INDEX

OIL PRICE

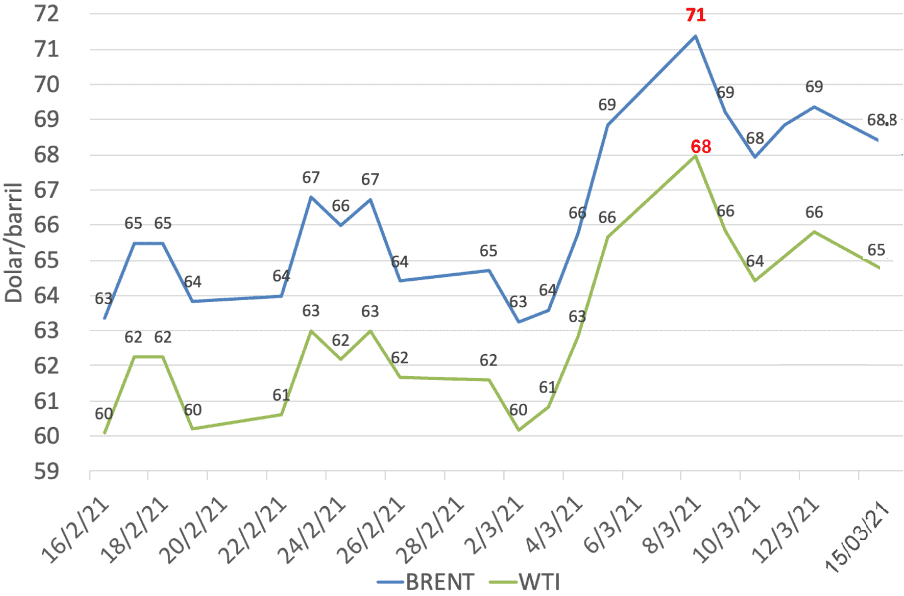

Oil prices reached a new high in March, when quotations reached the highest points recorded in the last two years, following OPEC+’s decision at its 14th Ministerial Meeting on March 4th to maintain production cuts unchanged, as well as the entry into force in February of Saudi Arabia’s additional cut of 1 million barrels per day of its production.

On Monday, March 15th, at the close of the European markets, Brent and WTI prices were down at 68.02 and 64.42 dollars per barrel, falling 2% compared to the previous week’s close following the news about the preventive suspension of the AstraZeneca vaccine in Europe.

However, prices experienced a sustained recovery since the beginning of March, when quotations experienced a recovery of 6% and 4% in comparison with their levels at the beginning of the month and 143% and 122% to the same date in 2020, to reach levels similar to the last quarter of 2018.

The recovery trend of oil markers remains stable, with expectations of strengthening their quotations, given market fundamentals’ growing balance.

OIL PRICE PERFORMANCE

BRENT AND WTI

(February 15th – March 15th, 2021)

The price has been supported by the compliance with OPEC+ production cuts, which in February was 113.16%, including Saudi Arabia’s voluntary cut, which has allowed the drainage of inventories and a growing balance in the supply.

Nevertheless, there are expectations in the market regarding the recovery of world oil demand due to the progress in vaccinations against COVID-19 in industrialized economies and the world’s economic growth for the second half of this year. The above has supported the increase in prices and the backwardation structure of the market.

The attacks on the oil infrastructure in the Persian Gulf also influenced the rise in prices. The Saudi Arabian Ministry of Energy spokesman reported a new attack on Sunday, March 7th, with drones and missiles, against a Saudi Aramco refinery, specifically on the oil tank farms located in the eastern port of Ras Tanura.

According to the International Energy Administration (EIA), in its report on the short-term energy market outlook (STEO) of March 9th, between March-April 2021, Brent and WTI crude oil price stood 67 and 63.50 dollars per barrel, respectively. The report highlights that this trend could reverse downward for the second quarter, as long as market fundamentals continue to balance, for an average Brent and WTI crude price of $58 and $55 per barrel, respectively.

Refining activity in the United States is progressively recovering from the forced shutdowns following the February weather events in Texas, as 7 of the 18 refineries operating in the area restarted operations. The rebound in activities has also favored the reduction of inventories.

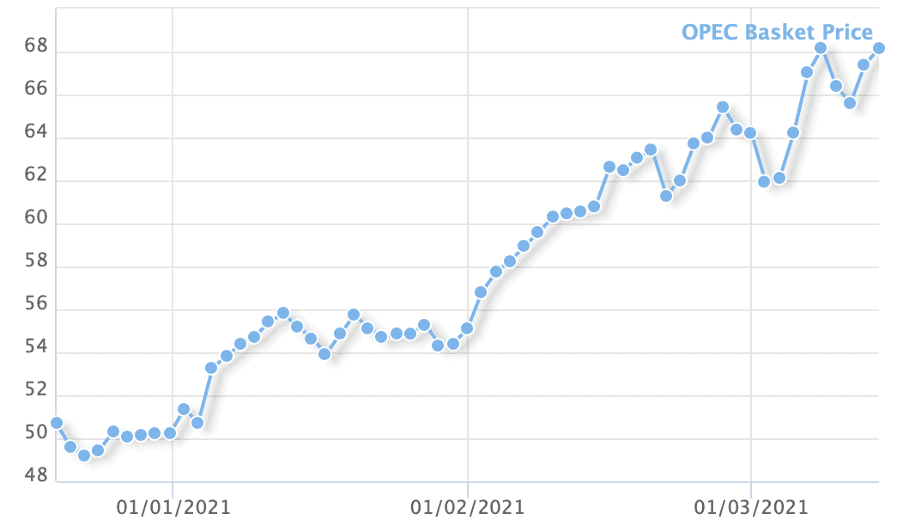

OPEC Basket

On March 15th, the OPEC Basket price reference was at 68.18 dollars per barrel, despite having shown a 4% drop on March 11th for the beginning of the week, it maintains its level at a new high of 68 dollars per barrel. OPEC crudes increased in a range of 12% to 14% between January and February, mainly North African crude references.

According to the Organization’s forecasts, the benchmark OPEC crude oil price will increase to $60.54 per barrel, increasing by 12% over 2020.

OPEP’s BASKET PRICE

(October-December 2020)

PRODUCTION

World Oil Production

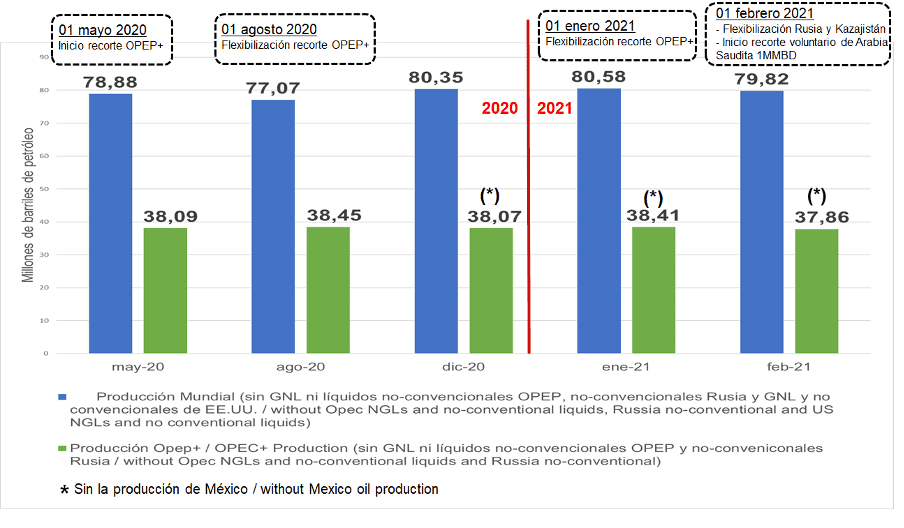

World oil production in February 2021 was 79.82 million barrels per day (MMBD), according to OPEC MOMR data for March, 760 thousand barrels per day of oil less than the previous month, with a month-on-month drop of 1%, the first since June 2020.

This drop reflects both Saudi Arabia’s unilateral decision to cut an additional 1 MMBD from its agreed quota voluntarily and the effects caused by the winter storm in Texas in mid-February, which affected U.S. oil production by 2 million barrels per day.

These production restrictions balanced the increases of other producers such as Russia, Nigeria, Kazakhstan and Iraq, keeping supply stable.

From world production, 37.86 MMBD corresponds to the producing countries grouped in OPEC+, equivalent to 47.43% of the world’s oil.

WORLD OIL PRODUCTION

(May 2020 – February 2021)

In its March 09th STEO, the EIA showed February 2021 projected production of 79.71 MMBD, very similar to that offered by OPEC, with a month-on-month drop of 970 thousand barrels of oil per day.

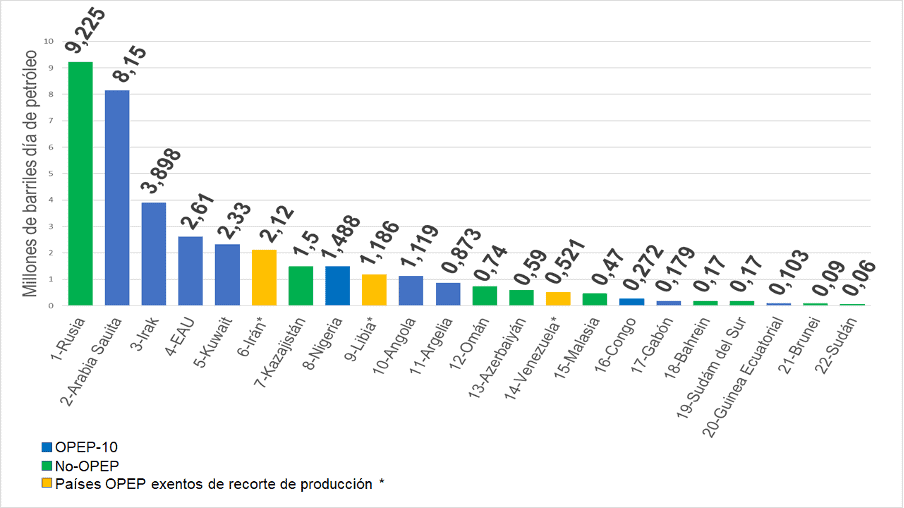

OPEC+

In February 2021, the production of the OPEC+ countries, signatories of the Declaration of Cooperation (DoC), was 37.86 MMBD, of which 24.848 MMBD correspond to the production of the 10 OPEC countries participating in the cuts, which represent 65.63% of the group’s production and 31.13% of world production.

OPEP+ COUNTRIES PRODUCTION

(February 2021)

For their part, the 9 Non-OPEC countries (Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Oman, Sudan, South Sudan and Russia) participating in the cuts had a production of 13.015 MMBD, 34.37% of OPEC+ production and 16.3% of world production.

At the OPEC+ meeting held last March 04th, the decision was announced to maintain the production cut levels recorded in January 2021 (except for Russia and Kazakhstan). Likewise, Saudi Arabia announced that they will extend until April the voluntary cut of 1 MMBD, which started to be effective on February 1st.

On the other hand, the pressure is increasing from some OPEC+ producers to modify the cut quotas, as evidenced by the new flexibility being granted exclusively to Russia and Kazakhstan to increase their production quota as of April. Russia will increase its production quota by 130 thousand oil barrels per day, while Kazakhstan will increase its production quota by 30 thousand barrels per day in April. The above is in addition to the flexibility approved at last January’s meeting, which authorized an increase in its production quota by 65 thousand (Russia) and 10 thousand barrels of oil per day (Kazakhstan) for February and March of this year.

Thus, OPEC+ allowed Russia to increase its production by 260 thousand oil barrels per day between February and April 2021, while Kazakhstan’s production increased by 50 thousand barrels per day in the same period. No other country in the group was authorized to increase its production quota in that period.

OPEC+ cut

Saudi Arabia’s voluntary action brought the production cut, in February 2021, to 8.063 MMBD, 938 thousand barrels of oil per day above the agreed February quota of 7.125 MMBD (including Kazakhstan’s and Russia’s flexibilities).

The OPEC-10, the Organization’s production-cutting countries (Algeria, Angola, Congo, Equatorial Guinea, Gabon, Gabon, Iraq, Kuwait, Nigeria, Saudi Arabia and the United Arab Emirates) cut their production by 5,661 MMBD, registering 1,097 MMBD above their cut quota of 4,564 MMBD, which 124.03% of the agreed quota.

Apart from the Saudi voluntary cut, it is worth mentioning Angola’s commitment to increase its production cut by 50 thousand barrels per day, a record 148 thousand barrels per day above its agreed quota of 261 thousand barrels per day. In Nigeria’s case, the African country complied in February of this year with the last additional cut to compensate for the overproduction recorded in 2020.

On the other hand, the 9 Non-OPEC countries signatories to the DoC agreement cut their production by 2.402 MMBD, 159 thousand barrels per day, below the agreed quota of 2.561 MMBD, which means compliance of 93.8%.

For this and the next month, the production cut quota will be modified due to the relaxation in Russia and Kazakhstan’s production, remaining at 7.05 MMBD in March and 6.89 MMBD in April.

However, thanks to the voluntary cut of 1 MMBD by Saudi Arabia, effective until April, the OPEC+ production cut will remain around 8 MMBD.

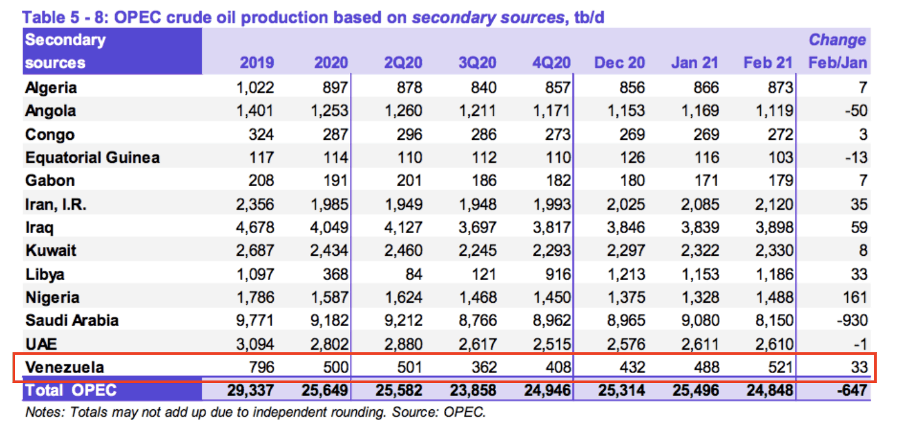

OPEC Production

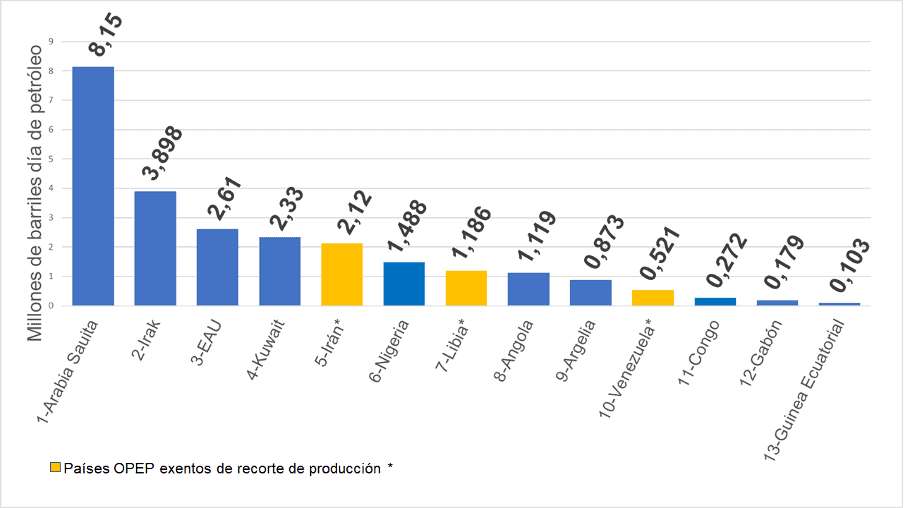

OPEC production, in February 2021, was 24.848 MMBD, according to preliminary data recorded in the MORM of March 11th, presenting a month-on-month drop of 647 thousand barrels of oil per day, in which the impact of Saudi Arabia’s voluntary cut is perceived.

Except for Saudi Arabia, U.A.E. and Kuwait maintained the production levels presented in January 2021. Hence, the three monarchies plus Iraq recorded in February output of 16.988 MMBD, reducing 862 thousand barrels per day to the previous month, representing 68.37% of OPEC production, 44.87% OPEC+ and 21.3% of world oil production.

Production from the 6 African countries (excluding Libya) recorded 4.034 MMBD in February, led by Nigeria (1.488 MMBD) and Angola (1.119 MMBD), covering 16.23% of OPEC production 10.65% of OPEC+ and 5.05% of world production.

Nigeria exercised, during February 2021, diplomatic demarches with the governments of Congo, Equatorial Guinea, Gabon and South Sudan to discuss issues related to compliance with the agreed cut quotas, which these small producers breached. These four countries recorded a combined production of 724 thousand oil barrels per day in February, with an overproduction of 84 thousand oil barrels per day, which has no impact on the oil market. It seems more like Nigeria’s political attempt to lead, within OPEC, the oil-producing countries in Africa.

The three countries exempt from production cuts recorded production of 3.827 MMBD in February 2021, of which 2.12 MMBD (55.4%) corresponds to Iran’s production, 1.186 MMBD (31%) to Libya’s and 0.521 MMBD (13.6%) to Venezuela’s production.

OPEP COUNTRIES PRODUCTION RANKING

(February 2021)

Saudi Arabia: ARAMCO plans define the Kingdom’s oil policy

On March 02nd at the CERA Week 2021 meeting, Saudi Aramco Chairman, Yasir al-Rumayyan, stated that if they see improving market conditions and «more appetite» from private equity investors towards ARAMCO, then they will consider selling more Saudi government shares.

With the privatization of part of Saudi Aramco, the world’s most expensive oil company, valued at $2 trillion, being one of the axes of Crown Prince Mohammed bin Salman’s «Saudi Vision 2030» policy, market stabilization and oil price recovery, as part of Aramco’s «assets», would seem to be an immediate objective of the Saudi Kingdom and would explain its voluntary cut of 1 million barrels per day effective between February and March.

This cut, which at the time was catalogued as «a gift to the market» on the part of the Crown Prince by Saudi Energy Minister Abdulaziz bin Salman himself, has been a fundamental factor in maintaining oil prices above 60 dollars per barrel.

The privatization of Saudi Aramco, initiated in November 2019, and the promise to pay minimum annual dividends of $75 billion to investors -at least until 2024-, regardless of market conditions, coincided with the oil market meltdown and the collapse of prices from the first quarter of 2020. The Saudi Kingdom has to face commitments for $250 billion by 2021 and is waiting for the best time to continue with its privatization plan.

Saudi oil policy, impacted by the commitments and needs for the privatization of Saudi Aramco, has gone in just one year from the «price war» and competition for markets with Russian producers in March-April 2020, to the defense of the OPEC+ production cut policy and the voluntary cut of 1 million additional barrels between February-April this year, a «gift» of 90 million barrels of oil to the market and its competitors.

Iran

It is remarkable the effort of the European Union, the U.S. and Iranian governments to return to diplomacy and reach an agreement to reactivate the Joint Comprehensive Plan of Action (JCPoA), despite the pressures of U.S. conservatives and the Israeli lobby pushing in the opposite direction.

On February 19th, President Joe Biden, through Department of State’s spokesman Ned Price, announced that he would accept an invitation from European Union High Representative Josep Borrell to attend a meeting between the P5+1 (US, France, China, Russia and the United Kingdom, plus Germany) and Iran, to «discuss a diplomatic track on the Iranian nuclear program». From the Persian country, the response came from its foreign minister, Javad Zarif, who made it clear that his country will «immediately» reverse all its corrective measures after the U.S. has «unconditionally and effectively» lifted all the sanctions imposed on Iran.

The day before, the president of the Council of the European Union, Charles Michael, communicated with the President of Iran, Hassan Rouhani, where both parties agreed on the importance of preserving a space for diplomacy, in addition to highlighting the importance of the agreement, which the Iranian president described as «a great achievement of world diplomacy». However, the point where there are discrepancies is Iran’s suspension of the Additional Protocol established in the JCPoA. Michael asked Rohuani that his country «facilitate» the full implementation of the JCPoA while recognizing the need for the U.S. to return to the JCPoA.

On February 20th, the Director-General of the International Atomic Energy Agency (IAEA), Rafael Grossi, arrived in Iran, where he reached an agreement with the Atomic Energy Organization of Iran (AEOI) to monitor Iran’s achievements, as well as its compliance with the Comprehensive Safeguards Agreement, allowing the IAEA to perform its work for three months (it can be extended or suspended). The agreement was reached days before the entry into force of the law called «Strategic Plan of Action for Lifting Sanctions and Defending the Interests of the Iranian Nation», where Iran stops implementing the voluntary measures provided for in the JCPoA.

Rouhani’s diplomacy continues to make progress; this time in telephone communication with U.K. Prime Minister Boris Johnson on March 10th, where the British premier asked the Iranian president «not to miss» the «opportunity being offered by Biden» to return to the agreement if Iran returns to compliance and stops all nuclear activity in violation of the JCPoA. For Rouhani, «the time has come to help solve this problem, where the path must lead to the lifting of sanctions and the fulfillment of U.S. commitments. There is no other option».

Thus, despite the full force of sanctions and the various legal actions taken by U.S. authorities to seize Iranian oil and fuel cargoes in various locations worldwide, Iran’s oil production for February 2021 was 2.12 MMBD, its highest record since October 2019. From the moment Joe Biden took office as U.S. president in January of this year, Iran increased its production by 100 thousand barrels per day of oil.

Guyana: the spoliation. Low royalties and tax exemptions.

Guyana, whose oil development is advancing in the Essequibo waters, the territory in dispute with Venezuela, is beginning to appear in oil reports, including OPEC’s MOMR, as a new oil producer on the international market map.

Although the presence of the oil transnationals in the disputed area has been carried out and is developing in the face of Venezuela’s inaction, while the country is immersed in a deep political and economic crisis that has enormously weakened its diplomatic capacities and political influence, it is foreseeable that this area will become a zone of conflict soon, to the extent that oil production increases – as the transnationals have announced in their plans – and that Venezuela can articulate a policy of claiming and demanding its sovereign rights over the disputed territory.

Meanwhile, the transnationals operate based on contracts and fiscal conditions, taken advantage of a small and developing country without any experience or political will to establish an oil legal framework following their national interests.

Last March 03rd, the U.S. transnational ExxonMobil reported that in 2020 the company paid 5.6 billion dollars in taxes. As reported by the Institute for Energy Economics and Financial Analysis (IEEFA), Guyana in 2020 did not receive a single cent from ExxonMobil, nor from its subsidiaries or partners in Guyana (Hess Corporation and CNOOC), as payment of income taxes.

By decision of the Guyanese authorities, the contracts contracted between Guyana and ExxonMobil are not known, nor are they in the public domain, which benefits the oil companies. In the face of various reports presented by anti-corruption organizations and political interpellations, the Guyanese government defends the signed contracts by affirming that «they will not be reviewed or modified».

Raphael Trotman, who was Minister of Natural Resources during the mandate of David Granger (2015-2020), signed in 2016 a Production Sharing Agreement (PSA) with ExxonMobil, which covers subsidiaries and partners of the U.S. company. According to this contract, the transnational will only pay 2% royalties on the oil extracted in the Stabroek block – one of the lowest percentages ever seen in the world – and, according to Trotman himself, Guyana will be entitled to 50% of the profits on the total reserves found in Stabroek.

Similarly, the same PSA grants ExxonMobil a permanent «tax exemption» from all taxes, a provision that cannot be modified according to Article 32 of the same Contract. According to IEEFA, in 2025, the year in which the U.S. oil company expects production of 750 thousand barrels of oil per day, Guyana will cease to receive taxes for oil activity of 653 million dollars. So it can be projected that, in 2020, Guyana ceased to receive close to 100 million dollars due to the «tax exemption» of the PSA, in a country of 770 thousand inhabitants whose annual budget in 2020 was 1.28 billion dollars, according to data from the Ministry of Finance of Guyana.

According to reports of the Guyanese specialized press, Guyana’s production in February was 125 thousand barrels per day of oil.

Canada

In February, the production projected by the EIA places Canada with a production of 5.79 MMBD, similar to that of last January when it registered 5.8 MMBD, although slightly lower than the 6.02 MMBD of December 2020, maximum level registered or projected in the history of the American institution.

For its part, the January 2021 data recorded in OPEC’s MORM published in March presented a production of 5.64 MMBD, a record level for Canada, according to the Organization’s history, but 160 thousand barrels per day less than the EIA’s projection. In the same OPEC report, the December 2020 production record (5.61 MMBD) is 400 thousand barrels per day, lower than the EIA projection for that month.

In either case, historical levels are being recorded in Canadian oil production, which had exceeded 4 MMBD in 2012, with the Kearl project and 5 MMBD in 2017, developing the oil sands projects in Alberta, which touched a historic 1.65 MMBD in the region and 2.01 MMBD in the country. Earlier, in August 2020, after the pandemic was declared in March, production had fallen to 4.8 MMBD.

The EIA records the progressive increase in Canadian oil imports to the U.S., which rose from 2 MMBD in January 2011 to over 3.5 MMBD in 2017 to 4 MMBD in December 2020. In January and February 2021, Canada imported 3.82 MMBD and 3.47 MMBD, respectively. Canadian demand has not exceeded 2.2 MMBD since the start of the pandemic. Before that, Canadian demand did not exceed 2.7 MMBD.

U.S.

According to the STEO, U.S. Oil production for February was 10.4 MMBD, which was affected by the winter storm that occurred between February 12 and 17, which forced the shutdown of shale oil operations and refinery activities in Texas, affecting production by up to 2 MMBD, placing the average production that week at 9.7 MMBD. In February, U.S. oil production suffered a month-on-month drop of 550 thousand barrels of oil per day.

However, since Texas’s situation began to normalize, production recovered rapidly, to register an average of 10.9 MMBD in the week of March 05th, 2021, projecting production to 11 MMBD, reaching the level of 11.1 MMBD estimated by the EIA for 2021.

We are facing a new reality. Trump’s volumetric policy placed U.S. production above 12 MMBD in April 2019 and 12.74 MMBD in March 2020 and promoted among E&P companies the acquisition of debt in the bond market and bank loans secured with oil reserves, the hedge funds used by E&P companies to protect their revenues, calculated at $50 and $60 per barrel. Between April 2019 and December 2020, 83 E&P companies filed for bankruptcy, with more than $100 billion in debt (secured and unsecured), according to the Oil Industry Bankruptcy Monitor 2020, by law firm Haynes and Boone.

Since December 2020, large E&P companies operate shale fields with a barrel above $45, which allows them to monetize capital and increase cash flow, which allows them to adjust production volumes without new investments to give value to their asset.

Meanwhile, on March 15th, Deb Haaland, an environmental activist, original co-sponsor of the Green New Deal, with a clear position against fracking, drilling on public lands and pipeline construction, was appointed by the Biden administration as U.S. Secretary of the Interior.

Drilling Activity

The number of active drill rigs in the U.S. continues to increase; according to the latest weekly report from Baker Hughes, operations are recorded at 309 rigs, 23 more than on February 12th, although 374 fewer than on March 13th, 2020. However, production remains stable at around 11 MMBD, with a high barrel price and a decline in oil inventories, which, according to EIA’s STEO, is expected to fall by 745 thousand barrels during the first half of 2021.

As we reported in the previous Oil Report, the current operators in shale wells decided to bring started but uncompleted wells instead of mobilizing rigs to start new drilling activities, which keeps the production level without changes. The E&Ps use the installed infrastructure instead of investing in new drills. This explains the increase in operational drilling rigs, even though no increase in production can be seen.

DRILLING ACTIVITY IN THE USA.

(November 2020-march 2021)

ECONOMY

Economic activity in industrialized countries and emerging economies started to show signs of recovery after partially adapting to pandemic-related restrictions and following massive vaccination programs.

The recovery has been characterized by the passage of unprecedented fiscal and monetary stimulus packages. In the last quarter of 2020, Gross Domestic Product (GDP) growth in industrialized and emerging economies exceeded previous expectations, rising from -3.9 to -3.7 percent. This trend is expected to continue during 2021, as long as new mobility restrictive measures are not implemented. Regarding the current year, a GDP growth of 5.1 percent is expected for 2021, improving February’s estimate of 4.8 percent.

All of the above, as long as the vaccination processes in the most advanced economies reach the largest possible population and the COVID-19 variants do not limit the effectiveness of vaccines against them.

However, the above does not apply to developing countries, where asymmetries in access to the necessary doses of COVID-19 vaccines continue to be evident, further delaying the onset of recovery itself. Prospects for sustainable growth vary widely across countries and sectors. Deploying a faster and more effective vaccination strategy worldwide is critical.

The outlook has improved in recent months, and signs of a rebound in trade in goods and industrial production in tandem with the progress of mass vaccination campaigns will be felt from mid-2021 onwards.

Similarly, growth prospects would improve if the production and distribution of doses of the different vaccines are accelerated, with better coordination and distribution worldwide to immunize the majority of the population and prevent mutations and spread of the virus. The above would allow containment measures to be relaxed quickly and global production to normalize rapidly.

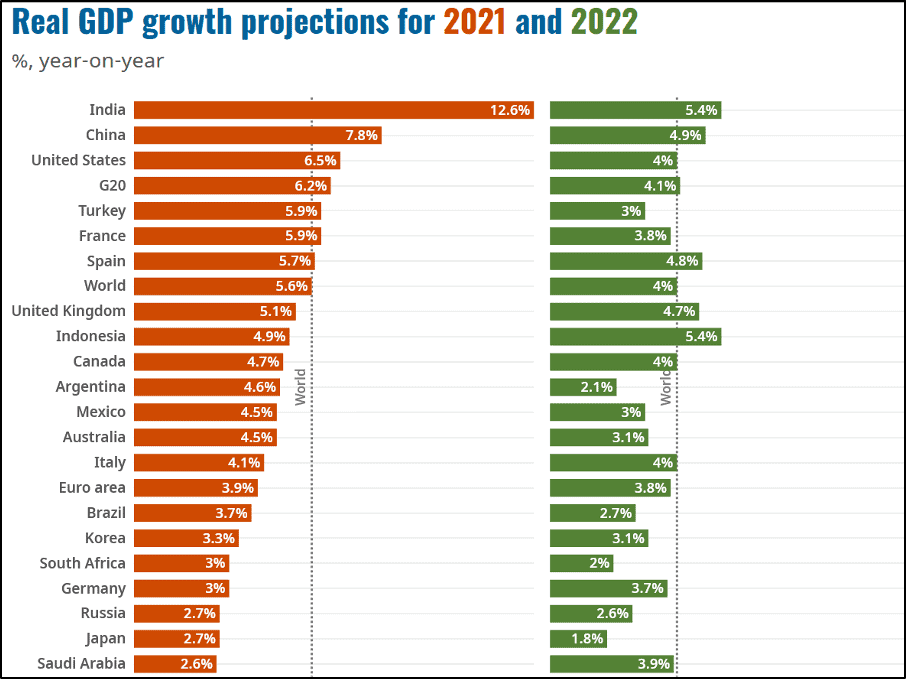

OECD: forecast for 2021 upgraded

Global GDP will grow by 5.6 percent this year if the rollout of vaccination is sufficiently rapid and effective worldwide, as announced by the Organization for Economic Co-operation and Development (OECD) on March 09th. The forecast was 1.4 percentage points higher than the outlook presented by the institution last December.

The OECD forecast that global output could reach pre-pandemic levels by mid-2021, following a 5.6 percent growth in 2021. The global economy is expected to grow by 4 percent in 2022, provided that progress is made in mass vaccination campaigns and new variants of the virus do not complicate the picture again.

In the same report, the OECD projected that the U.S. economy will grow by 6.5 percent in 2021 thanks to the expected new stimulus package, coupled with a sustained pace of mass vaccination.

On the other hand, for the Eurozone, where the level of fiscal stimulus is lower and the launch of vaccines slower, GDP is forecast to increase by 3.9 percent by the end of the current year.

As for the Asia-Pacific region, the outlook is very positive, as several countries have effectively contained the virus, allowing for a revival in industrial activity. GDP growth is forecast at 7.8 percent for China, while for India, it is estimated to reach 12.6 percent. Japan, 2.7 percent, the Republic of Korea, 3.3 percent and Australia, 4.5 percent.

For Latin America and Africa, the OECD forecasts a more moderate recovery, as they are highly conditioned by the mutations of the virus, including the «Brazilian variant,» affecting South America and, above all, by the slow deployment of vaccines given the problems of access for countries in both geographical areas.

PROJECTED REAL GDP GROWTH

REAL GDP GROWTH FOR 2021 and 2022

United States: Congress approves $1.9 trillion Relief Bill

The U.S. House of Representatives approved on Wednesday, March 10th, the final version of the $1.9 trillion Economic Relief Bill to alleviate the economic crisis caused by the COVID-19 pandemic. The House referred it to President Joe Biden, who signed it into law for immediate execution on Thursday, March 11th.

The House, with the Democrats majority, passed the bill by a 220-211 vote. The Senate passed the bill on a 50-49 vote last week, after making changes to the original House-passed version.

The legislation, known as the American Rescue Plan Act 2021, includes new direct payments to citizens of $1,400, $350 billion earmarked for state and local governments, and extends an additional $300 weekly federal unemployment benefit through September.

While Democrats claim the measure will significantly reduce poverty and boost economic recovery, Republicans argue that it is too costly. Moreover, they accuse their counterparts of abandoning bipartisanship to «promote non-pandemic liberal policies» based on Congress passing five pandemic rescue packages totaling $4 trillion on a bipartisan basis during 2020.

Wall Street and public sector economists have revised upward forecasts for U.S. economic growth due to the bailout package and the massive vaccination program underway in the United States. As previously discussed, the OECD this week predicted U.S. economic growth of 6.5 percent in 2021, improving from the 3.2 percent estimated in December. The U.S. economy contracted 3.5 percent in 2020 due to the pandemic’s impact on consumer spending and private investment, making it the most significant annual GDP decline since 1946.

Post-Brexit economy: U.K. delays customs checks for European goods

On Thursday 11th, the United Kingdom admitted that they are not yet fully ready to implement the terms of their withdrawal from the European Union.

The British government reported that it would allow free transit of some goods arriving at British ports from the European continent until January 2022, a tacit admission that they cannot carry out Brexit’s border controls.

In this way, the risk of shortages in foodstuffs or industrial activity components is avoided, favouring British companies’ normal functioning, highly dependent on these imports.

The Brexit, Prime Minister Boris Johnson’s main political initiative, would remain unimplemented for another year after being approved in a referendum in June 2016 and agreed in its terms last December, suggesting that the British government underestimated or minimized its multiple complexities.

With the UK being a member of the European Union, British companies could trade freely with those in the bloc, with minimal formalities. Once Brexit was approved, goods traded between the two parties now required customs declarations and, in the case of food products, health certification.

The British opted to phase in their controls, which will come into effect in July. But now, that deadline has been pushed back another six months to January 2022. For their part, European Union members immediately introduced customs controls on Britain’s goods, affecting some exporters. By way of example, imports of British goods from Germany fell by more than 56 percent in January compared to the same month in 2020. However, some of the above can be explained by stockpiling before Brexit implementation and the pandemic’s impact.

Currently, nearly three-quarters of U.K. businesses face delays in moving goods in and out of the European Union in the last three months, increasing administrative and logistics costs.

With rising tensions over trade, vaccine supply and other issues, relations between London and Brussels have deteriorated into a state of semi-permanent friction.

In a statement, the British government said it was changing plans at ports in response to businesses’ complaints that had faced severe challenges during the pandemic.

Thursday’s decision was followed by introducing a different and much more politically sensitive option to delay fuller border controls on Britain’s goods to Northern Ireland.

Because trade with Northern Ireland is covered by a separate agreement with the European Union, the U.K.’s unilateral decision to delay checks on some goods heading there has been frowned upon in the European bloc, as they claim it violates international law. The bloc’s executive body, the European Commission, is expected to initiate legal action against the British in the coming days.

European Union: ECB seeks to lower interest rates to stimulate recovery

The European Central Bank (ECB) has pledged to accelerate bond purchases over the next three months to prevent rising borrowing costs from affecting its economic recovery.

The ECB said it would make payments under its emergency purchase program faster than it did during the first few months of this year.

Christine Lagarde warned that the pandemic was threatening the recovery: «The pickup in global demand and additional fiscal measures are supporting global and euro area activity. But high levels of contagion, the spread of mutations of the virus and the tightening of containment measures are affecting economic activity in the euro area in the short term.»

Regarding the speed of vaccination programs in the European Union, he said they lag behind those in the United Kingdom and the United States.

While the overall economic situation is expected to improve throughout 2021, there is uncertainty about the near-term economic outlook related to pandemic dynamics and vaccination campaigns’ speed.

In reaction to the ECB’s move, European stock markets closed at one-year highs, while government bond yields retreated, given the relative improvement in the bloc’s economic outlook.

China: increase in foreign trade in 2021 helps global recovery

The People’s Republic of China’s foreign trade maintains an upward trend during the first two months of 2021, based on its economy’s strengths. According to several experts, they will give more confidence to their trading partners, and they will be pivotal in the global economic recovery.

According to the General Administration of Customs of China (GAC), China’s trade volume (total imports and exports of goods) expanded by 41.2 percent year-on-year, reaching 834.49 billion U.S. dollars for January-February.

In the specific case of its exports, exports increased by 60.6 percent year-on-year, totaling US$468.87 billion.

According to Tong Shiping, professor of economics at Dokkyo University, Japan, China’s exports to its main trading partners year on year have grown by double digits: 75.1 percent to the United States, 51.9 percent to the European Union and 43.2 percent to the Association of Southeast Asian Nations (ASEAN) countries, due to the growing dependence on Chinese products worldwide.

According to GAC, China’s total imports increased by 22.2 percent, $365.62 billion for the same January-February period.

In 2020, exports from countries and regions such as Japan, the E.U. and Latin America declined significantly, while their exports to China still showed a steady upward trend, becoming a bright spot in this field.

Tensions in China-US relations

On March 12th, 2021, the Quadrilateral Security Dialogue (Quad) Summit was held between the United States, Japan, India, and Australia, forming a common front against China and sending Beijing a strong message. This initiative would strengthen tensions between the Americans and the Asians, extending the conflict initiated during Donald Trump’s presidency.

The new Biden administration has identified the Pacific as a geostrategic region for the United States and a priority scenario for the Department of Defense. Thus, Secretary of State Antony Blinken and Secretary of Defense Lloyd Austin will make their first official foreign trip to Japan. This Tuesday, 16th, they will have a meeting with their Japanese counterparts, where they are expected to discuss and coordinate joint policies on Beijing’s maritime incursions. Similarly, Joe Biden invited Japanese Prime Minister Yoshihide Suga to the White House in April to be the administration’s first official visit by a foreign leader.

The growing tensions between the two world’s biggest economies will undoubtedly have a permanent destabilizing impact and tension between the two great powers trying, by commercial, diplomatic, political and even military means, to win the race for world supremacy in a post-Covid-19 economy.

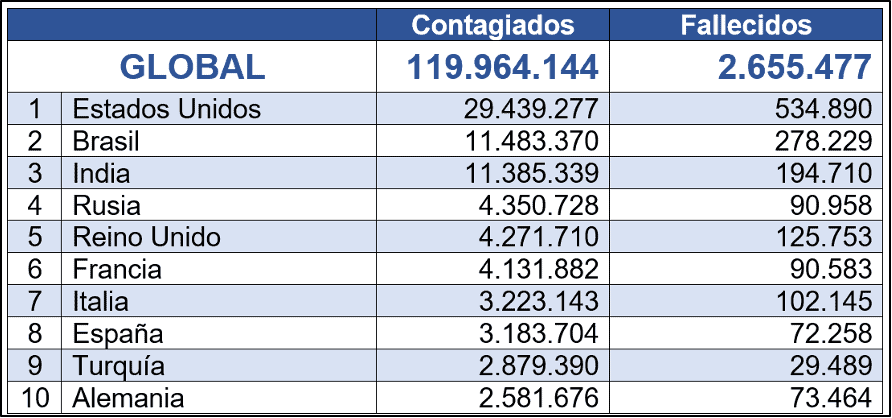

COVID-19

As of 03/15/2021, and one year after the World Health Organization declared COVID-19 a pandemic, the number of people infected worldwide is about to reach 120 million. The total number of deaths has reached 2.6 million, while 68 million people affected by COVID-19 have recovered.

MOST AFFECTED COUNTRIES BY COVID-19

On Thursday 11th, The European Union authorized Johnson & Johnson’s vaccine in people over 18. In this way, 200 million doses are expected to reach the 27-nation bloc, contributing to its still-slow vaccination efforts. The vaccine can be stored in standard refrigerators for up to three months and requires only one dose. It is the fourth to be approved by the E.U. regulatory agency.

Three more vaccines, Novavax (U.S.), CureVac (Germany) and Sputnik V (Russia), are undergoing continuing review, a preliminary step that could lead to approval. Although the latter, Sputnik V, is always subject to an anti-Russian diatribe from European and U.S. political sectors that do not welcome the Russian presence on their territory.

The E.U. also announced on Thursday that it will extend until June a mechanism that allows member states to block the export of vaccines manufactured within the E.U. in case local manufacturers fail to meet domestic orders.

Italy announced on Friday 12th that restrictions will be increased from Monday 15th to prevent Covid-19 from keep spreading in the country. The entire territory will be quarantined over the Easter weekend to combat the spike in infections amid a slow vaccination process. Italy surpassed 100,000 coronavirus deaths this week, with a current death rate of around 300 per day.

Health officials attribute the increase in infections and deaths, especially in central and northern Italy, to the most contagious variants. With approximately 7 percent of the population vaccinated, the country continues to experience delays in vaccine deliveries from Pfizer-BioNTech, Moderna and AstraZeneca.

The number of infections in Germany continues to rise, with more than half of them caused by the so-called British variant. This brings the country formally into the third wave of infection, following confirmation by public health officials.

Denmark, Iceland, Italy, France, Germany, Spain, Portugal and Norway temporarily suspended the AstraZeneca vaccine after some people developed blood clots after being inoculated. For the time being, European health regulators said there was no evidence that the vaccine had caused the clots.

Vaccine distribution

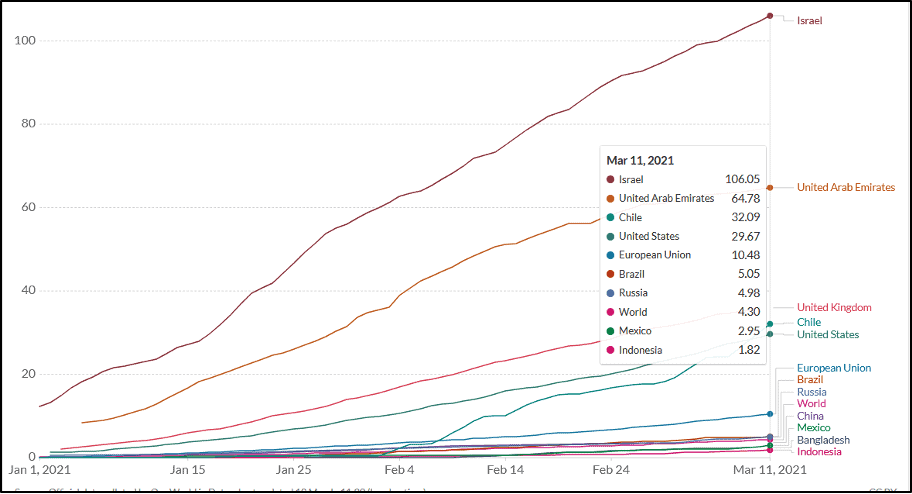

Of the existing vaccines, without taking into account laboratory or country of origin, as of 11/03/2021, the following average number of daily doses per country have been inoculated:

DAILY DOSES OF VACCINES ADMINISTERED

(WEEKLY AVERAGE)

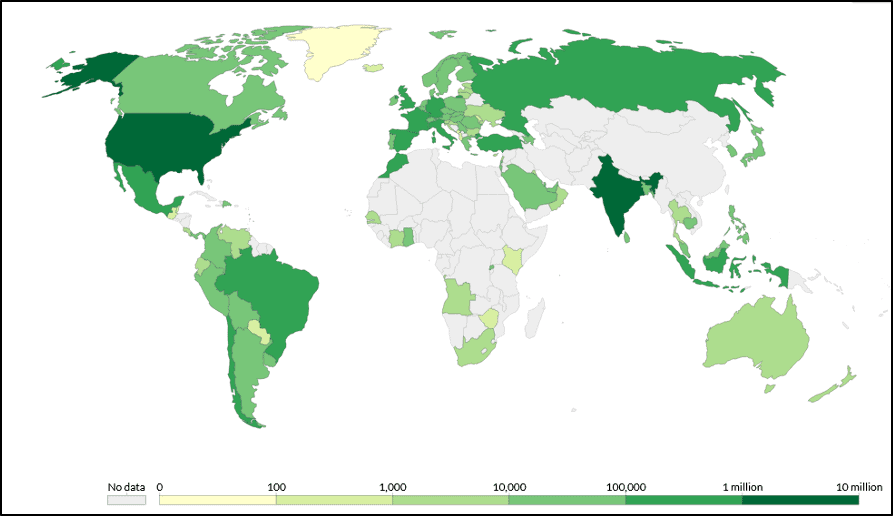

The above image shows that in addition to the countries in the northern hemisphere, where the number of people vaccinated is disproportionately higher than in the southern hemisphere (mainly developing countries), where, in many cases, vaccinations have not even begun.

To date, 19 percent of the U.S. population has been vaccinated, with almost 30 doses per capita inoculated to date, three times more than in the European Union. President Joe Biden announced that July 04th will be «Coronavirus Independence Day», announcing that the entire adult population of the United States will be vaccinated by that date.

Israel is the country with the highest proportion of vaccinated people (106 per 100 inhabitants), which means that they started to apply second doses to some of its citizens.

In Latin America and the Caribbean, an improvement can be seen concerning the previous month, with Chile standing out as the country in the sub-region with the highest number of people vaccinated in total (32 doses per 100 inhabitants), followed by Brazil (5/100) and Mexico (3/100).

TOTAL DOSES ADMINISTERED

(For every 100 people)

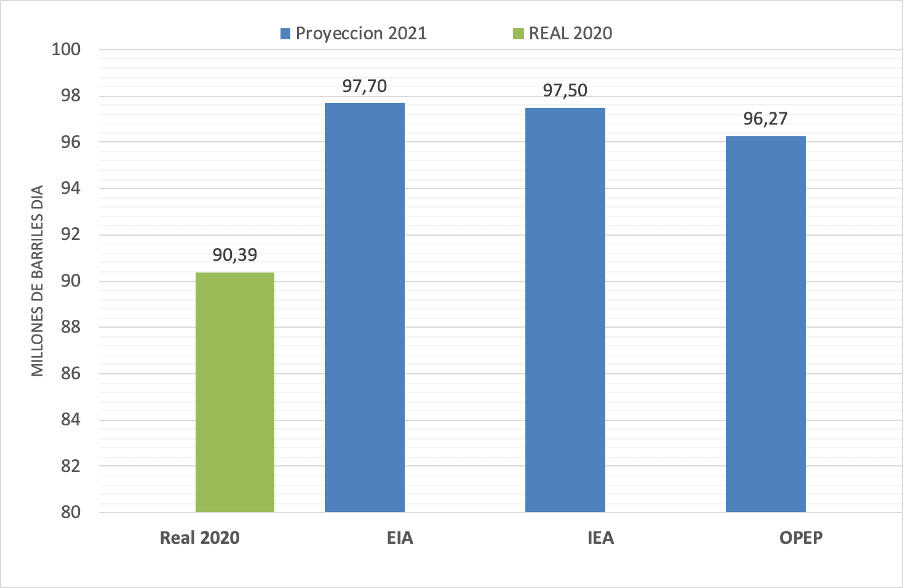

OIL DEMAND

According to OPEC’s data, World oil demand for the first quarter of 2021 was 93.03 million barrels per day, 3% up from the last quarter of 2020.

Consumption in OECD countries was revised downward for the first quarter, mainly due to containment measures and air traffic restrictions. Non-OECD countries are expected to increase more than estimated in February, thanks to economic activity and fuel consumption in China and India, with annual increases of 8 and 18 percent, respectively.

Regarding the second quarter, OPEC forecasts that world oil consumption will continue to increase when oil demand could increase, considering that vaccination’s positive effects will be seen in the world’s leading economies.

According to OPEC estimates, the average demand for 2021 will increase by 5.9 million, for an annual average of 96.3 million barrels per day, an increase of 6.5% over average consumption in 2020.

WORLD OIL DEMAND

(2020 – 2021)

For its part, the Energy Information Administration (EIA) adjusts annual average consumption upwards to 97.7 million barrels per day, considering that there will be a significant economic recovery in the world as a result of the positive effects of vaccination against Covid-19.

Asia

According to forecasts by the Energy Information Administration (EIA), Asia’s demand will increase to 35.98 million barrels per day, a 6% increase over the previous year. Forty-two percent of this year’s consumption will come from imports from China, which reached a record high in 2020 of 10.85 million barrels per day, and continues the upward trend with an increase in January of 500,000 barrels per day, 4% higher than the 2020 close.

Saudi Arabia is currently China’s leading oil exporter, increasing its exports 2% in 2020 with a total of 1.69 million barrels per day, followed by Russia with exports of 1.67 million barrels per day in the same period.

The upward trend that was registered in the face of falling oil prices will continue, driven mainly by the increase in import quotas allocated to private sector refineries known as «teapots», according to OPEC in its last monthly report.

China’s National Bureau of Statistics reported this Monday, March 15th, that industrial production of value-added increased 35% in January and February, an increase of 16% over what was recorded in the same period of 2019, which will favor the estimated increase in demand in 2021[43].

Asia will continue to be the region that will favor the sustainability of demand, although countries such as Japan and South Korea will lower their consumption in the last quarter of 2020 due to the reduction of transportation by the reactivation of confinement measures, data published by the Ministry of Economy, Trade and Industry of Japan (METI) indicate that in January 2021 it has shown a recovery trend, with an increase of 100 thousand barrels per day.

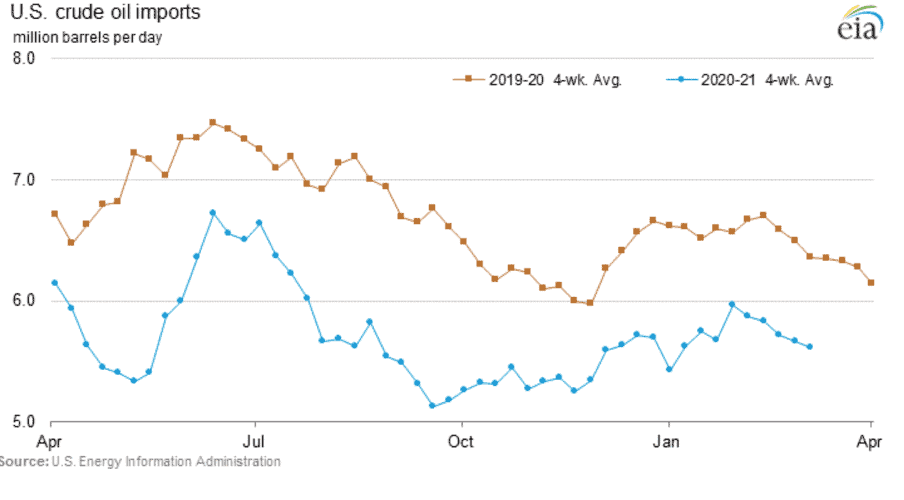

U.S.

According to the EIA’s weekly «This Week in Petroleum» report, imports into the United States fell to 5.611 million barrels on March 05th, dropping 11% from the previous year.

U.S. CRUDE OIL IMPORTS

(2018 – 2020)

U.S. refining activity fell by 14% during the last week of February and the first week of March, following significant freezes in Texas, to 12 million barrels per day. Consequently, according to EIA’s STEO report, the U.S. increased fuel imports from Europe.

According to EIA forecasts, in March, the US will be a net importer, for the first time since 2015, of 0.2 million barrels per day of gasoline.

In addition to the significant price drop in WTI crude oil prices in 2020 and a considerable contraction in crude oil production, the U.S. crude oil imports increased to 2.70 million barrels per day. EIA estimates that they will continue to increase in 2021 and 2022 to 3.40 and 3.94 million barrels per day, respectively, which refers to an increase of 26% and 46% over the 2020 actual average.

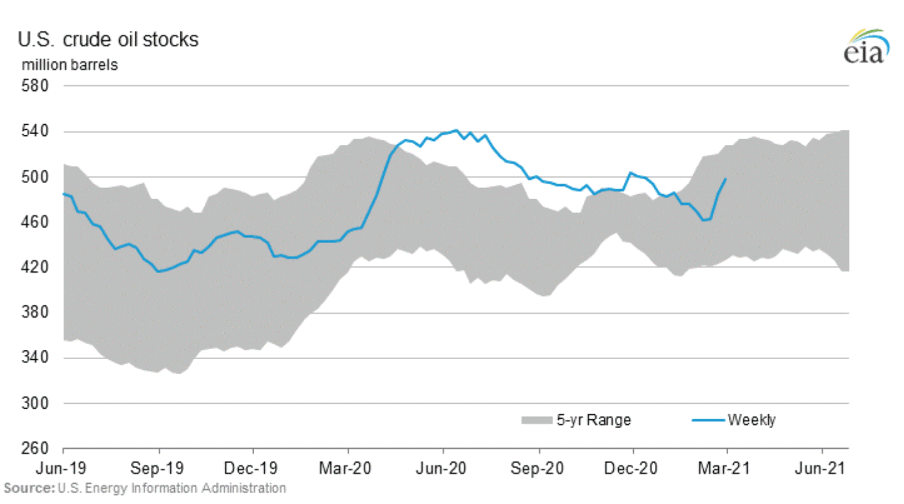

U.S. CRUDE OIL STORAGE

(2018 – 2019 – 2020)

U.S. Commercial inventories declined to 454 million barrels in 2021, down 6.39% from 2020’s significant increases. Regarding days of cover increased to 40.5 days the week of March 05th, an 8% increase from the previous week.

According to OPEC’s MOMR estimates, commercial storage in the U.S. was 485 million barrels in February, representing a month-on-month increase of 9%. It highlights that product storage fell by 43%, mainly due to the reduction in refining activity, which forced the use of products in inventories for domestic demand.

VENEZUELA

Oil production in the country remains at historic lows and is equal to 90 years ago levels. The oil industry and Petróleos de Venezuela (PDVSA) continue to be affected by the government’s dysfunctional management of the economy and state-owned companies, which, without exception, are paralyzed or in ruins.

PDVSA has been tremendously damaged in its managerial and operational capacities after successive political purges and internal razzias against managers and workers, which has undermined its capacities, adding this to the detour of funds and successive interventions ordered by the government as of 2014, and its subsequent militarization as of 2017.

Starting in 2017, during the administration of National Guard General Manuel Quevedo as president of PDVSA, the government has tried, unsuccessfully, of privatizing oil and gas production activities through Decree 3,368. Facilities, equipment, drills, oil service companies, ships, vessels and trading operations have been handed over to private operators. Simultaneously, the labor conquests and economic-social benefits of the workers have been ignored. They have been subjected to permanent persecution and mistreatment by security and military agencies in critical positions in the company.

The result has been disastrous. More than one hundred managers and workers imprisoned, 30 thousand engineers and specialized workers have left the company, and the production, processing and refining facilities are abandoned.

Between 2017-2019, production accelerated its fall, from 1.357 million barrels per day to 796 thousand barrels per day. A loss of 41% in 2 years, while the refining and gas processing system entirely collapsed, operating today at 10% of their capacity while the country suffers an acute shortage of fuels for its domestic market.

The latest government intervention, through the creation of the ARA Commission, instead of increasing PDVSA’s capacities and results, has concentrated its efforts on the privatization of PDVSA and of the oil activities reserved to the State, through the so-called «PDVSA Restructuring Plan» and the so-called «Anti-Blockade Law».

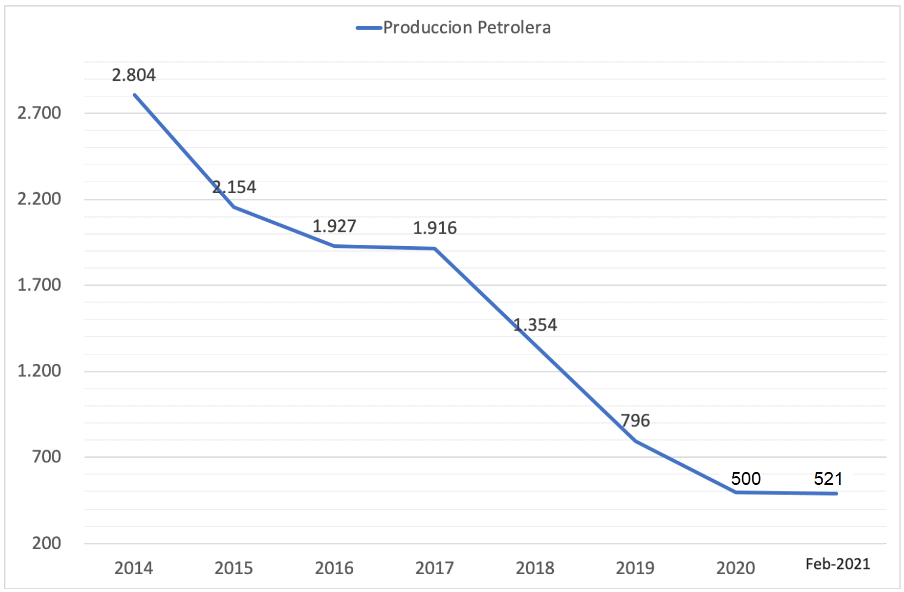

The management of the ARA Commission’s auditors, one year after their performance, continues to be marked by failure. Oil production has fallen, in one year, from 796 thousand barrels of oil per day in 2019 to 521 thousand barrels per day as of February of this year, a loss of 35% of production capacity.

The same has happened in the refining sector where, despite countless interventions, announcements by the authorities of the sector and implausible excuses ranging from «terrorist plans» to «missile attacks», the refining park continues paralyzed, as well as the oil upgrading complexes and gas processors, so gasoline imports from Iran and fuel rationing and shortages continue, especially in the interior of the country, with a particular emphasis now on diesel shortage.

Production

According to information from secondary sources, OPEC’s latest Market Monitoring Report (MOMR), published on March 11th, shows that the country’s crude oil production as of February barely reached 521,000 barrels per day.

OPEC’S PRODUCTION

(2019-February 2021)

Production shows a monthly increase of 33 thousand barrels per day. The absence of audited and public information on the country’s oil output is uncertain whether it is additional production or inventory drainage.

Venezuela’s production shows a stagnation compared to February 2020 production and a 47.9% drop compared to February 2019. Relative to December 2013 levels, with 3.015 million barrels of oil per day, the drop to current production is 2.4 million barrels of oil per day, 82.7%.

VENEZUELA’S OIL PRODUCTION

(2014 – February 2020)

The areas most affected by PDVSA’s operational and managerial collapse have been the West and the East, with 100,000 and 150,000 barrels per day. The traditional areas of the Orinoco Oil Belt, Morichal, Bare, San Tomé, maintain production at 271,000 barrels per day.

The plunge in oil production between 2014-2021 follows massive persecutions against PDVSA’s managers and workers and its militarization in 2017.

The drop occurs despite all the government’s stimulus to private companies in what has been a de facto privatization of the nation’s oil industry.

In 2018 the government, according to Decree 3,569, exempted oil operators in the country from paying income tax. Then through Decree 3,368, it turned over the best 14 fields and traditional oil production areas operated by PDVSA to private management both in the West, as well as in the East of the country, under the figure of «Oil Services Contracts» as well as the management of PDVSA’s equipment and facilities to contractors.

Regarding the Oil Belt, in 2018, the government ceded PDVSA’s participation and control of operations to the minority partners in two of the most important and prolific Joint Ventures in the country: Petromonagas and PetroSinovensa.

Although the minority partners of the joint-ventures Petropiar and PetroMonagas, have withdrawn from the country as a result of the U.S. sanctions, the contracts of incorporation of companies consider the possibility that PDVSA may assume the operations, if for any reason the minority partner is unable or unwilling to continue in the same. However, PDVSA has not had the technical-managerial capacity to do so after the militarization of the company.

The stoppage of the Extra Heavy Crude Upgraders at the Jose Upgrader Complex, in the northeast of the country, has prevented coke, sulfur and heavy components extraction from the Orinoco’s Oil Belt crude. Therefore, only mixtures of heavy crude with light crude or diluents can be made and commercialized as a blend. This operation detracts from the value of Orinoco’s Oil Belt operations. It makes it more difficult due to the need to import naphtha or light crudes, which, although they are subject to sanctions, could be brought from Iran or another producing or refining country.

The vertiginous drop in Venezuelan oil output places the country tenth in OPEC oil-producing positions, only above small producers such as Equatorial Guinea (103,000 barrels per day), Gabon (179,000 barrels per day) and Congo (272,000 barrels per day).

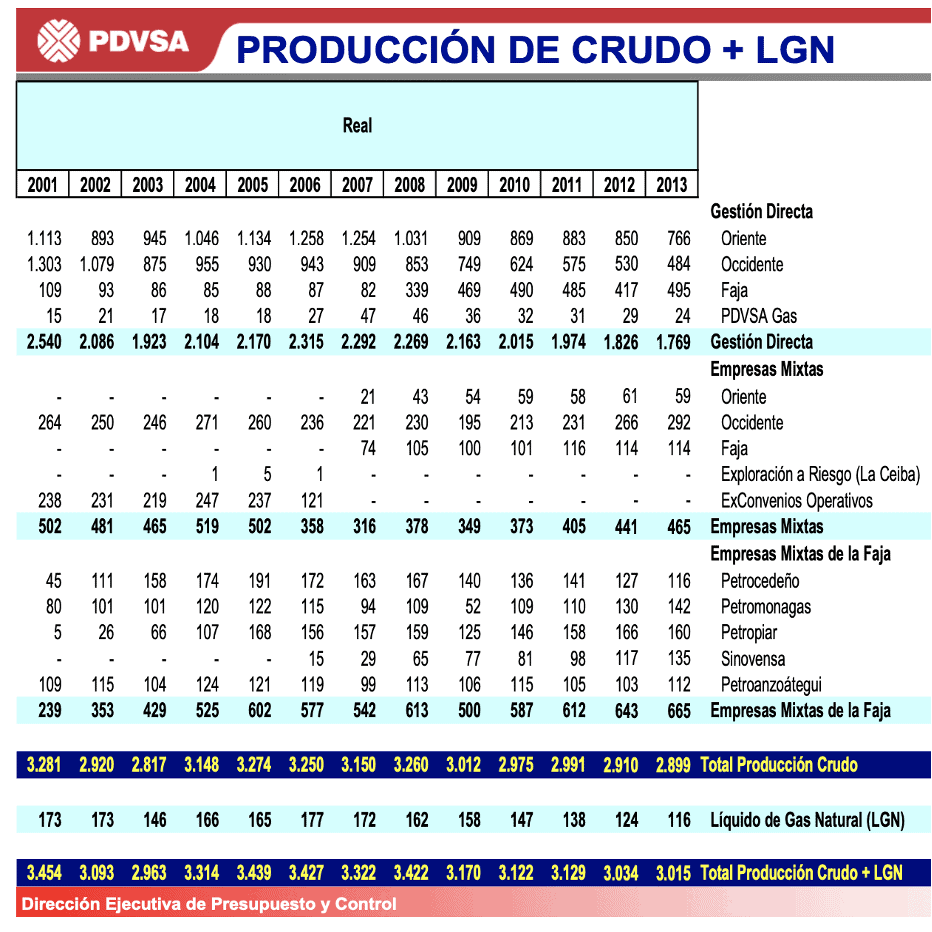

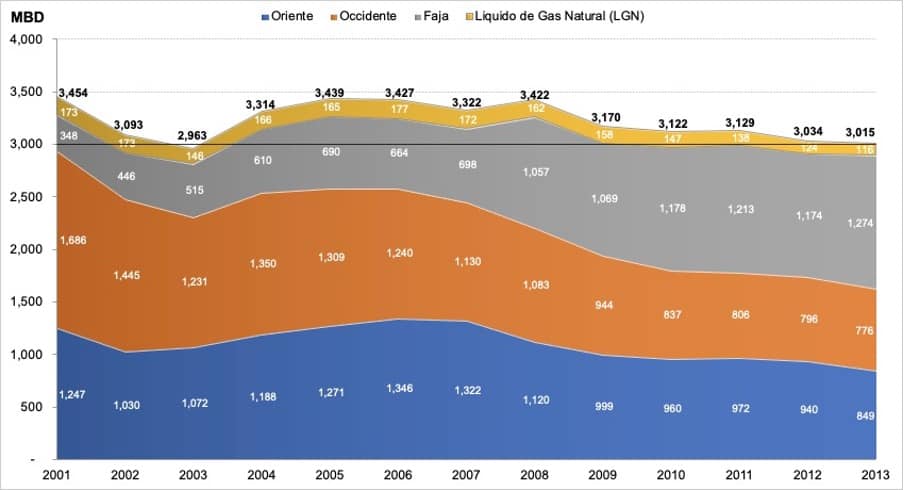

Historical oil production in Venezuela with Full Oil Sovereignty (2004-2013)

The collapse of oil production in Venezuela between 2014-2021 contrasts with the stability and levels of oil production in the country between 2004-2013, during President Chávez government and the development of our Full Oil Sovereignty policy.

The information coming from the country’s audited production is verifiable and is gathered in the different reports of both the Ministry of Petroleum and PDVSA. These numbers from the previous administration are reflected in the former statistical data report of the Ministry of Petroleum (PODE) and PDVSA’s management reports and audited financial statements, available for review and study by anyone interested in the subject.

OIL PRODUCTION IN VENEZUELA (MBD)

2001-2013

Even though PDVSA suffered sabotaged between December 2002 and February 2003, and that between 2004-2007 the process of reversing the Oil Opening was advanced, it can be observed that the production of oil and condensates in the country remained stable between 3.015 and 3.4 million barrels of oil per day.

This period of PDVSA’s management (2004-2014), within the framework of our laws and under the control of the Venezuelan State, under the full validity of our oil sovereignty, allowed, thanks to the adjustment of our fiscal oil regime, more than 700 billion dollars to enter the country, of which 511 billion dollars were contributions to the nation, which include royalties, taxes, contribution to the funds and social development. These results demonstrate that the Venezuelan oil industry can and should be managed and operated by the Venezuelan State through its national company Petróleos de Venezuela, PDVSA.

In 2009, the country participated in the production cut of 4.3 million barrels per day agreed by OPEC, of which 364 MBD corresponded to the country, to defend the price after the collapse of the world economy due to the crisis of the U.S. real estate «bubble».

In 2010, PDVSA was sanctioned by the U.S. government in the financial sphere and access to supplies and technology; however, production always remained above 3 million barrels per day.

Closing 2013, oil production in the country stood at 3,015 million barrels per day, of which, 116 thousand barrels per day of condensates, 776 thousand barrels per day of oil in the West, 849 thousand barrels per day of oil in the East and 1,274 million barrels per day of oil in the Orinoco Oil Belt.

CRUDE OIL AND LGN PRODUCTION IN VENEZUELA

DURING FULL OIL SOVEREIGNTY

2001-2013

The national refining system is still collapsed

Neither the authorities of the ARA Commission nor the government has been able to operate at total capacity the country’s refineries. In 2014, refineries processed 1.1 million barrels per day of oil, 694 thousand barrels per day for domestic consumption and 406 thousand barrels per day for exports.

The Puerto La Cruz Refinery, which had never been stopped, not even during the Oil Sabotage of 2002-2003, has been paralyzed for almost a year, while the government has concentrated its efforts in the El Palito Refinery, as well as in the Amuay-Cardón Refineries of the Paraguaná Refinery Complex.

Although the parts, components and additives used by these refineries are openly acquired in the international market, particularly in countries such as Russia, China, India or Iran, the government has not been able to reactivate these refinery complexes.

After having persecuted, imprisoned and removed from the company the technical-managerial cadres that reactivated the national refinery circuit after the oil sabotage and kept it operating continuously until 2014, the government has handed over the repair and start-up operations to untrained personnel, to private contractors or technicians from abroad, with no success whatsoever.

After several announcements, incidents, explosions and spills, the government has again resorted to imports to supply the domestic demand for fuels, significantly reduced by the 64% contraction of the economy in 7 years. While in 2014, the internal demand for Fuels stood at almost 700 thousand barrels per day and was wholly supplied by PDVSA’s national refining circuit, today it is estimated that the internal demand does not reach 80 thousand barrels per day and even then, it cannot be supplied by the national refining system which operates at less than 10% of its capacity.

Gasoline shortage continues

In view of the inability to reactivate the national refining circuit, the government has maintained its fuel import policy to alleviate the crude situation that Venezuelans are going through to obtain gasoline throughout the national territory.

The situation becomes critical in the province, becoming even worse in the states bordering Colombia, as is Zulia and Falcón. Even though the sector is under military control, the smuggling of fuel to the neighboring country continues from the service stations that sell at a subsidized price. The scarce fuel available is insufficient to satisfy the demand, evidenced in the long queues for refueling.

Amid this acute shortage, the government continues to hand over fuel distribution to the private sector, where fuel is sold at US$ 0.5 per liter, while the monthly minimum wage is US$ 0.9. This means that the distribution of fuels, as is the case with the distribution of food and other public services, is becoming concentrated in private hands and is destined for a «premium» market capable of paying in foreign currency for services and products.

Meanwhile, the British agency Argus Media reports that Venezuela is exchanging with Iran aviation fuel held in inventories.

The same agency indicates that the vessel Forest, belonging to the Iranian state-owned company NIOC, unloaded 277 thousand barrels of gasoline at El Palito refinery on February 20th and loaded 130 thousand barrels Jet-A1 fuel at the Cardón terminal, bound for Malaysia.

Diesel starts to become scarce

During the first week of March, protests were reported due to the lack of the diesel fuel used by trucks and heavy fleet, which would aggravate the distribution of food throughout the national territory, this during the terrible crisis that Venezuela is going through and which affects the different areas of the national activity.

Reuters published that currently, according to private estimates, diesel production in Venezuela ranges between 35 thousand and 49 thousand barrels per day. On the other hand, on condition of anonymity, oil workers assured that the instruction is to prioritize the scarce production of gasoline over diesel, a fuel that is also used for electricity generation and public transportation. These sectors have been deeply affected by the national crisis.

The government had alleviated the diesel shortage due to its refineries’ incapacity to produce it through an oil-for-diesel exchange program with companies in Europe and India. However, due to the 2020 sanctions by the U.S. government, this program was suspended because the operators refrained from continuing.

This scheme has continued with other countries and state-owned companies from both China and Russia, close allies of the government. However, it has not been implemented, and shortages are felt more strongly, affecting cargo transportation, public transportation and electricity generation.

Although in 2014, the national refining system produced 248 thousand barrels per day of diesel and gas oils and supplied the national demand, the operational collapse of the refineries, as explained above, makes the country extremely dependent on imports and vulnerable to sanctions.

BIBLIOGRAPHIC REFERENCES:

- [1] Comunicado de Prensa, “14th OPEC and non-OPEC Ministerial Meetingen OPEP, 04 febrero 2021.

- [2] Redacción “Datos históricos Futuros petróleo crudo WTI”, en Investing, 16 de marzo 2020.

- [3] Sala de Prensa, “Houthis fire missiles, drones at Saudi oil facilities”, en Aljazeera, 07 marzo 2021.

- [4] “Short-Term Energy Outlook”, en U.S. Energy Information Administration, 09 marzo 2021.

- [5] Nota de Prensa, “OPEC daily basket price stood at $68.18 a barrel Monday, 15 March 2021”, en OPEP, 16 de marzo 2021.

- [6] Mohammad Ali Danesh, “Monthly Oil Market Report” 2021, en OPEP, 11 de marzo 2021.

- [7] Javier Blas y Sheela Tobben, “Arctic Blast Cuts US Oil Output by 2 Million Barrels a Day”, en Transport Topics News, 16 febrero 2021.

- [8] Publicaciones, “Declaration of Cooperation”, en OPEC, 10 diciembre 2016.

- [9] Javier Blas, Grant Smith y Salma el Wadarny, “Saudis Take Charge of Oil Market With Surprise Output Cut”, en Bloomberg, 05 de enero 2021.

- [10] Equipo de Reuters, “Aramco chairman says Saudi government still planning stake sell-down” 2021, en Reuters, 02 de marzo 2021.

- [11] Reino de Arabia Saudita, “Saudi Vision 2030”, en Vision 2030, 2017.

- [12] Ammarie Hordern y Grant Smith, “Saudi Arabia’s Extra Oil Cut to Last Two Months, Minister Says”, en Bloomberg Quint, 06 de enero 2021.

- [13] Julia Horowitz, “Saudi Arabia announces IPO of world’s most profitable company”, en CNN, 04 noviembre 2019.

- [14] Equipo de Reuters, Saudi Aramco plans to pay base dividend of $75 billion in 2020”, en Reuters, 30 de septiembre 2019.

- [15] Dr. Abdullah Al Fozan, “Saudi Arabia Budget Report 2021”, KPMG en Arabia Saudita, diciembre 2020.

- [16] Consejo de Seguridad de la ONU, “Resolución 2231 (2015) Aprobada por el Consejo de Seguridad en su 7488a sesión”, en Documentos de la Organización de las Naciones Unidas ONU, 20 julio 2015.

- [17] Sala de Prensa, “EE.UU. pide formalmente a Irán reiniciar pláticas sobre acuerdo nuclear”, en Deutsche Welle, 19 de febrero 2020.

- [18] Javad Zarif, “Javad Zarif”, en Twitter, 19 de febrero 2021.

- [19] Comunicado de Prensa, “Readout of the telephone conversation between President Charles Michel and President of Iran Hassan Rouhani”, en Consejo Europeo, 18 de febrero 2015.

- [20] Nota de Prensa, “Joint statement by the Vice-President of the Islamic Republic of Iran and Head of the AEOI and the Director General of the IAEA”, Organización Internacional de Energía Atómica OIEA, 21 de febrero 2021.

- [21] Comunicado de Prensa, “PM call with President Rouhani of Iran: 10 March 2021”, en Gobierno de Reino Unido, 10 de marzo 2020.

- [22] Nota de Prensa, “Rohani asegura que a través de la diplomacia, el camino se despejará: levantamiento de las sanciones y cumplimiento de los compromisos por parte de EEUU”, de IRNA, 11 de marzo 2021.

- [23] “ExxonMobil Reports Results for Fourth Quarter 2020”, en ExxonMobil, 03 de marzo 2021.

- [24] Equipo de IEEFA , “Guyana gets none of ExxonMobil’s $5.6B tax bill”, en Institute for Energy Economics and Financial Analysis, 07 de febrero 2021.

- [25] Noticias, “Gov’t stands by Exxon oil deal, backs Trotman”, en Stabroek News, 10 de febrero 2020.

- [26] “Budget 2021”, de Ministerio de Finanzas de Guyana, 12 de febrero 2021.

- [27] “SHORT-TERM ENERGY OUTLOOK DATA BROWSER”, en Administración de Información Energética EIA, 09 de marzo 2021.

- [28] “Weekly Supply Estimates”, en Administración de Información Energética EIA, 10 de marzo 2021.

- [29] “HAYNES AND BOONE, LLP OIL PATCH BANKRUPTCY MONITOR”, en Haynes and Boone, 31 de diciembre 2020.

- [30] Clare Foran y Ted Barrett, “Senate confirms Deb Haaland as Biden’s Interior secretary in historic vote”, en CNN, 15 de marzo 2021.

- [31] “North America Rig Count”, en Baker Hughes, 12 de marzo 2021.

- [32] “Actualización de las perspectivas de la economía mundial”, en Fondo Monetario Internacional, 26 de enero 2021.

- [33] “Perspectivas económicas de la OCDE, marzo 2021”, en Organización para la Cooperación y Desarrollo Económico OCDE, marzo 2021.

- [34] Thomas Kaplan, “What’s in the Stimulus Bill? A Guide to Where the $1.9 Trillion Is Going”, en The New York Times, 11 de marzo 2021.

- [35] “H.R.1319 – American Rescue Plan Act of 2021”, en Congreso de EE.UU., 24 de febrero 2021.

- [36] “International treaty Summary Explainer”, en Gobierno del Reino Unido, 11 de marzo 2021.

- [37] “Withdrawal Agreement: Commission sends letter of formal notice to the United Kingdom for breach of its obligations under the Protocol on Ireland and Northern Ireland”, en European Comission, 15 de marzo 2021.

- [38] Rosalía Sácnhez, “Lagarde aumentará las compras de bonos en los próximos tres meses”, en ABC, 11 de marzo 2020.

- [39] “Aumento de comercio exterior de China en primeros dos meses del año revive recuperación mundial, según expertos”, en Xinhua Eswpañol, 10 de marzo 2021.

- [40] Sala de Prensa, “EEUU, Japón, Australia e India mantuvieron la primera reunión del grupo Quad, que busca contrarrestar la influencia de China”, en Infobae, 12 de marzo 2021.

- [41] “COVID-19 Data in Motion”, Jhons Hopkins University of Medicine, 16 de marzo 2021.

- [42] Francesco Guarascio, John Chalmers y Giselda Vagnoni, “UE prorrogará el control de las exportaciones de vacunas de COVID y bloquea cargamento”, en Reuters, 04 de marzo 2021.

- [43] Comunicado, “The National Economy Maintained the Momentum of Recovery in the First Two Months”, en National Bureau Statistics of China, 15 de marzo 2021.

- [44] Dirección Ejecutiva de Planificación de PDVSA, “PROPUESTA de REESTRUCTURACIÓN ”, en El Pitazo, marzo 2020.

- [45] Redacción, “Esta es la Ley Antibloqueo con todos sus detalles”, en Banca y Negocios, 30 de septiembre 2020.

- [46] “Decreto 3.569”, en Finanzas Digital, 01 de agosto 2018.

- [47] “Decreto 3.368”, en Finanzas Digital, 12 de abril 2018.

- [48] Nota de Prensa, “151st (Extraordinary) Meeting of the OPEC Conference”, en OPEP, 17 de diciembre 2008.

- [49] Equipo de Argus Media, “Iran swapping gasoline for Venezuelan jet fuel”, en Argus Media, primero de marzo 2021.

- [50] Tibisay Romero y Mircely Guanipa, “Venezuela raciona suministro de diésel a transportistas y empeora escasez de combustible”, en Reuters, 07 de marzo 2021.