negotiating parties have drafted a clear text on all issues and what remains outstanding requires a political decision by all», according to the statements of Saeid Jatibza, the spokesman of the Iranian Foreign Ministry.

Previously, on June 03rd, the U.S. State Department spokesman, Ned Price, after concluding the fifth round of meetings in Vienna, reported that «we have made progress (in the negotiations)», where «there have been discussions, indirectly with the Iranians, on ways in which we can recommit ourselves to mutual compliance with the terms of the 2015 JCPOA». It is worth remembering that the U.S. has no representative at the meeting table, having pulled out of the JCPOA nuclear agreement in 2018. Therefore, the delegation sent by U.S. President Joe Biden holds indirect meetings with Iran in the Austrian capital through its allies.

The U.S. spokesman made it clear that, unlike the one before the Iran nuclear agreement in 2015, this time they do have a text: «the same text of the JCPOA agreement signed in 2015». This is the most critical point where both the Iranian and U.S. sides agree.

Diplomacy has been another meeting point between Iran and the U.S., which they consider the «way» to resolve differences and reach agreements. On June 21st, Ned Price himself stated, following the line of Joe Biden’s administration to move away from that of his predecessor, Donald Trump, that the talks have been «constructive» and «professional,» being conducive to discussing two key issues, «first, the nuclear steps Iran would have to take if it decided, affirmatively, to once again fulfil its full commitments under the 2015 JCPOA. As well as the sanctions relief that the United States would have to take, if we could be able to come to a joint return to compliance and sanctions relief that, I should say, are incompatible with the JCPOA.» The Biden administration acknowledges that the JCPOA was not the only one that the United States would have to take.

Biden administration recognizes that it was a mistake to pull out of the agreement. The JCPOA was «constructed» to procure that «if one side violates (the JCPOA), the other would do so by taking countermeasures», as stated by the State Department Spokesperson’s Office in its press conference on June 24th.

In this context, the ultra-conservative cleric and Head of the Judiciary, Ebrahim Raisi, comfortably won (62% of the votes) the elections in Iran, with the lowest turnout (49%) since the Islamic Revolution in 1979, closing eight years of a reformist government. Raisi will assume the presidency of Iran on August 4th of this year. Raisi’s first statement on the meetings in Vienna, already as president-elect, was to urge the U.S. «to rejoin the Joint Comprehensive Plan of Action (JCPOA) and to fulfil its commitments».

The most recent statement from the Iranian government, on June 06th, gives the assurance of continuity with the next government in the indirect negotiations with the Americans. The Iranian Foreign Ministry spokesman, Saeid Jatibza, affirmed that with the change of government, «the Iranian position on the JCPOA will not change», making it clear that «if an agreement is reached, Mr Raisi’s government will be loyal to it».

Once the result of the Iranian presidential elections was known, the new Prime Minister (elected by the coalition of right, left and Arab parties), the religious-nationalist businessman Naftali Bennett, from the State of Israel, asked the «world powers» «not to resume the nuclear pact with Iran».

Faced with doubts about the change of government in Iran and the pressures of the Israeli lobby, Ned Price, makes it clear that the U.S. government, in a posture in defense of its interests, seeks the «mutual return» to compliance with the JCPOA «regardless of who is elected as president of Iran».

Price pointed out that it is the Iranian Supreme Leader who «determines Iran’s policy on several important issues», recalling that Ayatollah Khamenei had already been appointed Supreme Leader when the JCPOA nuclear deal was reached in 2015 and the indirect rounds of negotiations in Vienna in 2021, so he does not see a change in the path of what has been discussed, agreed and advanced with Iran. «We will continue to engage in that process in the future,» concluded the U.S. State Department spokesperson, referring to the next round of indirect meetings (the seventh), still without a definite date. In the same vein, the U.S. Secretary of Defense, Jack Sullivan, declared on January 20th – «the final decision on whether or not to return to the agreement rests with the supreme leader of Iran, who was the same person before and after the election» – and was ratified by the State Department itself on June 24th.

In this scenario, Iran increased its production by more than 400 thousand barrels per day since Joe Biden assumed the U.S. presidency last January 20th, at an average rate of 80 thousand barrels per day per month.

If the American and the Iranian governments manage to reach an agreement before August this year and sanctions on Iran are lifted, Iranian production may recover to 3.5 million barrels per day by the close of 2021, the level it was at in July 2018, before the economic sanctions imposed by former U.S. President Donald Trump.

The seventh round of negotiations on the nuclear deal in Vienna, scheduled between the last week of June and the first week of July, is still not happening.

Last Tuesday, July 06th, the International Atomic Energy Agency (IAEA) announced that «Iran had informed it that it intends to produce uranium metal-enriched to 20% purity». For Iran, this has no military intention but simply «peaceful purposes».

However, Germany, France and the United Kingdom immediately expressed their concern and qualified the Iranian decision as a violation of the terms of the 2015 JCPOA nuclear agreement, while the U.S. administration called the Iranian decision a «setback» in the talks.

All indicates that the change of government in Iran (to take place in August) already has immediate effects on the position of the Persian nation, in a process that remains in high tension and that develops both at the diplomatic level and in the field of military operations, where there have been successive attacks by the U.S. against pro-Iranian militias in Syria and attacks by pro-Iranian militias on U.S. bases in Iraq.

Climate Change: a brake on international oil companies?

In the context of increasing social awareness in favor of environmental preservation, especially in European countries and now in the USA, different political bodies have been dictating public policies to reduce greenhouse gas emissions and fossil energy consumption.

While the European Union has agreed on its goal of «Zero Emissions» by 2050 (Net Zero 2050), the new U.S. administration has halted the development of oil reserves in environmentally protected areas, the Arctic and Federal lands, as well as repealing permits for infrastructure projects for the oil sector, such as the development of the XL Kingston Pipeline, all within the framework of its «New Green Deal», as President Joe Biden’s flagship environmental policy.

These public policy decisions have been accompanied by attractive incentives in the economic programs and fiscal packages of the European Union (E.U.) and the U.S. Administration.

While the E.U. has directed the use of 20.5% (375 billion euros/445 billion dollars) of the resources of the Recovery Plan 2021-2027 to the development of renewable energies, the White House has kept 12% (274 billion dollars) from the resources of the «American Jobs Plan» to the development of «clean» energies of the «Green New Deal». Also, they are promoting a tax reform, «The Made in American Taxes», where the subsidy to fossil fuel producers is eliminated, and the tax on corporations is increased from 21% to 28%.

Some financial and economic operators in the private sector have accompanied some governments on environmental protection policies, the encouragement of alternative energies, and reducing carbon emissions. All of the above for «marketing» reasons to adjust to society’s greater interest in the environment and consumer preference for environmentally friendly products and the opportunity to obtain benefits from the resources and programs that governments are allocating to the use of «clean energies».

As part of this adaptation of private operators to climate change issues, capital managers – particularly Institutional Funds – with equity stakes in energy companies, grouped into two new organizations with activist profiles in the defense of climate and zero carbon emissions: Climate Action100+, to ensure, from within energy corporations, the reduction in carbon emissions; and Net Zero Asset Managers, to support investments aligned with zero carbon emission by 2050, to limit global temperature rise to 1.5 ºC.

Climate Action 100+ brings together 545 equity managers managing capital and assets of $52 trillion, of which 87 equity managers ($37 trillion) are also part of Net Zero Asset Managers.

The extent of what has been happening, since December 2020, in the energy sector is reflected in ExxonMobil and Chevron Corporation, where both corporations have Vanguard Group and Black Rock Inc (the world’s largest investment fund) as major shareholders, asset managers and members of the two new activist organizations. In contrast, the largest U.S. institutional funds, the California Public Employees’ Retirement System (CalPERS), the California Teachers’ Retirement System (CalSTRS) and the New York State Common Retirement Fund, are also shareholders in both companies and are part of Climate Action 100+.

Therefore, given the negative results of energy corporations in 2020, which led them to present billionaire losses and high indebtedness, their shareholders are looking for a turnaround in the direction that will lead them to generate lower capital expenditures and the creation of new investments in clean energies. At the same time, it will give a sustainable value to the company, its dividends, and the share value. There are 274 billion dollars in the portfolio for the development and infrastructure for «clean» renewable energies, included in the American Job Plan approved in April of this year, which could alleviate the losses suffered by the transnationals in 2020 and increase the income from dividends.

Both corporations presented losses in 2020. In the case of ExxonMobil, it was 22.44 billion dollars and a debt that grew 79% in one year, which includes 19 billion for impairment of assets, which, after amortization, remained as «non-strategic». In the case of Chevron, it presented losses of 5.54 billion dollars. Its debt had an annual growth of 65%, with an impairment in assets for 10 billion dollars, but recorded in December 2019. Not good news received by equity managers with shares in both corporations.

Thus, the opportunity arose for representatives of Engine No1 (holder of 0.02% of the oil company’s shares), a new capital fund founded by Christopher James, owner of Partners Fund Managers (asset and capital manager for 5 billion dollars), to run for ExxonMobil’s Board of Directors, with the support of Vanguard Group and Blackrock Inc.

The same capital investors joined their votes so that the same activist investor who won in ExxonMobil, also on that day – May 26th – voted in favor (61%) of a proposal presented by Chevron shareholders to reduce carbon emissions of the company’s customers, while achieving 54% of votes to deny the rejection by the company’s Board of Directors of the shareholders’ proposal for a report on the impacts of the Net Zero 2050 scenario, the plan to bring carbon emissions to zero by 2050.

Two weeks earlier – on May 11th – shareholders of ConocoPhillips, the third-largest U.S. oil company, voted in favor (59%) of setting carbon emissions reduction targets covering the company’s greenhouse gas emissions. The shareholders who voted are the same investors who voted for ExxonMobil and Chevron.

In Europe, on May 26th, a court in the Netherlands upheld the lawsuit filed against the Anglo-Dutch giant Royal Dutch Shell by the international organization Friends of the Earth, accusing the transnational oil company of «destroying the climate». The court ruled in favor of the accusers, obliging the Dutch transnational to reduce its carbon emissions by 45%, implying a reduction of 1 million barrels per day in its world oil production.

This type of action has been accompanied by strategic approaches of other European oil transnationals, such as B.P. and ENI, in the sense of orienting their efforts and plans towards the development of clean energies and reduction of carbon emissions, foreseeing a scenario where the concept of a «green economy» prevails over fossil fuels.

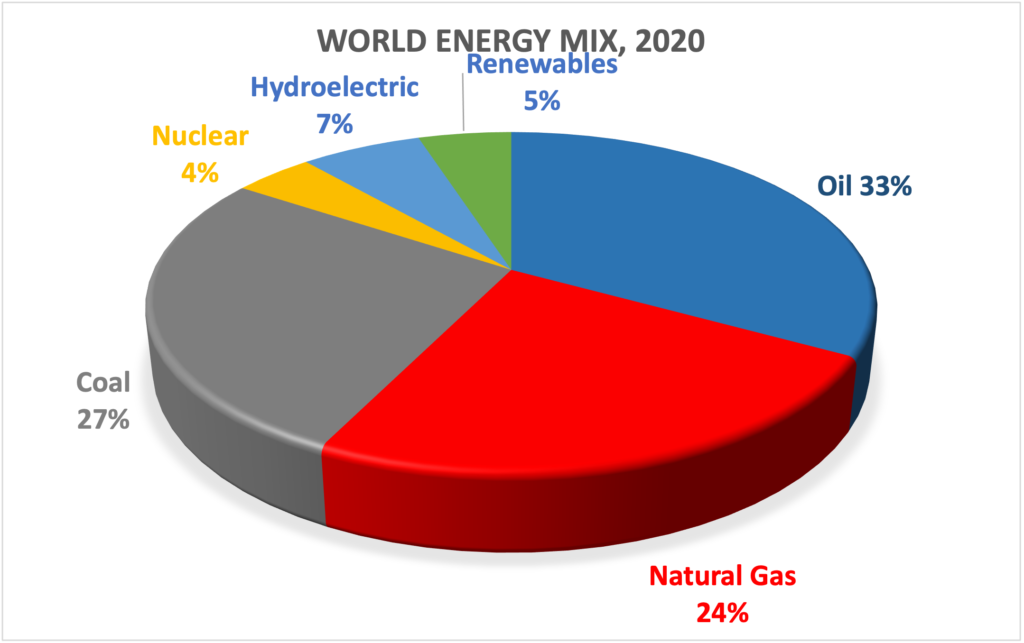

However, all available information on the energy consumption matrix in the world still give a privileged and preponderant place of 67% of the world’s energy consumption to oil and gas.

It would even be logical to assume that, in the transition to a «green economy», before replacing oil and gas consumption, the major industrialized economies will have to replace coal and nuclear consumption, energies that are much more dangerous for the environment and humans. The first step was taken by Germany when, on July 02nd, with the support of Austria, Denmark, Spain and Luxembourg, it sent a letter to the European Commission, asking that funds for the development of alternative energies should not be used to finance nuclear energy.

On the other hand, we must not lose sight of the fact that hundreds of millions of human beings living in poverty in Africa, Latin America and Asia, still have no access to any source of energy, so they still use firewood and other vegetables, which is known euphemistically in the statistics of specialized agencies as the use of «biomass». These countries and peoples have the legitimate right to access primary energies, which are more economical and accessible for their existence and help them get out of poverty.

At the moment, after the collapse of the world economy in 2020, as a result of the COVID-19 pandemic, it seems that the priority of the large industrialized economies will be to reactivate their economies in the industrial, manufacturing, processing and petrochemical sectors and to re-establish supply chains, trade and transportation, using fossil energies, oil and gas, which not only have the infrastructure in place but also exist in abundance and at a more competitive price.

Restrictions or reductions in oil production by international companies will be easily and quickly replaced by national oil companies, whether they are OPEC+ or not.

For the oil-producing countries, the exploitation of their reserves, non-renewable natural resources, must be managed and preserved to avoid its depletion and maintain its fair value. The call for attention is to an accurate and efficient consumption of oil, keeping in mind that the USA, Europe, and Asia’s industrialized economies consume 57% of the world’s oil. This conservationist stance is part of OPEC’s founding principles, and it has been the support of member countries and the organization in multilateral discussions on climate change, where the vast majority of OPEC member countries have signed the Kyoto and Paris Agreements.

The discussion is open, and the position of developing countries and their energy needs for development must be heard. It is, therefore, a question of seeking a balance between consumption and the environment, responsible and efficient energy consumption, as was the cry of the people demonstrating in the streets of Copenhagen on the occasion of the U.N. Climate Change Conference in 2009, «Let’s not change the climate, let’s change the system».

ECONOMY

The world economic growth forecast for 2021 remains unchanged at 5.5%, according to OPEC’s economic analysis in its June MOMR.

In the case of OECD countries, growth for 2021 remains at 4.8% (in 2020, it was -4.8%), with the acceleration of the U.S. economy as the main driving factor, with the Eurozone and Japan lagging further behind in their recovery.

In the case of emerging economies, India’s growth forecast for 2021 was adjusted by 9.5% (-0.2%) due to the recent impact of the high number of contagions in the country. As for China, after being the only economy with a positive variation in its Gross Domestic Product (GDP) during 2020 of 2.3%, it is expected to reach 8.5% growth in 2021 (+0.1%). For Brazil, the forecast remains at 3.0%, after a contraction of 4.1% in 2020. Russia is maintained at 3.0%, after contracting by 3.1% in 2020.

Thus, the recovery of the world economy continues, with the United States improving its domestic dynamics given the progress of its mass vaccinations and China leading the rebound in the Asian region. Europe, particularly the emerging and developing economies, with India and Brazil standing out, continue to face problems with COVID-19.

Despite the above, the assumptions for global economic recovery by 2021 remain, including the one that, by the second half of 2021, the pandemic will have been contained in advanced economies, with most of their citizens already vaccinated. Similarly, it is expected that the leading emerging economies will have been able to mitigate the impact of the coronavirus on their populations and their economies, even if it is clear that it will be less severe than in industrialized countries. The prognosis for the rest of the developing countries, particularly in Africa and Latin America, is much worse due to the limited access to the minimum necessary doses and, consequently, the low percentage of the vaccinated population in most of them.

In addition, the so-called «forced savings» of households during the shutdowns are expected to contribute to accelerating world economic growth during the second half of the year through an increase in the demand for goods and services. This dynamic is already beginning to be observed in many developed countries.

However, there are still significant elements of uncertainty. The rise of new variants or mutations of COVID-19 poses a risk that is difficult to parameterize. On the other hand, the sovereign debt of most economies has risen to levels at which an increase in interest rates could cause severe stress. Although interest rates are still low and are expected to remain stable in the short term, it is not excluded that this situation could change.

On June 13th, in Cornwall, United Kingdom, G7 countries: Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, concluded a three-day summit by issuing a joint communiqué in which they presented proposals on vaccinating the poorest countries against the coronavirus, higher taxes for large corporations and a proposal to tackle climate change through more technology and investment. The aim is to reactivate international cooperation between them after the distortions caused by the pandemic and by the role of former U.S. President Donald Trump in the group. The medium-term economic impact of the commitments made remains to be seen.

An additional element of uncertainty arises from the Joe Biden administration’s policy towards China, which, as observed in recent weeks, far from any opening, seems to maintain the same approach of his predecessor, Donald Trump, towards Beijing, albeit with differences in its execution. This could directly impact the recovery prospects of Chinese companies with a significant presence in the United States, their main export destination, followed by the European Union and Japan.

COVID-19

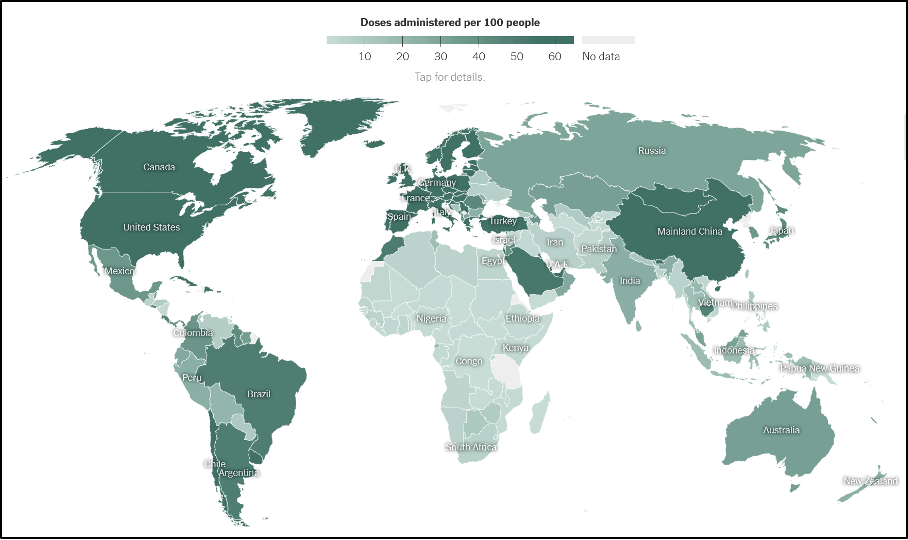

The global fight against COVID-19 continues, with the major economies advancing in their mass inoculation processes to reduce contagion in their countries. In contrast, most developing countries still lack the necessary vaccine quotas.

The proliferation of the Delta variant of COVID-19 initially identified in India is of worldwide concern. It is the fastest replicating strain of the virus and evades the body’s immune mechanism. This variant has affected countries that have already vaccinated a significant percentage of their population, such as the United Kingdom, Israel, and Australia, which have shown an increase in infections, causing a return to some movement restriction measures.

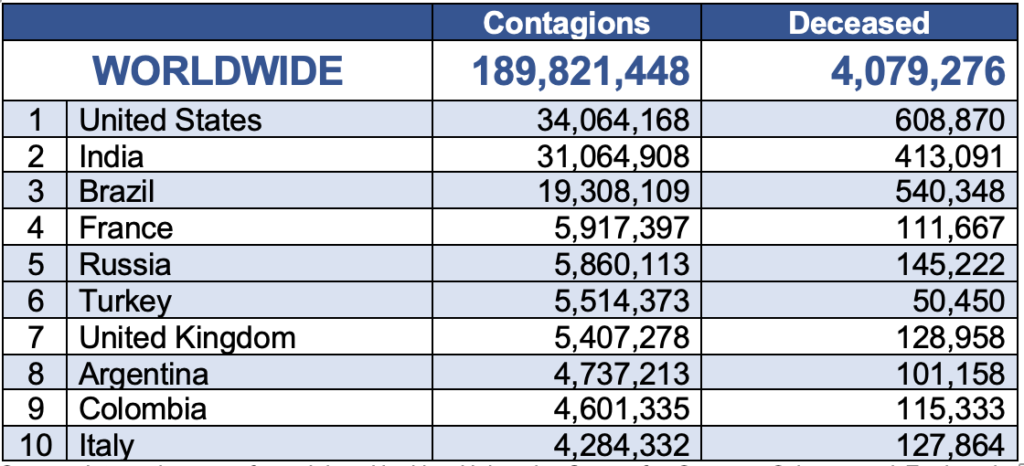

Contagions and deaths worldwide

As of July 17th, the number of people infected with COVID-19 worldwide exceeded 189 million, while the total number of deaths exceeded 4 million.

MOST AFFECTED COUNTRIES BY

Global Distribution of Vaccines

Almost 3.6 billion doses have been administered worldwide, equivalent to 43 doses per 100 people, nearly double the previous month’s figures. The gap between vaccination programs between developed and developing countries remains, with many of the poorest countries still without even the first dose provided to their citizens, compounded by the known variables of the virus, which come to complicate the current juncture.

The countries with the highest performance in mass vaccinations are the United Arab Emirates, with 166 doses per 100 inhabitants (i.e. they are already applying the second doses), followed by Malta (143/100) and Bahrain (136/100).

In the northern hemisphere, the United Kingdom has applied 122 per 100 inhabitants, the highest coverage among the major economies. On the other hand, the United States with 101/100. The European Union average 92 doses per 100 inhabitants, with Malta as the best performer (143/100) and Romania (47) the worst. Although a vaccine-producing country, the Russian Federation maintains a relatively low level of doses supplied (36/100).

In Latin America and the Caribbean, Uruguay continues to lead in terms of vaccinations (130/100), followed by Chile (128/100) and the Dominican Republic (85/100). Slightly back, the major economies: Argentina (59/100), Brazil (58/100), and Mexico (38/100).

Africa continues to be the region with the fewest vaccinations, with an average of less than 5 per 100 inhabitants, with only Mauritius (71/100) and Morocco (57/100) standing out.

In Asia, China reached 103 doses per 100 inhabitants. Compared to the previous month, Japan also improved its figures from 4 to 53 vaccinated per 100 people. On the other hand, India is still very slow in its vaccination rate (29/100), as it faces the consequences of the high number of infections. Mongolia and Israel (121/100) stand out, while Turkey (75/100) and Saudi Arabia (64/100) complete the best performing countries in the region.

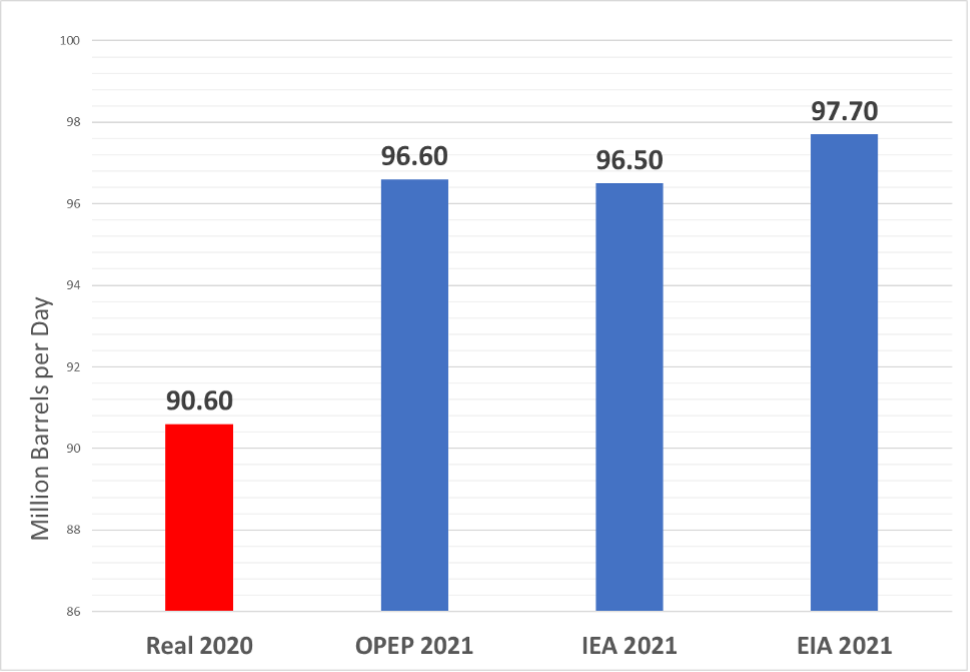

OIL DEMAND

According to June’s MOMR, world oil demand growth for this year remains unchanged at 6.0 million barrels per day, for a total oil demand of 96.6 million barrels per day. Following OECD data updates, total world oil demand for 2020 was adjusted downwards by 100 thousand barrels per day from last month, for total oil consumption of 90.6 million barrels per day.

The International Energy Agency (IEA) and the U.S. Energy Information Administration (EIA) maintained their forecasts of last month’s demand projection for the current year of 96.5 million barrels per day and 97.7 million barrels per day, respectively, an increase of 5.9 million barrels per day and 7.1 million barrels per day.

WORLD OIL DEMAND

(2020 – 2021)

The three agencies converge in the forecast of higher oil demand for the second half of 2021 to respond to the economic recovery of OECD countries and China. The above is due to progress in the vaccination processes initiated since the beginning of the year in those countries, the effect of the stimulus programs implemented and the increasing mobility for the summer vacation season.

For the OECD, annual demand was revised slightly downward, mainly to reflect lower than expected data from OECD America and Europe in the first quarter of 2021, but with increased internal mobility due to the removal of mobility restrictions, offsetting these forecasts upward.

For 2021, of the 6 million barrels per day increase in global oil demand, OECD is forecast to increase by 2.7 million barrels per day, with the highest growth during the second half of the year. The largest contributor to this increase would be the United States, supported by a rebound in demand for transportation fuels and light and middle distillates.

In the rest of the world, oil demand was revised slightly upward, with a projected increment of 3.3 million barrels per day. This was mainly due to increases in the Middle East and sustained growth in China, India and other Asian countries. Economic recovery in the Asian region will stimulate demand for industrial fuels and petrochemical feedstocks.

UNITED STATES

According to the EIA, oil demand increased by 0.9 million barrels per day y-o-y in March 2021, after registering a decline of 2.4 million barrels per day in February, compared to the same period in 2020. However, there were notable developments in gasoline, diesel and fuel oil demand in the face of the relaxation of COVID-19 restrictions in several states, leading to a month-on-month increase in ground transportation and improved industrial activity that supported growth in consumption of these fuels.

EIA estimates that gasoline consumption will reach 9.1 million barrels per day this northern summer (July through September), which is 1.3 million barrels per day more than the same period in 2020, but 0.4 million less than in 2019.

The May fuel consumption data reflects the impact following the Colonial pipeline outage due to the cyber attack it fell victim to on May 07th. However, an increase in gasoline demand was already projected, higher than initially forecast, with consumption expected to reach 8.7 million barrels per day by the end of 2021.

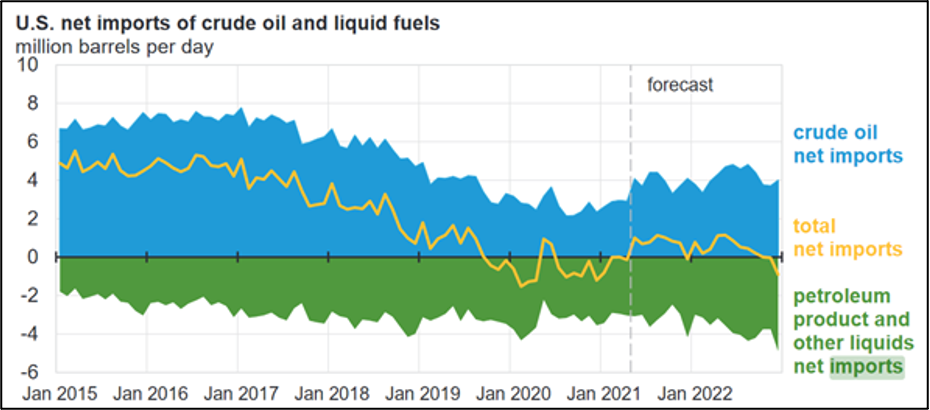

U.S. NET IMPORTS

OIL AND FUELS

(Projected March 2021-December 2022)

The United States has traditionally been a net importer of oil. This situation was reversed in 2020, when U.S. production reached record levels of 11.3 million barrels per day, becoming the largest oil producer in the world, underpinned by shale oil production, which increased extraordinarily from 2015 with the so-called «Shale Oil revolution». In this way, the U.S. reached its long-desired goal of «energy independence», a banner of all U.S. administrations since the ’70s.

However, since the COVID-19 pandemic and the collapse of the oil price and market, U.S. oil production fell by more than 935 thousand barrels per day, to remain at levels of 11.3 million barrels per day in 2020. In this scenario, EIA projects the U.S. back as a net oil importer on an annual basis in 2021 and 2022. Thus, rising crude oil imports will boost total hydrocarbon imports in 2021 and 2022, more than proportionately offsetting the reduction in refined products trade and increasing from their 2020 average (2.7 million barrels per day) to 3.7 million barrels per day by 2021 and 4.4 million barrels per day by 2022.

CHINA

In April, China’s oil demand increased by 1.6 million barrels per day year-over-year, following March’s high increase of over 2.1 million barrels per day y-o-y. China’s demand stands at 12.8 million barrels per day, comfortably above March 2019 levels by more than 0.3 million barrels per day, making it the only country so far to exceed pre-pandemic consumption levels.

With economic indicators permanently improving, following its GDP increase of 18.3% during the first quarter of 2021, including an increase in exports and an improvement in the manufacturing sector, Chinese oil demand will continue to increase. Although the Purchasing Managers’ Index (PMI) contracted to 51.1 in April, after registering 51.9 in March, it remains on an expansionary path. The Chinese economy is expected to grow by 8.5% this year.

Thus, with total hydrocarbon consumption increasing, it is expected to gain additional momentum in the second half of 2021, supported by near-term solid petrochemical capacity additions, which will also influence light distillate demand.

Product demand remains focused on fuels and, to a lesser extent, LPG from the petrochemical sector. Demand for diesel also increased, although at a slower rate than in previous months. Gasoline consumption followed a similar trend in the last two months, increasing by 600 thousand barrels per day, thanks to improvements in the mobility index. Jet/kerosene consumption grew strongly in April 2021, increasing by nearly 700 thousand barrels per day over 2020. Aviation data suggest an increase in domestic flights, with more limited improvements in international passenger travel. Meanwhile, diesel demand increased by around 100 thousand barrels per day compared to April 2020, at 2.83 million barrels per day.

Following the entry into force on June 12th of the import tax on heavy crude oil, some Chinese refineries, such as the Daqing refinery, owned by PetroChina, began to cancel gasoline exports. The tax is expected to have positive implications for the domestic crude oil and refined products market. Before the entry into force of the tax, in April and May, imports of heavy crude oil increased to around 400 thousand barrels per day.

For the week of June 14-20, Chinese gasoline exports fell by an average of 167 thousand barrels per day (compared to a four-week average of 202 thousand barrels per day), the firm KPLER estimated. As of June 28th, it would have fallen by an additional 16 thousand barrels per day. This could lead to excess refining capacities in China and the Asian region, leading to adjustment processes in refining capacity.

INDIA

In April 2021, India’s oil demand increased by 1.9 million barrels per day y-o-y to stand at 4.6 million barrels per day, driven by some improvements in mobility, just before deteriorating towards the end of the month due to a spike in contagions.

In terms of product performance, gasoline demand led the gains, up 400 thousand barrels year-over-year, amid a significant decline in miles travelled compared to April last year. The gains were driven by an increase in the use of motorcycles instead of public transportation.

On the other hand, diesel demand increased by 800 thousand barrels compared to the same period in 2020 due to improved industrial activity and increased agricultural demand during the harvest season. India’s manufacturing PMI came in at 55.5 in April, up from 55.4 in March, suggesting a slight improvement in the industrial sector. Naphtha demand showed substantial gains, supported by increased demand from the petrochemical sector.

New daily cases of COVID-19 increased in May, forcing closures and other restrictions that led to a sharp decline in mobility and, with it, reduced fuel consumption. As the contagions are controlled, and restrictions ease, oil demand is expected to pick up during the second half of 2021, with the increase in transportation fuel as the main factor. However, there is still uncertainty due to the infection rate (which in May, passed 400,000 cases per day and is currently around 50,000), the variants of COVID-19 found, and other related health problems that have not allowed life in India to return to normal.

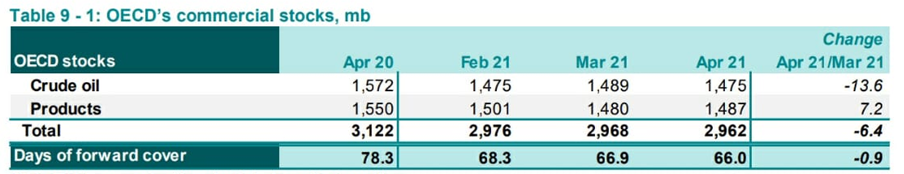

OIL STORAGE

One of the most evident signs of stabilizing oil market fundamentals is the draining of oil and oil product inventories. Inventories to continue to drain in 2021, falling below the record levels reached in 2020 and below the average over the 2015-2019 period, which is higher than the increase in oil product storage over the same period.

OECD countries

According to OPEC’s June MOMR, OECD countries’ commercial crude oil and product inventories stood at 2,962 million barrels in April, down 6.4 million barrels from March and 13 million barrels from April, falling by 159.9 million barrels from the same period in 2020 and 25.2 million barrels below the 5-year average. Days of inventory coverage was 66 days, down 0.9 days from March and 12.3 days lower than in April 2020.

Of the OECD countries, only the Asia-Pacific countries, led by Japan – 6.6 million barrels – showed an increase in crude oil inventories. In contrast, all OECD countries showed an increase in product storage.

OECD: CRUDE OIL INVENTORIES IN OECD COUNTRIES

(April 2020 – April 2021)

Of the total OECD commercial inventories, 1,475 million barrels correspond to crude oil, showing a drain of 13.6 million barrels to March of this year, placing 97 and 35 million barrels of oil below April 2020 and the average of the last five years, respectively.

Meanwhile, 1,487 million barrels of commercial inventories correspond to oil products, presenting an increase of 7.2 million barrels in March and 10.7 above the average of the last five years, despite presenting a drop of 63 million for April 2020.

For its part, the EIA, the STEO of July 07th, estimated total crude oil and oil products inventories in OECD countries at 2,884 million barrels for April, forecasting a monthly and annual decrease of 31 and 228 million barrels, respectively.

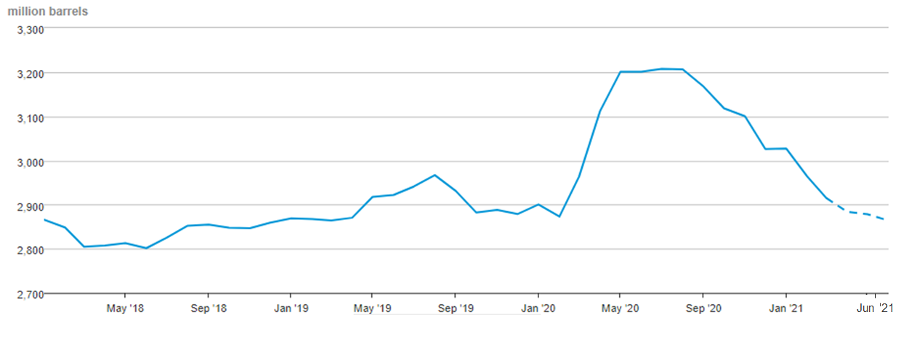

EIA: OIL INVENTORIES OECD COUNTRIES

(May 2018 – June 2021)

For May and June 2021, the EIA projected a level of 2.878 and 2.864 million barrels, respectively, in total OECD crude oil and product inventories, presenting a monthly decline of 6 million barrels and an annual decline of 323 million barrels in May and of 14 of barrels (monthly) and 343 million barrels (annual) in June.

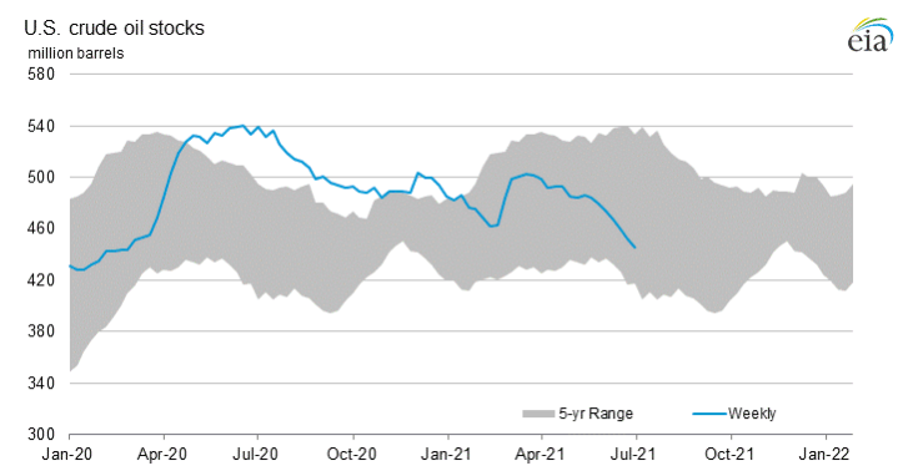

United States

Since May 21st, U.S. commercial crude oil inventories had a drain of 38.87 million barrels, to stand at 452.35 million barrels as of July 02nd, according to data from the weekly report of the EIA on July 07th, presenting an annual decrease of 94 million barrels of crude oil.

In June 2021, commercial reserves were at 449.28 million barrels, down 24.75 million barrels for the previous month and 26.57 with January of this year, placing 29.9 million barrels below the last five years’ average. Since March 2021, stocks have declined 52.63 million barrels, after peaking at 501.9 million barrels for the year due to winter storms that affected refining activity in Texas in February and March.

U.S. COMMERCIAL CRUDE OIL INVENTORIES.

(January 2020 – July 02nd 2021)

According to the same report, the EIA forecasts July commercial crude oil stocks to have a monthly decline of 10.54 million barrels, which would put inventories at their lowest level since December 2019.

The trend for U.S. crude inventories in 2021 is downward, adjusting the year-end projection to stand at 441.05 million barrels.

For July 02nd, according to the latest EIA weekly report on July 08th, days of coverage dropped to 27.5 days, when the June average was 29.2 days, showing 2.8 days less than in May. Between the end of February and March 19th, 2021, the coverage was above 40 days, with an all-time high of 41.8 days on March 12th.

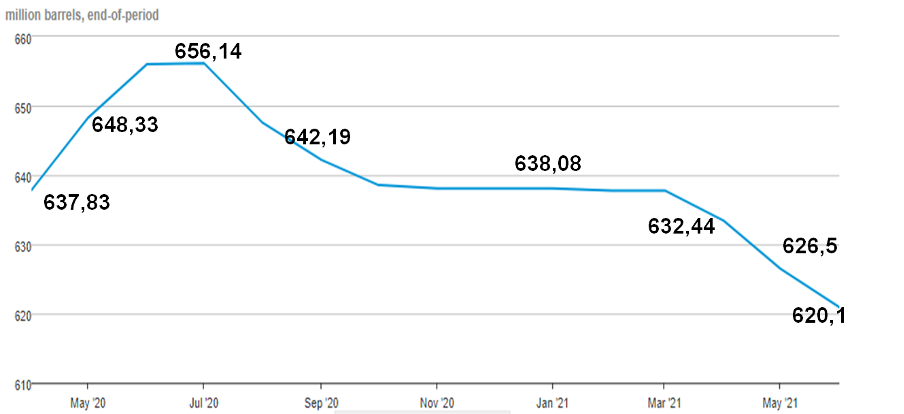

On the other hand, the strategic reserves drained 5.2 million barrels since June 04th, to reach 621.3 million barrels as of July 02nd, presenting an annual drop of 34.7 million barrels over its highest level. The aforementioned occurred when former U.S. President Donald Trump authorized, in April 2000, the use of strategic reserves to store the excess production of U.S. operators to prevent the shutdown of their production because of the collapse of the Cushing Oklahoma.

Although the EIA estimates show no variation in strategic reserves for July, the forecast at the end of the year is downward, forecasting 616.67 million barrels in 2021.

U.S. STRATEGIC OIL RESERVES

(May 2020-June 2021)

VENEZUELA

The minister’s unfulfilled promises: gasoline queues continue.

Last June 21st, in an interview for Bloomberg, the Minister of Oil and President of the ARA Commission, Tareck el Aissami assured that the fuels shortage that has affected the country since 2018, would end by the end of June because the national refining system would be soon capable of supplying the Venezuelan domestic market. The minister stated textually that «by the end of June, the queues will disappear».

It is already July, and the queues and the shortage continues, showing an enduring problem in the country. The government lied once again. The gasoline, diesel and gas shortages occur in the whole country, especially outside the capital, despite the government’s strong campaign in social networks to hide it and the fact that no media dares to report and reflect the fuel shortage situation, fearing censorship and reprisals from the government.

Paradoxically, the government appoints its highest officials to give interviews to international agencies and transmit messages of «confidence and tranquillity» to the international financial sector – in an attempt to attract them to its plans to privatize the sector. But the minister of oil just offered vague statements and promises with no technical-economic basis and which are not even part of a plan for the recovery of the oil industry in the country. The effect of the minister’s unfulfilled promises is devastating and contrary to his political intentions.

PDVSA’s problem is not technical but political and has nothing to do with the Organic Hydrocarbons Law, which the government is bent on changing. It has to do with Miraflores and the government’s policies towards the national oil sector, which has suffered since 2015 a systematic process of persecution of its workers and technical-managerial teams, militarizing the industry, causing the dismantling of its facilities and productive capacities that are now being auctioned off under cover of the secrecy of the so-called «anti-blockade law».

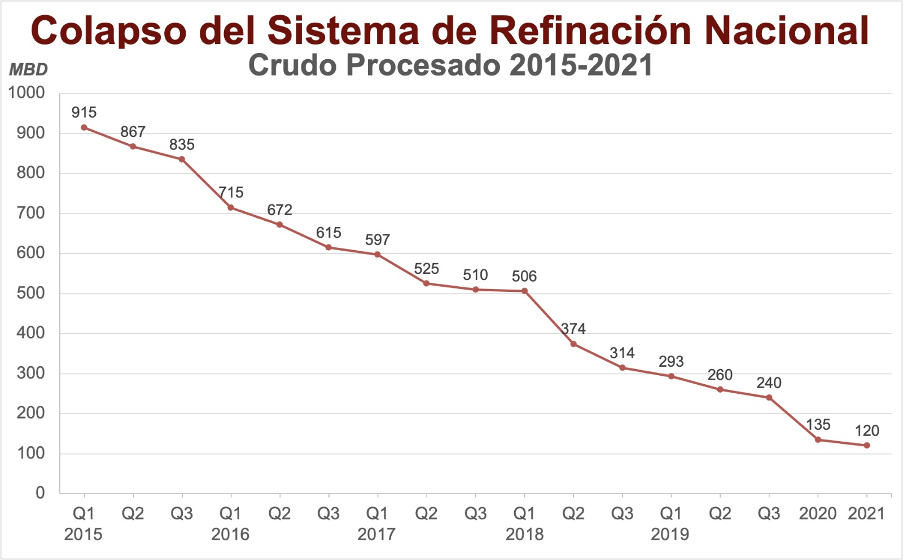

The fuel shortage is a consequence of the collapse of the national refining system (2015-2021).

Our national refining system, the country’s refineries, excluding CITGO, Cienfuegos, Petrojam and Refidomsa, has ALWAYS been able to supply our domestic fuel market.

Only during the oil sabotage between December 2002 and March 2003, when the so-called «Gente del Petroleo» (Oil People) sabotaged production and refineries, paralyzing Amuay, Cardon, Bajo Grande and El Palito, the country was subjected to a severe shortage of fuel and gas. However, in those years of President Chavez’s government, the Ministry of Petroleum and PDVSA structured a PDVSA recovery plan taking the measures to re-establish both oil production – which had fallen in January 2003 to only 23,000 barrels per day – and the operability of our refineries, objectives which we achieved between March and April of that same year.

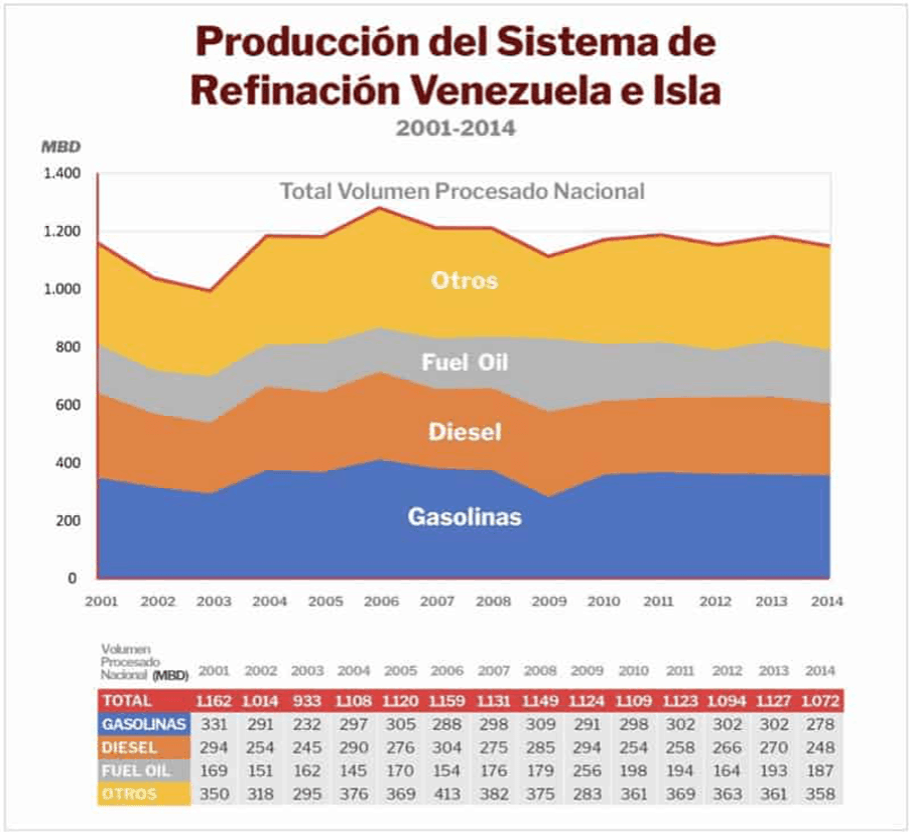

After overcoming the Oil Sabotage, our country maintained, between 2004-2013, average oil production of 3 million barrels per day and average refining of crude oil of one million barrels per day in the national circuit.

By the close of 2014, according to PDVSA’s Annual Management Report, our national refining circuit processed 1.15 million barrels per day and produced 1,042 thousand barrels per day of fuels, of which 638 thousand barrels per day were destined to the domestic market 404 thousand barrels per day were destined for export.

The composition and quantity of refined products between 2001-2014 were as follows:

However, as of 2015, PDVSA was successively intervened by the government, diverting the resources budgeted for the industry’s investments, maintenance, and operations, including those required by the refining system.

The Vice-Presidency of Finance, successively occupied by officials trusted by the government, systematically diverted the company’s resources to attend to the government’s priorities -including paying a foreign debt- and suspended the contracting processes of supplies and services for the company’s operations.

In addition to this deviation of resources and suspension of contracts, the government dedicated itself to persecute and purge the directors, managers, supervisors and workers who were in charge of PDVSA and the national refining sector during the government of President Chávez, the same ones who managed to recover the company from the effects of the oil sabotage of 2002-2003, and who today are out of the country or are in prison, abandoned to their fate as if they were criminals.

The effects of this lack of resources and the dismantling of the management of the national refining system, facilities susceptible to timely maintenance and highly complex operations were catastrophic.

As of 2017, with the militarization of the company, the government handed over the management of the refineries to groups related to the different interests and political sectors represented in PDVSA’s Board of Directors, most of the time without the knowledge or the capacity to manage such complex facilities.

From that moment on, scheduled maintenance programs, plant shutdowns and the replacement of equipment, parts, and spare parts began to be suspended or postponed. Also, the practice of «cannibalizing» equipment, that is, extracting equipment, parts or spare parts from one refinery or plant to use them in another, became widespread, ignoring their incompatibility and the fact that our national refining system -built by the different transnationals that operated in the country during the concession period- has completely different ages, technologies, systems and operating philosophies.

By 2020, the situation of the national refining system was of total collapse. In those conditions was left by the former president of PDVSA (2017-2020), General Manuel Quevedo, with the Puerto La Cruz and Bajo Grande refineries wholly paralyzed, while Amuay, Cardón and El Palito were at minimum load, not only due to inoperability but also due to lack of crude oil.

The ARA Commission, with its new authorities, has failed in its attempts to reactivate the refineries to 100% of their capacity, the Venezuelan refining system, with an installed capacity of 1.2 million barrels per day, as a whole operates at no more than 10% of its capacity. Successive reactivation attempts and many accidents -attributed by the minister himself, as the product of «terrorist» attacks, using «missiles»- have marked the whole period with failed attempts or inability to reactivate the refineries.

The government and its propaganda apparatus repeatedly argue that the shortage of the fuels required by the domestic market is due to the U.S. sanctions against PDVSA, avoiding the fact that such were imposed at the beginning of 2019 when the refining system was already basically paralyzed due to management problems and detour of resources.

The government that has partially privatized the oil industry and freed fuel prices to international market prices has resorted to importing fuels from Iran, a country that, paradoxically, is indeed subject to a strong blockade by the U.S., to partially guarantee the diminished domestic market that, after a 72% drop in the accumulated GDP since 2014, barely reaches 120 thousand barrels per day.

Despite the minister’s statements and government propaganda, long queues of citizens to supply gasoline in the country continue, and the acute shortage of fuels continues.

Cardon refinery paralyzed

Oil workers of the Paraguaná Refinery Complex informed that last July 05th, the catalytic plant of the Cardón Refinery, used to produce gasoline located within the referred complex, was paralyzed due to multiple failures in its operations. For that reason, it had to be stopped for maintenance, for which reason it is estimated to be out of service for at least eight weeks, which would worsen the depleted supply of fuel in several regions of the country.

So far, no authority has made any statement on the matter. However, the workers assure that the failures presented in the facility are a consequence of the absence of preventive maintenance for the last five years, which is necessary for its correct operation.

Oil production remains stagnant at 1930 levels.

According to OPEC’s latest Market Monitoring Report (MOMR), issued this month, oil production in Venezuela for May stood at 531 thousand barrels per day of oil, the same production level of 1930, a drop of 2.484 million barrels per day, 82.39%, concerning the country’s average production of 3.015 million barrels per day in 2013.

OIL PRODUCTION OF OPEC COUNTRIES

(May 2021)