OPEC+ AND CLIMATE CHANGE

The OPEC + decided on November 4, during the 22nd Ministerial Meeting, by which the easing of the cuts remained unchanged at 400 thousand barrels per day, ratifying its decision of July 18. The above occurs at a time when there is an open debate on climate change and the measures aiming to reduce the consumption of fossil fuels, as well as the unsatisfied demand for oil and gas persists, causing an exponential increase in the prices of the latter, as well as it has kept oil prices above $ 80 per barrel since the end of September.

With this decision, OPEC+ production (without Mexico’s output) will be at 38.34 million barrels per day by December 2021.

The extraordinary increase in gas prices and oil price levels for the last quarter of the year indicates unsatisfied global demand. From several analyses, including OPEC’s, it was already foreseen that the world’s economy is recovering towards the end of the year, so oil demand is expected to increase to 99.5 thousand barrels per day in that period. Both the agencies and OPEC agreed on this issue.

OPEC’s decision to ignore market demand and the requests made by large consumers, such as the United States and China, seem to correspond more to Saudi Arabia and Russia’s political needs than the strategic vision of the interests of oil-producing countries.

As we expressed in our interview with EFE, published on our blog www.rafaelramirez.net, on November 2, OPEC+ must seriously consider increasing its oil production, both to meet demand and not to increase the cost of fossil fuels, especially when its use is severely challenged by the greenhouse effect caused by CO2 emissions into the atmosphere.

On the other hand, it is the best strategic interest of OPEC to maintain oil and gas at competitive prices, not only given the cost of renewable energy but also because of the more expensive and polluting oil production, such as fracking and shale oil, open-cast mining of oil sands in Canada, production of Costa Aoutera and environmentally protected areas, as is the case in the Arctic.

The large industrialised economies have not replaced oil and gas consumption with other energy sources because, as demonstrated by the gas crisis in Europe, there is currently no economically viable alternative to hydrocarbons. But this is something which will happen at any time. It’s a matter of time. The clearest example of this was that China significantly increased coal consumption, thereby increasing the price of coal in the face of restrictions on gas supply.

Large industrialised economies are discussing energy transition and even deliberating on reverting to the widespread use of other energy sources, such as nuclear ones. At the G20 meeting in Rome on October 30, it was clear that the industrialised economies, especially the United States, Canada, the United Kingdom, and Europe, will decide to reduce carbon emissions to the environment through public policies, fossil energy consumption. Countries and large capitals, including investment funds, have also decided to reduce investments in oil and gas production projects and turn to finance and promote renewable energies or alternatives to oil. Decarbonisation will be a reality, or the climate consequences will be devastating for the planet.

In this scenario, oil-producing countries, grouped in OPEC+, should maintain the natural resource price at a level, which could be placed in a band between $70 and $80 per barrel, allowing it to be valued appropriately. On the other hand, that maintains a cost that allows it to continue to be the world’s first consumption option and even be available to many poor and underdeveloped countries, which have a potential energy demand and are entitled to meet it. The aim is to maintain a balance between the interests of producers and consumers.

The energy transition will not be an immediate change because, at the moment, there are no energy sources to replace hydrocarbons. Still, the increase in oil and gas will make the big industrialised economies accelerate plans and use all their resources, economic and technological so that this becomes a reality in the shortest possible time.

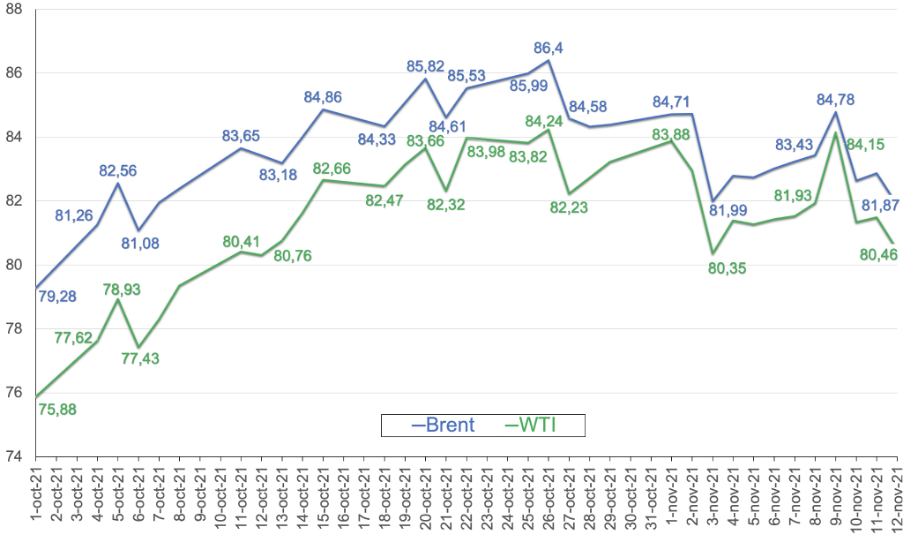

OIL PRICE

On November 12, at 10 AM (GMT), Brent and WTI crude markers were quoted at USD 81.87 and USD 80.46, respectively, due to information on the use by the U.S. Department of Energy of more than 3 million barrels of their strategic oil reserves. This caused market expectations for the potential increased use of U.S. and OECD strategic reserves, which has contained the increase in prices quoted by US$84 and USD 82 barrel for Brent and WTI, respectively, following the OPEC+ meeting.

BRENT AND WTI CRUDE PRICES

(October 4 — November 12 2021)

Current Brent and WTI prices increased by 87.14 % and 95.67 %, respectively, compared to 2020 and 32 % and 41 % to October 2019. This is a clear indication of global oil demand recovery and the market stabilisation after the collapse of 2020 due to the COVID-19 pandemic.

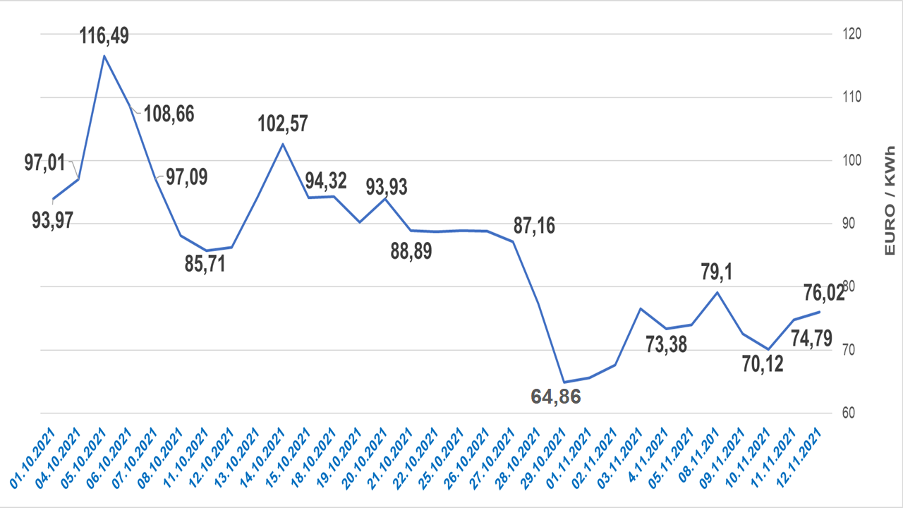

The price of gas in the European market

After reaching historical peaks on October 5, when it surpassed 160 euros/MWh, the Dutch TTF Gas Future, the indicator for the European gas market, has fallen in its price, reaching below 90 euros/MWh from October 20, reaching a minimum of 64.86 euros/MWh on October 29. This occurred a day after Russian President Vladimir Putin ordered Gazprom to increase production to the countries of the European Union. The Russian gas company reported on November 9, the beginning of gas injection to underground storage in Europe.

However, prices rose again after the Russian giant announced that it would not send gas through Ukraine and Poland. On November 12, the Dutch TTF was trading between EUR 79.5 and EUR 76 per MWh, due to the warning, from Belarus that Russian gas would not be allowed into Europe if, from the E.U., new sanctions are applied to the country. Before this, on November 11, the Dutch TTF had closed at 72.77 MWh, with an increase of 308 % in 2021.

GAS PRICE FOR EUROPE

(October – November 12 2021)

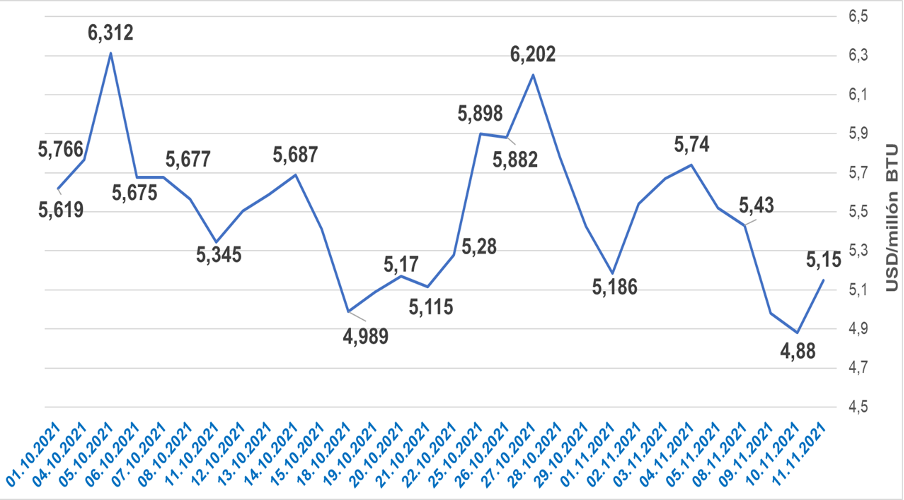

The price of gas in the North American market

Henry Hub Natural Gas (NG1), a benchmark for the U.S. natural gas market, has been under pressure during 2021 by rising gas prices in Europe and increasing LNG shipments. However, last week the price fell due to Russia’s decisions on its supply to Europe and the announcement of a «less cold» winter, lowering its share by up to 15 % between 04-10 November. However, the announcement of the annual inflation increase of 6.2 in the U.S. CPI caused it to rise again, closing the November 11 day by $5.15 a million BTU. This is a 99 % increase in its share during 2021, with values in October and November that were not recorded since 2010 and 2011.

HENRY HUB NATURAL GAS QUOTE (NG1)

(October — November 11 2021)

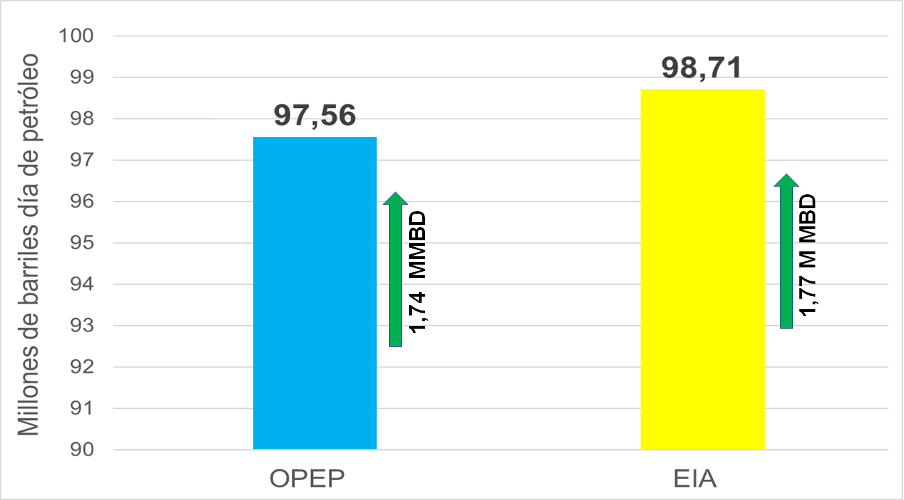

OIL PRODUCTION

World oil production

World production of oil, condensates, LNG and unconventional liquids continues to increase gradually, mainly due to the ease in OPEC+ cuts and the entry of volumes from other producers, stimulated by the recovery of oil prices. However, as reflected in crude oil prices, this increase does not meet the current demand or prospects for the economy’s recovery by the end of 2021.

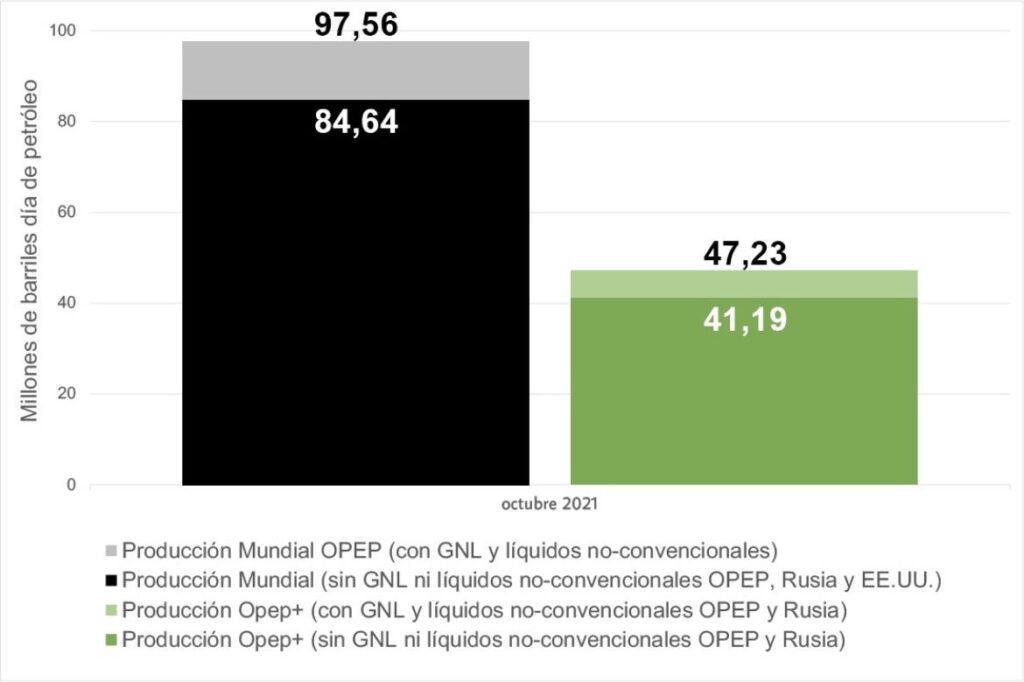

According to data fromOPEC’s latest Monthly Oil Market Report (MOMR) of November 11, world production stood at 97.56 million barrels per day, representing a monthly increase of 1.74 million barrels per day in October.

WORLD PRODUCTION

of oil, condensates, LNG and unconventional liquids

(October 2021)

If we separate the volumes of condensates, LNG, and unconventional liquids in the U.S., Russia and OPEC, the global oil production in October stands at 84.64 million barrels per day, according to both OPEC data, EIA information, as well as data from the Russian Ministry of Energy.

Oil production shows a monthly increase of 2.2 million barrels per day, mainly due to the easing of OPEC+ and the recovery of 700 thousand barrels per day in U.S. production.

WORLD OIL PRODUCTION

(October 2021)

OPEC+ production

Of the 84.64 million barrels per day corresponding to world oil production in October, 48.7 % correspond to OPEC+ with a production of 41.19 million barrels per day. Of the total OPEC+ production, 56.3 % -23.2 million barrels per day — corresponds to the production of OPEC countries participating in the cuts, while 33.4 % — 13.74 million barrels per day — corresponds to the non-Opep countries participating in the agreements. The remaining 10.3 % — 4.25 million barrels per day — corresponds to OPEC countries exempt from cutting their production, mainly Iran and Libya.

For the rest of 2021, the production of OPEC+ will be governed, according to the scheme of flexibilisation ratified, so that the production cut for November will remain at 4,159 million barrels per day and in December at 3,759 million barrels per day, closing the year with a decrease of 5.94 million barrels per day compared to the original cut of 9.7 million barrels day, started on May 1 2020.

The production adjustment agreement will be valid until December 2022. As agreed, it will continue with the same flexibility scheme of 400 thousand barrels per day per month, applying it until September or when OPEC+ returned to the market the whole adjusted volume in May 2020.

It was also agreed that from May 2022, the production base would be increased by 1,632 million barrels per day over the reference for the April 2020 agreement, with 43,732 million barrels per day, an increase of 1,632 million barrels per day, which does not include the production of Iran, Libya and Venezuela. With the latter, there has been a redistribution of production quotas, where Saudi Arabia and Russia will rise each to 11.5 million barrels per day (an increase of 500 thousand barrels per day), while the UAE managed to raise its own to 3.5 million barrels per day, an increase of 332 thousand barrels per day with its current base.

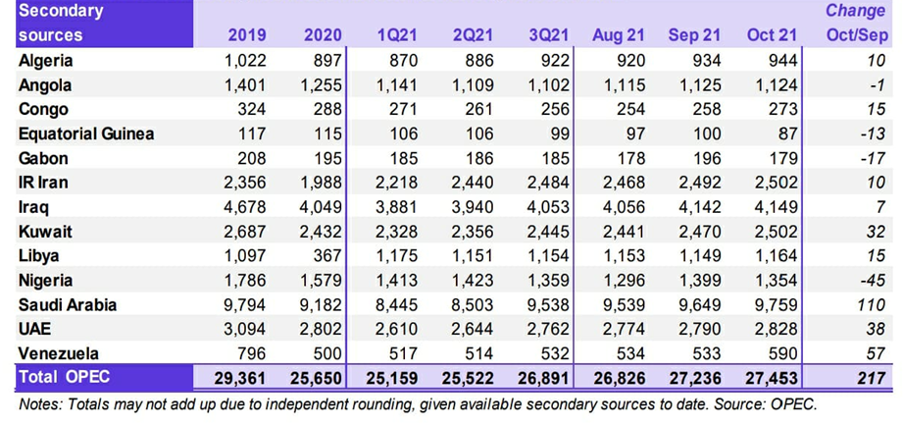

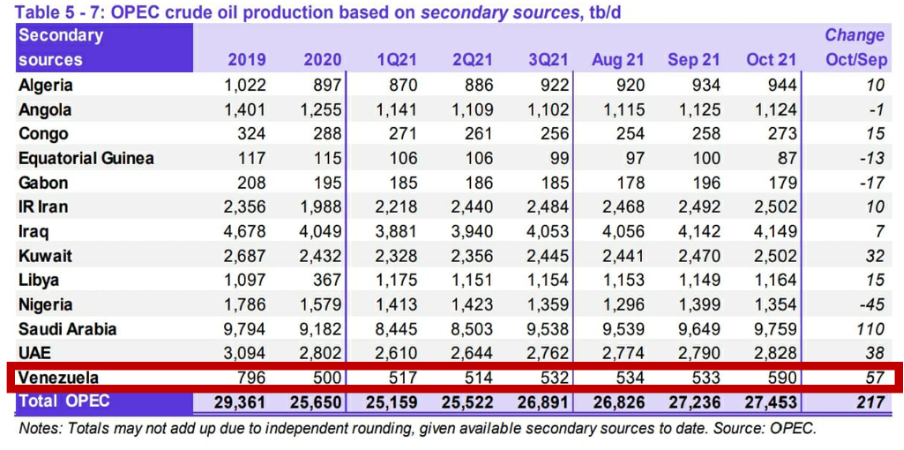

OPEC production

According to MOMR data, oil production in member countries was 27.45 million barrels per day as of October — the highest levels in a year and a half — due to the easing of their production.

PRODUCTION OF OPEC COUNTRIES

(September — October 2021)

Producers in the Gulf

Saudi Arabia, together with the countries of the Persian Gulf (without Iran), totalled a production of 19,238 in October million barrels per day, corresponding to 70.1 % of OPEC production. Of this production, 9,76 million barrels per day corresponds to Saudi Arabia. This is the fundamental reason for the leadership of Saudi Arabia and the Gulf monarchies in the conduct of OPEC, in which the political interests of this group of countries prevail over the interests of the rest of the members.

African producers

Nigeria and the rest of the African countries (without Libya) presented a production of 3.96 million barrels per day in October. African producers accounted for 14.4 % of OPEC production in October and 9.6 % of OPEC+ production.

Producers outside the cut-off agreement

For their part, Iran, Libya and Venezuela — the three OPEC countries free from production cuts — presented in October a joint production of 4.26 million barrels per day, of which 2.5 million barrels per day (58.7 %) was Iran and 1.17 million barrels per day in Libya; while Venezuela’s production remains stagnant at around 590 thousand barrels of oil.

There are strong expectations in the oil market following the announcement of the resumption of negotiations between the United States, Europe and Iran on the terms and conditions of the 2015 Nuclear Agreement. The above could produce the lift of the sanctions on the Persian nation, bringing additional volumes of Iranian production until it regains its share of 4 million barrels per day of oil.

If this expectation were realised, in 2022, additional volumes of oil would enter the market, which would force OPEC to hold a quota discussion and look for space for Iranian production to the detriment of other countries that cannot meet their production quotas, like Venezuela.

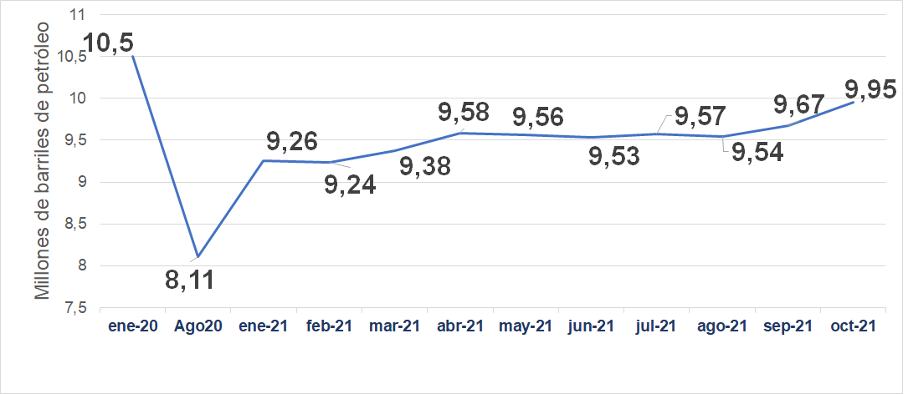

Russia

According to data published by the Ministry of Energy of the Russian Federation, the country’s oil production in October stood at 9.95 million barrels per day, representing 36.25 % of OPEC+ production and is located 190 thousand barrels per day above Saudi production. This is the fundamental factor for both countries to lead and co-chair OPEC+.

October production was 330 thousand barrels more than in September, again standing above the production quota agreed at OPEC+. This, due to the reactivation of production in the Caspian Sea, after the maintenance stop, which affected the production of 160 thousand barrels per day in September.

Production of Russia

(January 2020-October 2021)

Russian oil production has had an annual increase, by October 2021, of 750 thousand barrels per day, 8.2 % compared to its production levels of 12 months ago, thanks to the policy of easing cuts of OPEC+. However, it is still 500 thousand barrels per day — 5.2 % — below its record production levels in January 2020 of 10.5 million barrels per day, before the COVID-19 pandemic.

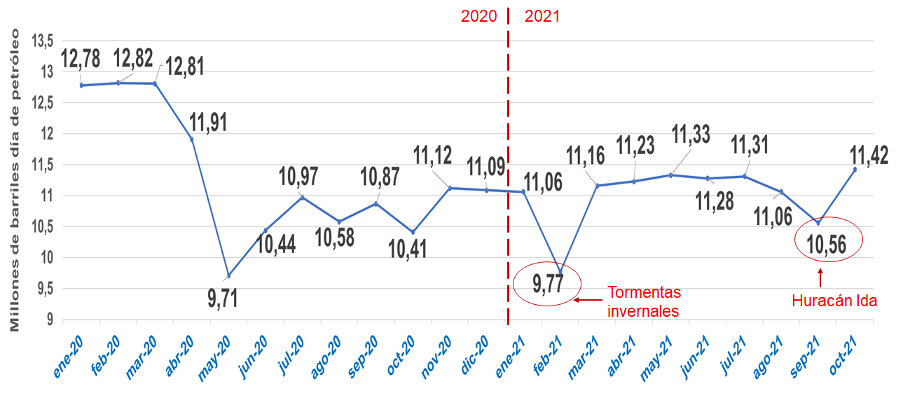

United States

For October, oil production in the U.S. was 11.4 million barrels per day, the largest registered since April 2020. This is a clear indication that oil prices are stimulating the entry of American shale oil, surpassing estimates for 2021 by the Secretary of the Department of Energy (DOE), as well as the estimates of 11.2 million barrels per day, made by the EIA in its monthly report (STEO) of November 9.

The latest weekly report of the EIA, published on November 10, the U.S. production, at the close of the week of November 5, stood at 11.5 million barrels per day, the highest weekly record since May 2020. The EIA projects oil production in the U.S. of 11.4 million barrels per day and 11.6 million barrels per day for November and December, respectively.

The United States remains the world’s largest oil producer, producing 1.5 and 1.7 million barrels per day, respectively, above Russia and Saudi Arabia. In November 2019, North American production peaked at 13 million barrels per day, remaining at 12.8 million barrels per day during the first quarter of 2020, well above its closest producers: Russia and Saudi Arabia.

The U.S. has achieved its energy self-sufficiency, becoming a net exporter of energy. A strategic advantage over China, Asian economies and Europe, who constitute their economic competitors. This happens, even though Joe Biden came to the White House with a Green Economy proposal and the expectation of reducing hydrocarbon production and turning to renewable energy production.

However, the geopolitical reality and the need to recover its economy and stay above the Chinese economy have generated a dual position in the White House. On the one hand, political efforts are accompanied, and the commitment to climate change, the goals of the Paris Agreement and the need for the energy transition are proclaimed. On the other hand, it has not done or will do anything to contain the increase in American Shale Oil production since the energy vulnerability of China or Europe cannot be allowed.

High oil prices and OPEC’s stance of restricting production in the face of unsatisfied demand has stimulated shale oil production. Some analysts predicted that it had come to an end, given the severe financial problems and massive bankruptcy suffered by the sector during the collapse of prices in 2020.

Shale oil production has been recovering, as prices have recovered, since July 2020. There had been no increase in their volumes since fracking was a business highly dependent on the financing of hedge funds. Operators had concentrated on paying debts and dividends to shareholders and conducting a merger process between the operating companies. But starting in September, given a prospect of stable prices, above $80 a barrel, U.S. production has been increasing. This increase is reflected only in October. During September, severe environmental phenomena, such as Hurricane Ida, forced them to paralyse operations in the Gulf of Mexico.

The high oil prices underpin and give economic viability to North American shale oil producers and the development of major projects, such as the Russian Vostok in the Arctic.

U.S. OIL PRODUCTION *

(January 2020 — October 2021)

Source: Own development with data from STEO of November 9 2021, from the U.S. Energy Information Administration. (EIA).

INTERNATIONAL POLICY

COP26 World Leaders: pressure to reduce fossil energy consumption and production

From October 31 to November 2, the COP26 Global Leaders Summit (XXVIth United Nations Climate Change Conference) was held in Glasgow (Scotland, United Kingdom). It was attended by the heads of state and government of the world’s most important economies. However, key countries such as Russia, China, India, and Saudi Arabia were absent, reflecting the profound differences beyond the discourses between the big producers and consumers regarding the issue of energy.

COP26 came after the end of the G20 Summit in Rome, where leaders of countries that account for more than 80 % of world GDP, 75 % of trade and 60 % of the world’s population (which also account for three-quarters of the world’s total greenhouse gas (GHG) emissions), were unable to reach any concrete agreement on climate change. They could only agree on the need to limit the planet’s temperature increase to 1.5 degrees, without a clear horizon: «for or around the middle of the century», without setting a specific date.

The summit highlighted the divisions between developed countries, with the most significant historical responsibilities for GHG production, and emerging economies led by China, whose emissions are increasing as their economies grow.

While the United States, the United Kingdom and the European Union have set 2050 as the target date for net-zero emissions, China, Russia, and Saudi Arabia point to 2060.

The final statements and the interventions of the U.S. President, the President of the International Monetary Fund and the presidents of European countries call for the divestment of fossil energies and a «fast» Energy Transition to «renewable energy», an «energy decarbonisation», to reduce carbon emissions. To fulfil these objectives, they aim to reduce the consumption of fossil energies, seeking a change in the global energy matrix, where fossil energies are left behind.

Since the various interventions at COP26, fossil energy was identified as the cause of climate change, indirectly holding oil and gas producing countries accountable.

The leaders of the US, Germany, France, the U.K., South Korea and Japan — major energy consumers — amid the economic plan they offer to achieve the reduction of carbon emissions, pointed to the production of fossil energies as the one responsible for the carbonisation of the environment, promoting their divestment.

Data published by British Petroleum shows that in 2019, of the 22 countries that belong to OPEC+, only Russia (4.5 %), Saudi Arabia (1.7 %) and Iran (2 %) are among the ten countries with the highest carbon (CO2) emissions in the world in 2019 (before the pandemic in 2020). Together with the other 19 countries in the group, they emitted less CO2 than the U.S. (14.5 %). OPEC’s 13 oil-producing countries accounted for less than 8 % of global CO2 emissions. In contrast, Norway, the other major global producer, emitted only 0.1 %.

The same publication reported that the US, France, Germany, South Korea and Japan are responsible for 27 % of global carbon emissions, 3.5 times more than oil-producing countries and twice as much as OPEC+ countries. The world’s largest CO2 emitter, with 28.8 % of the global, is China.

ECONOMY

As forecasted by the various multilateral organisations and specialised agencies, the world economy continues to recover. More significant growth is expected for the third quarter of 2021, despite the increased uncertainty caused by disruptions in supply chains, the rise in energy prices – gas and coal – in Asia and Europe, the increase in inflation and the new variants or fourth wave of COVID-19.

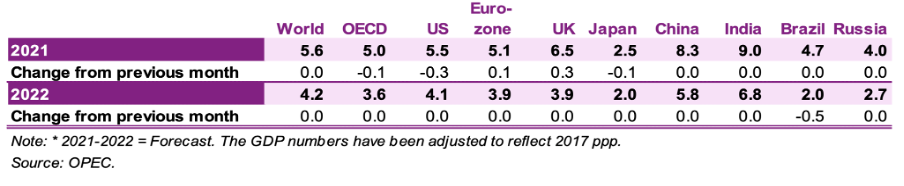

According to the latest OPEC report, with some changes in the previous forecasts of the various key economies, global economic growth remains unchanged at 5.6 % for 2021 and 4.2 % for 2022.

ECONOMIC GROWTH FORECASTS (2021-2022)

The International Monetary Fund (IMF) in its World Economy Outlook, published on October 12, forecasts a greater increase in the world economy, with 5.9 % in 2021 and 4.9 % in 2022.

However, bottlenecks in supply chains and rising energy prices in China, Asia, and Europe have reduced the pace of the expected economic recovery.

The most emblematic case was China, where rising gas prices and fuel shortages for the electricity and industrial sector, coupled with problems in the semiconductor supply chain and the crisis in its real estate market, led to a growth of 4.9 %, compared to 5.2 % expected in the third quarter. The government, therefore, authorised the energy importers to obtain supplies for the economy at any cost. They also authorised to maximise local coal production and import from Australia, suspended following geopolitical problems in the South China Sea.

The Asian giant has had to pause its targets for reducing carbon emissions and advance on around thirty coal-based thermoelectric plant projects in at least 15 countries worldwide because they estimate that the gas supply deficit will affect its growth.

A slowdown in China could lead to a downward revision of growth forecasts within the Asian region and in the global economy. For now, the projection of 8.3 % for 2021 is maintained.

For the United States, the economy is also revised slightly downwards to 6.0 % (-0.3 %). By contrast, euro area economic growth is revised upwards to 5 % (+ 0.3 %), following a strong rebound in the second quarter of 2021, due to the reduction of restrictions on movement and the reactivation of productive activity. The rise in energy prices experienced in Europe in recent weeks may be internalised by the next quarter.

For both the United States and Europe, inflation has become an element of attention due to the massive injections of money for the reactivation of their domestic economies and the increase in prices, a product of restrictions in supply chains and rising energy costs.

In the case of the U.S., inflationary levels above 6 % were reached, the highest level in 30 years, which has provoked all kinds of speculation regarding the performance of the American economy beyond 2022, even though the Federal Reserve assures that this phenomenon will be transitory.

To control the inflationary phenomenon, the White House administration announced the release of volumes of its strategic reserves. At the same time, President Biden has openly called on OPEC and Saudi Arabia to increase oil production to lower the price and reduce the cost of fuels, which has become an element of inflationary pressure in his country.

As for Europe, the European Economic Commission forecasts rising inflation levels, with an average of 2.2 % for 2021 and 1.6 % for next year, 2022. This is the fundamental reason why the European Union has taken a set of measures and opened talks with Russia to increase supply and reduce the gas price, curb the inflationary phenomenon, and sustain the recovery of its economy.

For India, they remain at 9 % for 2021. On the other hand, the IMF maintained its growth forecast for India by 2022 and 2023 at 9.5 per cent and 8.5 per cent, respectively, keeping it the fastest-growing economy in the world.

OIL DEMAND

Despite uncertainties regarding the recovery targets of the world economy, the various agencies and specialised agencies, EIA and OPEC, adjusted their estimates of global oil demand, projecting an annual increase of between 5.12 and 5.65 million barrels per day, respectively, in 2021, to stand at 97.54 (+ 0.1) and 96.44 (- 0.13) MMDB.

However, oil price levels above $80 per barrel and drainage of inventories indicate that growth in demand is not being accompanied by oil supply. The same has happened with the increase in gas and coal prices, given the increased demand in China, Asia, and Europe as a result of the economic recovery.

Demand for oil and fuel is expected to continue to increase, not only because of increased industrial activity, trade and transport due to the lifting of mobility restrictions but by the winter season in the northern hemisphere. Asian and European countries are making forecasts to face the effects of energy costs during the winter.

According to OPEC, by 2022, global oil demand growth stood at 4.2 million barrels per day, with total global demand reaching 100.6 million barrels per day.

The central premise of OPEC for its oil demand estimates as of 2022 remains to maintain economic recovery dynamics in major consuming countries and achieve better management of the pandemic in developing countries that still face domestic immunisation problems.

OIL STORAGE

The market trend towards inventory drainage continues in 2021 until reaching the average values of the five years that preceded the market collapse in 2020.

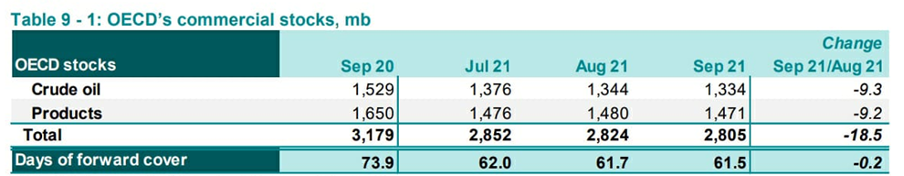

OECD countries

In OECD countries, inventory levels are below the record levels reached in 2020 and the average in 2015-2019, higher than the increase in the storage of oil products in the same period.

According to the November MOMR, OECD countries’ trade inventories of crude oil and products adjusted their data to 2,805 million barrels in September, falling by 374 million barrels compared to the same period in 2020 and 163 million barrels below the 2015-2019 average.

Inventory coverage days for September were 61.5 days, 12.4 days lower than in September 2020.

CRUDE OIL INVENTORIES OECD COUNTRIES

(September 2020 — September 2021)

In its latest monthly report, the EIA estimated at 2.784 million barrels the total inventories of crude oil and oil products in the OECD countries for October, a monthly drop of 1.3 million barrels after having had a monthly drop of 22.7 million barrels in September.

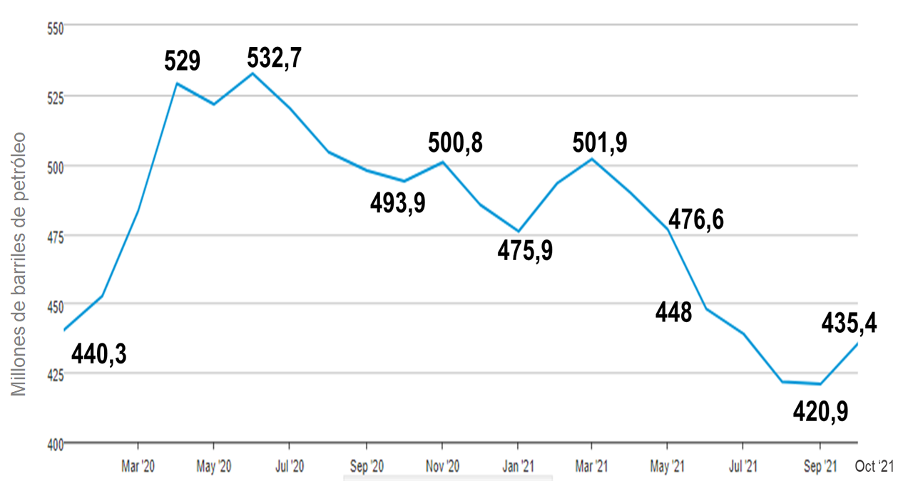

United States

The commercial inventories of crude oil for October are located at 435,104 million barrels as of November 5, according to data from the latest weekly report of the EIA, showing an annual decrease of 53.6 million barrels of crude.

This recovery responds to the U.S. decision to take advantage of its production recovery (above 11 million barrels per day in the month) to increase its commercial crude inventories. They also used their strategic oil reserves to avoid the price increase and cover the domestic fuel demand. In this way, they counteracted the effects on the price of WTI given the decision of OPEC not to increase its production quota above 400 thousand barrels per day.

Between January and October 2021, U.S. trade inventories have fallen 50 million barrels, projecting a drop of 54 million barrels in 2021.

COMMERCIAL INVENTORIES OF CRUDE OIL IN THE U.S.

(January 2020-November 5th 2021)

The trend of crude oil inventories in the U.S. in 2021 continues to be estimated downwards, adjusting the projection for the end of the year to remain at 431.8 million barrels, 1 million more than the forecast estimated in October.

By November 5, coverage days rose to 28.8 days a week, when they were on 27.6 on October 1. Between the end of February and March 19 2021, coverage days were above 40 days, recording the historical record of 41.8 days on March 12.

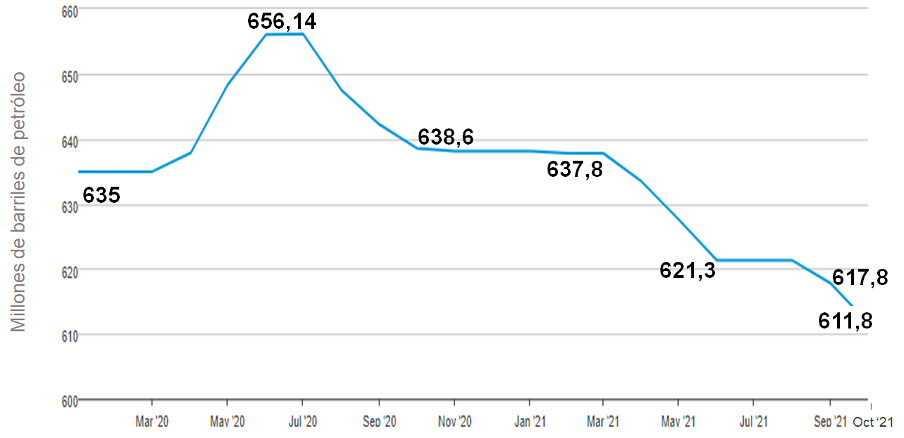

For its part, by November 5, strategic reserves were located at 609.4 million barrels of oil, with weekly drainage of 3.14 million barrels, while they have been used since September 10. Between October 1 and November 5, strategic crude oil reserves have fallen 8.4 million barrels.

STRATEGIC RESERVES

OF U.S. OIL

(May 2020– October 2021)

VENEZUELA

The Venezuelan oil industry continues to show obvious signs of a structural collapse in all sectors that comprise it: oil production, gas production, refining and exports; depriving the Venezuelan economy of its primary economic income, sinking the country into a deep economic, political, social and humanitarian crisis of catastrophic dimensions.

Unable to articulate a plan for the recovery of the oil industry, after seven years of internal persecution, imprisonment of its workers and diversion of PDVSA’s resources, the government proclaims that «it has surpassed the oil rentier model», apparently relinquishing any attempt to recover the productive capacities of the decimated national company: Oil of Venezuela.

This announcement by Maduro to abandon the oil sector comes after repeated failures of his successive boards at the head of PDVSA and the failure to comply with the repeated promises of the President and his minister to recover the levels of oil production of the country, as well as the productive capacities of the national refiner park.

Although Venezuela has the largest oil reserves on the planet (316,000 million barrels, certified in 2007 during the Chávez government), it is an opportunist capitulation of the government to use the national company, ceding its management to national and international private capitals, to which it has repeatedly invited to take over the national oil sector, creating for such purpose the very opaque and unconstitutional «Anti-blockade Law».

Nicolas Maduro’s statements and his resignation from the sovereign management of the Venezuelans’ main resource demonstrate what we have said repeatedly: the problem of the collapse of the oil industry does not have its origin in any technical aspect, but turns out to be an eminently political problem and the inability of the government to manage and manage the national economy.

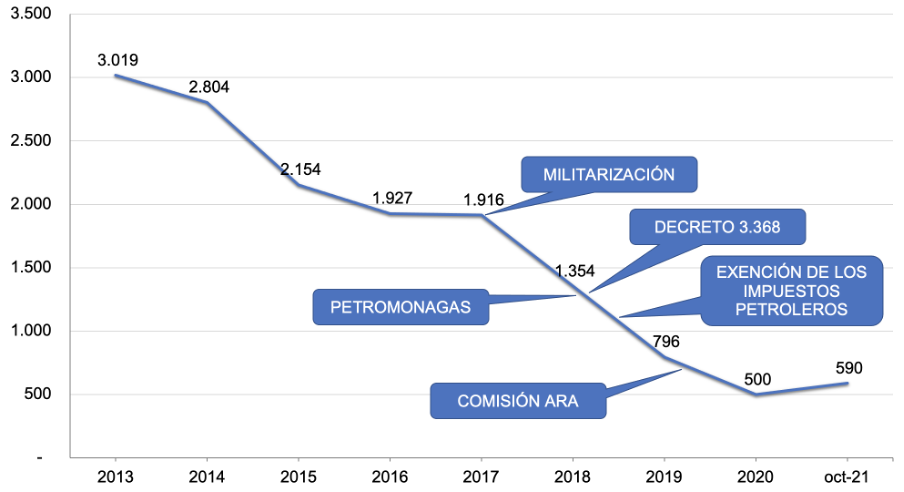

Oil production

The latest OPEC Market Monitoring Report places Venezuelan oil production at 590 thousand barrels per day for October, an increase of 10 % over September.

OIL PRODUCTION OF VENEZUELA

(October 2021)

This increase is due to the export of crude oil mixed with naphtha and condensates, which have been supplied to the country from the Islamic Republic of Iran in an unspecified quantity.

This indicates that the 10 % increase reflected in Venezuelan production, corresponding to October, would have to subtract the volume of condensates and naphthas imported by the country to mix with our heavy crude oil and thus export it.

Under normal operating conditions, condensate and naphtha used to produce heavy crude oil from the Orinoco Petroleum Belt are extracted from the improvers. That volume is re-used to produce more volumes of heavy crudes. But, when breeders are not working, or are not at total capacity, as is the current situation, there is no way to separate naphtha and condensates, so it should be sold as a mixture at a price below the market price.

What the buyers do is that this mixture, which does not meet the commercial conditions of the Venezuelan domestic market known as DCOM, is bought to separate the heavy component from the light component. Likewise, in other markets, such as the Asian market, there are hunters of «special offers», who buy crude oil out of specification, with discounts of 40 and 50% of the price, change its name to bitumen and use it to burn in the industrial sector or to generate low-quality products.

Beyond these technical and commercial devices, the reality is that the oil production in Venezuela remains stagnant at the levels of production that the country had in the 1930s, that is, a 90-year decline in our productive capacities.

Venezuela’s fall in oil production has no record in any oil country, which has not been subject to invasions or armed conflicts. Between 2014 and 2021, the country’s oil production went from 3.015 million barrels per day at the end of December 2013 to the current level of 590 thousand barrels per day. That is, we lost 2.4 million barrels per day, an 80.4 % drop in our productive capacity.

OIL PRODUCTION OF VENEZUELA

(2013 — October 2021)

That difference, 2.425 million barrels day lost due to the inability of the government to manage the oil industry and the internal persecution of its workers, which has led to the imprisonment and exile of hundreds of them, as well as the departure from the country of 30,000 workers specialised in the oil sector, are equivalent to the current prices of our reference crude, WTI, to 62 billion dollars of annual oil revenues, of which the country has been irresponsibly deprived.

The failure of the government in the management of PDVSA and the oil business is more evident even when the President himself has announced, repeatedly, since 2017, after he attacked the oil workers and militarised the company, that the country would increase its oil production, repeatedly failing to comply with its word.

In 2017, he promised with his Minister of Petroleum and President of PDVSA, General Manuel Quevedo, that the country’s oil production, which was then 1.8 million barrels per day, would increase in one year by 2 million barrels of oil per day. Not only did it not keep its promise, but by 2018 Venezuelan oil production had fallen 38 % below the level of 2017.

The same happened in 2020, when, after a year of activities of the failed PDVSA Presidential Intervention Commission, installed in February of that year, the President of the Republic and his Minister of Petroleum, Tareck El Aissami, promised that by the end of 2021, oil production would be at 1.5 million barrels day. They still lied.

According to October reports, Venezuelan production stands at 590 thousand barrels of oil per day, 60.7 % below the target announced by these officials at the beginning of the year.

A similar situation is observed in the national refining system. Since 2017, due to the mismanagement, lack of maintenance, and the persecution of the best managers and workers, our refineries have operated far below their installed processing capacity of 1.2 million barrels per day. The above has forced the Venezuelan population to a prolonged shortage of essential fuels for the life and daily activity of the population, such as gasoline, diesel and gas.

Faced with this situation, and after repeated failures and accidents that the government has attributed to terrorist attacks of all kinds, including missile attacks, the oil minister promised, in a propaganda effort with an international agency, that the supply of fuels to the domestic market will be regularised in the country, clearly stating that by July «the queues at the filling stations would end.» Not only did they blatantly lie to the country, but the government, taking advantage of the latest official devaluation of the currency, increased the fuel price at the international level in a country where the monthly minimum wage equals 1.5 dollars a month.

Guyana: its development as an oil province continues

While the national government has been unable to manage our oil industry and exploit the world’s largest oil reserves, the oil transnationals continue to advance in the territorial sea of Essequibo territory in their plans to turn Guyana into an influential oil province.

With plans advancing in Venezuela’s claimed territory, its government remains silent and inactive.

On October 20, the President of Guyana, Irfaan Ali, amid his first official visit to the United Arab Emirates (UAE), was in the Port of Khalifa, where he met with Abu Dhabi Ports President Mohamed Juma Al Shamisi, signing an agreement for the UAE to mount a logistics centre with a deep-water port in Guyana so that the Emirates can connect commercially with the rest of the American continent and West Africa, reported the presidential press department of Guyana.

The Guyanese President made it clear that his government will «offer» UAE all the facilities and incentives to make investments «feasible» for both sides, offering not only oil and gas but the «unexplored freshwater» found in CARICOM’s countries. In the negotiations, he even proposed a connection between the «regional gas transport corridor» between Brazil, Suriname, French Guiana and Guyana, with the logistics centre that UAE wants to set up in Guyanese territory. In President Ali’s own words, the UAE agreement «is connected to opportunities in Brazil’s oil and gas sectors.»

Then, at a press conference held in Dubai, the Guyanese President offered his country’s energy resources as the lowest-cost in the region, «the perfect combination» with renewable energies.

Before the start of the official visit to the UAE, the Director General of the Office for Investment of the Government of Guyana, Peter Ramsaroop, reported that «the decision is taken» for Dubai to build a 220 km pipeline for the transport of gas produced in the Liza field in phases 1 and 2.

Similarly, Guyanese authorities reported that they are making progress in negotiations with the United Arab Emirates to construct a 220-kilometre-long pipeline, which will begin in 2022. The purpose of this project is to replace the outdated existing infrastructure for electricity supply whose energy source is fuel oil and to take advantage of the large gas reserves associated with the oil fields.

With the interest of the oil transnationals, mainly North American, Guyana has been carrying out oil exploration and exploitation activities in offshore deposits in territorial waters in the disputed area of Essequibo territory in recent years, so that part of that wealth could be part of Venezuela.

Bibliographic References

- [1] 22nd OPEC and non-OPEC Ministerial Meeting concludes, OPEP, 04 de noviembre 2021.

- [2] 19th OPEC and non-OPEC Ministerial Meeting concludes, OPEP, primero de septiembre 2021.

- [3] Joe Biden, “Remarks by President Biden in Press Conference, La Casa Blanca, 04 de noviembre 2021.

- [4] Declaración, “STATEMENT ON INTERNATIONAL PUBLIC SUPPORT FOR THE CLEAN ENERGY TRANSITION, COP26, 04 de noviembre 2021.

- [5] Chandelis Duster, “Americans should expect to pay higher heating costs this winter, Granholm says, CNN, 07 de noviembre 2021.

- [6] Vladimir Isachenkov, “Europe gas prices drop on Putin’s order to fill EU storages”, AP News, 28 de octubre 2021.

- [7] Gazprom, “Twitter”, 09 de noviembre 2021.

- [8] Hassan Balfakeih, “Monthly Oil Market Report October 2021”, OPEP, 11 de noviembre 2021.

- [9] Redacción, “Iran: Nuclear talks with world powers to resume on November 29, Al Jazeera, 03 de noviembre 2021.

- [10] Ned Price, “Department Press Briefing, Departamento de Estado EE.UU., 03 de noviembre 2021.

- [11] “Short-Term Energy Ooutlook Data Browser”, Administración de Información Energética de EE.UU. (EIA), 09 de noviembre 2021.

- [12] “Weekly Supply Estimates”, Administración de Información Energética de EE.UU. (EIA), 10 de noviembre 2021.

- [13] Prensa, “Rosneft Sells 5% in Vostok Oil to a Consortium of Vitol and MME”, Rosneft, 14 de octubre 2021.

- [14] G20 Rome Leaders’ Declaration”, G-20, 31 de octubre 2021.

- [15] “Statistical Review of World Energy 2021, British Petroleum BP, julio 2021.

- [16] Redacción, “China tiene planes para construir más de una treintena de plantas de carbón pese a la promesa de Xi Jinping, El Economista, 27 de octubre 2021.

- [17] “Maduro: «Ha nacido un nuevo modelo económico, Venezuela no dependerá más del petróleo», Aporrea, 11 de noviembre 2021.

- [18] Nota de Prensa, “Gov’t wants to create new UAE logistics hub in Guyana -President Ali, Departamento de Prensa del Gobierno de Guyana, 20 de octubre 2021.

- [19] Nota de Prensa, “Lowest energy rate in the region will see multiple sectors flourishing in Guyana – President Ali, Oil Now 20 de octubre 2021.

- [20] Redacción, “Oil-Rich Guyana eyes 135-mile undersea gas pipeline – says Go-Invest Head, News Room Guyana, 20 de octubre 2021.