INDEX

OIL PRICE

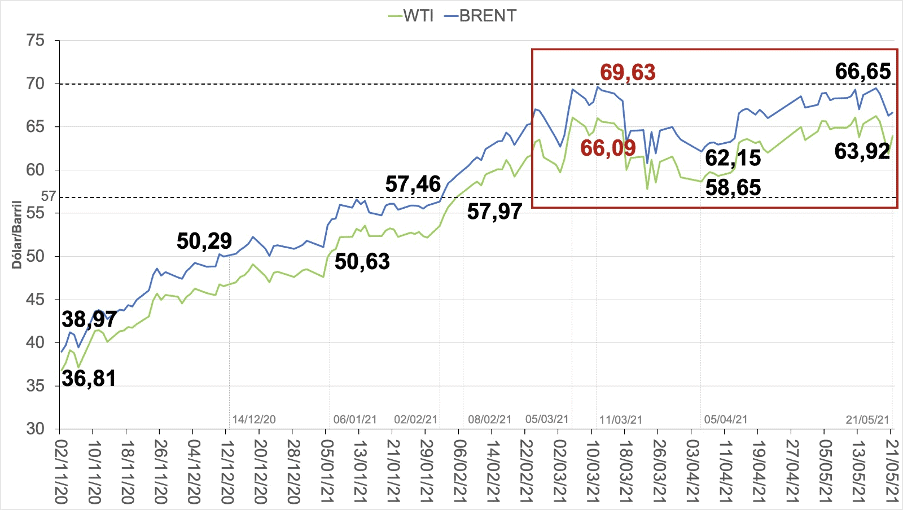

The primary crude oil price markers, Brent and WTI, have been impacted in the third week of May by both political and financial situations that have affected their quotations downwards.

Brent quotations have been affected by the announcement of an agreement between the U.S. and Iran for the return of the parties to comply with the Joint Comprehensive Plan of Action (JCPOA) nuclear agreement and the lifting of U.S. sanctions, which will allow increasing the supply of Iranian oil -exempt from the OPEC+ cuts agreements- by 500 thousand b/d from the middle of this year.

According to statements by Iranian President Hassan Rouhani to Iranian television, «the major powers have agreed to lift sanctions – including in the oil sector – as part of the return to the 2015 nuclear deal.» The lifting of sanctions on Iran opens the possibility that the Persian nation could increase its oil production from the current 2.3 million barrels per day, up to 4 million barrels per day. However, it is expected that if negotiations are finalized and sanctions are lifted before June 18th -the date which will culminate Rouhani’s term in office- oil production could increase by 500 thousand b/d by mid-year, which would place Iranian production at 2.8 million barrels per day. This possibility has been reflected in Brent crude oil prices, which have fallen by 4% to their 17th May price, to stand at 66.65 dollars per barrel.

Regarding WTI, it has been affected downwards, together with other commodities, as a reaction to a possible interest rate hike by the U.S. Federal Reserve, due to the most recent data on U.S. inflation -almost 1.6 points in one month-, with April’s Consumer Price Index (CPI) of 4.16%.

At the same time, several Asian countries, including Japan, Malaysia, Taiwan and Singapore, took further measures to restrict mobility given the recent increase in outbreaks of the COVID-19 virus in the region. In contrast, China increased traffic controls in the northeast of the country, contributing to the fall in oil price markers.

At the close of European markets on May 21st, the International Exchange Futures (ICE) quoted Brent at $66.65 a barrel, while the New York Mercantile Exchange (NYMEX) quoted WTI at $63.92, both markers up on the day, but showing a decline of 2.8% and 2.1% from their quotations at the close of the second week of May 2021. However, both Brent and WTI markers showed a recovery of 115% and 158%, respectively, concerning their quotations for the first week of May 2020.

PRICES PERFORMANCE

(November 2nd 2020 – May 19th 2021)

Despite their fluctuations, oil prices continue their upward trend, which began in November 2020, reflecting the progressive market stability achieved after the massive OPEC+ production cuts initiated a year ago, the draining of inventories and the gradual recovery of world oil demand.

Since November 2020, Brent and WTI prices have maintained their upward trend, recovering their values by 70% and 72%, respectively.

Then, in April 2021, Brent fluctuated between 66 and 70 dollars, while WTI fluctuated between 61 and 67 dollars. Both values are sustained by production cuts and the draining of inventories, the Chinese economy’s performance and its successful containment of COVID-19, and the progress in vaccination in the USA, United Kingdom, and the European Union (E.U.).

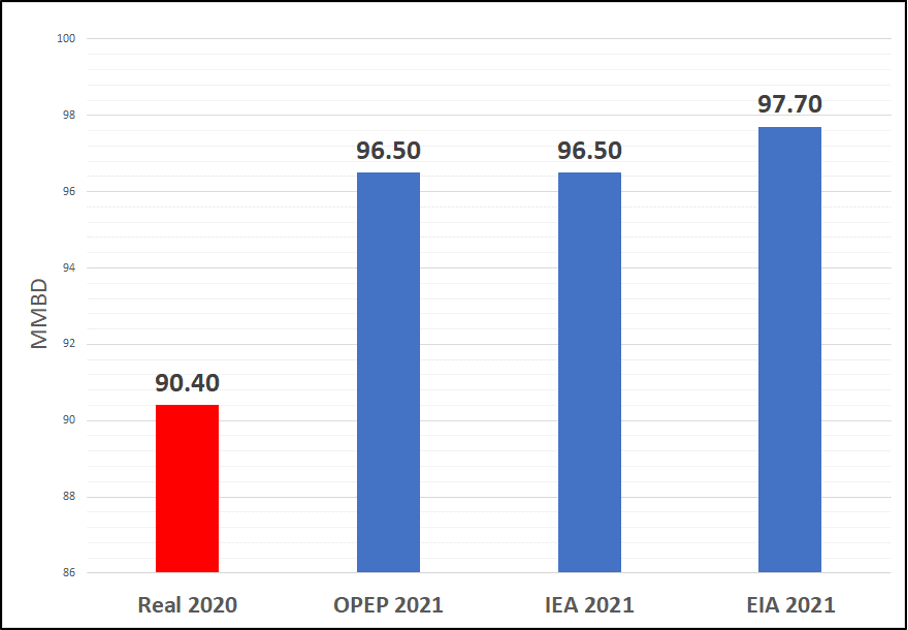

However, uncertainty remains, and demand recovery, estimated for this year at 96.5 million barrels per day -an increase of 6 million barrels per day compared to 2020- will be achieved due to the increase in infections in India, Japan and other Asian countries, Latin America and Africa, as well as the slowdown in vaccinations in E.U.

OPEC and most agencies estimate that the expected recovery in demand for this year will occur from the third quarter or even from the last quarter of this year.

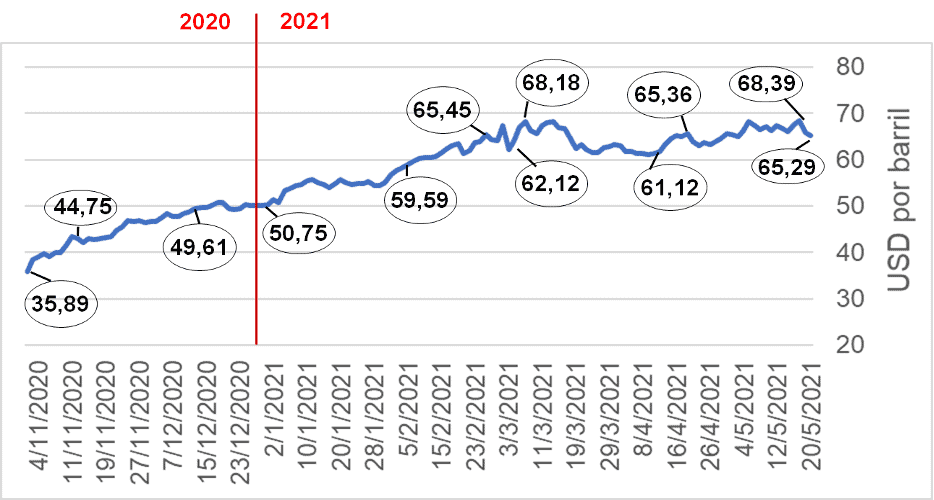

OPEC Reference Basket (ORB)

The OPEC Reference Basket (ORB) was quoted on May 20th at 65.29 dollars per barrel, 53.2% higher than its November 2020 price, maintaining its upward trend, despite the 3.4% drop experienced since May 17th.

ORB decreased by 2% in April 2021, influenced by the decline in reference prices, particularly light oil, according to OPEC’s Monthly Oil Market Report (MOMR) of May 11th.

However, the annual average value of the OPEC basket rose 41.6% compared to April 2020, standing at $60.97 per barrel, reflecting the systematic recovery of the price since the group’s production cuts began, with the most significant rebound occurring in November 2020. Since March 2021, ORB has managed quotes above $65 a barrel, which had not happened in 15 months.

OPEP REFERENCE BASKET PRICES

(November 2020 – May 20th 2021)

Murban IFAD

In our previous OIL REPORT, on March 29th, we mentioned that announcement of the state-owned Abu Dhabi National Oil Company (ADNOC) about the sale of Murban, its premium crude oil, and the launch of the Abu Dhabi Murban Crude Oil Future with futures contracts on the new ICE Future Abu Dhabi (IFAD), the representation of the global operator of exchanges and listing services of the International Exchange (ICE) in Abu Dhabi. This will be the first crude oil transaction in the United Arab Emirates (UAE) for future contract markets in the Arabian Gulf and the Asia-Pacific region.

By giving investors and traders access to Murban oil, ADNOC makes a significant concession to international private capital from consuming countries, allowing them to speculate with its price in the Middle East, and affecting the control that OPEC countries – in particular Saudi Arabia – have over the value of their resources. Thus, in June of this year, ADNOC should have already withdrawn the contractual requirements of Murban, with which, in that month, it will deliver 5.11 million barrels for 511 contracts that expired on April 30th.

Murban crude – the new reference for Murban, Upper Zakum, Das and Umm Lulu crudes – was quoted at US$64.88 per barrel for April, registering a month-on-month increase of 5.14%. On May 21st, its quotation was up for the day, trading at US$65.73 per barrel after a week of downward movement.

OIL PRODUCTION

The 16th OPEC+ Ministerial Meeting, held on April 27th, maintained the decisions from the precedent meeting, with no changes in its production cuts flexibility policy. As a result, as of May, OPEC+ supply will increase by 1,441 million barrels of oil per day, compared to January 2021.

According to the agreements reached last April 1st by OPEC+, production cuts will be 6.55 million b/d in May, 6.2 million b/d in June and 5.759 million b/d in July, representing a decrease of 3,905 million b/d concerning the original cut of 9.7 million barrels per day initiated on May 1st, 2020.

For its part, Saudi Arabia, starting this May, will end its production cut corresponding to 1 thousand b/d that had been in effect since February of this year. Instead, Saudi production will increase by 250 thousand b/d in May, 350 thousand b/d in June and 400 thousand b/d in July.

Thus, between May and July, OPEC+ oil supply will increase by 2.291 million b/d to 40.66 million b/d of oil. Furthermore, if we add the expected 500 thousand b/d increase in Iran’s production for the beginning of the third quarter of the year -if sanctions are lifted-, then OPEC+ countries’ crude oil supply for July would be 41.16 thousand b/d, an increase of 2.791 thousand b/d to April’s output.

If July’s OPEC+ output, plus Iran -and any increase from Non-OPEC countries-, is not synchronized with the recovery of demand, in the volumes and at the expected time, then any surplus production and stock will affect the stability and recovery of the oil market. Therefore, the above will probably force OPEC+ to review its policy of flexibility in production cuts.

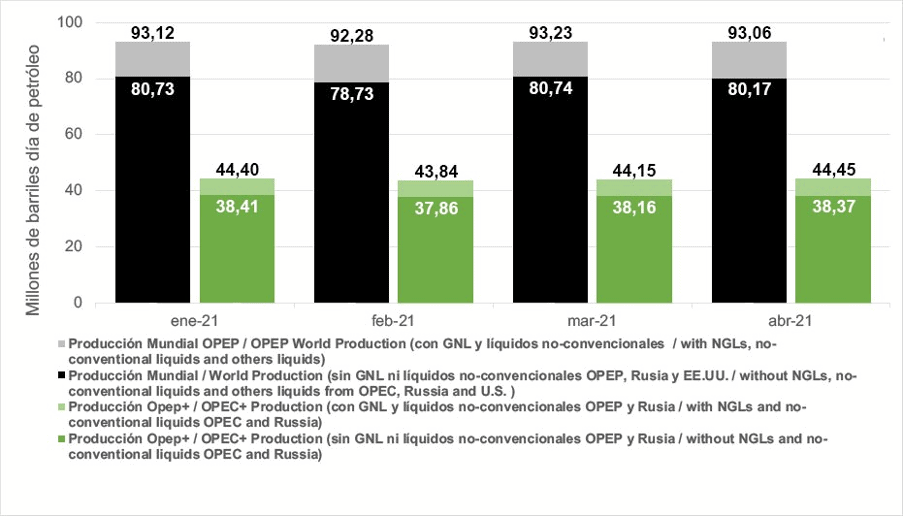

World Production in April

OPEC’s MOMR data set world production of oil, condensate, NGLs and unconventional liquids at 93.06 million b/d, while the Energy Information Administration (EIA) puts it at 94.04 million b/d.

However, when we exclude condensates, NGLs and unconventional liquids, the U.S., Russia and OPEC, world oil production stands at 80.17 million b/d, according to OPEC’s MOMR on May 11th, as well as EIA -also on May 11th- and Russian Energy Ministry data.

While OPEC+ recorded a monthly increase of 210 thousand b/d, mainly due to a 200 thousand b/d increase in Russian production, Norwegian and Canadian production was affected by 500 thousand b/d due to annual maintenance activities of their production infrastructure and crude upgrading, planned in both countries.

WORLD OIL PRODUCTION

(Crude oil, condensates, NGLs and other unconventionals)

(January – April 2021)

OPEC+ Production

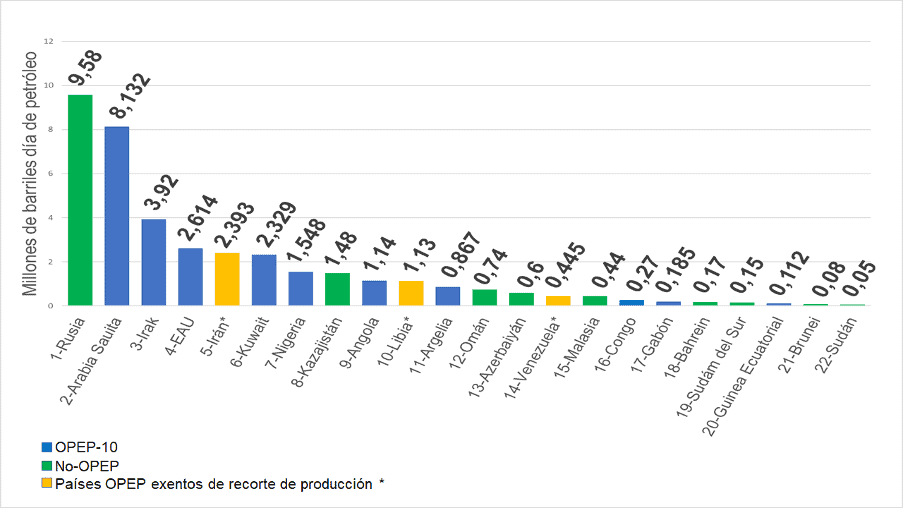

The signatory countries of the Declaration of Cooperation (DoC), grouped in OPEC+, produced (excluding condensates and LNG), 38.37 million b/d, representing 47.86% of world oil production, showing an increase of 500 thousand b/d to February of this year, due to the relaxation of cuts and the overproduction of Russia and Kazakhstan, as well as the increase in Iran’s production.

The 13 OPEC countries presented an output of 25.08 million b/d, which corresponds to 65.37% of OPEC+ supply and 31.29% of world production.

PRODUCTION OPEP+ COUNTRIES

(April 2021)

On the other hand, the nine Non-OPEC countries presented a production of 13.29 million b/d, equivalent to 34.63% of OPEC+ production and 16.58% of world production.

OPEC+ production cuts

The OPEC+ production cut was 7.696 million b/d, including 987 thousand b/d of Saudi Arabia’s additional voluntary cut. Under the 6.9 million b/d agreement of March 4th last year, the group’s cut was 6.709 million b/d, with a compliance rate of 97.23%.

The OPEC countries (Angola, Saudi Arabia, Algeria, Congo, Gabon, Equatorial Guinea, United Arab Emirates, Iraq, Kuwait and Nigeria) cut 5.57 million b/d, including 987 thousand b/d of Saudi Arabia’s unilateral cut and the additional cut of 127 thousand b/d by Angola, to compensate the overproduction during the second quarter of 2020. In contrast, Iraq presented an overproduction of 63 thousand b/d. Compliance with the cut by OPEC-10 countries (signatories of the DoC agreements) was 100.4%.

The nine Non-OPEC countries cut was 2,127 million b/d, with an overproduction of 209 thousand barrels of oil per day, with Russia and Kazakhstan reaching compliance with the cut of 90.28%.

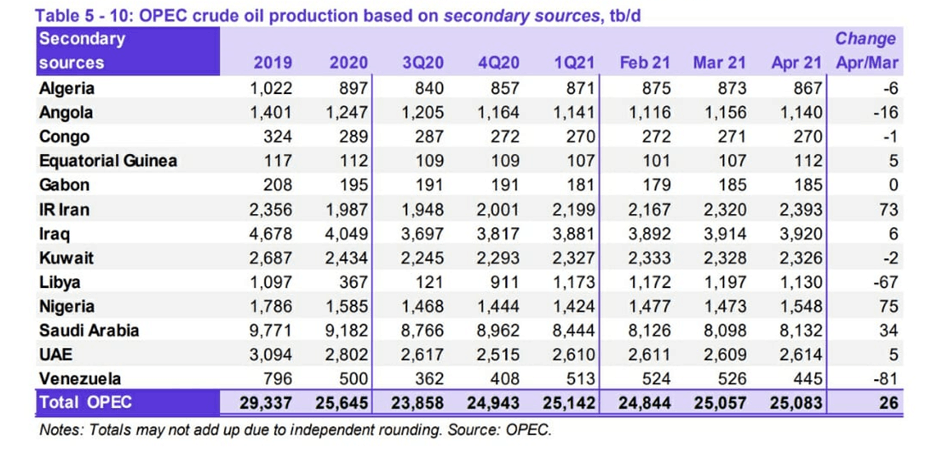

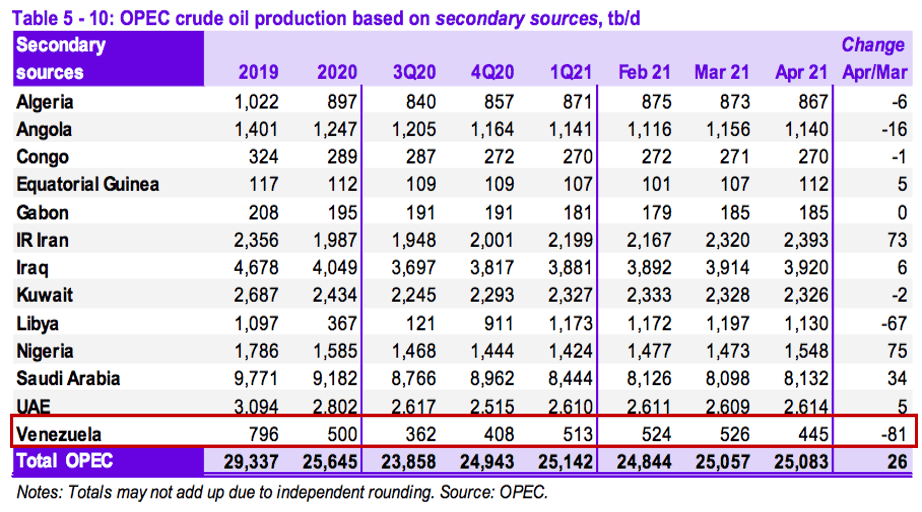

OPEC Production

OPEC oil production was 25.083 million b/d, according to data from secondary sources recorded in the May 11th MOMR, maintaining the same production level of the last quarter of 2020 except for January 2021 -25.5 million b/d-, when Libya was able to recover its production by 1.05 million b/d, once a ceasefire was agreed, and the blockade on oil fields was lifted between September and October 2020.

OPEC PRODUCTION

(March 2021)

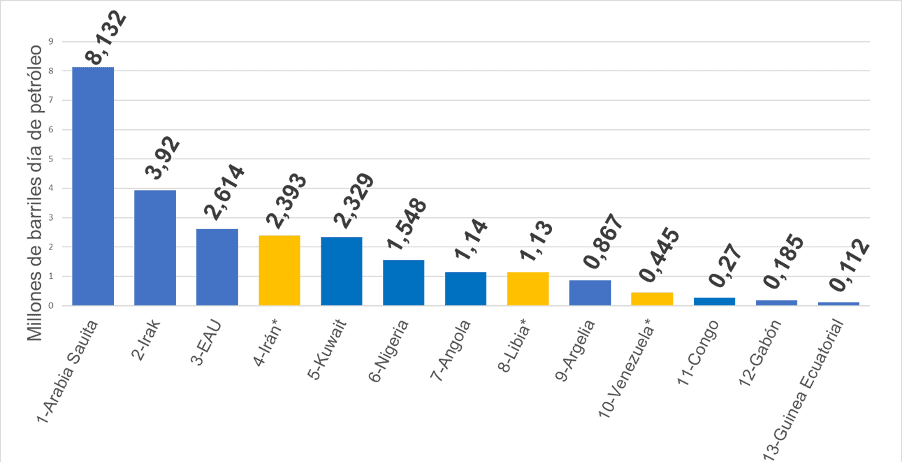

Along with the other Gulf monarchies (the United Arab Emirates and Kuwait) and Iraq, Saudi Arabia adds up to 16.992 million b/d, representing 67.74% of OPEC production and 44.28% of OPEC+ and 21.2% of world oil production.

Nigeria leads the group of African countries (excluding Libya), Angola, Algeria, Congo, Gabon and Equatorial Guinea, which presented a combined production of 4,122 million b/d, representing 16.46% of OPEC production 10.74% of OPEC+ production and 5.14% of world production.

OPEC COUNTRIES PRODUCTION RANKING

(March 2021)

Iran, Libya and Venezuela, the three countries exempted from production cuts, presented a 3,968 million b/d, of which 2,393 million b/d (60.31%) corresponds to Iran, equivalent to 9.54% of OPEC production and 2.98% of world oil supply. Libya produced 1.13 million b/d (4.5% OPEC and 1.41% worldwide) and Venezuela 445 thousand barrels of oil per day (1.77% OPEC and 0.55% worldwide).

U.S. – Iran: dialogue progressing

Negotiations between the U.S. and Iran already have an agreed framework, and it could be signed next week, as reported on May 19th by the Iranian Deputy Foreign Minister for Political Affairs, Seyed Abbas Araqchi, the highest representative of the Iranian government in the meetings of the Joint Commission of the Joint Comprehensive Plan of Action (JCPOA) in Vienna, after the end of the fourth round of meetings in that city.

According to Deputy Minister Araqchi, the framework of the agreement will be the structure of the JCPOA pact, which «defines the main text (of the framework of the agreement) and its appendices», clarifying that the final text is not yet complete, as there are still some articles that are still being negotiated, which is why both parties decided to end the fourth round and take a few days to return to their respective countries and make consultations with the authorities, said the Iranian official.

Araqchi’s words had been revealing last week, when, on May 12th, he affirmed the Iranian government’s readiness to resume full implementation of the JCPOA «as early as tomorrow» if sanctions are lifted and verified, hinting that an agreement should be in place by May 21st.

On the U.S. side, State Department spokeswoman Jalina Porter confirmed, on May 19th at a press conference, the progress of the negotiations between the parties, acknowledging the «crystallization» of the options available to both the U.S. and Iran for a joint return to compliance with the JCPOA.

The last round of negotiations, which began on May 7th, was the most intense since the Commission was set up on April 6th, but, at the same time, brought them closer to the point of agreement that had already been in evidence. Therefore, the fifth -perhaps definitive- round of meetings will be held the week of May 24th.

The commitment to reach an agreement shown by the U.S. and Iran -and that both parties recognize-, can be understood from the statements made starting May. Both nations agreed that everything has to follow what is written in the JCPOA nuclear agreement signed in 2015, with the endorsement of the United Nations Security Council.

From the Department of State, statements were offered last May 6th, with significant differences to the decisions taken by former President Donald Trump. They state that whatever is inconsistent with a U.S. return to the JCPOA will be eliminated since Joe Biden’s government considers the return of both countries to the agreement as a national security interest. Likewise, they believe that negotiations could be concluded before the next presidential elections in Iran, on June 18th.

From the side of Iranian President Hassan Rouhani, the talks with the U.S. are advancing «within the right framework and on the right path», according to statements made on May 5th. President Rouhani declared yesterday, May 19th, that «the great powers» are ready to reach an agreement and lift the sanctions on his country.

In this context, Iran has increased its production by more than 300 thousand b/d since Joe Biden assumed the U.S. presidency on January 20th, at an average rate of 100 thousand b/d per month.

If the U.S. and Iranian governments manage to reach an agreement and sanctions on Iran are lifted, the Persian country’s production can recover to 3.8 million b/d in less than a year, the level it had in July 2018, before the economic sanctions imposed by Trump.

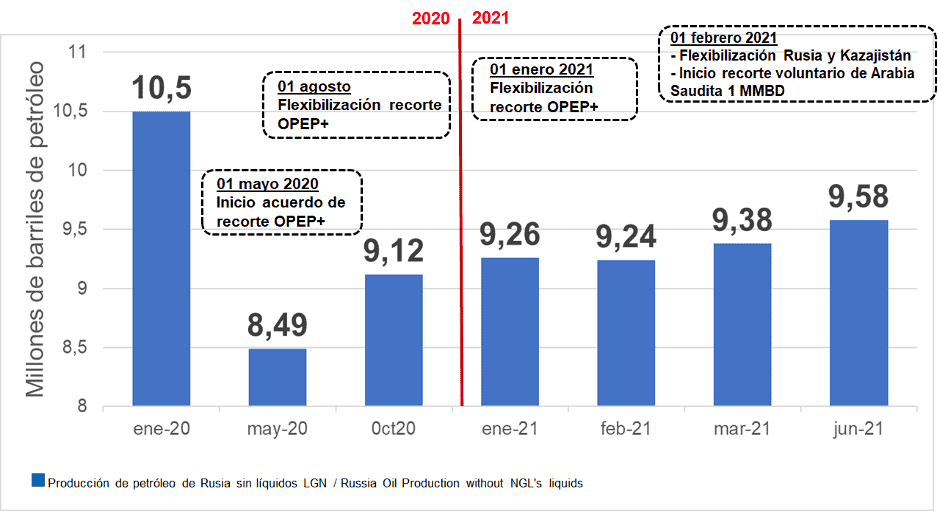

Russia

According to their Ministry of Energy, Russia’s crude oil production was 9.58 million b/d, reflecting an increase of 200 thousand b/d over the previous month, showing its highest record since production cuts began in May last year.

Despite having the OPEC+ agreement for a relaxation of its production quota again, Russia shows levels of oil overproduction, this time of 201 thousand b/d.

RUSSIAN OIL PRODUCTION

(January 2020 – April 2021)

The Russian Minister of Energy, Nikolai Shulginov, in declarations offered last May 14th to the Russian News Agency (TASS), reaffirms the role of his country and fossil fuels in the world economy, responding to the report of the International Energy Agency, which recommended not to invest more in such sources, to meet the European Union’s goal of zero emissions by 2035.

The minister calls on the Russian authorities and the local energy sector not to «rush to abandon» oil exports, as by 2035, neither Europe nor the U.S. «will be completely free» from the use of hydrocarbons.

The minister pointed out that more technology needs to be developed regarding energy transition, and costs must be reduced to make it accessible to consumers. So far, traditional energy resources are much more accessible, both in terms of inventories and cost, than «green energy» sources.

As the highest oil authority of one of the main oil-producing countries, the Russian minister defends fossil energies and local oil companies, such as Rosneft, Gazprom, Lukoil and Tatneft, in maintaining the supply of oil and gas, underpinning the stability of the world economy. The above was demonstrated, together with the oil-producing countries gathered in OPEC+, when, at the beginning of the world crisis due to COVID-19, they decided to cut their production, intervening and stabilizing the oil market, assuring the energy supply for the recovery of the world economy.

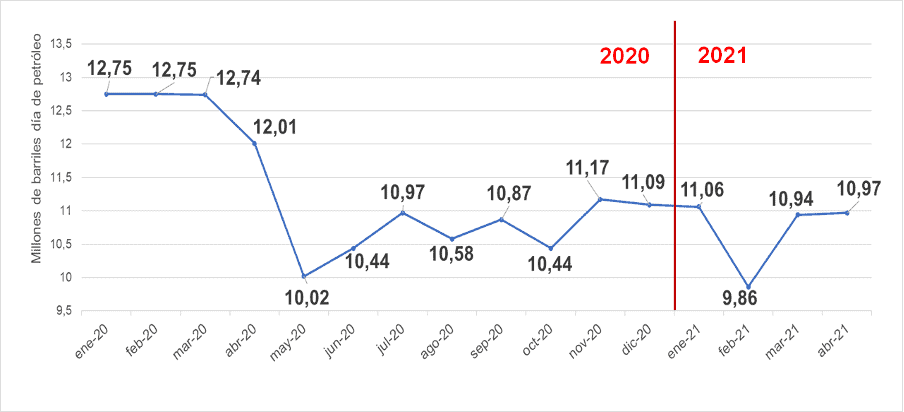

U.S.

According to EIA data published last May 11th, U.S. crude oil production was 10.97 million b/d, closing unchanged from the previous month, remaining stable at around 11 million b/d since September 2020.

U.S. CRUDE OIL PRODUCTION

(January 2020 – April 2021)

Drilling

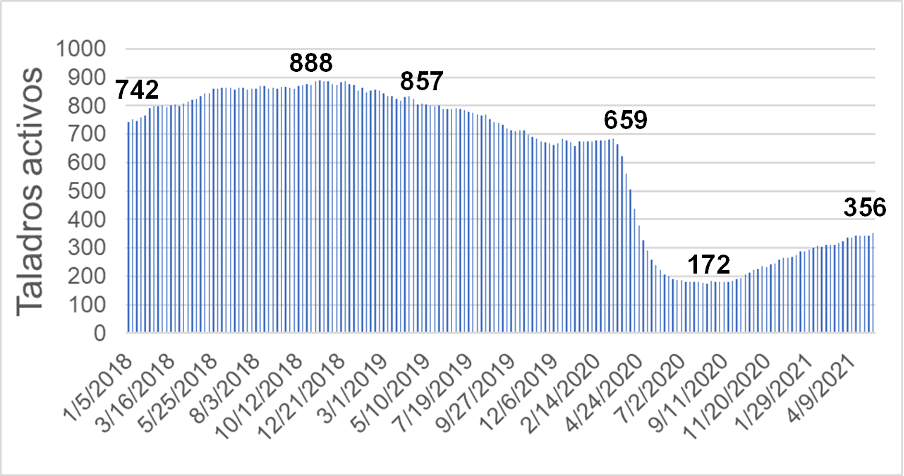

According to data published by Baker Hughes, the number of active drilling rigs registered in the U.S. on May 21st was 356, continuing the upward trend since the fourth quarter of 2020, with four more rigs operating than the previous week and 32 more than last April. This is the highest increase since the OPEC+ production cut began in May last year.

In the Permian Basin in Delaware, more than 65% of activity has been recorded, with 230 operating drills, 89 more than the record of activity on October 30th, 2020 and 243 less than in July 2018, in which U.S. oil production recorded 11 million b/d, before beginning the production climb to 12.7 million b/d between November 2019 and March 2020.

Haynesville, between Louisiana and Texas, is the second basin with the highest drilling activity, recording 46 operations.

ACTIVE DRILLS IN THE US.

(January 2018 – May 21st, 2021)

During the shale oil boom in the U.S., it became widespread for drills to be used to drill shale wells and leave them uncompleted, abandoning activities and moving rigs to drill other wells. These drilled but abandoned wells were referred to as DUC (Drilling but Uncompleted Wells). Under this form of production, the number of new wells drilled began to exceed, monthly, the total number of completed wells, so that DUCs became the oil «reserves» of E&P operators, to be used in situations where it is necessary to adjust expenses and investment in production.

Between January 2014 and March 2020, the monthly operating rig count dropped from 1,391 to 702 units, while the amount of new drilling went from 1,645 per month to 1,009, with shale oil production rising from 4.5 million b/d to 9.2 million b/d, while DUCs increased from 4,502 to 8,557.

During the same period, the number of wells drilled but not completed increased monthly, without exception, until reaching a peak of 8,868 DUC in June 2020, three months after the COVID-19 pandemic declaration. Since then, the opposite has happened the number of wells completed monthly by E&P operators has been higher than the number of new wells drilled. This is due to the control of expenses and investments that the operators are carrying out, taking advantage of the recovery of oil prices to recapitalize themselves and cover their debts.

In the EIA’s Weekly Drilling Report of May 17th, it can be seen that in April, 394 drills were operational for a production of 7.71 million b/d in shale wells. The number of completed wells was 754, and while new drilling was recorded in 513 wells. Meanwhile, 6,857 wells were recorded drilled but uncompleted, decreasing 241 DUC for the month and 2,011 DUC over one year.

U.S. oil production outlook

As commented in previous OIL REPORTS, the Department of Energy and industry analysts estimate that oil production in the U.S. will remain at around 11 million b/d for 2021 due to the need for Shale Oil producers to distribute dividends among their shareholders and pay the debts accumulated after the collapse of the oil market in 2020.

Although the financial results of the four largest U.S. E&P companies reflected, during the first quarter of 2021, net earnings of $2.5 billion in U.S. oil production activities. (ExxonMobil, Chevron, ConocoPhillips and EOG Resources), other U.S. companies, such as Pioneer Natural Resources (which owns the largest number of fields in the Permian Basin) and Occidental Resources (OXY), reported losses during the first three months of the year.

Likewise, in their financial statements published at the beginning of May 2021, the four companies showed, for the first quarter of the year, expenses and investment on U.S. soil for $6.6 MM, a decrease of $1.7 MM compared to the same period of 2020 of $8.3 MM.

According to Rystad Energy, U.S. producers, even with a barrel of oil continuing to trade above $60 a barrel, the reinvestment rate for upstream activities in shale well fields, in 2021, may drop by 46% and, in the case of the Permian Basin, by 57%, due to «debt service» and hedging losses.

North American oil companies continue with the severity in controlling expenses and investments, prioritizing the payment of debts and dividends, as in ExxonMobil, which announced the payment of 4 billion dollars of its debt during the first quarter of 2021.

Although oil prices as of February 12th, 2021, have been placed above $60 per barrel – a comfortable level for North American producers – the financial needs of producers will keep the country’s oil production levels at around 11 million b/d in 2021, at least, 1.8 million b/d below its peak of 12.8 thousand b/d recorded during November 2019, which was maintained until March 2020.

Rystad Energy estimates that from 2022 onwards, the effects of a barrel above $55 (if the price is maintained over time) will be seen with a production increase.

For its part, the EIA estimates, in its forecasts for 2022, that U.S. production should increase to 11.8 million b/d.

This estimate by this US DOE agency comes in an adverse environment for oil producers, not only because of the financial situation, especially for independent oil producers, but also because of the regulatory framework and environmental policy of Biden’s administration.

As part of his American Jobs Plan, President Biden included in his tax reform plan «The Made in American Taxes», the elimination of subsidies for fossil fuel producers, which, according to the plan, would save 35 billion dollars over ten years, as well as the increase from 21% to 28% of taxes for corporations.

The above measure is in addition to reviewing the permits granted by the previous administration for oil production on federal lands and in environmentally protected areas and the permit revocation for the XL Kingston Pipeline within the framework of a change in U.S. energy policy. The infrastructure plan proposed by the new administration, which would allocate 174 billion dollars only for the development of the electric vehicle sector.

Colonial Pipeline: «hackers» impact fuel supply

In an unusual event in the U.S., the Colonial Pipeline system, with a daily transportation capacity of 2.5 million b/d and 8,850 kilometers of pipeline, which supplies 45% of the East Coast’s fuel, was the victim of a cyber-attack on May 7th, affecting the supply of 1.2 million b/d of fuel between May 7 and 12.

This situation led several refineries like Motiva Enterprises, Total Port Arthur, Citgo in Lake Charles, Valero Energy, Phillip 66 and Marathon Petroleum to reduce their fuel production between 25% and 45%, causing more than 10% of the service stations in several East Coast states to run out of gasoline and, in some cases, this percentage reached 65%, as happened in North Carolina.

The cyber-attack culminated when Colonial Pipeline paid 5 million dollars to the hackers who identified themselves as DarkSide, who, according to President Joe Biden, carried out the criminal maneuver from Russia. Biden clarified that the government of Russian President Vladimir Putin is not involved in this cyber attack.

Although this cyber attack is an unusual situation in the U.S., however, there are precedents of this type of attacks in other oil-producing countries such as Iran and Venezuela.

In the case of Venezuela, during the oil sabotage of December 2002 and March 2003, as part of the political destabilization to overthrow President Chavez, PDVSA’s operations were disrupted by the U.S. company SAIC, which had been granted the control and management of all the company’s automated systems through its subsidiary INTESA.

The cyber-attack on PDVSA left the company in a complete operational blackout. At the same time, oil production dropped from 3 million barrels per day to 23 thousand barrels after SAIC/INTESA disconnected the automated control systems. The above led to the need to carried out and controlled manually until the PDVSA’s automated operations were reestablished by setting up its automated system under internal control.

The cyber-attack on the Colonial Pipeline system revealed a critical vulnerability of the USA’s fuel supply system and showed the U.S. administration the high dependence of the transportation system and the country’s economy on the use of hydrocarbons.

ECONOMY

During April, the world economy continued to recover, led by China, the USA and Europe, countries that have been able to contain the COVID-19 pandemic and are advancing in the process of vaccinating their populations.

The recovery of the global economy occurs at different rates, mainly according to the level of development and financial capacities of each country or block of countries, in addition to access to the doses of vaccine necessary for mass inoculation campaigns, as well as to the economic resources necessary for the implementation of massive fiscal relief programs.

According to OPEC’s MOMR, with the progressive economic improvement in the United States and China, 2021 world’s growth forecast was revised upwards to 5.5% (+0.1% in March), with a more sustained recovery during the second half of the year, always based on the premise that the pandemic has been controlled in industrialized and emerging economies.

OECD countries growth in 2021 was also revised upwards to 4.8%, from 4.6% in the previous month, driven by the U.S. with an expected Gross Domestic Product (GDP) growth of 6.2% and the U.K., with 5.0%, leading the group’s recovery expectations. In addition, other major industrialized economies such as the E.U. (4.2%) and Japan (3.0%) will improve, but at lower rates than previously estimated (-0.1%).

In the U.S., in the process of its sustained economic recovery, the long-awaited inflationary phenomenon has emerged due to the massive contributions and fiscal relief since the pandemic began. In April, U.S. inflation reached 4.2%, the highest rate recorded in 12 years, reviving global inflation fears. According to the Department of Labor, Consumer Price Index increased by 3% over the same period in 2020 and by 0.8% over the previous month. The increase in the annual headline CPI rate was the fastest since September 2008, while the monthly increase was the largest since 1981.

Likewise, overall energy prices rose 25% from a year earlier, including a 49.6% increase for gasoline and a 37.3% increase for diesel. This occurred although most energy categories experienced a decline in April, resuming their climb in May. Further increases are likely due to the cyber-attack on Friday, the 14th, which shut down Colonial Pipeline’s main transmission line from Houston to New Jersey.

For China, the OPEC MOMR forecasts a GDP growth of 8.5% (+0.1%) for 2021, considering that China was the only country that maintained positive numbers (2.3%) in its economic performance during 2020. In the first quarter of the year, China had a positive performance of 18% of its economy, underpinned by the growth of the Industrial Production Index, with an increase of 14.1% year-on-year for March and 24.5% % for the first quarter of 2021.

India continues to suffer from the exponential contagion spike observed during these first four months, conditioning the expected growth forecast for this year at 9.7% (-0.1%). India’s growth, higher than China’s, is explained by its performance during 2020, where India’s GDP fell by 7 per cent, while China was the only country in the world with a positive GDP variation.

On the other hand, Latin America, Africa, and the low-income countries of Asia are behind regarding the normalization of their productive activity.

It remains to be known if the sustained increase in the sovereign debt of most countries could create fiscal imbalances. Particularly in a context where an increase in economic activity determines an increase in interest rates, conditioning the monetary policies of those economies that have implemented fiscal easing programs.

COVID-19

As detailed in previous editions of the OIL REPORT, the pattern of unequal access to COVID-19 vaccines continues. On the one hand, some developed economies producing or accessing large amounts of doses, thus initiating mass inoculations that effectively reduce the infection curve in their countries.

On the other hand, the vast majority of developing countries, except for China (producer of vaccines and leader of the global economic recovery since the end of 2020), that do not have access to vaccines like industrialized countries (many of them headquarters of large pharmaceutical companies), nor have they been successful in the containment measures for the pandemic, as is the case of Latin America and India.

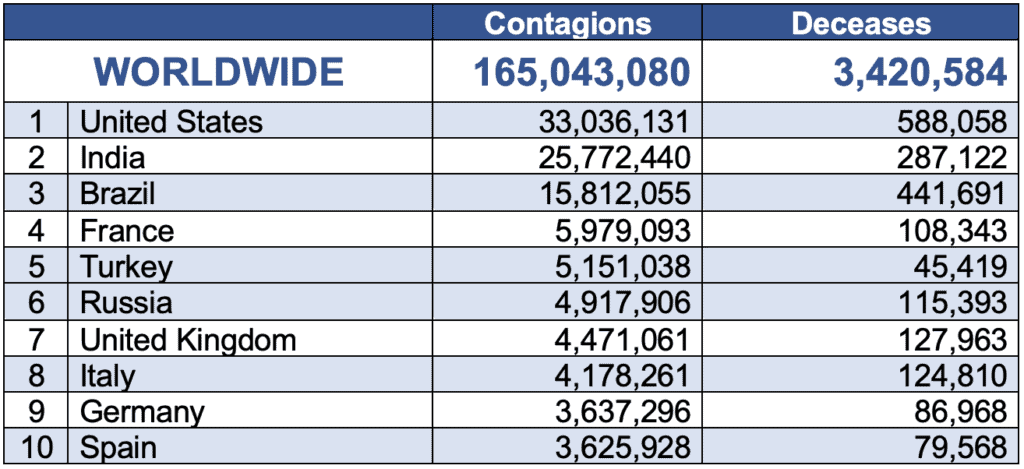

Contagions and deceases worldwide

As of 20/05/2021, the number of people infected by the coronavirus worldwide has reached 165 million people, while the total number of deaths is 3.4 million.

TOP 10 COUNTRIES MOST AFFECTED BY THE PANDEMIC

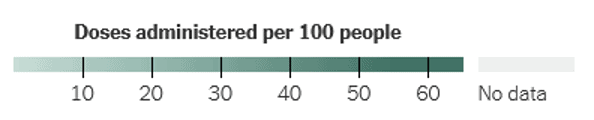

Global Vaccine Distribution

More than 1.56 billion doses have been administered worldwide, equivalent to 20 doses per 100 people. However, there is still a large gap between vaccination programs between developed and developing countries, with many of the latter still without mass injections or available vaccination figures.

The asymmetry in global access and distribution of vaccines remains, with 18 out of every 100 of the world’s population has received at least one dose.

The United States and the United Kingdom have administered 80 and 81 doses per 100 inhabitants, respectively. For its part, the European Union has an average of 36 doses per 100 inhabitants, even though it is still struggling with limits in its vaccine inventories, having decided to terminate the contract with AstraZeneca, alleging non-compliance on the part of the pharmaceutical company.

Among the countries with the highest performance in mass vaccinations are Seychelles with 132/100 (i.e. they are on their second doses), followed by the United Arab Emirates and Israel, both with 116/100.

In the case of Latin America and the Caribbean, Chile stands out (85/100). It is followed by Argentina (21/100), Brazil (18/100) and Mexico (17/100), the countries with the largest populations, with the rest of the region averaging only 9 out of 100.

Africa continues to be the region lagging, with less than 1 in 100, with countries not having started mass vaccinations.

In Asia, China, with 25 doses per 100 population, and India (18/100), with the latter amid the record spike in cases. Japan, far behind with 4.2/100.

The Russian Federation, for its part, still has a relatively low level of vaccination (16/100), being a producer of antivirals.

This unbalanced vaccination rate, and to a large extent, below the needs to reach immunization to prevent the spread of COVID-19 and its variants – which emerge as the virus has enough time to mutate – is one of the fundamental reasons for estimating that the recovery of the economy will occur from the second half or at the end of this year.

The most likely scenario is that towards the end of the year, large industrialized economies will announce the containment of the virus thanks to the progress of mass vaccinations. However, it seems that the poor or middle-income countries of Latin America, Africa and Asia will continue to face problems in containing the virus and recovering their economies, generating free transit and communication zones in the world only among the group of «COVID-free» countries, with restrictions on trade with the rest of the world.

DEMAND

According to MOMR, OPEC maintains the estimate for global oil demand growth this year at 6.0 million barrels of oil per day (million b/d), with a sustained increase starting in the second half of the year to 96.5 million b/d.

This estimate of demand behavior comes on the heels of slower-than-expected demand in the American hemisphere during the first quarter of 2021, combined with pandemic spikes in India and other countries.

GLOBAL OIL DEMAND

(Crude, condensates, NGLs and other non-conventionals)

(2020 – 2021)

The International Energy Agency (IEA) agrees with OPEC while maintaining its demand projection for the current year. The U.S. Energy Information Administration (EIA) forecasts a higher increase in demand, 1.2 million b/d above the OPEC/IEA estimate, to 97.7 million b/d.

All these organizations agree that, by the second half of 2021, oil demand will be stimulated by economic recovery, supported by the stimulus programs implemented by the leading economies and by increasing mobility after eliminating many restrictive measures the pandemic.

Massive and efficient vaccination in the United States and the United Kingdom, coupled with economic recovery in Asia, with China leading the way, promotes the consumption of fuels for all types of transportation and the recovery of demand.

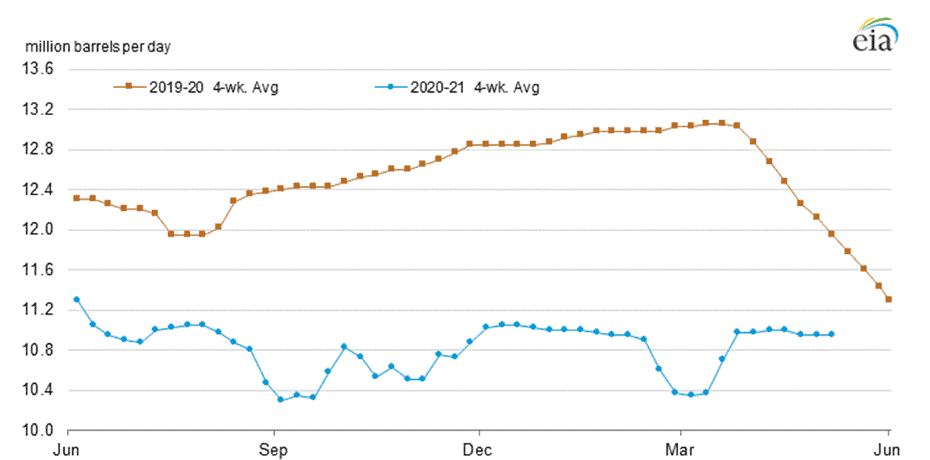

U.S.

The slowdown in transportation fuel consumption negatively affected U.S. oil demand during the first quarter of 2021. However, the rapid progress of the vaccination process and the containment of the pandemic have allowed lifting restrictions on mobility and transportation, which has allowed reversing the beginning of the first quarter.

According to the EIA, gasoline prices are expected to be higher this summer (an average of $2.78 per gallon) than last summer ($2.07) because, as the pandemic impacts are mitigated, there will be fewer mobility restrictions and greater demand for gasoline.

Overall economic activity in both the U.S. and the rest of the world is expected to be significantly higher this summer compared to the last one.

The North American market is expected to go upwards in gasoline consumption due to the proximity of the summer season and the lifting of land transit restrictions in the country.

However, uncertainty persists in some sectors, especially aviation fuels, pending the extent of COVID-19 containment measures and the speed with which vaccination targets are reached in the U.S., U.K. and Europe.

Overall, in 2021, gasoline, diesel and light distillates demand are expected to increase, thanks to the excellent performance of the petrochemical sector.

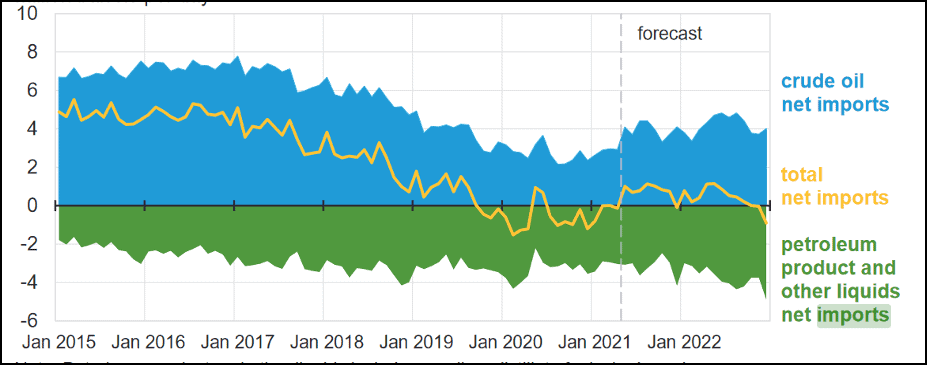

Regarding imports, according to EIA, the United States is expected to be a net importer of oil in 2021 and 2022. 2020 was the first year in which Americans were net exporters of oil due to declines in crude oil production. According to the Agency, net crude oil imports will increase from their 2020 average of 2.7 million b/d to 3.7 million b/d in 2021 and 4.4 million b/d in 2022.

U.S. NET IMPORTS OF PETROLEUM AND PRODUCTS

(million b/d, Projection 2021-2022)

CHINA

By March 2021, China’s oil demand increased by more than 2.1 thousand b/d, relative to 2020, following a growth of 2.5 thousand b/d, in February, reaching 12.95 thousand b/d. When compared to 2019, demand increased by 0.1 thousand b/d. Most of the recorded increases are related to higher demand for gasoline, diesel and jet fuel, resulting from increased economic activity and reduced restriction measures following the Chinese New Year holiday period.

It is expected that, in conjunction with the greater dynamization of productive activity, oil demand will continue to increase in the second quarter of the year, expecting that, in the aggregate of 2021, demand will exceed 2019 levels.

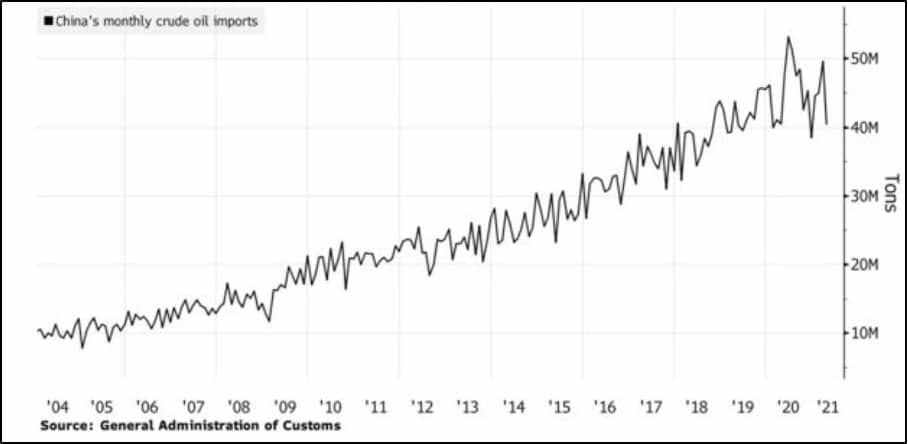

INCREASE IN CHINA’S OIL IMPORTS

OIL IMPORTS FROM CHINA

(2004-2021)

As of 2019, China, with domestic production of 4 million barrels per day of oil, has become the world’s largest oil importer at 10.19 million b/d, well above the U.S. and more than double the imports of India and Japan combined.

This year, all economic sectors are showing recovery, driven by the rebound in the transportation, industrial and petrochemical sectors, with the latter, in turn, boosting LPG and naphtha requirements. Gasoline demand will be stimulated by economic improvements and increased vehicle sales over 2020. Compared to the previous year, diesel demand is expected to grow in 2021 in line with industrial, construction, and agricultural activities.

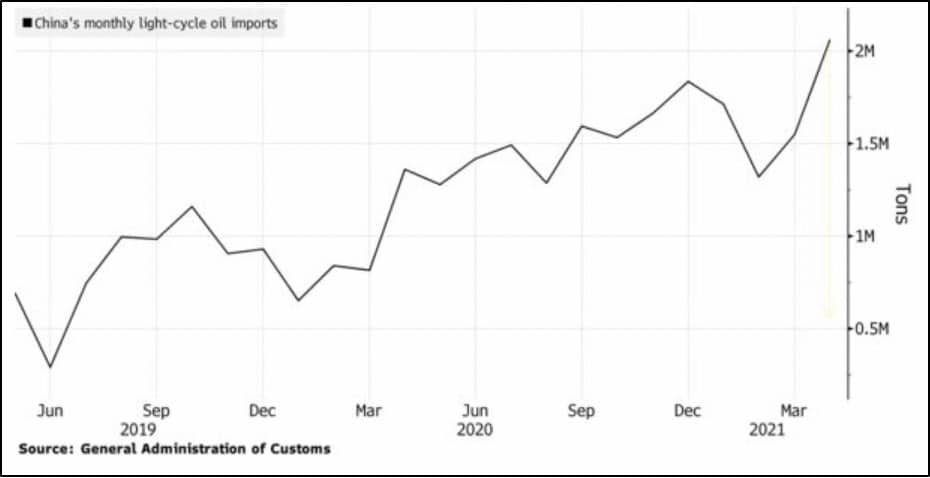

Chinese authorities from the Ministry of Finance will impose higher taxes on imports of bitumen and low-quality hydrocarbon blends («light-cycle oil») to restrict the import of low-quality hydrocarbons, which are cheaper but generate high carbon dioxide emissions.

CHINESE IMPORTS OF LCO

(LIGHT CYCLE OIL)

(2019-2021)

This decision by the Chinese government puts a brake on private importers of these low-quality hydrocarbons, or blends, forcing them to purchase better quality heavy crude oil to supply the domestic market.

INDIA

India’s oil consumption grew 0.7 thousand b/d, year-on-year, in March 2021, reaching 4.83 MDB, following a drop of more than 0.2 thousand b/d in February, compared to 2020. Compared to March 2019 levels, demand decreased by approximately 0.1 thousand b/d. Most product categories recorded increases, with diesel and gasoline standing out. Gasoil demand recovered compared to last year, registering a year-on-year growth of around 0.5%, recording year-on-year growth of around 0.4 thousand b/d. For gasoline, it showed an increase of about 0.2 thousand b/d, following a marginal decline in February.

However, for the second quarter of 2021, India’s oil demand will be affected by the exponential increase in COVID-19 contagions registered in the last weeks. With this situation continuing during May and possibly June, global oil demand will be affected, and the economic growth prospects for the Indian economy, which was expected to reach 9.8%.

OIL STORAGE

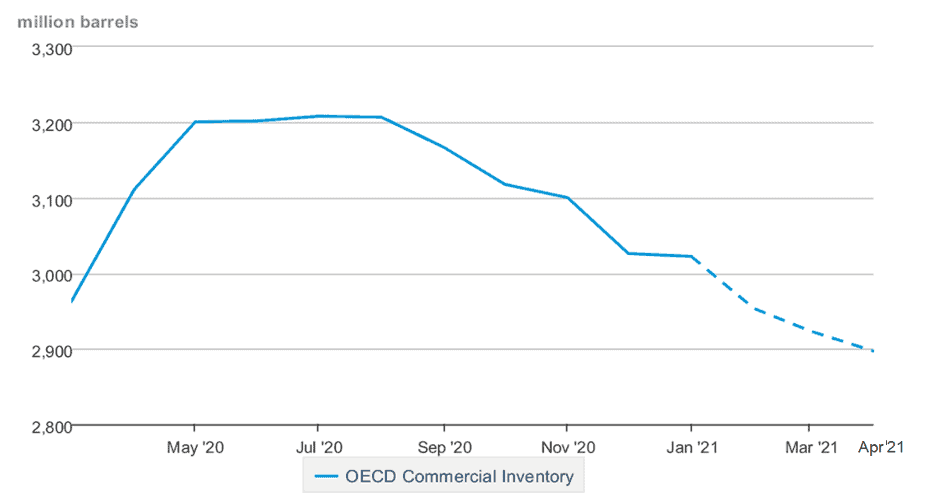

One of the most evident signs of the oil market stabilization is the draining of oil and product inventories. The trend is for OECD countries inventories to drain in 2021, despite the increase recorded in February and March, mainly due to the atmospheric phenomena that affected the refining sector in the U.S.

OECD countries

According to OPEC’s May MOMR, crude and product inventories stood at 2.987 million barrels, 7 and 17 million barrels higher than in February and January 2021, respectively, 10 million barrels higher than a year ago and 3.4 million barrels above the 5-year average. Days of inventory coverage were 67.4 days, down 0.6 days compared to February, and presented an annual increase of 7.3 days.

OECD: CRUDE OIL INVENTORIES IN OECD COUNTRIES

(March 2020 – March 2021)

For its part, the EIA, in its STEO Browser projections of May 11th, estimated total crude oil and oil product inventories in OECD countries at 2,922 million barrels for March, forecasting a monthly and annual decline of 30 and 9.86 million barrels, respectively.

EIA: OIL INVENTORIES OECD COUNTRIES

For April 2021, the EIA projected a record of 2,897 million barrels in total OECD crude oil and product inventories, presenting a monthly decline of 26 million barrels and an annual decline of 114.9 million barrels.

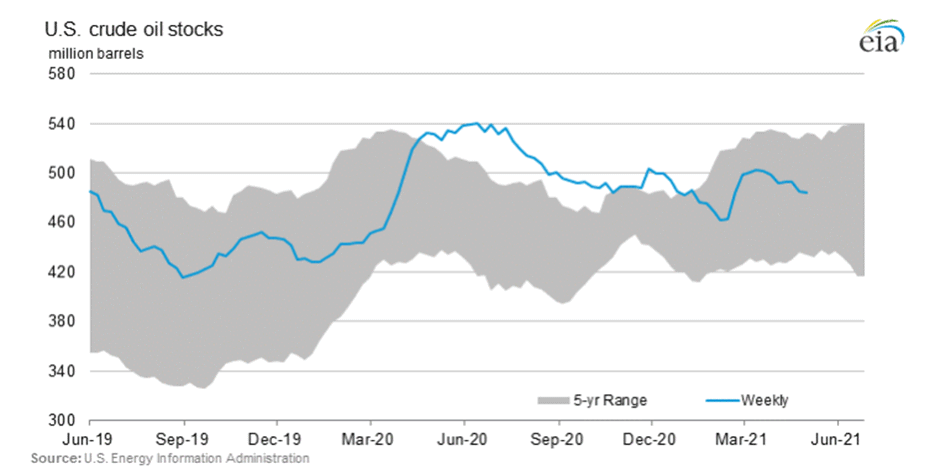

U.S.

In the last three weeks, commercial crude oil inventories in the U.S. had a drain of 8.11 million barrels, remaining at 486 million barrels as of May 14th, according to data from the EIA’s weekly report on May 19th, presenting an annual decrease of 40.4 million barrels of commercial crude oil.

U.S. COMMERCIAL CRUDE OIL INVENTORIES.

(June 2019 – May 2021)

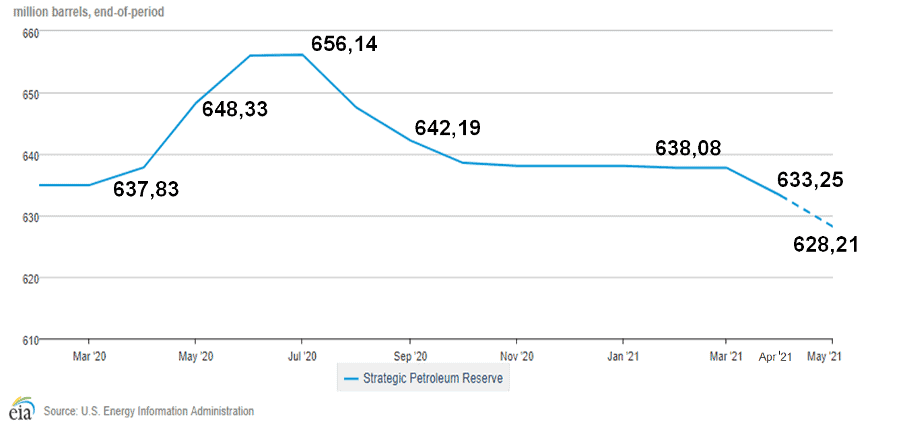

Strategic reserves drained 5.9 million barrels in the same span, added to U.S. oil production, to stand at 630.13 million barrels as of May 07th, presenting an annual drop of 8.74 million barrels and 25.1 million to July 2020, when, by order of former U.S. President D. Trump, authorized the use of such reserves to store production surplus of U.S. operators to prevent the shutdown of their production, in the face of the collapse of the Cushing Oklahoma.

The EIA estimates maintain the downward mark this year, forecasting that at the end of May, the strategic reserves will stand at 628.21 million barrels and by the end of 2021, they will stand at 617.33 million barrels of oil.

U.S. STRATEGIC PETROLEUM RESERVES.

(March 2020 – May 2021)

In April 2021, commercial reserves felt 13.62 million barrels compared to the previous month and 9.9 million barrels compared to the average of the last five years, but 8.84 million barrels above the reserves recorded last January, due to the monthly increase in February and March, as a consequence of the winter storms that affected refining activity in Texas.

The trend of crude oil inventories in the U.S. in 2021 is downward, to close the year at 451.87 million barrels.

By May 14th, according to the EIA’s latest weekly report, the days of coverage dropped to 32.2 days. They were above 40 days between February and March, registering on March 12th the historical record of 41.8 days.

U.S. OIL HEDGING DAYS

(June 2019 – May 14th, 2021)

VENEZUELA

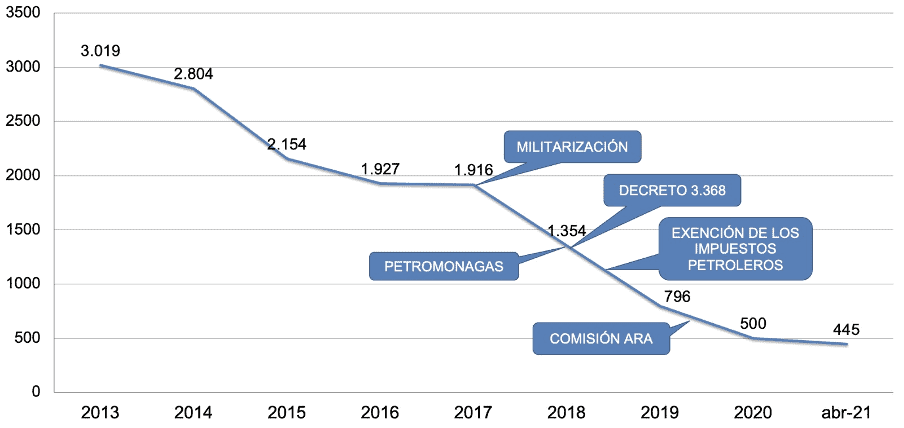

According to OPEC’s latest Market Monitoring Report (MOMR), Venezuela’s oil production fell by 81 thousand barrels of oil per day to the previous month, to 445 thousand barrels of oil per day, a drop of 85% to production levels of 3.015 million barrels per day in 2013.

OIL PRODUCTION IN OPEC COUNTRIES

(April 2021)

Oil production activity accumulates a drop of 2.570 million barrels of oil per day for 88 continuous months, being the only OPEC country that has experienced a similar situation.

Due to the successive government interventions in PDVSA with the process of dismantling and persecution of its management structure, its procurement and contracting procedures and processes, as well as the diversion of the resources budgeted by the company between 2015-2017, for its operations, maintenance and investment, the production and processing of oil and gas, refining and exports have collapsed.

The government has not been able to structure, nor present a recovery plan for the company and its operational capacities, although, in 2007, the largest oil reserves in the planet were certified – 316 billions barrels of oil – and that PDVSA, in its 2013 audited financial statements, was the fifth largest oil company in the world, with 231 billion dollars in assets and 84,486 billion dollars in equity. Moreover, with average production in the period 2004-2013 of 3 million barrels of oil per day, contributions to the treasury of 480 billion dollars and contributions to social development and other State funds for 216 billion dollars during the Full Oil Sovereignty period.

Instead of presenting a plan to recover the company, the government, as of 2017, militarized the entire management structure of the company, unleashed open political persecution and imprisonment of directors, managers and workers, snatched the social and economic conquests of its workers, causing the departure of more than 30 thousand workers and qualified personnel from the company.

VENEZUELA’S OIL PRODUCTION

(2013 – April 2021)

Once the company was militarized, under the presidency of the National Guard General Manuel Quevedo, the government promised the country that it would increase oil production by 1 million barrels per day in one year.

Once PDVSA was militarized, the government began its privatization, violating the Constitution and the Organic Law of Hydrocarbons in force.

In 2018, based on Decree 3368, the government, with the signing of the «Service Contracts», handed over to private parties the control and operation of the best oil production areas in the country operated until then by PDVSA. He also decreed a tax exemption for the oil sector and began to hand over the best areas of the Orinoco Oil Belt to inexperienced and unskilled oil companies through the Constitutional Chamber of the TSJ, as well as to cede PDVSA’s participation and control over the best joint ventures in the country.

The results were disastrous: not only production did not increase by one million barrels per day as promised by the government, but it fell from the level of 1.9 million barrels per day in December 2017 -when the militarization begins- to 500 thousand b/d, a drop of 1.4 million barrels per day, a 74% drop between 2017-2020, until General Quevedo leaves and a new PDVSA intervening commission, the ARA Commission (named after former PDVSA’s president Alí Rodríguez Araque) was installed in February 2020.

The ARA Commission came to privatize PDVSA

This new Interventory Commission, coordinated by Tareck al Aisami, arrived at a dismantled Ministry of Petroleum and a destroyed PDVSA to privatize the company.

On May 01st, 2020, we denounced the privatization plan of the oil sector, where the ARA Commission, in open violation of the Constitution and Laws, presented to the potential buyers of PDVSA a plan which hands over all the assets and the oil patrimony of the country to the private sector.

The privatization plan of the ARA Commission also plans to hand over the operations and control of the oil areas of the country, the oil and gas production areas, the sale of refineries, cryogenic plants, tank yards, terminals, as well as plants, platforms, drilling rigs and ships, among others.

The Commission does not propose developing new production and refining areas, but rather the simple sale of everything that already exists, which is absolutely contrary to the national interest established in the Constitution and the laws.

Now the ARA Commission is circulating a document among the private sector, where it places a price on the assets and oil patrimony of the Venezuelan people, concentrated in 152 «business opportunities». For the government and the ARA Commission, oil sovereignty is worth 77 billion dollars.

The document, where PDVSA is sold off, widely disseminated by the major agencies and representatives of transnational oil capital, is justified with the argument that resources are required to bring oil production to the levels «prior» to the government of President Chávez. They are openly avoiding the fact that during that period, there was the oil price policy defense, which enforced the regulation of production -as demonstrated by OPEC+ during the pandemic- but the average oil production in the country remained between 2004-2014 at 3 million barrels of oil per day, this despite the effects of the 2002 Oil Sabotage.

An important aspect to highlight is not only the illegalities and inconsistencies of the operation but also the underestimation of PDVSA’s assets value. The company was valued at 251 billion dollars in 2013, is now being auctioned for 77 billion dollars; that is, the government is offering the private sector a discount of 174 billion dollars or 74% in its value. A real «bargain» for the transnationals.

On the other hand, the government promised all kinds of assurances to the investors, not only international arbitration -already contemplated in the Law for the protection of investments approved by the National Constituent Assembly-, but absolute confidentiality in the transactions, which already take place without rendering accounts to any of the State’s controlling bodies, or to anyone, without transparency of any kind, repealing or «disapplying» the laws of the Republic as established in the unconstitutional «anti-blockade law», approved -again- by the extinct National Constituent Assembly.

The obstacle for privatization: the 1999 Constitution and the Organic Law of Hydrocarbons.

The current legal framework hinders the government’s privatization plans for the oil sector, which includes both the Constitution of the Bolivarian Republic of Venezuela, widely approved after the 1999 Constituent Assembly process and the Organic Law of Hydrocarbons, which came into force in 2002 and has been tested and successfully applied during the Full Oil Sovereignty policy, between 2004 and 2014.

The government knows that the laws approved by the National Constituent Assembly are not only questioned by the legitimacy and overreach but also collide with the current Constitution. Therefore, no significant investor of the international oil sector will come to participate in acts that, being vitiated by nullity, lack validity and do not produce legal effects.

For this reason, the government, now in control of the National Assembly, is accelerating the reform or repeal of the Organic Law of Hydrocarbons to adjust it to its plans for privatization of the sector.

The analysis of the constitutionality of the amendments or repeal of the Organic Laws of the sector (among them the Organic Law of Hydrocarbons and the Law of Nationalization of the Orinoco Oil Belt) establishes that such laws constitute the legal instrument to exercise «the reservation on the oil activity and other industries, exploitations, services and goods of public interest and strategic nature». Therefore, no reform or law may violate the reservations made therein on the oil activity or the principles and provisions enshrined in the Constitution, among others, the one that establishes hydrocarbons as property of the State.

The ownership of oil cannot be exercised if its exploitation, operation, and commercialization are not controlled. If the State does not obtain the necessary income from taxes and royalties as the natural resource owner, as established in the Law.

By modifying the Organic Law of Hydrocarbons, privatizing PDVSA and handing over the operations and control of the oil to third parties, any possibility of exercising the reserve and ownership of the oil is lost, and therefore it is unconstitutional.

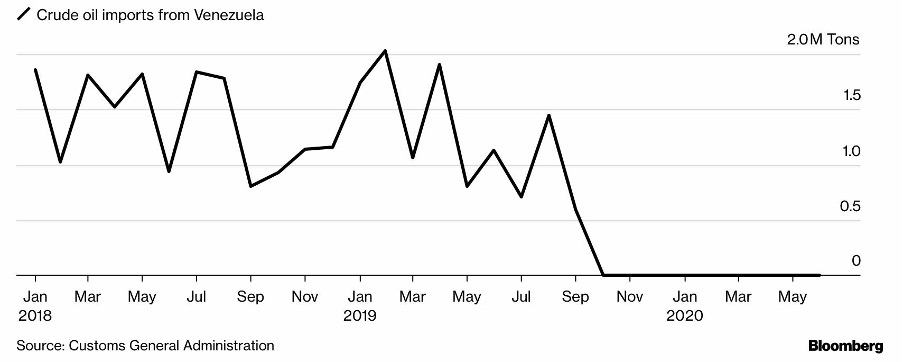

China’s tariff reform reduces oil export options from Venezuela

This week, the Chinese Ministry of Finance decided to impose additional taxes on what is called «light-cycle oil» (LCO), which are oil or mixtures of heavy oil, also known as «bitumen-diluted», which, when processed or used, generate a lot of carbon dioxide emissions into the environment.

With this measure, the Chinese government is trying to block or make more expensive the acquisition by private Chinese refiners of this type of hydrocarbon mixture, which they acquire at a low cost, to force them to buy better quality heavy crude oil in fewer additions to the environment.

Why does this measure affect Venezuela?

Within the framework of the market diversification policy, advanced by Venezuela during President Chávez period, as from 2006, essential supply agreements were subscribed with China, India, and other Asian countries to diversify and create a market niche for our heavy crudes.

Until 2014, Venezuela supplied China with up to 640 thousand b/d of heavy oil, which, when sold at market prices, formula type, meant a valuation for our crudes in a market where competition with heavy crude producers is lower, but also the commercial exchange, which reached 24 billion dollars with China, allowed the establishment of beneficial relations for both countries.

Chinese state-owned companies expanded their presence in the country through the constitution of joint ventures within the framework of the LOH, in which PDVSA has at least 60% participation and control in the areas of the Orinoco Oil Belt. In addition, a cooperation mechanism had been structured in this way, which included oil supply at market prices from Venezuela, Chinese investments for the oil and non-oil sector, and financial and technological assistance within the framework of the China-Venezuela Joint Commission.

Chinese state-owned companies continued importing Venezuelan oil until 2019, when they decided not to maintain the exchange because of the defaults from PDVSA, which as of 2017 began to breach most of the supply agreements such as Petrocaribe, China, among others, yielding to U.S. pressure and sanctions against Venezuelan oil exports.

CHINESE IMPORTS OF VENEZUELAN CRUDE OIL.

It seems evident that China decided to reduce its geopolitical risk with Venezuela, given its non-compliance and internal problems. An opposite stance to the one taken with Iran, where, despite the strict sanctions imposed by the U.S. against the referred nation, Chinese state-owned companies have continued importing crude oil from the Persian nation.

As of 2019, when PDVSA conceded oil commercialization to third parties, Venezuelan exports to China have been carried out through private Chinese companies and private traders that operate for PDVSA, who transport Venezuelan oil, especially blends and Merey, to Malaysia and other Asian destinations. After making ship-to-ship transfers, the crude is mixed with other hydrocarbons.

Venezuelan Merey oil, after blending, falls into the category of low-quality hydrocarbons or hydrocarbon blends, «light-cycle oil», also known as «bitumen-diluted», which will now be taxed with a duty, which will be applied to the Venezuelan crude oil, especially the blends and Merey crude oil, to Malaysia and other Asian destinations, which will now be taxed at a higher rate by the Chinese government.

Thus, the tax reform, which will come into effect on June 12th, would impose a tax equivalent to almost US$ 30 per barrel for low-quality liquid hydrocarbons.

Sales of Venezuelan crude oil, especially blends and Merey crude, marketed by private operators, are sold at significant discounts since formula prices are no longer applied for our crudes. At the same time, the control capacities of the Venezuelan Ministry of Petroleum were dismantled – in 2017, the government intervened and closed the sales price monitoring office of the Ministry of Petroleum in Vienna – in such a way that the new taxes leave tiny margin for PDVSA and the intermediaries through which it operates.

The government, which ceded or surrendered an essential part of PDVSA’s fleet of oil tankers, among them the 4 VLCC (Junín, Boyacá, Carabobo and Ayacucho, tankers with a transport capacity of 2 million barrels of oil) acquired to supply China and India, will now be limited in its shipments to China so that the crude inventories in the country which have been draining since the beginning of the year will probably be replenished.

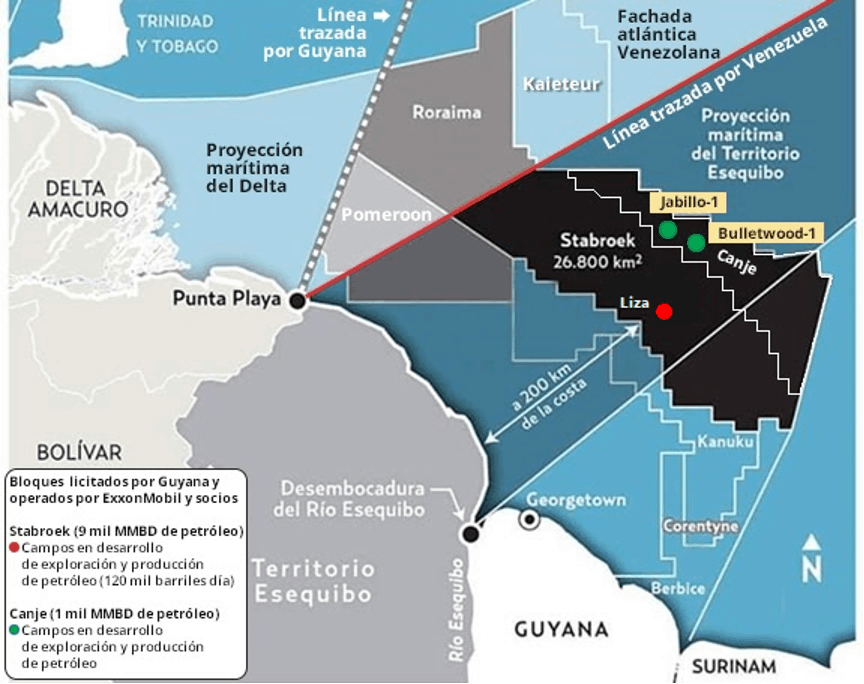

Guyana

Last April 28th, in a press release, the U.S. oil company ExxonMobil, operator (45%) of the Stabroek block -with the US Hess Corporation (30%) and the Chinese CNOOC (25%) as partners- announced the discovery of oil in the Urau-2 well, the 19th well made by the transnational oil company in the waters of the Essequibo and the Venezuelan Atlantic coast. With this discovery, still unquantified, new oil reserves are being added to the 9 billion barrels of reserves ExxonMobil estimated in 2020 in Stabroek.

OIL PRODUCTION BLOCKS IN THE WATERS OF THE ESSEQUIBO AND VENEZUELA’S ATLANTIC COAST

In view of the new oil discovery, the President of Guyana, Irfaan Ali, informed of ExxonMobil’s plans to have three additional Floating Production, Storage and Offloading (FPSO) units operational by 2027 (with which it expects to have ten operational FPSOs), to «significantly» increase production activities and take it to 1 million barrels of oil per day that same year.

The increase in oil activity and the development of infrastructure for the production and processing of oil and gas in the waters of the Essequibo territory in dispute with Venezuela is the dispossession of the territory and resources, going beyond the Geneva agreement and the sovereign right of Venezuela to control and develop the natural resources on its continental shelf, and to preserve its access to the Atlantic coast.

BIBLIOGRAPHIC REFERENCES:

- [1] Consejo de Seguridad ONU, “Resolución 2231”, Documentos ONU, 20 julio 2015.

- [2] Maryam Sinaiee, “Rouhani insists Agreement-In_Principle reached in Vienna Iran nuclear talks”, Iran International, 20 mayo 2021.

- [3] “Inflación Estados Unidos – índice de precios al consumo (IPC)”, Global Rates, 18 mayo 2021.

- [4] “Weekly Epidemiological and Operational updates May 2021”, Organización Mundial de la Salud OMS, 18 mayo 2021.

- [5] Redacción, “OPEC daily basket price stood at $65.29 a barrel Thursday, 20 May 2021”, OPEP, 21 mayo 2021.

- [6] Mohammed Sanusi, “Monthly Oil Market Report”, OPEP, 11 mayo 2021.

- [7] Dania Saadi, “Some 5.11 mil barrels of Murban to be delivered in June to settle IFAD futures”, S&P Global Platts, 04 mayo 2021.

- [8] Nota de Prensa, “OPEC and non-OPEC Ministerial Meeting highlights importance of ongoing rebalancing efforts”, OPEP, 27 abril 2021.

- [9] “Short-Term Energy Outlook Data Browser”, Administración de Información Energética de EE.UU., 11 mayo 2013.

- [10] “Statistic”, Ministerio de Energía de Rusia, mayo 2021.

- [11] “Declaration of Cooperation”, OPEP, 10 diciembre 2016.

- [12] Nota de Prensa, “OPEC and non-OPEC Ministerial Meeting highlights importance of ongoing rebalancing efforts”, OPEP, 27 abril 2021.

- [13] Nota de Prensa, “Araqchi: En las negociaciones se ha progresado considerablemente”, Agencia de Noticias de Irán IRNA, 20 mayo 2021.

- [14] Nota de Prensa, “JCPOA: Joint Commission resumes on Wednesday in Vienna”, Servicios de Exteriores de la Unión Europea, 18 mayo 2021.

- [15] Nota de Prensa, “Araqchi: La renovación del Protocolo Adicional requiere el previo levantamiento de las sanciones”, Agencia de Noticias de Irán IRNA”, 12 mayo 2021.

- [16] Jalina Porter, “Department Press Briefing – May 19, 2021”, Departamento de Estado de EE.UU., 19 mayo 2021.

- [17] Alto Funcionario, “Briefing with Senior State Department Official On Ongoing U.S. Engagement in Vienna Regarding the JCPOA”, Departamento de Estado de EE.UU., 06 mayo 2021.

- [18] “Executive Order 13846”, Reimposing Certain Sanctions With Respect to Iran, Federal Register, Home of Teasure, 07 agosto 2018.

- [19] Nota de Prensa, “Rohani: Las conspiraciones de los sionistas contra el JCPOA y su oposición a las relaciones de Irán con sus vecinos están fracasando”, Agencia de Noticias de Irán IRNA”, 05 mayo 2021.

- [20] Nota de Prensa, “Russia shouldn’t rush to abandon oil exports, says Energy Minister”, Agencia de Noticias de Rusia TASS, 14 mayo 2021.

- [21] “Short-Term Energy Outlook Data Browser”, Administración de Información Energética de EE.UU., 11 mayo 2013.

- [22] “Rig Count”, Baker Hughes, 21 mayo 2021.

- [23] “Drilling Productivity Report”, Administración de Información Energética de EE.UU. EIA, 17 mayo 2021.

- [24] Artem Abramov, “US shale pre-hedge revenues are set for an all-time high in 2021 if WTI prices remain strong”, Rystad Energy, 05 mayo 2021.

- [25] “First Quarter 2021 Report”, ExxonMobil, 30 abril 2021.

- [26] “American Jobs Plan”, Casa Blanca de EE.UU., 31 marzo 2021.

- [27] “The Made in American Taxes”, Departamento del Tesoro de EE.UU., abril 2021.

- [28] Christopher Bing y Stephanie Kelly, “Cyber attack shuts down U.S. fuel pipeline ‘jugular,’ Biden briefed”, Reuters, 09 mayo 2021.

- [29] Eamon James y Amanda Macias, “Colonial Pipeline paid $5 million ransom to hackers”, CNBC, 13 mayo 2021.

- [30] Eva Golinger, “El Código Chávez»”, página 105, Abajo Cadenas / Monte Avila Editores, 2005.

- [31] “CPI for all items rises 0.8% in April; used cars and trucks among many indexes rising”, Oficina de Estadísticas Laborales de EE.UU., 12 mayo 2021.

- [32] “Oil Market Report – May 2021”, Agencia Internacional de Energía IEA, 12 mayo 2021.

- [33] “Energy production in April of 2021”, Oficina Nacional de Estadísticas de China, 18 mayo 2021.

- [34] “Weekly Stocks”, Administración de Información Energética de EE.UU. EIA, 19 mayo 2021.

- [35] Nicolás Maduro, Decreto 3.668, Finanzas Digital, 12 abril 2018.

- [36] “Ley Orgánica De Hidrocarburos”, Ministerio de Petróleo de Venezuela, 24 mayo 2006.

- [37] Muyu Xu y Chen Aizhu, “China cierra laguna tributaria con aranceles a importación de combustibles para mezclas”, Reuters, 14 mayo 2021.

- [38] Nota de Prensa, “ExxonMobil announces discovery at Uaru-2 offshore Guyana”, ExxonMobil, 28 abril 2021.[39] Redacción, “Guyana President confirms major ramp up coming in ExxonMobil’s oil production operations”, Oil Now, 28 abril 2021.