INDEX

The 20th OPEC+ Ministerial was held on September 1st, ratifying what was agreed at the 19th Meeting, held last July 18th. There will be a monthly increase of 400 thousand barrels per day between August and December 2021, until September 2022, when the 5.8 million barrels per day cut in OPEC+ oil production will be eliminated. This cut comes from the agreed 9.7 million barrels per day of oil, in force since May 2020.

The group noted that «while the effects of the COVID-19 pandemic continue to create some uncertainty, market fundamentals have strengthened, and OECD inventories continue to fall as the (market) recovery accelerates.»

Although the brief OPEC+ meeting confirming its policy of flexible cuts was a reassuring factor for the market, due to the availability of sufficient oil supply, there is a certain degree of uncertainty regarding the fulfillment of the initial estimates of annual recovery of 5.95 million barrels per day in world oil demand in 2021, with emphasis on the second half of the year. Thus, demand would reach 98.23 and 99.82 million barrels per day for the third and fourth quarters of the year, respectively, according to the estimate made by OPEC, due to the effects on the recovery of the world economy caused by the «fourth wave» of COVID-19 and its Delta variant.

In this sense, both the International Energy Agency (IEA), in its Monthly Report of August 12th and the Energy Information Administration (EIA) -in its Short-Term Energy Outlook (STEO) of August 10th-, place the annual recovery of world oil demand at 650 thousand barrels per day below the forecast published by OPEC in its Monthly Oil Market Report (MOMR) of August 15th.

A lower than expected demand and the relaxation of the production cuts ratified by OPEC+ and the increasing production of the Non-OPEC countries that don’t participate in the cuts could place the market in 2022, once again, in the scenario of an oversupply that would affect oil prices.

For this reason, there was an expectation of a possible reconsideration, within OPEC+, of the production increase agreement reached last July 18th, after the considerations made by the IEA in its Monthly Report, where they stated that «the immediate OPEC+ momentum is colliding with slower demand growth and higher production from outside the alliance,» where the new restrictions to mobility generated by the COVID-19 Delta variable in the world «could derail the recovery of demand, just when more barrels are reaching the market.»

A similar concern was expressed by the Kuwaiti Oil Minister, Mohammad Abdulatif al-Fares, who, in declarations made on August 29th to Reuters -before the 20th Ministerial Meeting-, said that the markets «are slowing down» due to the fourth wave of contagions in several countries, for that reason, in OPEC+, «we must be careful and reconsider this increase,» referring to the agreement to increase production agreed at the Meeting held on July 18th. The Kuwaiti minister considered that «there may be a halt in the 400 thousand barrels per day increase».

Nevertheless, at the 20th Ministerial Meeting, a consensus prevailed – very quickly – to maintain the agreement of the 19th Meeting, despite these concerns and U.S. pressures to further accelerate the easing of production cuts. It did not happen.

PRICE

On September 2nd, markers closed higher due to the 7 million barrel drain in U.S. commercial crude inventories, the weekly drop in U.S. jobless claims, and the 0.3% loss in the dollar’s value against the euro on September 1st. At the close of European markets, the Intercontinental Exchange Futures Europe (ICE Futures Europe) quoted Brent at $73.44 a barrel. In contrast, the New York Mercantile Exchange (NYMEX) closed with WTI at $69.99 a barrel.

The current Brent and WTI quotations represent an annual increase of 65.3% and 68.6%, respectively, and of 25.2% and 28% to 2019 quotations, a clear indication of the recovery of the oil market, despite the permanent uncertainty regarding the performance of the international economy due to the COVID-19 pandemic.

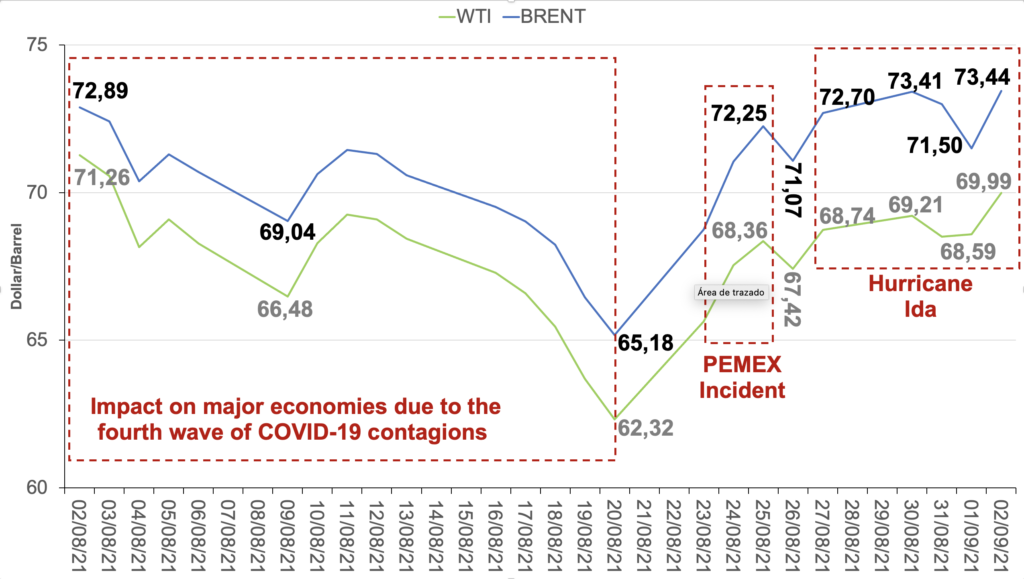

Price chart for the month of August-02 September

During August, the oil market was influenced by different situations ranging from the affectation of large economies -due to the «fourth wave» of COVID-19 contagions and its «Delta» variant-, the accident in the E-KU A2 oil platform of the Mexican state-owned company PEMEX and the effects of Hurricane Ida in the Gulf of Mexico, contributing all to place oil price in a range between 62 and 73 dollars per barrel.

The oil price markers in August were influenced by the 0.9 point drop of the PMI index in the manufacturing industry in China in July and August; as well as, by the monthly increase, in August, of 0.5% in inflation in the U.S. and increases in the CPI for oil, gas, and fuel in both the Asian and North American countries, which slowed down the economies of both countries, affected by the new restrictions on mobility due to the spread of the Delta variant of COVID-19 in China, the USA, several Asian countries (including Japan), Oceania and the Middle East.

Between August 2 and 20, Brent fell from US$72.89 to US$65.18 per barrel, while WTI fell from US$71.26 to US$62.32 per barrel, its lowest values in the month, showing a 10% and 12.5% drop, respectively. The U.S. benchmark crude oil has traded below 70 dollars since August 4th and during the month.

However, the markers were able to recover 12% (Brent) and 9.9% (WTI) between August 23 and 31, reaching their highest value for the month on August 30th, when Brent traded at US$73.41 per barrel, while WTI traded at US$69.21 per barrel.

This rebound was due to the damage caused by Hurricane Ida as it passed through the Gulf of Mexico. The contingence forced the evacuation of more than 50% of the platforms and 100% of the drilling rigs, affecting 8.34 million barrels of oil between August 27th and September 1st (an average of 269 thousand barrels per day of U.S. oil production). Since August 29th, more than 2 million barrels per day of processing capacity in refineries located in the state of Louisiana, which represents 13% of the refining capacity on U.S. soil, was also affected.

Likewise, the accident last August 24th, at the E-KU A2 oil platform of the Mexican state-owned PEMEX, affected 25% (400 thousand barrels per day) of Mexican production (3 million barrels per day), shutting down the operations of 125 oil wells until August 30th and affecting the recovery of oil prices during that period.

OPEC Reference Basket (ORB)

The OPEC reference basket of crude oil (ORB) traded on September 1st at US$71.27 per barrel, a 5% drop to the price on July 30th. Despite this, the ORB quotation was 67.26% above its November 2020 quotation, managing to maintain its upward trend, with values in June and July not seen since October 2018.

DROP IN THE PRICE OF THE OPEP REFERENCE BASKET (ORB).

(August 2nd – September 1st, 2021)

The crude oils that make up the OPEC basket reached, in July, an average quotation of US$73.53 per barrel -the highest since October 2018-, presenting a monthly increase between 1.7% and 4.4% in all its referential components, an average of 2.3% upward, influenced by the increase in the referential prices, due to the increase in demand, mainly in the U.S. and Europe, and to the increase in the oil prices, mainly in the U.S. and Europe. According to OPEC’s MOMR, this was due to the increase in demand, mainly in the U.S. and Europe, the stability of demand in Asia, and the absorption of crude oil volumes by refineries in India.

OIL PRODUCTION

Flexibilization

The agreement reached by OPEC+ last April 1st, at its 15th Ministerial Meeting, allowed for an increase in supplies of 1,291 million barrels per day of oil to the market between May and July 2021, with an easing of 500 thousand barrels per day in May, 350 in June and 441 in July.

Subsequently, the 19th OPEC+ Ministerial Meeting, on July 18th, closed with the decision to increase production by 400 thousand barrels per day monthly, starting in August and until December 2022, with which, by the end of 2021, the market will have an additional 2 million barrels per day, capable of satisfying the expected increase in demand, thus guaranteeing the supply-demand balance.

At the same meeting, OPEC+ agreed that the production cut would be extended beyond May 2022 -as initially agreed in April 2020-, but based on a production of 43,73 million barrels per day, an increase of 1,632 million barrels per day to the output previously taken as a reference, which did not include the production of Iran, Libya or Venezuela.

As we commented in the previous newsletter, this decision has led to a redistribution of production quotas, where Saudi Arabia and Russia will each increase to 11.5 million barrels per day (an increase of 500 thousand barrels per day). In comparison, the UAE managed to increase its production to 3.5 million barrels per day over the previous year, an increment of 332 thousand barrels per day, allowing the Emirates to get closer to its target of 4 million barrels per day set for 2020, within the volumetric policy imposed in the country, amid the privatization process of the Emirati oil sector.

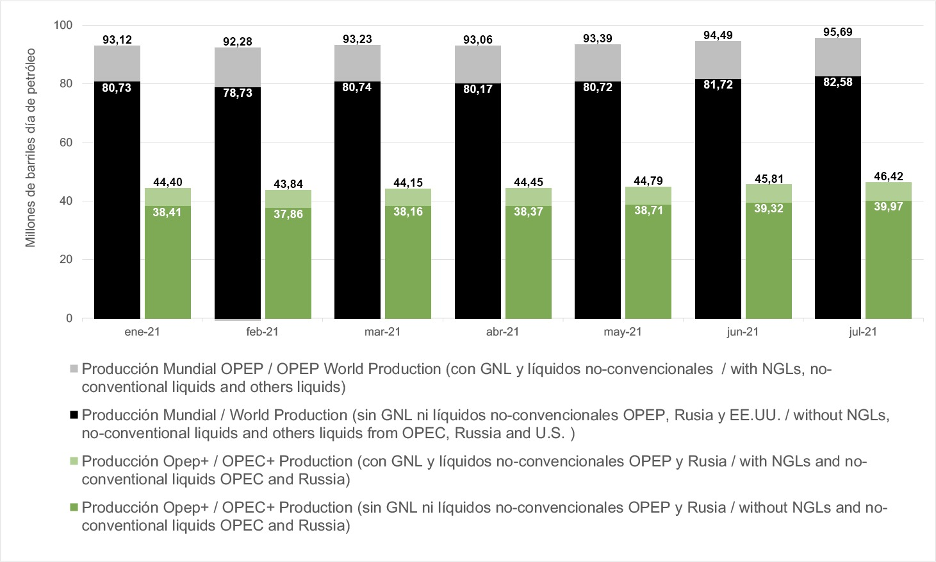

World oil production

Data from OPEC’s Monthly Oil Market Report (MOMR), corresponding to August 12th, places world production of oil, condensates, NGLs, and unconventional liquids at 95.69 million barrels per day for July.

WORLD PRODUCTION

(Crude oil, condensates, NGLs, and unconventional liquids)

(January – July 2021)

Excluding condensates, NGLs, and unconventional liquids, in the U.S., Russia, and OPEC, world oil production stands at 82.58 million barrels per day, according to OPEC data, EIA data for August 10th, and Russian Ministry of Energy data released in July.

OPEC+ production

Of the world oil production of 82.58 million barrels per day, OPEC+ accounted for 39.97 million barrels per day, or 48.4%, of world production.

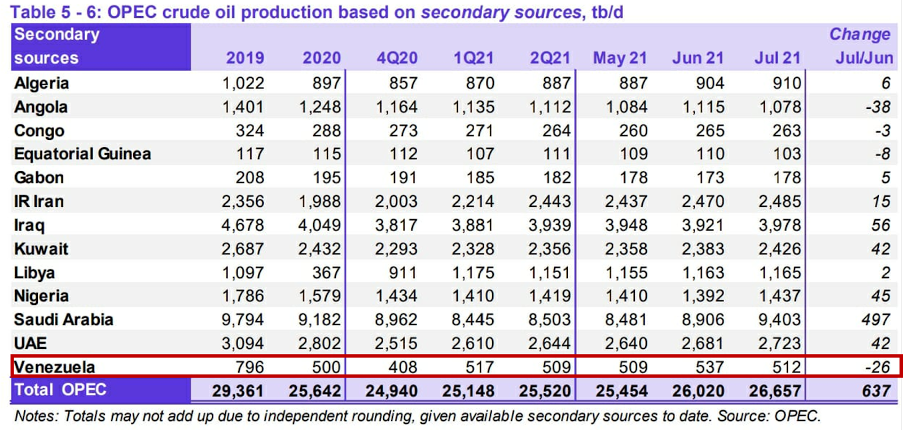

Of OPEC+ production, 26.657 million barrels per day, or 32.28% of world production, corresponds to the production of OPEC countries participating in the cuts. In comparison, 13.31 million barrels per day, or 16.18%, corresponds to Non-OPEC countries participating in OPEC+ agreements.

Production cuts

In compliance with the agreements of the 15th OPEC+ Meeting, in June 2021, 441 thousand barrels per day of oil flexibilization in the group’s cuts came into effect, bringing the total cut to 5.759 million barrels per day. For its part, Saudi Arabia recovered 400 million barrels per day in its July production and ended its additional and voluntary cut of 1 million barrels per day, which is applied between February and April 2021. This cut dropped to 750 thousand barrels per day in May and 400 thousand barrels per day in June until July.

From August onwards, monthly flexibilities will be applied, as agreed on July 18th, so that month’s cut will be 5.36 million barrels per day, 4.96 million barrels per day for September, 4.56 for October million barrels per day, 4.16 million barrels per day for November, and finally, 3.76 million barrels per day for December, closing the year with a decrease of 5.94 million barrels per day concerning the original cut of 9.7 million barrels per day, which started on May 1st, 2020.

Therefore, OPEC+ oil supply for August will stand at 42.85 million barrels per day due to the relaxation of the group’s cuts, while in September, it will be 43.25 million barrels per day.

Compliance

The OPEC+ production cut for June was 6.27 million barrels per day. A compliance of 108.8% over the agreement of 5.76 million barrels per day.

The OPEC countries participating in the production adjustments (Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iraq, Kuwait, Nigeria, Saudi Arabia, and the United Arab Emirates) cut 4,16 million barrels per day, an additional adjustment of 509 thousand barrels per day, of which 216 thousand barrels per day is by Angola. According to the Minister of Natural Resources, Oil and Gas, Diamantino Pedro Azevedo, the African country is experiencing the consequences of not investing more in operations and the production capacity of the state-owned National Fuel Company of Angola (Sonangol). Meanwhile, 142 thousand barrels per day are from the production of Nigeria – which has the same fate as Angola – and another 92 thousand barrels per day from the production of Saudi Arabia. With this, compliance with the OPEC-10 countries’ cut was 113.95%.

On the part of the nine Non-OPEC countries that signed the DoC, the production cut was 2,107 million barrels per day, with an overproduction of 75 thousand barrels per day by Russia, on the one hand, and an additional 74 thousand barrels per day cut in its production by Malaysia, on the other, reaching compliance with the cut of 99.91%.

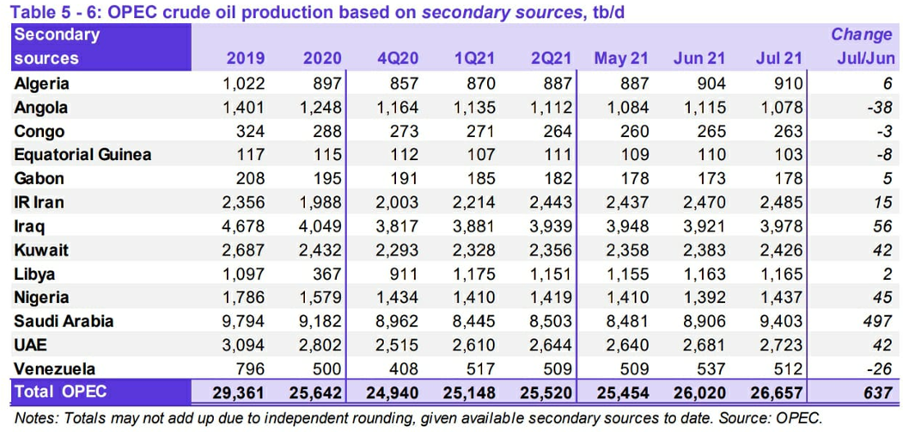

OPEC Production

According to data from OPEC’s MOMR on August 12th, the oil production of member countries as of July was 26,657 million barrels per day – its highest level in 15 months – an increase of 637 million barrels per day to June of this year, both due to the easing of 360 thousand barrels per day corresponding to the month, and the return of 400 thousand barrels per day of the additional and voluntary cut by Saudi Arabia.

PRODUCTION OF OPEP COUNTRIES

(July 2021)

Saudi Arabia, together with the Persian Gulf countries (excluding Iran), United Arab Emirates, Kuwait and Iraq, added 18.53 million barrels per day -639 thousand barrels per day more than in June-, corresponding mainly to Saudi production, and representing 69.53% of OPEC production, 46.34% of OPEC+ and 22.44% of world oil production.

Nigeria and the rest of the African countries (excluding Libya), Angola, Algeria, Congo, Gabon, and Equatorial Guinea, presented a production of 3.969 million barrels per day -showing 10 thousand barrels per day more than the previous month-, which represents 14.89% of OPEC production, 9.93% of OPEC+ production and 4.81% of world production.

On the other hand, Iran, Libya, and Venezuela, the three OPEC countries exempt from production cuts, presented a combined production of 4,162 million barrels per day, of which 2,485 million barrels per day (59.71%) corresponds to Iran, equivalent to 9.32% of OPEC production and 3.01% of world oil supply. Libya produced 1,165 million barrels per day (4.37% OPEC and 1.41% world) and Venezuela 512 thousand barrels of oil per day (1.92% OPEC and 0.62% world).

These results indicate that Venezuela, having less than 2% of the group’s production, ceded to the Organization part of its 11% production quota (3.1 million barrels per day) within OPEC production, which was assigned to them in 1982 as a founding member of the group. Most likely, the 9.1% of the group’s production (2.6 million barrels per day) that Venezuela is giving up will be taken from the additional quota assigned to the UAE during the group’s de facto redistribution of production quotas among member countries.

Russia

According to the Ministry of Energy of the Russian Federation, the country’s oil production in July -without condensates and NGLs- stood at 9.57 million barrels per day, 40 thousand barrels per day more than in June, but still with an overproduction of 74 thousand barrels per day regarding their agreed quota in the OPEC+ cuts. This situation has been a constant since the third quarter of last year.

Russian oil production has seen an annual increase of 950 thousand barrels per day, up 12.05% from its production levels 12 months ago, thanks to OPEC+’s policy of easing cuts. However, it still sits 930 thousand barrels per day – 8.85% – below its January 2020 record production levels of 10.5 million barrels per day before COVID-19.

RUSSIA’S OIL PRODUCTION

-without LNG and condensates-

(July 2021)

United States

The U.S. oil production remains stable at around 11.10 million barrels per day since November 2020 -except in February 2021, due to the impact of winter storms-, with slight increases since May, presenting a record of 11.32 million barrels per day in June, with a projection for August varying 100 thousand barrels per day downward, as reported by the EIA on August 10th.

U.S. OIL PRODUCTION.

-Without condensates, NGLs, and unconventional liquids-

(January 2020 – July 2021)

On August 27th, before Hurricane Ida hit the Gulf of Mexico, production had a slight increase over the volumes recorded in 2021 -except for those of February-, presenting a production of 11.5 million barrels per day, the highest recorded since May 15th, 2020, according to the weekly report of the EIA of September 1st.

Then, the passage of Hurricane Ida affected U.S. production by 8.34 million barrels of oil between August 27th and September 1st, an average of 269 thousand barrels per day (thousand barrels per day) of U.S. oil production.

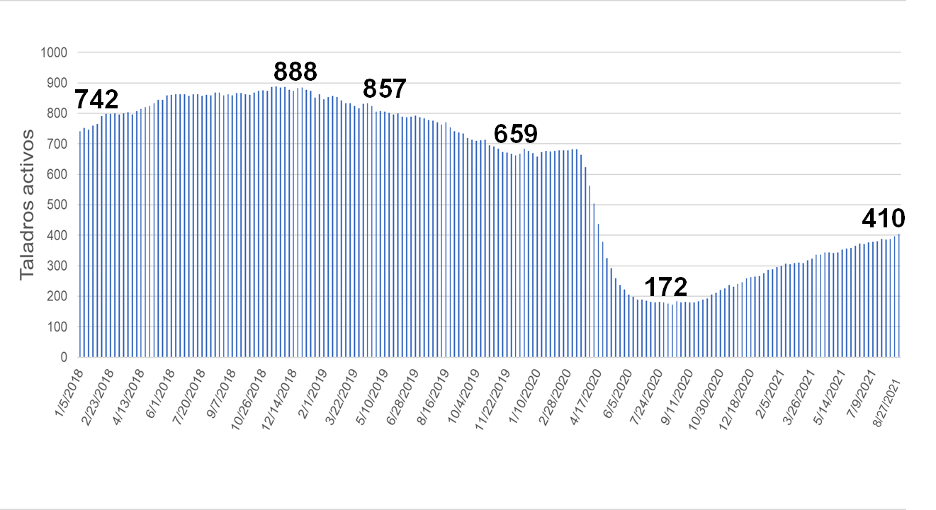

Drilling Activity

The number of active drills registered in the U.S. as of August 27th was 410 -twenty-five more than on July 30th-, and 230 more than a year ago, maintaining the upward trend it has been showing since the fourth quarter of 2020, according to data published by Baker Hughes. This is the highest activity record since the OPEC+ production cut began in May of last year.

ACTIVE DRILLS IN THE US.

(January 2018 – August 27th, 2021)

INTERNATIONAL POLICY

Iran-U.S.: Awaiting the resumption of negotiations in Vienna

On August 8th, Seyyed Ebrahim Raisi was sworn in as the new president of the Islamic Republic of Iran. The return of the hard-wing of the conservatives, after eight years of a reformist government. Several Iranian official speakers before the inauguration assured that the new president will not modify the progress and results of the indirect negotiations between Iran and the U.S., within the framework of the Joint Commission of the Joint Comprehensive Plan of Action (JCPOA), the Iran nuclear deal approved and signed in July 2015 at the U.N. Security Council.

The President of France, Emmanuel Macron, the Head of Government of the Kingdom of Spain, Pedro Sanchez, as well as other European leaders, communicated with Raisi, greeting him on his presidential inauguration, while expressing their willingness to resume the round of meetings in Vienna and to achieve the return of both parties to the JCPOA.

From Russia, the authorities have expressed their interest in resuming the indirect meetings between the Iranian and U.S. representations. In a telephone conversation on August 27th with his Iranian counterpart, Hosein Amir Abdolahian, Russian Foreign Minister Sergei Lavrov expressed his country’s interest in the «earliest possible resumption» of negotiations in Vienna.

Earlier, on August 17th, the Russian ambassador and representative to international organizations in Vienna, Mikhail Ulyanov, met with his Iranian counterpart, Qazem Qaribabadi, where they «discussed» «prospects for the resumption of the Vienna talks for the resumption of the JCPOA,» according to Ambassador Ulyanov’s own words.

The picture looks complicated, but the U.S. government administration made it clear that, regardless of the opinions that the new Iranian authorities may express, the government of U.S. President Joe Biden will continue to use diplomatic channels to reach an agreement with Iran. During a press conference on August 5th, the Secretary of the Department of State, Ned Price, assured that the Biden administration «has made it very clear that we are willing to return to Vienna to resume negotiations,» but warned that the diplomatic process currently being used by the parties to reach an agreement is not unlimited. «The opportunity to achieve a mutual return to compliance with the JCPOA will not last forever,» Price stressed.

The U.S. government stated that their interest is to «guarantee» their country’s security and, in that sense, the objective of the diplomacy it is conducting to return to the JCPOA is to «ensure in a permanent and verifiable» way, that Iran «does not have access» to a nuclear weapon.

Nevertheless, the Biden administration is likely to harden its negotiating position with Iran in the face of internal difficulties and criticism for the White House and the president himself after the withdrawal of U.S. troops from Afghanistan, which provoked the withdrawal of NATO allies and the rapid fall of the country under the control of the Taliban. The political damage suffered by Biden, especially after the deadly attack at the Kabul airport -attributed to ISIS-K- which left 174 dead, 13 of whom were US Marines, leaves him more exposed to attacks and pressures from the Jewish lobby and the Republicans on the issue of the nuclear deal with Iran.

The U.S. in the face of rising gasoline prices

The latest report presented by the U.S. Bureau of Labor Statistics. (BLS), shows rising inflation in 2021, which stands at 4.1%, where the consumer price index (CPI) for gasoline has risen 25.7 points from January to July of this year, with a cumulative increase of 41.8 points in the last 12 months. Likewise, the CPI for diesel has risen 39.1 points since August 2020, while energy commodities have risen 41.2 points in a year.

Against this backdrop, Joe Biden’s administration has been making a turnaround in its decisions regarding fossil energies, trying to control the price of oil.

On August 11th, the White House declared the intention to intervene in controlling the price of oil to lower its market price, publishing a statement in which it affirms that the production agreement approved by OPEC+, an increase of 400 thousand barrels per day per month in the group’s production until December 2022, is «not sufficient.»

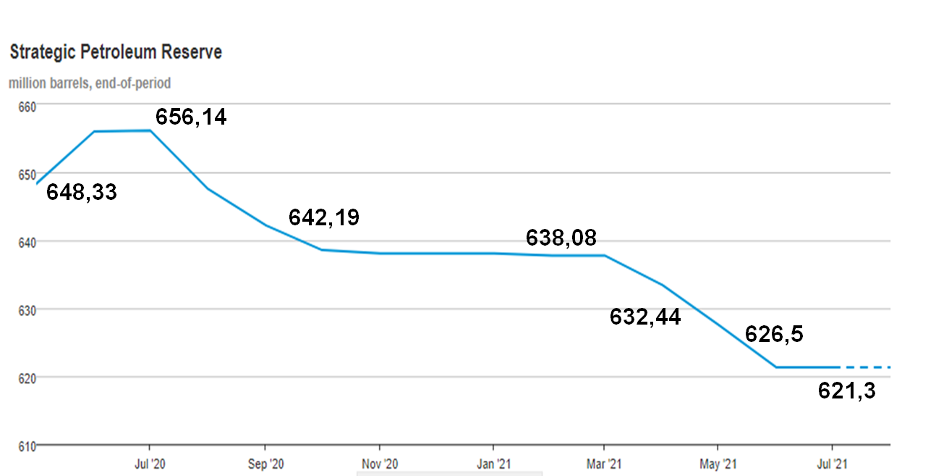

Furthermore, on August 23rd, the U.S. Department of Energy announced the selling of 20 million barrels of its strategic reserves for deliveries between October 1st and December 15th of this year. The above complying with section 403 of the Bipartisan Budget Act of 2015 and section 30204 of the Bipartisan Budget Act of 2018, both of which oblige it to sell a certain amount of U.S. strategic petroleum reserves before the end of each fiscal year.

The U.S. government’s concern has to do with rising fuel prices in the U.S., since, according to the same statement, President Biden «wants Americans to have access to affordable and reliable energy.» Therefore, according to the statement, the U.S. government «will always talk to international partners on issues of importance that affect our economic and national security issues,» addressed to Saudi Arabia in its de facto dominance in OPEC and as president of OPEC+, to increase the volume of production quotas agreed on last July 18th, a request that the organization did not positively address at its last ministerial meeting.

However, such concerns and needs leave open the possibility that the U.S. Government may slow down its «Green New Deal» policy and look more sympathetically on the increase of U.S. oil production, particularly shale oil production, for the second half of the year, given the favorable price and the demand conditions.

ECONOMY

The world economy continues to recover, albeit under uncertainty due to the pandemic and the recent spikes in infections linked mainly to the unvaccinated and the spread of the Delta variant.

Although global growth has improved slightly this month, asymmetries between the two groups of countries remain and are increasing. On the one hand, the more industrialized economies and China have partially contained the pandemic, thanks to greater access to vaccine doses for their population and the financial capacity to implement economic stimulus measures. On the other hand, developing countries with less access to vaccines and scarce financial resources to apply fiscal incentives or grant economic aid.

According to OPEC’s MOMR, the global economic growth forecast for 2021 was revised slightly upward from 5.5% to 5.6%, very much in line with the 5.4% of the United Nations Department of Economic and Social Affairs (UN-DESA) and the 6% proposed by the International Monetary Fund. By 2022, OPEC expects growth of 4.2%.

This is based on the expectation of new fiscal stimulus measures in the United States for the second half of 2021, combined with the current monetary policies in the industrialized economies. Although the growth of the US Gross Domestic Product in the second quarter of the year was lower than expected, leading to a downward revision of the country’s annual GDP growth forecast (from 7.0% to 6.5%), the results of the eurozone were better than expected, helping global results.

However, there are some critical elements of uncertainty. As expected, the evolution of the COVID-19 pandemic will be the main factor influencing the pace of recovery in the short term, with the possible emergence of new variants of the virus posing additional risk.

But on the strictly economic front, the sovereign debt of many countries has risen to levels where a rise in interest rates could lead to severe fiscal stress.

Another factor to consider is the rise in inflation worldwide in recent months, for multiple reasons. The increase is likely to be temporary, as the main factors appear to have been the effects of the reopening in the first half of the year and temporary supply constraints. In the U.S., higher energy and food prices drove the annual price change.

The main scenarios on inflation are unchanged from last month, with OECD economies not exceeding the 2% average, but with the United States at around 4%.

COVID-19

The coronavirus pandemic is far from over, with some countries experiencing new infections in recent weeks. This situation could halt the progress made in production processes in many places, including developed countries.

Industrialized countries, particularly the U.S. and the European Union, have tightened their positions to restrict the transit of people who are not vaccinated and, therefore, lack the respective COVID certificate, especially given the new school term and the return to work after the summer holiday period.

While industrialized countries continue with mass vaccinations, most developing countries still lack the necessary doses. The world is facing an increase in the number of COVID-19 infections and, at the same time, the «Delta» variant, which is more dangerous due to its infectious aggressiveness. The Delta variant is the most resistant to antibodies and has the highest transmission speed, particularly lethal for those not vaccinated.

Worldwide infections and deaths

As of September 2nd, the number of people infected with COVID-19 worldwide exceeds 218 million, while the total number of deaths is 4.54 million.

COUNTRIES MOST AFFECTED BY THE PANDEMIC

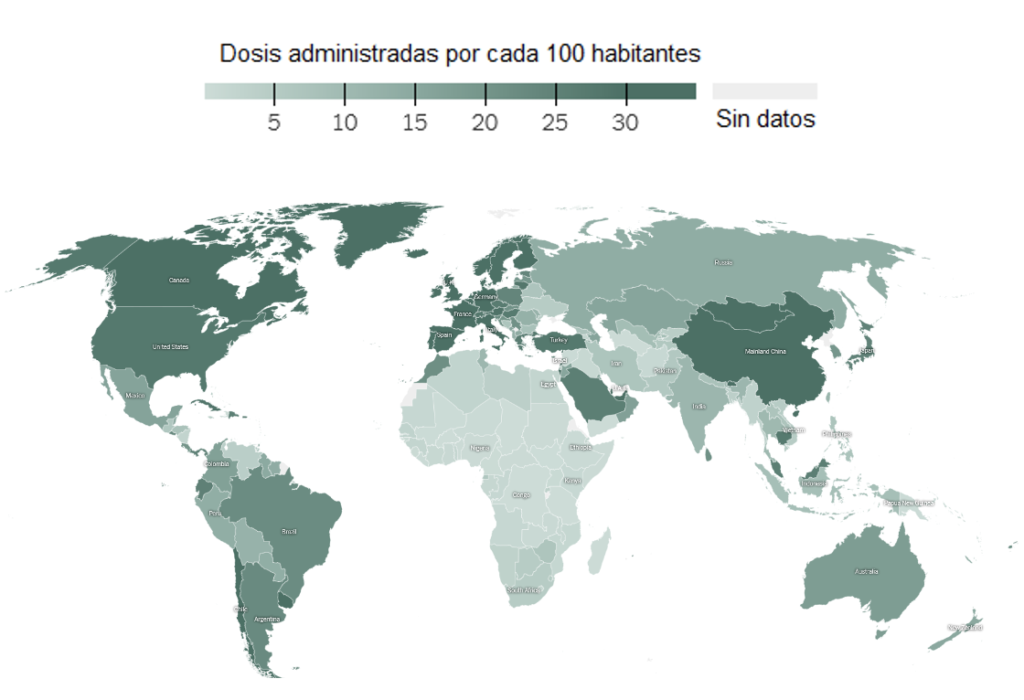

Global Distribution of Vaccines

To date, more than 5.2 million doses have been administered worldwide, equivalent to 67.2 doses per 100 people, nearly double the previous month’s figures. The gap between vaccination programs between developed and developing countries remains, with many of the poorest countries still without even the first dose provided to their citizens.

The countries with the highest performance in mass vaccinations are the United Arab Emirates, with 183 doses per 100 inhabitants (already administering second doses), followed by Malta (158/100) and Uruguay (157/100).

In the northern hemisphere, Canada leads (141/100), followed by Portugal and Belgium, both with 140/100. On the other hand, the Russian Federation still maintains a relatively low level of doses supplied (54/100).

Africa continues to be the region with the fewest vaccinations, with Morocco (86/100), Tunisia (43/100), and Zimbabwe (27/100) standing out, while many countries average less than 5 per 100 inhabitants.

In Asia, the Emirates are followed by China (143/100), Bhutan (136/100), Saudi Arabia (104/100), and Japan (64/100). India is far behind (44/100), maintaining a high number of infections and suffering the consequences of the Delta variant.

In Latin America and the Caribbean, after Uruguay, as mentioned earlier, Chile (149/100) and the Dominican Republic (102/100) lead the ranking. The three most populous countries in the region, Argentina (90/100), Brazil (88/100), and Mexico (65/100), continue to vaccinate, although at a lower rate than required. Venezuela is far behind the rest of the countries, with only 16 vaccinated per 100 inhabitants, with an estimated 10% of the population vaccinated.

OIL DEMAND

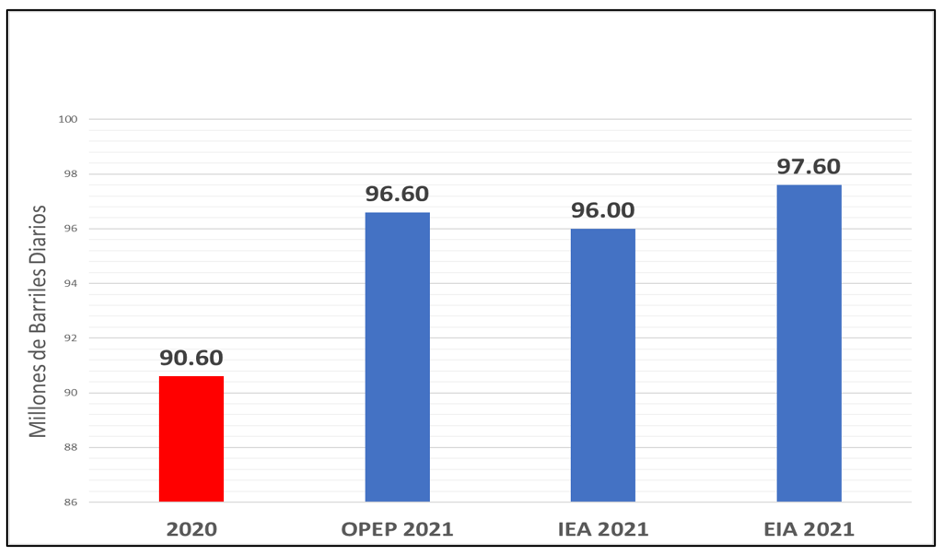

According to the August 2021 MOMR, world oil demand growth in 2021 remains at 5.95 million barrels per day, unchanged from its report last month. The current year global oil demand estimate of 96.57 million barrels per day is also maintained. This, despite the upward revision to global GDP growth, as they expect the growing economic recovery to take place primarily in non-oil intensive sectors.

The International Energy Agency (IEA) adjusted its forecast downward (-0.5) to 96 million barrels per day. In comparison, the U.S. Energy Information Administration (EIA) maintained its previous month’s estimate of 97.6 million barrels per day. The forecast in the annual increase in global oil demand in 2021 from both the EIA and the IEA is placed 650 thousand barrels per day below OPEC’s estimate.

WORLD OIL DEMAND

(2020 – 2021)

All scenarios maintain the assumptions on economic growth based on the stimulus packages of the major economies and better control over COVID-19, thanks to the advances in the vaccination programs, which will allow a progressive increase in world oil demand.

The three energy agencies maintain their assumptions of higher oil demand for the second half of 2021, driven by increased production activity in OECD countries and China, supported by increased mobility, economic activity and trade, due to reduced travel restrictions.

Regarding OECD countries, oil demand is expected to stand at 2.6 MMDB, reaching 44.6 MMDB, 100 thousand barrels per day lower than estimated in July, due to lower-than-expected gasoline demand during the first quarter of 2021 and a slower recovery in some Asia-Pacific countries due to the pandemic.

In non-OECD countries, oil demand is expected to increase by 3.4 MMDB (+0.1 from last month) to 51.9 MMDB, with the Middle East and Africa recovering and improving forecasts for industrial fuel consumption recovery. The above is offset by data from India, where recovery lags due to contagion problems and reviving economic activity.

By 2022, global oil demand is forecast to increase by 3.3 million barrels per day, leaving the forecast unchanged from last month. OPEC forecasts total world oil demand to exceed 100 million barrels per day in the second half of 2012 and average 99.9 million barrels per day in 2022.

United States

According to the latest monthly data available in the United States for May, oil demand increased by 3.9 MMDB y-o-y (+24% higher), standing at 20.38 MMDB and recovering from the historical drop in May 2020 1.4 million barrels per day lower than in May 2019. Needs for gasoline (+1.9 million barrels per day) and aviation kerosene (+0.7 million barrels per day) contributed the most to the increase, compared to the same month in 2020.

According to the Federal Highway Administration, U.S. vehicle miles travelled increased 28.7% year-over-year in May of this year, after rising 54.9% year-over-year in April. On the other hand, the U.S. companies Autodata (automotive technical information) and Haver Analytics (statistics) reported that retail sales of light vehicles stood at 17.2 million units, compared to 18.8 million units in April. Historical figures showed total sales of 12.1 million units in May 2020.

Industrial production, a leading indicator of industrial fuel demand, rose 16.2% y-o-y in May after increasing 17.6% y-o-y in April. The indicator was flat in May 2019, according to data from the Federal Reserve Board.

Gasoil demand increased by 300 thousand barrels per day y-o-y in May 2021, following a 500 thousand barrels per day increase in April. Preliminary June data indicate a continuation of the recovery in transportation fuels performance, with both gasoline and aviation kerosene increasing by more than 1.6 million barrels per day y-o-y combined. Gasoil is forecast to increase by 400 thousand barrels per day y-o-y in June 2021.

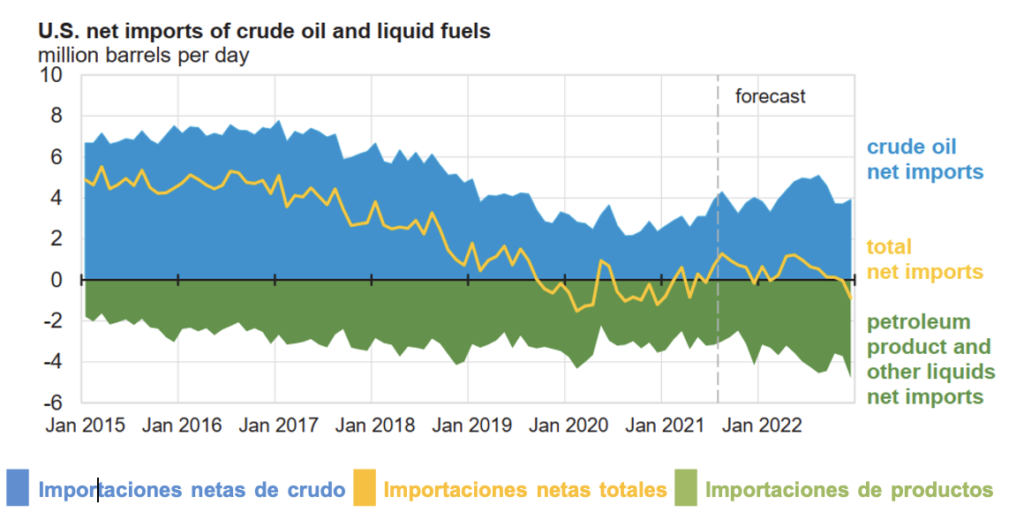

U.S. NET IMPORTS OF CRUDE OIL AND LIQUID FUELS.

(Million b/d, Projected March 2021-December 2022)

China

China’s June oil demand data shows a growth of over 400 thousand barrels per day y-o-y to 13.49 million barrels per day (+3.2%).

Gasoline and jet fuel grew the most in May, with 600 thousand barrels per day year-on-year change. LPG, meanwhile, also posted respectable gains thanks to a higher use for propane dehydrogenation plants and lower maintenance activities.

Gasoline demand increased by around 500 thousand barrels per day year-on-year, following an increase of around 600 thousand barrels per day year-on-year in May, thanks to increased road traffic, despite a decline in vehicle sales. According to the China Passenger Car Association, vehicle sales fell by 14.0% year-on-year in June, following a decline of around 3.0% year-on-year in May.

Jet fuel demand also recorded an increase of 100 thousand barrels per day y-o-y, while diesel declined by around 300 thousand barrels per day y-o-y in June. Slower demand from the industrial sector and a fall in the manufacturing procurement index contributed to this decline. This indicator fell for the fifth consecutive month to its lowest level since the pandemic began, standing at 50.1 in August, down from 51.9 in March.

Oil demand is expected to grow solidly in 2021, driven mainly by sustained economic activity led by the transportation, petrochemicals and manufacturing sectors. As a result, demand for products demanded by these activities such as gasoline, diesel, LPG and naphtha is expected to grow.

By 2022, China’s oil demand is expected to increase by 500 thousand barrels per day, with total demand exceeding 2019 levels based on economic growth forecasts.

India

India’s oil demand increased marginally in June by just over 60 thousand barrels per day over June 2020 (+1.5%) to stand at 4.3 million barrels per day. Compared to June 2019 demand, decreased by 200 thousand barrels per day due to lower consumption of transportation fuels.

LPG and gasoline consumption increased yearly, while jet/kerosene and fuel oil demand remained unchanged. Meanwhile, diesel and naphtha demand decreased compared to the same period in 2020. LPG was supported by increased demand from domestic cookstoves due to stay-at-home policies from increased COVID-19 cases. In contrast, gasoline demand was supported by a distorted baseline and increased month-on-month mobility.

In June, lower activity in the construction sector, road transport, and the fall in the manufacturing activity index were key drivers of lower diesel consumption.

Jet/kerosene demand continued to be impacted by fewer international flights, reducing jet fuel demand and LPG substitution for kerosene in the residential sector.

Economic activity recovery is expected to continue during the second half of the year, even if uncertainty persists due to the pandemic impact in the country.

In 2022, similar to last month’s expectations, oil demand is forecast to increase by around 300 thousand barrels per day, with total volumes exceeding pre-pandemic levels.

OIL STORAGE

One of the most evident signs of stabilizing oil market fundamentals is the draining of oil and oil product inventories. The draining of inventories has resulted in a significant reduction of oil supplies from OPEC+ countries after the entry into force of the production cuts in May 2020. At the same time, the market balance index has allowed the organization to relax this policy as of August 2020.

The market trend continues to point to inventory drains in 2021, below the record levels reached in 2020 and below the average in the 2015-2019 period, higher than the increase in oil product storage in the same period.

OECD countries

According to OPEC’s August MOMR, OECD countries’ commercial crude oil and product inventories adjusted their data, standing at 2.922 billion barrels on June, 23 million barrels lower than in May, falling by 290 million barrels from the same period in 2020 and 90.4 million barrels below the 5-year average. Days of inventory coverage was 63.6 days, down 0.7 days from May and 12.4 days lower than in June 2020.

According to OPEC data, all OECD countries showed a drop in crude oil inventories and product storage.

OPEC: CRUDE OIL INVENTORIES IN OECD COUNTRIES

(June 2020 – June 2021)

From the total OECD inventories, 1,416 million barrels correspond to crude oil, presenting a drop of 38 million barrels concerning May of this year, placing 168 and 96.2 million barrels of oil below May 2020 and the average of the last five years, respectively.

Meanwhile, 1,507 million barrels of commercial inventories correspond to oil products, presenting an increase of 16 million barrels to May and 5.8 higher than the average of the last five years, despite presenting a drop of 120.6 million to June 2020.

The EIA estimated in 2,873 million barrels the total inventories of crude oil and oil products in the OECD countries for June, foreseeing the existence of a monthly and annual decrease of 34.4 and 328.2 million barrels, respectively.

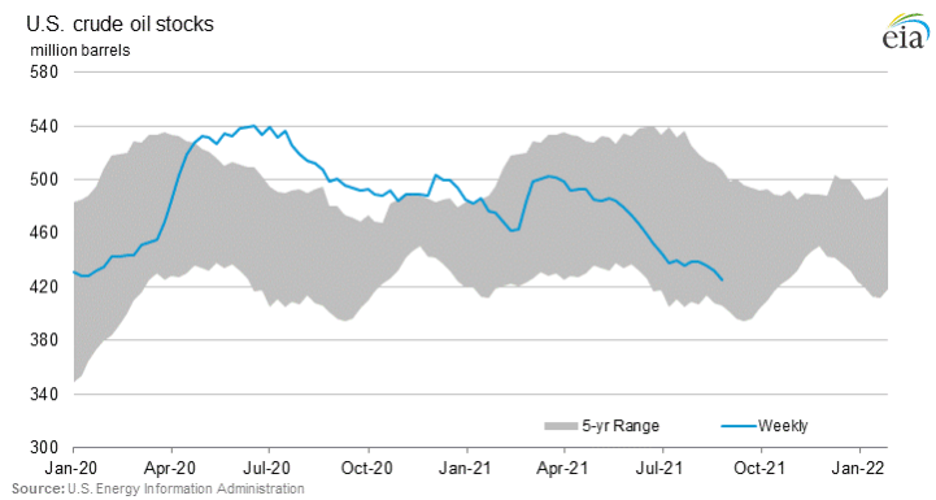

United States

Since July 1st, commercial crude oil inventories in the U.S. had a drain of 20.08 million barrels, to stand at 425.40 million barrels as of August 27th, with a significant acceleration in the drain of commercial inventories, according to data from the EIA weekly report of September 1st. This means an annual decrease of 73 million barrels of crude oil in storage, 2 million barrels less than the annual ratio recorded in June.

So far in 2021, U.S. commercial inventories have fallen 60.1 million barrels, despite showing an increase of 16 million barrels in storage between February 19th and April 19th as a result of the winter storm that affected oil operations in Texas and Louisiana.

In July 2021, commercial inventories were at 438.54 million barrels, down 6.93 million barrels from June and 37.34 million barrels from January, placing 28 million barrels below the 5-year average.

COMMERCIAL CRUDE OIL INVENTORIES IN THE US.

(January 2020 – August 20th, 2021)

The trend of U.S. crude oil inventories in 2021 continues to be estimated downward, adjusting the year-end projection to stand at 440.94 million barrels.

By August 27th, covering days fell to 26.5 days, when the July average was 27.3 days. Between the end of February and March 19th, 2021, the days of coverage were above 40 days, registering an all-time high of 41.8 days on March 12th.

On the other hand, on August 27th, strategic reserves stood at 621.3 million barrels of oil, showing the same level of coverage as on March 12th, 2021.

VENEZUELA

Oil production remains stagnant at 1930 levels.

Since 2014 PDVSA, Venezuela’s State Hydrocarbons Company began a progressive and sustained decline in its crude oil production.

According to OPEC in its Monthly Oil Production Report (MOMR) of August 12th, 2021, the country’s oil production stood at 512 thousand barrels per day in July, a volume comparable to Venezuela’s oil production for the year 1930. This production level reflected a drop equivalent to 83 % to its production of 3,015 million barrels per day on average in 2013.

OIL PRODUCTION OF OPEC COUNTRIES

(July 2021)

The decisions and policies that the government of Nicolás Maduro assumed after August 2014 regarding PDVSA have collapsed Venezuela’s century-old oil industry during the period 2015-2021. The appointment of political stalwarts without any knowledge or experience in the company’s management positions, the penetration of political and economic interest groups in PDVSA’s Board of Directors, the detour of resources, the interruption of procurement and contracting processes, the suspension of investments, plans and projects, as well as the militarization of the organizational structure of the company, the persecution and imprisonment of its managers and directors -both in PDVSA and in the Ministry of Petroleum-, were all actions that caused the current industry collapse.

The economic sanctions imposed in 2019 by the U.S. on PDVSA have become the government’s justification for the chaotic situation in which the industry finds itself. Although the sanctions have affected PDVSA’s marketing and operations since 2019, the industry’s unprofessional, arbitrary and improvised management have been the factors with the most significant impact on the collapse of exploration, production, and refining activities. By January 2019 -before the sanctions- oil production was already at 1.1 million barrels per day, a drop of 2 million concerning 2013 production and the refining system was already at minimum load.

All industrial processes have suffered from the lack of technical and professional personnel after the purges and internal persecutions, the lack of financial resources, spare parts and equipment, due to the deviation of budgetary resources as of December 2014, as well as a marked and generalized improvisation in all operational areas, due to the absence of knowledge, discipline and capacity of the successive authorities and military placed at the head of the oil industry.

Currently, PDVSA’s national refining circuit is working at 10% of its capacity, which is why the country is suffering a severe and acute shortage of fuel and domestic gas. In Caracas, the average time to supply gasoline ranges from 12 to 24 hours. Meanwhile, in other cities of the country, this time is between 2 to 5 days. The same situation occurs with fuel production for cargo vehicles, public transportation, and domestic gas.

While this situation is being suffered by the citizens daily, the dismantling of PDVSA’s production infrastructure in the operational areas continues. Now, abandoned to its fate in the hands of «scrap dealers» who dismantle and sell the entire production infrastructure as if it were a plague, acting with the approval or indifference of the company’s authorities and the military forces responsible for the custody of these strategic assets for the country.

Drills, platforms, equipment, pipes, barges, all types of the oil industry’s infrastructure are being dismantled and scrapped to be sold abroad because they are made of high-quality special steel. This is the new business of «exporting scrap». This systematic dismantling of the infrastructure has its consequences in PDVSA because its operational capacity is reduced and because the systems are left without their protection or support mechanisms.

Last August 30th, workers denounced the collapse of the production gas flaring of the San Joaquín Complex. This gas flaring -indispensable for natural gas production in the east of the country- was the highest gas flaring of its type in Venezuela, with tensors and metallic supports to guarantee its support. It so happened that, after more than 20 years of uninterrupted operation, the «scrap dealers» dismantled the supports of the gas flaring so that, due to the frequent rains in the area, the system collapsed and collapsed. This damages PDVSA’s productive capacities and proves the absence of surveillance and protection and the lack of adequate supervision and maintenance of our oil installations.

PDVSA is currently a decimated and dismantled company. The level of destruction goes beyond its operational infrastructure.

Within the company, there is a process of demoralization and tremendous deterioration in the working conditions of its personnel. Not only were their labor conquests of years taken away, during the ill-fated military administration of General Manuel Quevedo, pension funds, medical insurance and benefits, but the salaries of its personnel are in a range between 4-20 dollars per month. Impoverishment, persecution and fear, has caused, since 2017, the departure of more than 30 thousand qualified workers from the company.

On the other hand, from the point of view of the company’s management and control systems, the setback has been enormous, and the company is inoperative and vulnerable to any illicit acts. All internal procurement and contracting regulations and procedures, including the various committees and control bodies, have been deactivated. None of the administrative control systems and its management system (SAP system) is functioning. These systems were replaced by Whatsapp Groups and, in the best cases, by Spreadsheets.

In the face of the immense tragedy of Venezuela’s oil industry, the government lacks the political will and intention to recover it.

The last intervention board over PDVSA, the so-called ARA Commission, has only focused its actions on the privatization and handing over of the company’s assets and the essential activities of the industry to private operators and agents.

In open violation of the laws, administrative management control mechanisms, and lack of accountability, the government continues to sell and transfer PDVSA’s assets, protected by its authorities’ «secrecy» and impunity.

The auction of PDVSA’s assets continues

The last operation of handing over assets of the company -valued in PDVSA’s 2013 Financial Statements at 231 billion dollars- took place with the «sale» of 49% of PDVSA’s participation in the Dominican Refinery. «Refidomsa», as announced by the country’s authorities last August 19th.

However, the operation took place through an «exchange» of PDVSA debt bonds in favor of PATSA LTD, a private company -owned by the Rizek Group, a financial operator- which became the owner of PDVSA’s participation -valued at 135 million dollars in 2010- for a value of 88 million dollars.

In other words, PDVSA ceded to the Rizek Group 49% of its participation in Refidomsa at a discount of US$ 47 million, equivalent to 35% of its value; moreover, payable in PDVSA’s bonds.

However, no authority, either from the company or the government, explains the details and particulars of this type of operation, bypassing the control mechanisms established in the Law.

The Dominican Republic had already been favored with financial operations with massive discounts in its favor when, in 2015, the Maduro government offered a «discount» of 52% of the Dominican Republic’s debt with PDVSA for the PETROCARIBE agreement. Of the US$4 billion debt, the Dominican Republic only paid US$1.99 billion to Venezuela, settling the total debt with a «discount» of US$2 billion.

This is not the first time that the government disposes of PDVSA and the Republic’s assets outside the control and accountability mechanisms established by Law.

The same happened in December 2017, when PDVSA ceded 49% of its stake in the Cienfuegos Refinery, in Cuba, to CUPET, alleging «debt compensation with Cuba» -a not very credible argument, after the country had sent 100 thousand barrels per day of oil to Cuba for ten years-, and in May 2020, when PDVSA ceded its majority shareholding in the NYNAS refinery in Sweden to private operators with interests in Venezuela.

No authority has explained or informed anything about these secret operations with the assets of all Venezuelans.

International oil companies continue to leave the country.

Amid this atmosphere of opacity and chaos that prevails in the Venezuelan oil industry, PDVSA’s former international partners, who formed joint ventures within our Organic Hydrocarbons Law framework, continue to leave the country.

Last August 29th, INPEX, a Japanese oil and gas company, announced that it was ceasing its gas production operations in the country and selling its assets to an unknown company of «national capital», formed by lawyers.

The departure of IMPEX is in addition to the departure of the European giants Total of France and Equinor of Norway, partners of PDVSA in the Mixed Company PETROCEDEÑO, the best project of the Orinoco Oil Belt. The European companies, faced with the impossibility of following a production recovery plan in the Mixed Enterprise, preferred to declare their assets in the country as a loss, transferring them to PDVSA and abandoning their operations in the country.

Big international oil companies took desperate and extraordinary decisions to avoid losses and keep being subject to the whims and improvisations of the Venezuelan authorities; a terrible sign but a clear example of the chaos and lack of credibility of the government.

BIBLIOGRAPHIC REFERENCES:

- [1] Comunicado de prensa, “20th OPEC and non-OPEC Ministerial Meeting concludes, OPEP, primero de septiembre 2021.

- [2] “Oil Market Report”, Agencia Internacional de Energía (IEA), 12 agosto 2021.

- [3] «Short-Term Energy Ooutlook Data Browser», Administración de Información Energética de EE.UU. (EIA), 10 agosto 2021.

- [4] Hassan Balfakeih, “Monthly Oil Market Report August 2021”, OPEP, 15 agosto 2021.

- [5] Sala de Prensa, “OPEC+ should reconsider output increase: Kuwaiti oil minister”, Arab News, 29 agosto 2021.

- [6] Héctor Usla, “Pemex pierde 25% de su producción petrolera por explosión en plataforma”, El Financiero, 24 agosto 2021.

- [7] Nota de Prensa, “BSEE Monitors Gulf of Mexico Oil and Gas Activities in Response to Hurricane Ida”, Oficina de Seguridad y Cumplimiento Ambiental (BSEE), primero de septiembre 2021.

- [8] Nota de Prensa, “Purchasing Managers Index for August 2021”, Oficina Nacional de Estadísticas de China, primero de septiembre 2021.

- [9] Nota de prensa, “Consumer Price Index Summary”, Oficina de Estadísticas Laborales de EE.UU., 11 agosto 2021.

- [10] Lauren Masterson, “Ida may cut US Gulf coke, coal supply for weeks”, Argus Media, primero de septiembre 2021.

- [11] Nota de Prensa, “15th OPEC and non-OPEC Ministerial Meeting concludes”, OPEP, primero de abril 2021.

- [12] Nota de Prensa, “19th OPEC and non-OPEC Ministerial Meeting concludes”, OPEP, 18 julio 2021.

- [13] “STATISTICS”, Ministerio de Energía de la Federación Rusa, primero de agosto 2021.

- [14] «Weekly Supply Estimates», Administración de Información Energética de EE.UU. (EIA), primero de septiembre 2021.

- [15] «North America Rig Count”, Baker Hughes, 27 agosto 2021.

- [16] Resolución 2231 (2015), Consejo de Seguridad de la ONU, 20 julio 2015.

- [17] Nota de Prensa, «Irán y Rusia, decididos a desarrollar su cooperación bilateral», Agencia de Noticias de Irán (IRNA), 27 agosto 2021.

- [18] Nota de prensa, “«Irán y Rusia examinan la reanudación de las negociaciones en Viena sobre el acuerdo nuclear»”, Agencia de Noticias de Irán IRNA, 17 agosto 2021.

- [19] Ned Price, «Department Press Briefing – August 5, 2021», Departamento de Estado de EE.UU., 05 agosto 2021.

- [20] Nota de prensa, “Consumer Price Index Summary”, Oficina de Estadísticas Laborales de EE.UU., 11 agosto 2021.

- [21] Jake Sullivan, “Statement by National Security Advisor Jake Sullivan on the Need for Reliable and Stable Global Energy Markets”, La Casa Blanca, 11 agosto 2021.

- [22] “DOE Announces Notice of Sale of Crude Oil from the Strategic Petroleum Reserve”, Departamento de Energía de EE.UU., 23 agosto 2021.

- [23] “Bipartisan Budget Act of 2015”, Congreso de los EE.UU., 02 noviembre 2015.

- [24] Bipartisan Budget Act of 2018”, Congreso de los EE.UU., 09 febrero 2018.

- [25] Comunicado de Prensa, “ARPA State Fiscal Recovery Fund Allocations”, Conferencia Nacional de Legislaturas Estatales NCSL, 26 agosto 2021.

- [26] Nota de Prensa, “La economía de la Eurozona crece un 2% en el segundo trimestre y deja atrás la recesión”, Deutsche Welle DW, 17 agosto 2021.

- [27] “Weekly Stocks”, Administración de Información Energética de EE.UU. (EIA), primero septiembre 2021.

- [28] Registro Federal de Documentos Presidenciales, “Executive Order 13857: Taking Additional Steps To Address the National Emergency With Respect to Venezuela”, The Department of the Treasury, 30 de enero 2019.

- [29] Mohammad Ali Danesh, “Monthly Oil Market Report February 2019”, OPEP, 12 febrero 2019.

- [30] “Decreto N° 3.415, mediante el cual se autoriza a la empresa Pdvsa Industrial, S.A., para la comercialización nacional y exportación de chatarra ferrosa, proveniente de Petróleos de Venezuela, S.A. (PDVSA). y sus filiales y empresas mixtas”, Pandectas Digital, 10 mayo 2018.

- [31] Giovanna Pellicani, “Se cayó el más alto mechurrio de Pdvsa”, El Pitazo, primero de septiembre 2021.

- [32] Dirección Ejecutiva de Presupuesto y Control y la Gerencia Corporativa de Asuntos Públicos, “Informe de Gestión Anual 2013”, PDVSA, enero 2014.

- [33] Comunicado de Prensa, “Gobierno dominicano adquiere el control del 100 % de las acciones de la REFIDOMSA”, Gobierno de República Dominicana, 19 agosto 2020.

- [34] Redacción, “Venezuela condona a República Dominicana 52% de su deuda petrolera”, BBC Mundo, 30 de enero 2015.

- [35] Redacción, “La refinería de Cienfuegos pasa a ser propiedad de Cuba”, NotiAmérica, 15 diciembre 2017.

- [36] Equipo de Prensa, “Refinador sueco Nynas dice que PDVSA ya no tiene mayoría accionaria en la empresa”, Reuters, 12 mayo 2020.

- [37] Redacción, “Sigue éxodo de socios extranjeros: empresa venezolana compra participaciones de japonesa Inpex en proyectos con Pdvsa”, Banca y Negocios, 29 agosto 2021.

- [38] Redacción, “Equinor y Total salen de proyecto petrolero en Venezuela, mencionan impacto de emisiones”, Reuters, 29 julio 2021.